UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULES 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024

Commission File Number: 001-12610

GRUPO TELEVISA, S.A.B.

(Translation of registrant’s name into English)

Av. Vasco de Quiroga No. 2000, Colonia Santa Fe 01210 Mexico City, Mexico

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.)

Form 20-F ☒ Form 40-F ☐

|

|

Investor Relations

PRESS RELEASE

|

Televisa Reports Fourth Quarter and Full Year 2023 Results

2023 Highlights

Consolidated

|

•

|

On January 31, 2024, we incorporated a new controlling entity of the Spun-off Businesses (as defined below), Ollamani, S.A.B., which was listed and began trading on February 20, 2024, in

the form of Ordinary Participation Certificates (Certificados de Participación Ordinarios or CPOs), on the Mexican Stock Exchange under the ticker symbol “AGUILAS CPO”.

|

|

•

|

Revenue and Operating Segment Income (“OSI”) declined by 2.3% and 5.4%, respectively.

|

Cable

|

•

|

Successfully passed 843 thousand homes with fiber-to-the-home (“FTTH”), achieving close to 19.6 million homes passed.

|

|

•

|

Total Revenue Generating Units (“RGUs”) of about 15.4 million, with around 519 thousand disconnections mainly due to a proactive subscriber base clean-up in the third quarter.

|

|

•

|

Revenue growth of 0.8% and OSI decline of 5.4% with a margin of 38.6%.

|

|

•

|

MSO revenue increased by 2.4% while OSI decreased by 3.5%, for a 40.4% margin.

|

Sky

|

•

|

Total RGUs of more than 6.1 million, with around 798 thousand net disconnections of which more than 85% were prepaid video subscribers.

|

|

•

|

Revenue and OSI fell by 13.5% and 10.7%, respectively, translating into a 32.6% margin.

|

Other Businesses

|

•

|

Revenue and OSI growth of 7.2% and 15.5%, respectively, for a 24.8% margin.

|

Earnings Call Date and Time: Friday, February 23, 2024, at 10:00 A.M. ET.

Conference ID # is 2709545

From the U.S.: +1 (877) 883 0383

|

International callers: +1 (412) 902 6506

|

Rebroadcast: +1 (877) 344 7529

|

Rebroadcast: +1 (412) 317 0088

|

The teleconference will be rebroadcast starting at 1:00 P.M. ET with the access code #7739896

on February 24th and will end at midnight on March 8th.

Consolidated Results

Mexico City, February 22, 2024

— Grupo Televisa, S.A.B. (NYSE:TV; BMV: TLEVISA CPO; “Televisa” or “the Company”), today announced results for the full year and fourth quarter of 2023. The results have been prepared in accordance with International Financial Reporting Standards

(“IFRS”).

Financials have been adjusted to reflect the impact of the TelevisaUnivision, Inc. (“TelevisaUnivision”) transaction which was closed on January 31, 2022. Results from the

content assets included in the transaction are presented as discontinued operations.

The following table sets forth condensed consolidated statements of income for the years ended December 31, 2023 and 2022, in millions of Mexican pesos.

| |

2023

|

Margin

|

2022

|

Margin

|

Change

|

|

%

|

%

|

%

|

|

Revenues

|

73,767.9

|

100.0

|

75,526.6

|

100.0

|

(2.3)

|

|

Operating segment income1

|

26,504.8

|

35.7

|

28,010.1

|

36.8

|

(5.4)

|

1 The operating segment income margin is calculated as a percentage of segment revenues.

Revenues decreased by 2.3% to Ps.73,767.9 million in 2023 compared with Ps. 75,526.6 million in 2022. This decrease was due to a revenue decline in the Sky segment.

Operating segment income decreased by 5.4%, translating into a 35.7% margin.

The following table sets forth condensed consolidated statements of income for the years ended December 31, 2023 and 2022, in millions of Mexican pesos:

|

|

2023

|

Margin

|

2022

|

Margin

|

Change

|

|

%

|

%

|

%

|

|

Revenues

|

73,767.9

|

100.0

|

75,526.6

|

100.0

|

(2.3)

|

|

Net (loss) income

|

(10,611.6)

|

(14.4)

|

45,283.9

|

60.0

|

n/a

|

|

Net (loss) income attributable to stockholders of the Company

|

(10,235.9)

|

(13.9)

|

44,712.2

|

59.2

|

n/a

|

|

Segment revenues

|

74,258.3

|

100.0

|

76,089.6

|

100.0

|

(2.4)

|

|

Operating segment income (1)

|

26,504.8

|

35.7

|

28,010.1

|

36.8

|

(5.4)

|

(1)The operating segment income margin is calculated as a percentage of segment revenues.

Net income or loss attributable to stockholders of the Company amounted to a net loss of Ps.10,235.9 million for the year ended December 31, 2023, compared with a net income

of Ps.44,712.2 million for the year ended December 31, 2022.

The unfavorable change of Ps.54,948.1 million reflected (i) the absence in 2023 of a Ps.56,222.2 million income from discontinued operations that we recognized in 2022 in

connection with the TelevisaUnivision transaction; (ii) a Ps1,703.7 million decrease in operating income before other expense; (iii) a Ps.51.2 million increase in other expense, net; and (iv) a Ps.3,668.4 million unfavorable change in income tax

benefit or expense.

These unfavorable variances were partially offset by (i) a Ps.4,581.9 million decrease in finance expense, net; (ii) a Ps.1,168.1 million decrease in share of loss of

associates and joint ventures, net; and (iii) a Ps.947.4 million favorable change in net income or loss attributable to non-controlling interests.

Full year results by business segment

The following table presents full year consolidated results ended December 31, 2023 and 2022, for each of our business segments, in millions of Mexican pesos.

|

Revenues

|

2023

|

%

|

2022

|

%

|

Change

%

|

|

Cable

|

48,802.5

|

65.7

|

48,411.8

|

63.6

|

0.8

|

|

Sky

|

17,585.2

|

23.7

|

20,339.0

|

26.7

|

(13.5)

|

|

Other Businesses

|

7,870.6

|

10.6

|

7,338.8

|

9.7

|

7.2

|

|

Segment Revenues

|

74,258.3

|

100.0

|

76,089.6

|

100.0

|

(2.4)

|

|

Intersegment Operations1

|

(490.4)

|

|

(563.0)

|

|

|

|

Revenues

|

73,767.9

|

|

75,526.6

|

|

(2.3)

|

|

Operating Segment Income2

|

2023

|

Margin

%

|

2022

|

Margin

%

|

Change

%

|

|

Cable

|

18,821.0

|

38.6

|

19,902.8

|

41.1

|

(5.4)

|

|

Sky

|

5,731.4

|

32.6

|

6,416.3

|

31.5

|

(10.7)

|

|

Other Businesses

|

1,952.4

|

24.8

|

1,691.0

|

23.0

|

15.5

|

|

Operating Segment Income2

|

26,504.8

|

35.7

|

28,010.1

|

36.8

|

(5.4)

|

|

Corporate Expenses

|

(1,259.9)

|

(1.7)

|

(1,538.1)

|

(2.0)

|

18.1

|

|

Depreciation and Amortization

|

(21,554.4)

|

(29.2)

|

(21,117.4)

|

(28.0)

|

(2.1)

|

|

Other expense, net

|

(866.8)

|

(1.2)

|

(815.6)

|

(1.1)

|

(6.3)

|

|

Intersegment Operations1

|

(160.0)

|

(0.2)

|

(120.4)

|

(0.2)

|

(32.9)

|

|

Operating Income

|

2,663.7

|

3.6

|

4,418.6

|

5.9

|

(39.7)

|

|

1 For segment reporting purposes, intersegment operations are included in each of the segment operations

|

|

2 Operating segment income is defined as operating income before depreciation and amortization, corporate expenses, and other income or

expense, net.

|

Fourth-quarter Results by Business Segment

The following table presents fourth quarter consolidated results ended December 31, 2023 and 2022, for each of our business segments. Consolidated results for the fourth quarter

of 2023 and 2022 are presented in millions of Mexican pesos.

|

Revenues

|

4Q’23

|

%

|

4Q’22

|

%

|

Change

%

|

|

Cable

|

12,240.4

|

66.0

|

12,463.3

|

64.2

|

(1.8)

|

|

Sky

|

4,181.6

|

22.5

|

4,936.6

|

25.5

|

(15.3)

|

|

Other Businesses

|

2,127.8

|

11.5

|

2,002.3

|

10.3

|

6.3

|

|

Segment Revenues

|

18,549.8

|

100.0

|

19,402.2

|

100.0

|

(4.4)

|

|

Intersegment Operations1

|

(137.4)

|

|

(269.9)

|

|

|

|

Revenues

|

18,412.4

|

|

19,132.3

|

|

(3.8)

|

|

Operating Segment Income2

|

4Q’23

|

Margin

%

|

4Q’22

|

Margin

%

|

Change

%

|

|

Cable

|

4,701.8

|

38.4

|

5,059.3

|

40.6

|

(7.1)

|

|

Sky

|

1,140.9

|

27.3

|

1,151.6

|

23.3

|

(0.9)

|

|

Other Businesses

|

463.1

|

21.8

|

499.2

|

24.9

|

(7.2)

|

|

Operating Segment Income2

|

6,305.8

|

34.0

|

6,710.1

|

34.6

|

(6.0)

|

|

Corporate Expenses

|

(589.4)

|

(3.2)

|

(705.7)

|

(3.6)

|

16.5

|

|

Depreciation and Amortization

|

(5,344.0)

|

(29.0)

|

(5,702.7)

|

(29.8)

|

6.3

|

|

Other income (expense), net

|

213.9

|

1.2

|

(315.2)

|

(1.6)

|

n/a

|

|

Intersegment Operations1

|

(41.5)

|

(0.2)

|

(119.3)

|

(0.6)

|

n/a

|

|

Operating income (loss)

|

544.8

|

3.0

|

(132.8)

|

(0.7)

|

n/a

|

|

1For segment reporting purposes, intersegment operations are included in each of the segment operations.

|

|

2Operating segment income is defined as operating income before depreciation and amortization, corporate expenses, and other income or

expense, net.

|

Cable

Total net additions for the quarter were approximately 9.6 thousand RGUs. Broadband net additions were 595, while video net additions of

104. We also had 8.5 thousand mobile net additions, ending the year with more than 307.8 thousand mobile subscribers.

The following table sets forth the breakdown of RGUs per service type for our Cable segment as of December 31, 2023 and 2022.

|

RGUs

|

4Q’23 Net

Adds

|

2023 Net

Adds

|

2023

|

2022

|

|

Video

|

104

|

(398,726)

|

4,059,494

|

4,458,220

|

|

Broadband

|

595

|

(305,720)

|

5,678,431

|

5,984,151

|

|

Voice

|

388

|

117,421

|

5,351,145

|

5,233,724

|

|

Mobile

|

8,515

|

67,600

|

307,807

|

240,207

|

|

Total RGUs

|

9,602

|

(519,425)

|

15,396,877

|

15,916,302

|

Fourth quarter revenues decreased by 1.8% to Ps.12,240.4 million compared with Ps.12,463.3 million in the fourth quarter of 2022.

Full year revenues increased by 0.8% to Ps.48,802.5 million compared with Ps.48,411.8 million in 2022. Total RGUs were close to 15.4

million, with around 519 thousand disconnections mainly due to a proactive subscriber base clean-up in the third quarter.

Fourth quarter operating segment income decreased by 7.1% to Ps.4,701.8 million compared with Ps.5,059.3 million in the fourth quarter

of 2022. The margin reached 38.4%. During the quarter, operating segment income declined by 6.7% and 22.4% for our MSO and our Enterprise Operations, respectively. Profitability for our MSO and our Enterprise Operations declined by 290 basis points and

140 basis points year-on-year, respectively. However, on a quarter-on-quarter basis profitability for our MSO Operations increased by 320 basis points driven by the headcount reduction implemented in the third quarter.

Full year operating segment income fell by 5.4% to Ps.18,821.0 million compared with Ps.19,902.8 million in 2022. The margin reached

38.6%. During the year, operating segment income declined by 3.5% and 26.4% for our MSO and our Enterprise Operations, respectively. Profitability for our MSO and our Enterprise Operations declined by 250 basis points and 400 basis points year-on-year,

respectively.

The following tables set forth the breakdown of revenue and operating segment Income, excluding consolidation adjustments, for our MSO and Enterprise Operations for the fourth quarter of 2023 and

2022, and for the full year of 2023 and 2022.

|

MSO Operations (1)

Millions of Mexican pesos

|

2023

|

2022

|

Change %

|

4Q’23

|

4Q’22

|

Change %

|

|

Revenue

|

45,033.2

|

43,958.9

|

2.4

|

11,108.7

|

11,138.2

|

(0.3)

|

|

Operating Segment Income

|

18,201.9

|

18,865.1

|

(3.5)

|

4,569.4

|

4,896.2

|

(6.7)

|

|

Margin (%)

|

40.4

|

42.9

|

|

41.1

|

44.0

|

|

|

Enterprise Operations (1)

Millions of Mexican pesos

|

2023

|

2022

|

Change %

|

4Q’23

|

4Q’22

|

Change %

|

|

Revenue

|

5,803.7

|

6,721.9

|

(13.7)

|

1,567.1

|

1,867.1

|

(16.1)

|

|

Operating Segment Income

|

1,328.3

|

1,805.9

|

(26.4)

|

278.4

|

358.9

|

(22.4)

|

|

Margin (%)

|

22.9

|

26.9

|

|

17.8

|

19.2

|

|

| (1) Full year results do not include the consolidation adjustments of Ps.2,034.4 million in

revenues nor Ps.709.2 million in Operating Segment Income for 2023, neither the consolidation adjustments of Ps. 2,269.0 million in revenues nor Ps.768.2 million in Operating Segment Income for 2022. Likewise, fourth quarter results do not

include the consolidation adjustments of Ps.435.4 million in revenues nor Ps.146.0 million in Operating Segment Income for fourth quarter 2023, neither the consolidation adjustments of Ps.542.0 million in revenues nor Ps.195.8 million in

Operating Segment Income for fourth quarter 2022. Consolidation adjustments are considered in the consolidated results of the Cable segment. |

Fourth quarter revenues and operating segment income in our MSO Operations decreased by 0.3% and 6.7%, respectively. Profitability at

our MSO Operations reached a 41.1% margin. On a sequential basis, our margin expanded by 320 basis points compared with the 37.9% margin of the third quarter.

Fourth quarter revenues in our Enterprise Operations decreased by 16.1% and the operating segment income declined by 22.4%. Our

profitability declined by 140 basis points year-on-year.

Full year revenues and operating segment income in our MSO operations increased by 2.4% and

declined by 3.5%, respectively, reaching a margin of 40.4%.

Full year revenues and operating segment income in our Enterprise Operations decreased by 13.7% and 26.4%, respectively.

Sky

During the quarter, Sky had around 160.4

thousand RGUs disconnections. This was mainly driven by the loss of 130.5 thousand video RGUs.

The following table sets forth the breakdown of RGUs per service type for Sky as of December 31, 2023 and 2022.

|

RGUs

|

4Q’23 Net Adds

|

2023 Net Adds

|

2023

|

2022

|

|

Video

|

(130,521)

|

(689,633)

|

5,567,426

|

6,257,059

|

|

Broadband

|

(29,865)

|

(125,205)

|

515,089

|

640,294

|

|

Voice

|

(21)

|

(109)

|

344

|

453

|

|

Mobile

|

(12)

|

16,900

|

32,502

|

15,602

|

|

Total RGUs

|

(160,419)

|

(798,047)

|

6,115,361

|

6,913,408

|

Fourth quarter revenues decreased by 15.3%

to Ps.4,181.6 million compared with Ps.4,936.6 million in the fourth quarter of 2022, mainly explained by the year-on-year decline in RGUs and lower recharges at Sky’s prepaid packages.

Full year revenues were Ps.17,585.2

million, declining 13.5% compared with Ps.20,339.0 million in 2022.

Fourth quarter operating segment income

decreased by 0.9% to Ps.1,140.9 million compared with Ps.1,151.6 million in the fourth quarter of 2022, driven mainly by the lower revenue. The margin was 27.3%, expanding by 400 basis points year-on-year.

Full year operating segment income

decreased by 10.7% to Ps.5,731.4 million compared with Ps.6,416.3 million in 2022, impacted by the lower revenue. The margin was 32.6%, an expansion of 110 basis points compared with 2022.

Other Businesses

Fourth quarter revenues increased by 6.3% to Ps.2,127.8 million compared with Ps.2,002.3 million in the fourth quarter of 2022.

Full year revenues increased by 7.2% to Ps.7,870.6 million compared with Ps.7,338.8 million in 2022. This growth was mainly driven by a better performance in the gaming and fútbol businesses.

Fourth quarter operating segment income

decreased by 7.2% to Ps.463.1 million compared with Ps.499.2 million in the fourth quarter of 2022.

Full year operating segment income

increased by 15.5% to Ps.1,952.4 million compared with Ps.1,691.0 million in 2022.

Corporate Expense

Corporate expense decreased by Ps.278.2 million, or 18.1%, to Ps.1,259.9 million in 2023, from Ps.1,538.1 million in 2022. The decrease

reflected primarily a lower share-based compensation expense, as well as a decrease in other non-allocated corporate expenses.

Share-based compensation expense in 2023 and 2022 amounted to Ps.748.5 million and Ps.968.6 million, respectively, and was accounted

for as corporate expense. Share-based compensation expense is measured at fair value at the time the equity benefits are conditionally sold to officers and employees and is recognized over the vesting period.

Other Expense, Net

Other expense, net, increased by Ps.51.2 million, to Ps.866.8 million in 2023, from Ps.815.6 million in 2022. This increase reflected

primarily (i) an increase in non-recurring severance expense in connection with headcount reductions in our Cable segment; (ii) non-recurring expense related to damage caused by Hurricane “Otis” in our Cable segment; and (iii) impairment

adjustments of long-lived assets. These unfavorable variances were partially offset by (i) the absence in 2023 of other expense in connection with a settlement agreement of a class action in the fourth quarter of 2022; and (ii) an interest income

for recovery of asset tax from prior years.

The following table sets forth the breakdown of cash and non-cash other (expense) income, net, stated in millions of Mexican pesos, for

the years ended December 31, 2023 and 2022.

|

Other (Expense) Income, net

|

2023

|

2022

|

|

Cash

|

(1,369.7)

|

(736.5)

|

|

Non-cash

|

502.9

|

(79.1)

|

|

Total

|

(866.8)

|

(815.6)

|

Finance Expense, Net

The following table sets forth the finance (expense) income, net, stated in millions of Mexican pesos for the years ended December

31, 2023 and 2022.

| |

2023

|

2022

|

Favorable

(Unfavorable)

Change

|

|

Interest expense

|

(7,654.3)

|

(9,455.6)

|

1,801.3

|

|

Interest income

|

3,307.4

|

2,151.1

|

1,156.3

|

|

Foreign exchange loss, net

|

(142.5)

|

(1,791.0)

|

1,648.5

|

|

Other finance expense, net

|

(134.9)

|

(110.7)

|

(24.2)

|

|

Finance expense, net

|

(4,624.3)

|

(9,206.2)

|

4,581.9

|

Finance expense, net, decreased by Ps.4,581.9 million, or 49.8%, to a Ps.4,624.3 million in 2023, from Ps.9,206.2 million in 2022.

This decrease reflected:

|

(i)

|

a Ps.1,801.3 million decrease in interest expense in connection with a lower average principal amount of debt in the year ended December 31, 2023, resulting

primarily from prepayments made in 2023 of our long-term debt;

|

|

(ii)

|

a Ps.1,156.3 million increase in interest income explained primarily by higher interest rates in 2023, which effect was partially offset by a lower average

amount of cash and cash equivalents for the year ended December 31, 2023; and

|

|

(iii)

|

a Ps.1,648.5 million decrease in foreign exchange loss, net, resulting primarily from the appreciation of the Mexican peso against the U.S. dollar on a lower

average U.S. dollar net asset position for the year ended December 31, 2023, compared to a higher average U.S. dollar net asset position for the year ended December 31, 2022, which was partially offset by a 13.1% appreciation of the

Mexican peso against the U.S. dollar in 2023, compared to a 5.0% appreciation in 2022.

|

These favorable variances were partially offset by a Ps.24.2 million increase in other finance expense, net, resulting from a higher

loss in fair value of our derivative contracts for the year ended December 31, 2023.

Share of Loss of Associates and Joint Ventures, Net

Share of loss of associates and joint ventures, net, decreased by Ps.1,168.1 million, to a share of loss of Ps.6,210.1 million in 2023,

from Ps.7,378.2 million in 2022. This decrease reflected primarily a lower net loss of TelevisaUnivision for the year ended December 31, 2023.

Share of loss of associates and joint ventures, net, for the year ended December 31, 2023, included primarily our share of loss of

TelevisaUnivision.

Income Taxes

Income taxes changed by Ps.3,668.4 million, to an income tax expense of Ps.2,440.9 million for the year ended December 31, 2023, from

an income tax benefit of Ps.1,227.5 million for the year ended December 31, 2022. This unfavorable change reflected primarily a non-cash net income tax expense in connection with the recognition of income taxes from prior years, as well as

write-offs of deferred income tax assets.

Net Income or Loss Attributable to Non-controlling Interests

Net income or loss attributable to non-controlling interests changed by Ps.947.4 million to a net loss of Ps.375.7 million in 2023,

compared with a net income of Ps.571.7 million in 2022. This change reflected primarily a net loss attributable to non-controlling interests in our Cable and Sky segments.

Net loss attributable to non-controlling interests for the year ended December 31, 2023, included primarily a net loss attributable to

non-controlling interests in our Cable segment.

Capital Expenditures

During the year ended December 31, 2023, we invested approximately U.S.$828.5 million in property, plant and equipment as capital

expenditures.

The following table sets forth the breakdown by segment of capital expenditures for the years ended December 31, 2023 and 2022, in

millions of U.S. dollars.

|

Capital Expenditures

(Millions of U.S. Dollars)

|

2023

|

2022

|

|

Cable

|

633.0

|

645.9

|

|

Sky

|

149.2

|

193.1

|

|

Other Businesses

|

46.3

|

17.4

|

|

Continuing operations

|

828.5

|

856.4

|

|

Discontinued operations

|

-

|

3.4

|

|

Total

|

828.5

|

859.8

|

Debt and Lease Liabilities

The following table sets forth our total consolidated debt and lease liabilities as of December 31, 2023 and 2022. Amounts are stated

in millions of Mexican pesos.

| |

December 31,

2023

|

December 31,

2022

|

Increase

(Decrease)

|

|

Current portion of long-term debt

|

9,988.0

|

1,000.0

|

8,988.0

|

|

Long-term debt, net of current portion

|

78,547.9

|

104,240.7

|

(25,692.8)

|

|

Total debt (1)

|

88,535.9

|

105,240.7

|

(16,704.8)

|

|

Current portion of long-term lease liabilities

|

1,280.9

|

1,373.2

|

(92.3)

|

|

Long-term lease liabilities, net of current portion

|

6,010.6

|

6,995.8

|

(985.2)

|

|

Total lease liabilities

|

7,291.5

|

8,369.0

|

(1,077.5)

|

|

Total debt and lease liabilities

|

95,827.4

|

113,609.7

|

(17,782.3)

|

| (1) As of December 31, 2023, total debt is presented net of finance costs in the amount

of Ps.1,278.4 million. |

As of December 31, 2023, our consolidated net debt position (total debt and lease liabilities, less cash and cash equivalents, and

non-current investments in financial instruments) was Ps.60,654.5 million. As of December 31, 2023, the non-current investments in financial instruments amounted to an aggregate of Ps.2,586.6 million.

In December 2023, our Sky segment prepaid outstanding debt in the principal amount of Ps.400 million, in connection with funds used in

2023 from a revolving credit facility.

Spun-off Businesses

In connection with a spin-off proposal approved by our Board of Directors and Stockholders to separate most of the net assets

comprising the operations of our former Other Businesses segment (“Spun-off Businesses”):

|

(i)

|

a new controlling entity of the Spun-off Businesses, Ollamani, S.A.B. (“Ollamani”), was incorporated under the laws of Mexico as a limited liability public stock

corporation on January 31, 2024;

|

|

(ii)

|

a spin-off of the Spun-off Businesses was carried out on January 31, 2024;

|

|

(iii)

|

we obtained all required corporate and regulatory authorizations for this spin-off proposal on February 12, 2024;

|

|

(iv)

|

the shares of Ollamani were listed and began to trade on February 20, 2024, in the form of CPOs, on the Mexican Stock Exchange under the ticker symbol “AGUILAS

CPO”; and

|

|

(v)

|

beginning in the first quarter of 2024, we will begin to present the results of operations of our Spun-off Businesses as discontinued operations in our

consolidated statements of income for any comparative prior period and for the month ended January 31, 2024.

|

Shares Outstanding

As of December 31, 2023 and 2022, our shares outstanding amounted to 323,976.5 million and 330,739.7 million shares, respectively, and

our CPO equivalents outstanding amounted to 2,769.0 million and 2,826.8 million CPO equivalents, respectively. Not all of our shares are in the form of CPOs. The number of CPO equivalents is calculated by dividing the number of shares outstanding

by 117.

As of December 31, 2023 and 2022, the GDS (Global Depositary Shares) equivalents outstanding amounted to 553.8 million and 565.4

million GDS equivalents, respectively. The number of GDS equivalents is calculated by dividing the number of CPO equivalents by five.

Sustainability

In 2023, we launched our new purpose that brings to life the mission and vision of our business - WE BRING PEOPLE CLOSER TO WHAT

MATTERS MOST TO THEM. Our focus on environmental, social and governance issues is an integral part of our business purpose and strategy. Year after year, we continue to strengthen our commitment to connect lives, a reason why we redefined our ESG

strategy focused on four pillars: Climate Resilient Connections, Digital Inclusion, Empowering People and Leading by Example.

Our transparency and reporting strategy is aligned with international frameworks and standards. We prepare the Sustainability Report

aligned with the Global Reporting Initiative (GRI), an internationally recognized framework for sustainability reporting that helps organizations report on their economic, environmental, and social impacts; as well as with the industry standards

of the Sustainability Accounting Standards Board (SASB), and the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Grupo Televisa supports the Ten Principles of the United Nations Global Compact (“UNGC”).

The Company continues to be recognized with the FTSE4Good Index Series indices: FTSE4Good Emerging Markets, FTSE4Good Emerging Latin

America, and received the Socially Responsible Company Distinction 2023 (Socially Responsible Company 2023 recognition), awarded by the Mexican Center for Philanthropy. Also, the Company was confirmed as a signatory to the United Nations Global

Compact, the world's largest corporate sustainability initiative.

COVID-19 Impact

The COVID-19 pandemic has had a negative effect on our business, financial position, and results of operations.

An increase in infection rates, the effect of new COVID-19 variants, or the emergence of a new pandemic, could

trigger a renewal of governmental restrictions on non-essential activities, including but not limited to temporary shutdowns or additional guidelines, which could be expensive or burdensome to implement, and may affect our operations.

Due to the evolving and uncertain nature of a pandemic such as COVID-19, we are not able to estimate the full extent of the impact

that an event of this nature may have in our business, financial position, and results of operations over the near, medium or long-term.

Additional Information Available on Website

The information in this press release should be read in conjunction with the financial statements and footnotes contained in the

Company's Annual Report and on Form 20-F for the year ended December 31, 2022, which is posted on the “Reports and Filings” section of our investor relations website at televisair.com.

In addition, TelevisaUnivision and/or its subsidiaries publish annual and quarterly financial statements and financial information as

well other important information concerning its business from time to time on its website and elsewhere. The Company is not responsible for such TelevisaUnivision information in any way, and such information is not intended to be included as

part of, or incorporated by reference into, the Company’s public filings or releases. Please see attached tables for financial information.

About Televisa

Grupo Televisa S.A.B. (“Televisa”) is a major telecommunications

corporation which owns and operates one of the most significant cable companies as well as a leading direct-to-home satellite pay television system in Mexico. Televisa’s cable business offers integrated services, including video, high-speed

data and voice to residential and commercial customers as well as managed services to domestic and international carriers. Televisa owns a majority interest in Sky, a leading direct-to-home satellite pay television system and broadband

provider in Mexico, operating also in the Dominican Republic and Central America. Televisa holds a number of concessions by the Mexican government that authorizes it to broadcast programming over television stations for the signals of

TelevisaUnivision, Inc. (“TelevisaUnivision”), and Televisa’s cable and DTH systems. In addition, Televisa is the largest shareholder of TelevisaUnivision, a leading media company producing, creating, and distributing Spanish-speaking content

through several broadcast channels in Mexico, the US and over 50 countries through television networks, cable operators and over-the-top or “OTT” services.

Disclaimer

This press release contains forward-looking statements regarding the

Company’s results and prospects. Actual results could differ materially from these statements. The forward-looking statements in this press release should be read in conjunction with the factors described in “Item 3. Key Information –

Forward-Looking Statements” in the Company’s Annual Report on Form 20-F, which, among others, could cause actual results to differ materially from those contained in forward-looking statements made in this press release and in oral statements

made by authorized officers of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. The Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise.

Contact Information

Investor Relations

www.televisair.com.mx

Tel: (52 55) 5261 2445

Rodrigo Villanueva, VP, Head of Investor Relations / rvillanuevab@televisa.com.mx

Andrés Audiffred, Investor Relations Director / aaudiffreda@televisa.com.mx

Media Relations

Rubén Acosta / Tel: (52 55) 5224 6420 / racostamo@televisa.com.mx

Alejandra Garcia / Tel: (52 55) 4438 1205 / agarcial@televisa.com.mx

GRUPO TELEVISA, S.A.B.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF DECEMBER 31, 2023 AND 2022

(Millions of Mexican Pesos)

| |

December 31,

2023

(Unaudited)

|

|

December 31,

2022

(Audited)

|

|

ASSETS

|

|

|

|

|

Current assets:

|

|

|

|

|

Cash and cash equivalents

|

Ps.

|

32,586.3

|

|

Ps.

|

51,131.0

|

|

Trade notes and accounts receivable, net

|

|

8,131.5

|

|

|

8,457.3

|

|

Other accounts and notes receivable, net

|

|

342.5

|

|

|

315.0

|

|

Income taxes receivable

|

|

6,386.2

|

|

|

6,691.4

|

|

Other receivable taxes

|

|

7,158.7

|

|

|

6,593.7

|

|

Derivative financial instruments

|

|

251.7

|

|

|

11.2

|

|

Due from related parties

|

|

1,450.2

|

|

|

311.2

|

|

Transmission rights

|

|

1,725.6

|

|

|

888.3

|

|

Inventories

|

|

1,261.3

|

|

|

1,448.3

|

|

Contract costs

|

|

2,011.5

|

|

|

1,918.3

|

|

Reimbursement receivable

|

|

-

|

|

|

1,431.5

|

|

Other current assets

|

|

1,661.7

|

|

|

2,379.6

|

|

Total current assets

|

|

62,967.2

|

|

|

81,576.8

|

| |

|

|

|

|

|

|

Non-current assets:

|

|

|

|

|

|

|

Trade notes and accounts receivable, net of current portion

|

|

428.7

|

|

|

438.4

|

|

Due from related party

|

|

4,630.5

|

|

|

6,365.0

|

|

Derivative financial instruments

|

|

-

|

|

|

532.3

|

|

Transmission rights

|

|

641.2

|

|

|

1,022.8

|

|

Investments in financial instruments

|

|

2,586.6

|

|

|

3,389.5

|

|

Investments in associates and joint ventures

|

|

41,428.3

|

|

|

50,450.9

|

|

Property, plant and equipment, net

|

|

77,848.1

|

|

|

82,236.4

|

|

Investment property, net

|

|

2,790.2

|

|

|

2,873.2

|

|

Right-of-use assets, net

|

|

6,085.9

|

|

|

6,670.3

|

|

Intangible assets, net

|

|

40,398.5

|

|

|

41,123.6

|

|

Deferred income tax assets

|

|

18,497.0

|

|

|

18,770.0

|

|

Contract costs

|

|

3,318.7

|

|

|

3,399.9

|

|

Other assets

|

|

214.9

|

|

|

258.4

|

|

Total non-current assets

|

|

198,868.6

|

|

|

217,530.7

|

|

Total assets

|

Ps.

|

261,835.8

|

|

Ps.

|

299,107.5

|

| |

|

|

|

|

|

GRUPO TELEVISA, S.A.B.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF DECEMBER 31, 2023 AND 2022

(Millions of Mexican Pesos)

| |

December 31,

|

|

December 31,

|

| |

2023

|

|

2022

|

|

LIABILITIES

|

(Unaudited)

|

|

(Audited)

|

| |

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

Current portion of long-term debt

|

Ps.

|

9,988.0

|

|

Ps.

|

1,000.0

|

|

Interest payable

|

|

1,506.8

|

|

|

1,761.1

|

|

Current portion of lease liabilities

|

|

1,280.9

|

|

|

1,373.2

|

|

Derivative financial instruments

|

|

-

|

|

|

71.4

|

|

Trade accounts payable and accrued expenses

|

|

13,673.6

|

|

|

16,083.9

|

|

Customer deposits and advances

|

|

1,391.5

|

|

|

1,841.1

|

|

Current portion of deferred revenue

|

|

287.7

|

|

|

287.7

|

|

Income taxes payable

|

|

840.0

|

|

|

4,457.9

|

|

Other taxes payable

|

|

2,839.1

|

|

|

2,661.2

|

|

Employee benefits

|

|

1,563.9

|

|

|

1,384.8

|

|

Due to related parties

|

|

579.0

|

|

|

88.3

|

|

Provision for lawsuit settlement agreement

|

|

-

|

|

|

1,850.2

|

|

Other current liabilities

|

|

1,773.8

|

|

|

1,510.0

|

|

Total current liabilities

|

|

35,724.3

|

|

|

34,370.8

|

|

Non-current liabilities:

|

|

|

|

|

|

|

Long-term debt, net of current portion

|

|

78,547.9

|

|

|

104,240.7

|

|

Lease liabilities, net of current portion

|

|

6,010.6

|

|

|

6,995.8

|

|

Deferred revenue, net of current portion

|

|

4,890.4

|

|

|

5,178.0

|

|

Deferred income tax liabilities

|

|

1,027.7

|

|

|

1,249.5

|

|

Post-employment benefits

|

|

733.1

|

|

|

771.5

|

|

Other long-term liabilities

|

|

1,875.0

|

|

|

2,171.3

|

|

Total non-current liabilities

|

|

93,084.7

|

|

|

120,606.8

|

|

Total liabilities

|

|

128,809.0

|

|

|

154,977.6

|

| |

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

Capital stock

|

|

4,722.8

|

|

|

4,836.7

|

|

Additional paid-in capital

|

|

15,889.8

|

|

|

15,889.8

|

| |

|

20,612.6

|

|

|

20,726.5

|

|

Retained earnings:

|

|

|

|

|

|

|

Legal reserve

|

|

2,139.0

|

|

|

2,139.0

|

|

Unappropriated earnings

|

|

126,649.9

|

|

|

84,202.7

|

|

Net (loss) income for the year

|

|

(10,235.9

|

|

|

44,712.2

|

| |

|

118,553.0

|

|

|

131,053.9

|

|

Accumulated other comprehensive loss, net

|

|

(9,794.1

|

|

|

(10,823.9

|

|

Shares repurchased

|

|

(11,745.6

|

|

|

(12,648.6

|

| |

|

97,013.3

|

|

|

107,581.4

|

|

Equity attributable to stockholders of the Company

|

|

117,625.9

|

|

|

128,307.9

|

|

Non-controlling interests

|

|

15,400.9

|

|

|

15,822.0

|

|

Total equity

|

|

133,026.8

|

|

|

144,129.9

|

|

Total liabilities and equity

|

Ps.

|

261,835.8

|

|

Ps.

|

299,107.5

|

GRUPO TELEVISA, S.A.B.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE

THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2023 AND 2022

(Millions of Mexican Pesos)

| |

Three months ended December 31,

|

|

Twelve months ended December 31,

|

|

| |

2023

|

|

2022

|

|

2023

|

|

2022

|

|

| |

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

Ps.

|

18,412.4

|

|

Ps.

|

19,132.3

|

|

Ps.

|

73,767.9

|

|

Ps.

|

75,526.6

|

|

|

Cost of revenues

|

|

12,278.7

|

|

|

12,903.5

|

|

|

48,893.6

|

|

|

48,807.6

|

|

|

Selling expenses

|

|

2,563.4

|

|

|

2,729.6

|

|

|

9,146.9

|

|

|

9,422.9

|

|

|

Administrative expenses

|

|

3,239.4

|

|

|

3,316.8

|

|

|

12,196.9

|

|

|

12,061.9

|

|

|

Income before other expense

|

|

330.9

|

|

|

182.4

|

|

|

3,530.5

|

|

|

5,234.2

|

|

|

Other income (expense), net

|

|

213.9

|

|

|

(315.2

|

)

|

|

(866.8

|

)

|

|

(815.6

|

)

|

|

Operating income (loss)

|

|

544.8

|

|

|

(132.8

|

)

|

|

2,663.7

|

|

|

4,418.6

|

|

|

Finance expense

|

|

(1,990.7

|

)

|

|

(2,818.8

|

)

|

|

(7,931.7

|

)

|

|

(11,357.3

|

)

|

|

Finance income

|

|

904.5

|

|

|

594.4

|

|

|

3,307.4

|

|

|

2,151.1

|

|

|

Finance expense, net

|

|

(1,086.2

|

)

|

|

(2,224.4

|

)

|

|

(4,624.3

|

)

|

|

(9,206.2

|

)

|

|

Share of loss of associates and joint

ventures, net

|

|

(6,920.5

|

)

|

|

(12,638.0

|

)

|

|

(6,210.1

|

)

|

|

(7,378.2

|

)

|

|

Loss before income taxes

|

|

(7,461.9

|

)

|

|

(14,995.2

|

)

|

|

(8,170.7

|

)

|

|

(12,165.8

|

)

|

|

Income tax (expense) benefit

|

|

(1,560.4

|

)

|

|

2,211.8

|

|

|

(2,440.9

|

)

|

|

1,227.5

|

|

|

Net loss from continuing operations

|

|

(9,022.3

|

)

|

|

(12,783.4

|

)

|

|

(10,611.6

|

)

|

|

(10,938.3

|

)

|

|

Income from discontinued operations, net

|

|

-

|

|

|

618.5

|

|

|

-

|

|

|

56,222.2

|

|

|

Net (loss) income

|

Ps.

|

(9,022.3

|

)

|

Ps.

|

(12,164.9

|

)

|

Ps.

|

(10,611.6

|

)

|

Ps.

|

45,283.9

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders of the Company

|

Ps.

|

(8,662.0

|

)

|

Ps.

|

(12,188.7

|

)

|

Ps.

|

(10,235.9

|

)

|

Ps.

|

44,712.2

|

|

|

Non-controlling interests

|

|

(360.3

|

)

|

|

23.8

|

|

|

(375.7

|

)

|

|

571.7

|

|

|

Net (loss) income

|

Ps.

|

(9,022.3

|

)

|

Ps.

|

(12,164.9

|

)

|

Ps.

|

(10,611.6

|

)

|

Ps.

|

45,283.9

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) earnings per CPO attributable to

stockholders of the Company:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations

|

Ps.

|

(3.10

|

)

|

Ps.

|

(4.53

|

)

|

Ps.

|

(3.66

|

)

|

Ps.

|

(4.06

|

)

|

|

Discontinued operations

|

|

-

|

|

|

0.23

|

|

|

-

|

|

|

19.86

|

|

|

Total

|

Ps.

|

(3.10

|

)

|

Ps.

|

(4.30

|

)

|

Ps.

|

(3.66

|

)

|

Ps.

|

15.80

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

GRUPO TELEVISA, S.A.B.

|

|

| |

|

|

|

|

|

By:

|

/s/ Luis Alejandro Bustos Olivares |

|

| |

Name: |

Luis Alejandro Bustos Olivares |

|

| |

Title:

|

Legal Vice President and General Counsel |

|

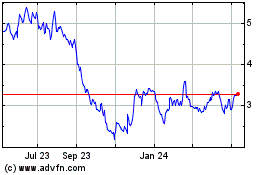

Grupo Televisa (NYSE:TV)

Historical Stock Chart

From Mar 2024 to Apr 2024

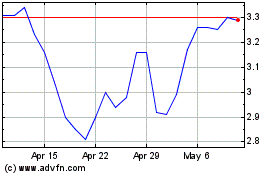

Grupo Televisa (NYSE:TV)

Historical Stock Chart

From Apr 2023 to Apr 2024