Total revenue generating units reached 12.5 million. Quarterly growth was mainly driven by 18.5 thousand broadband net additions and 149.1 thousand voice net additions. Video RGUs decreased by 42.0

thousand. Total net additions for the quarter were approximately 125.6 thousand.

The following tables set forth the breakdown of revenues and operating segment income, excluding consolidation adjustments, for our MSO and enterprise operations for third-quarter 2019 and 2018.

During the quarter, Sky continued growing in video RGUs adding 19.0 thousand, and also kept on growing its broadband business after adding 80.6 thousand broadband RGUs. It reached a total of 319.0

thousand broadband RGUs.

Sky ended the quarter with 7.7 million video and broadband RGUs, of which 166,173 were video RGUs in Central America and the Dominican Republic.

Content

Excluding the non-recurring licensing revenue, third-quarter sales decreased by 0.5% to Ps.8,659.0 million

compared with Ps.8,700.0 million in third-quarter 2018. Third-quarter sales, including 2018 non-recurring licensing revenue, declined 10.8%.

|

Millions of Mexican pesos

|

3Q’19

|

%

|

3Q’18

|

%

|

Change %

|

|

Advertising

|

4,786.6

|

55.3

|

5,051.2

|

58.1

|

(5.2)

|

|

Network Subscription

|

1,238.9

|

14.3

|

1,182.8

|

13.6

|

4.7

|

|

Licensing and Syndication

|

2,633.5

|

30.4

|

2,466.0

|

28.3

|

6.8

|

|

Net Sales

|

8,659.0

|

100.0

|

8,700.0

|

100.0

|

(0.5)

|

|

Non-recurring licensing revenue

|

n/a

|

|

1,010.1

|

|

n/a

|

|

Net Sales

|

8,659.0

|

|

9,710.1

|

|

(10.8)

|

Advertising

Third-quarter advertising sales decreased by 5.2% to Ps.4,786.6 million compared with Ps.5,051.2 million in third-quarter 2018. The

decline was mostly driven by lower government advertising revenue. Private sector advertising grew 1.3%, including the transmission of the World Cup last year. Excluding the effect of the World Cup, core private sector advertising revenue was up by

5.1%.

Network Subscription

Third-quarter Network Subscription revenues increased by 4.7% to Ps.1,238.9 million compared with Ps.1,182.8 million in third-quarter 2018.

Licensing and Syndication

Third-quarter Licensing and Syndication sales increased by 6.8% to Ps.2,633.5 million from Ps.2,466.0 million in third-quarter 2018. Royalties from

Univision increased 2.7%, reaching U.S.$100.2 million dollars in third-quarter 2019 compared to U.S.$97.6 million dollars in third-quarter 2018.

Third-quarter operating segment income, excluding the non-recurring licensing revenue, increased by 0.1% to

Ps.3,112.3 million compared with Ps.3,110.7 million in third-quarter 2018. The margin was 35.9%, in line with third-quarter 2018.

Other Businesses

Third-quarter sales increased by 35.3% to Ps.2,633.1 million compared with Ps.1,946.5 million in third-quarter 2018. The increase is mainly explained by

non-recurring soccer revenue and by growth in our gaming business, partially compensated by the publishing business.

Third-quarter operating segment income increased by 508.1% to Ps.770.5 million compared with Ps.126.7 million in third-quarter 2018. The increase was mainly

explained by the abovementioned non-recurrent soccer revenue and growth in our gaming business, mainly compensated by the publishing business.

Corporate Expense

Corporate expense decreased by Ps.59.7 million, or 12.0%, to Ps.436.3 million in third-quarter 2019, from Ps.496.0 million in third-quarter 2018. Corporate expense reflected primarily a share-based

compensation expense.

Share-based compensation expense in third quarter 2019 and 2018 amounted to Ps.251.8 million and Ps.317.2 million, respectively, and was accounted for as corporate expense. Share-based compensation

expense is measured at fair value at the time the equity benefits are conditionally sold to officers and employees and is recognized over the vesting period.

Some of our outstanding awards ("Awards") under Televisa's Long-Term Retention Plan (the "Plan") currently have purchase prices that greatly exceed the current market price of the underlying CPOs or

CPO equivalents. In order to provide long-term incentives, align our officers' and employees' interests with those of our stockholders and retain officers and employees, the Board of Directors, with the favorable opinion of the Corporate Practices

Committee, which oversees executive compensation, has authorized Televisa to terminate certain Awards, subject to the consent of their respective holders, and to substitute it with an award for half the number of CPOs or CPO equivalents that were

terminated, with an initial price to be based on market price on the date hereof, subject to potential upward adjustments. This action could terminate Awards for up to 82 million CPO equivalents in the aggregate. This will represent a non-cash cost for

the Company of up to the equivalent of approximately U.S.$30 million dollars in the aggregate over a period of three years.

Other Expense, Net

Other expense, net, decreased by Ps.43.1 million, or 10.0%, to Ps.389.4 million in third-quarter 2019, from Ps.432.5 million in third-quarter 2018. This

decrease reflected primarily a lower non-recurrent severance expense in connection with dismissal of personnel in our Content segment, as well as the absence of a loss on disposition of investments, which was partially offset by an increase in other

expense related to legal and financial advisory professional services, as well as a higher loss on disposition of property and equipment.

The following table sets forth the breakdown of cash and non-cash other expense, net, stated in millions of Mexican pesos, for the

three months ended September 30, 2019 and 2018.

|

Other expense, net

|

3Q’19

|

3Q’18

|

|

Cash expenses, net

|

183.9

|

245.2

|

|

Non-cash expenses, net

|

205.5

|

187.3

|

|

Total

|

389.4

|

432.5

|

Finance Expense, Net

The following table sets forth finance (expense) income, net, stated in millions of Mexican pesos for the quarters ended September 30, 2019 and 2018.

|

|

3Q’19

|

3Q’18

|

(Increase)

Decrease

|

|

Interest expense

|

(2,861.5)

|

(2,395.1)

|

(466.4)

|

|

Interest income

|

565.4

|

419.3

|

146.1

|

|

Foreign exchange (loss) gain, net

|

(929.5)

|

17.0

|

(946.5)

|

|

Other finance income (expense), net

|

355.4

|

(530.5)

|

885.9

|

|

Finance expense, net

|

(2,870.2)

|

(2,489.3)

|

(380.9)

|

The finance expense, net, increased by Ps.380.9 million, or 15.3%, to Ps.2,870.2 million in third-quarter 2019 from Ps.2,489.3 million in third-quarter 2018.

This increase reflected

|

I.

|

a Ps.946.5 million unfavorable change in foreign exchange gain or loss, net, resulting primarily from a 2.9% depreciation of the Mexican peso

against the U.S. dollar in comparison to a 5.7% appreciation in third-quarter 2018, on a higher average net U.S. dollar liability position in third-quarter 2019; and

|

|

II.

|

a Ps.466.4 million increase in interest expense, primarily due to a higher average principal amount of debt in third-quarter 2019, as well as

a Ps.106.8 million interest expense related to lease liabilities recognized on January 1, 2019, in connection with the adoption of IFRS 16 Leases, which became effective on that date.

|

These unfavorable variances were partially offset by (i) a Ps.146.1 million increase in interest income explained primarily by a higher average amount

of Mexican peso cash equivalents in third-quarter 2019, as well as higher interest rates applicable in such quarter; and (ii) a favorable change of Ps.885.9 million in other finance income or expense, net, resulting primarily from a net gain in fair

value of our derivative contracts in third-quarter 2019.

Share of Income of Associates and Joint Ventures, Net

Share of income of associates and joint ventures, net, decreased by Ps.166.7 million, or 51.0%, to Ps.159.9 million in third-quarter 2019 from Ps.326.6 million in third-quarter

2018. This decrease reflected mainly:

|

I.

|

the absence of share of income of Ocesa Entretenimiento, S.A. de C.V. (“OCEN”), a live entertainment company with operations in Mexico, Central America and Colombia, where we maintain a

40% stake, as we classified this investment as held for sale as of July 31, 2019, and discontinued the recognition of share of income of OCEN beginning on August 1, 2019, in connection with an agreement to dispose of this associate, subject

to certain customary closing conditions; and

|

|

II.

|

a lower share of income of Univision Holdings, Inc. (“UHI”), the controlling company of Univision Communications Inc.

|

Share of income of associates and joint ventures, net, for the third-quarter 2019, includes primarily our share of income of UHI.

Income Taxes

Income taxes increased by Ps.27.3 million, or 3.9%, to Ps.726.8 million in third-quarter 2019 compared with Ps.699.5 million in third-quarter 2018. This

increase reflected primarily a higher effective income tax rate.

Net Income Attributable to Non-controlling Interests

Net income attributable to non-controlling interests decreased by Ps.98.2 million, or 19.6%, to Ps.403.4 million in third-quarter 2019, compared with

Ps.501.6 million in third-quarter 2018. This decrease reflected primarily a lower portion of net income attributable to non-controlling interests in our Cable and Sky segments.

Capital Expenditures

During third-quarter 2019, we invested approximately U.S.$250.9 million dollars in property, plant and equipment as capital expenditures. The following

table sets forth the breakdown of capital expenditures for third-quarter 2019 and 2018.

|

Capital Expenditures

Millions of U.S. Dollars

|

3Q’19

|

3Q’18

|

|

Cable

|

178.1

|

207.6

|

|

Sky

|

50.5

|

45.3

|

|

Content and Other Businesses

|

22.3

|

36.7

|

|

Total

|

250.9

|

289.6

|

For the full year, we are maintaining our guidance of approximately one billion U.S. dollars of capital expenditures in property, plant and equipment.

Debt, Lease Liabilities and Other Notes Payable

The following table sets forth our total consolidated debt, lease liabilities and other notes payable as of September 30, 2019 and December 31, 2018.

Amounts are stated in millions of Mexican pesos.

|

|

September 30, 2019

|

December 31, 2018

|

Increase

(Decrease)

|

|

Current portion of long-term debt

|

10,484.4

|

988.4

|

9,496.0

|

|

Long-term debt, net of current portion

|

124,283.3

|

120,983.6

|

3,299.7

|

|

Total debt 1

|

134,767.7

|

121,972.0

|

12,795.7

|

|

Current portion of long-term lease liabilities

|

1,213.8

|

651.8

|

562.0

|

|

Long-term lease liabilities, net of current portion

|

8,442.8

|

4,666.1

|

3,776.7

|

|

Total lease liabilities

|

9,656.6

|

5,317.9

|

4,338.7

|

|

Current portion of other notes payable

|

1,315.2

|

1,288.4

|

26.8

|

|

Other notes payable, net of current portion

|

-

|

1,288.4

|

(1,288.4)

|

|

Total other notes payable2

|

1,315.2

|

2,576.8

|

(1,261.6)

|

|

Total debt, lease liabilities and other notes payable

|

145,739.5

|

129,866.7

|

15,872.8

|

1 As of September 30, 2019 and December 31, 2018, total debt is presented net of finance costs in the amount of Ps.1,478.6 million and Ps.1,152.7 million,

respectively, and does not include related accrued interest payable in the amount of Ps. 2,240.2 million and Ps.1,120.0 million, respectively. On October 3, 2019, we prepaid all of the outstanding Notes due 2020, in the principal amount of Ps.10,000.0

million. Accordingly, we classified this debt as current as of September 30, 2019, net of related finance costs, in the amount of Ps.9,992.4 million.

2 Notes payable issued in 2016 in connection with the acquisition of a non-controlling interest in Televisión Internacional, S.A. de C.V., one of our Cable segment subsidiaries.

In July 2019, we announced that we executed a credit agreement for a five-year term in the principal amount of Ps.10,000 million, which was funded by a syndicate of banks. This loan was primarily

used for refinancing of existing indebtedness.

In July 2019, we prepaid all of the outstanding Notes (“Certificados Bursátiles”) due 2021 and 2022, in the aggregate principal amount of Ps.11,000 million. Also, in October 2019, we prepaid all of

the outstanding Notes (“Certificados Bursátiles”) due 2020, in the aggregate principal amount of Ps.10,000 million.

As of September 30, 2019, our consolidated net debt position (total debt, lease liabilities and other notes payable less cash and cash

equivalents, temporary investments, and certain non-current investments in financial instruments) was Ps.94,994.7 million. The aggregate amount of non-current investments in financial instruments included in our consolidated net debt position as of

September 30, 2019, amounted to Ps.12,021.6 million.

Share Repurchase Program

In the context of the repurchase program previously approved by the Board of Directors, the Company repurchased, during the third quarter 2019, 8.3 million CPOs, equivalent to approximately Ps.291.7 million.

So far during 2019, the Company has repurchased 39.0 million CPOs for up to Ps.1,385.8 million in the open market. The Company has considered from time to time additional repurchases of its CPOs, and is considering

additional repurchases by any available method, including open market purchases, block trades or tender offers pursuant and subject to applicable laws. Any repurchase would result in a reverse dilution for outstanding CPOs, including under Awards

granted under the Long-Term Retention Plan, and could affect the trading price of CPOs.

Radiopolis

In connection with the sale of Televisa’s 50% equity participation in Sistema Radiópolis, S.A. de C.V. announced

on July 17, 2019, Corporativo Coral, S.A. de C.V. and Miguel Alemán Magnani (jointly, the “Obligors”) failed to make an initial payment for approximately U.S.$32 million dollars. According to the Obligors, they have experienced delays in securing the

necessary financing. Access to financing was not agreed as a condition precedent to payment. The Company will commence the corresponding legal actions if the Obligors remain in breach of its payment obligations.

Shares Outstanding

As of September 30, 2019 and December 31, 2018, our shares outstanding amounted to 337,244.3 million and 338,329.1 million shares, respectively, and our CPO equivalents outstanding amounted to 2,882.4 million and

2,891.7 million, respectively. Not all of our shares are in the form of CPOs. The number of CPO equivalents is calculated by dividing the number of shares outstanding by 117.

As of September 30, 2019 and December 31, 2018, the GDS (Global Depositary Shares) equivalents outstanding amounted to 576.5 million and 578.3

million, respectively. The number of GDS equivalents is calculated by dividing the number of CPO equivalents by five.

Sustainability

In September, Televisa was selected as a member of the 2019 Dow Jones Sustainability MILA Pacific Alliance Index, which is comprised

of sustainability leaders from Chile, Peru, Mexico, and Colombia. In addition, Televisa was selected as one of three Mexican companies to be included in the 2019 Dow Jones Sustainability Emerging Markets Index, which is comprised of sustainability

leaders from Western Europe, India, China, South Africa, Central America, South America, and other countries.

Additional Information Available on Website

The information in this press release should be read in conjunction with the financial statements and footnotes contained in the Company's Annual Report

and on Form 20-F for the year ended December 31, 2018, which is posted on the “Reports and Filings” section of our investor relations website at televisair.com.

About Televisa

Televisa is a leading media company in the Spanish-speaking world, an important cable operator in Mexico and an operator of a

leading direct-to-home satellite pay television system in Mexico. Televisa distributes the content it produces through several broadcast channels in Mexico and in over 75 countries through 26 pay-tv brands, television networks, cable operators and

over-the-top or “OTT” services. In the United States, Televisa’s audiovisual content is distributed through Univision Communications Inc. (“Univision”) the leading media company serving the Hispanic market. Univision broadcasts Televisa’s audiovisual

content through multiple platforms in exchange for a royalty payment. In addition, Televisa has equity and warrants which upon their exercise would represent approximately 36% on a fully-diluted, as-converted basis of the equity capital in Univision

Holdings, Inc., the controlling company of Univision. Televisa’s cable business offers integrated services, including video, high-speed data and voice services to residential and commercial customers as well as managed services to domestic and

international carriers. Televisa owns a majority interest in Sky, a leading direct-to-home satellite pay television system and broadband provider in Mexico, operating also in the Dominican Republic and Central America. Televisa also has interests in

magazine publishing and distribution, radio production and broadcasting, professional sports and live entertainment, feature- film production and distribution, and gaming.

Disclaimer

This press release contains forward-looking statements regarding the Company’s results and prospects. Actual results could differ

materially from these statements. The forward-looking statements in this press release should be read in conjunction with the factors described in “Item 3. Key Information – Forward-Looking Statements” in the Company’s Annual Report on Form 20-F,

which, among others, could cause actual results to differ materially from those contained in forward-looking statements made in this press release and in oral statements made by authorized officers of the Company. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of their dates. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or

otherwise.

(Please see attached tables for financial information and ratings data)

###

Contact Information

Investor Relations

www.televisair.com.mx

Tel: (52 55) 5261 2445

Carlos Madrazo. VP, Head of Investor Relations cmadrazov@televisa.com.mx

Santiago Casado. Investor Relations Director. scasado@televisa.com.mx

Media Relations:

Alejandro Olmos / Tel: (52 55) 4438 1205 / aolmosc@televisa.com.mx

Artemisa Padilla / Tel: (52 55) 5224 6360 / apadillagu@televisa.com.mx

GRUPO TELEVISA, S.A.B.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF SEPTEMBER 30, 2019 AND DECEMBER 31, 2018

(Millions of Mexican Pesos)

|

|

|

September 30,

|

|

|

December 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

ASSETS

|

|

(Unaudited)

|

|

|

(Audited)

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

Ps.

|

38,710.9

|

|

|

Ps.

|

32,068.3

|

|

|

Temporary investments

|

|

|

12.3

|

|

|

|

31.0

|

|

|

Trade notes and accounts receivable, net

|

|

|

17,204.6

|

|

|

|

19,748.9

|

|

|

Other accounts and notes receivable, net

|

|

|

10,417.9

|

|

|

|

6,376.6

|

|

|

Derivative financial instruments

|

|

|

3.0

|

|

|

|

115.7

|

|

|

Due from related parties

|

|

|

863.8

|

|

|

|

1,078.3

|

|

|

Transmission rights and programming

|

|

|

6,803.1

|

|

|

|

7,785.7

|

|

|

Inventories

|

|

|

1,354.2

|

|

|

|

1,026.4

|

|

|

Contract costs

|

|

|

1,309.1

|

|

|

|

1,143.0

|

|

|

Assets held for sale

|

|

|

1,094.6

|

|

|

|

-

|

|

|

Other current assets

|

|

|

3,807.7

|

|

|

|

2,679.0

|

|

|

Total current assets

|

|

|

81,581.2

|

|

|

|

72,052.9

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

Derivative financial instruments

|

|

|

3.2

|

|

|

|

919.8

|

|

|

Transmission rights and programming

|

|

|

9,606.8

|

|

|

|

9,229.8

|

|

|

Investments in financial instruments

|

|

|

47,280.1

|

|

|

|

49,203.4

|

|

|

Investments in associates and joint ventures

|

|

|

9,352.2

|

|

|

|

10,546.7

|

|

|

Property, plant and equipment, net

|

|

|

83,368.4

|

|

|

|

87,342.5

|

|

|

Right-of-use assets, net

|

|

|

7,676.2

|

|

|

|

-

|

|

|

Intangible assets, net

|

|

|

42,920.1

|

|

|

|

43,063.5

|

|

|

Deferred income tax assets

|

|

|

24,293.4

|

|

|

|

22,181.8

|

|

|

Contract costs

|

|

|

2,267.5

|

|

|

|

2,227.7

|

|

|

Other assets

|

|

|

290.6

|

|

|

|

402.5

|

|

|

Total non-current assets

|

|

|

227,058.5

|

|

|

|

225,117.7

|

|

|

Total assets

|

|

Ps.

|

308,639.7

|

|

|

Ps.

|

297,170.6

|

|

|

|

|

|

|

|

|

|

|

|

GRUPO TELEVISA, S.A.B.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF SEPTEMBER 30, 2019 AND DECEMBER 31, 2018

(Millions of Mexican Pesos)

|

|

|

September 30,

|

|

|

December 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

LIABILITIES

|

|

(Unaudited)

|

|

|

(Audited)

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Current portion of long-term debt and interest payable

|

|

Ps.

|

12,724.6

|

|

|

Ps.

|

2,108.4

|

|

|

Current portion of lease liabilities

|

|

|

1,213.8

|

|

|

|

651.8

|

|

|

Current portion of other notes payable

|

|

|

1,315.2

|

|

|

|

1,288.4

|

|

|

Derivative financial instruments

|

|

|

101.9

|

|

|

|

148.1

|

|

|

Trade accounts payable and accrued expenses

|

|

|

22,361.6

|

|

|

|

22,029.5

|

|

|

Customer deposits and advances

|

|

|

10,920.8

|

|

|

|

13,637.7

|

|

|

Income taxes payable

|

|

|

2,385.7

|

|

|

|

3,054.8

|

|

|

Other taxes payable

|

|

|

2,709.6

|

|

|

|

1,280.3

|

|

|

Employee benefits

|

|

|

869.9

|

|

|

|

1,067.2

|

|

|

Due to related parties

|

|

|

649.7

|

|

|

|

714.5

|

|

|

Other current liabilities

|

|

|

2,195.2

|

|

|

|

2,550.8

|

|

|

Total current liabilities

|

|

|

57,448.0

|

|

|

|

48,531.5

|

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

|

|

Long-term debt, net of current portion

|

|

|

124,283.3

|

|

|

|

120,983.6

|

|

|

Lease liabilities, net of current portion

|

|

|

8,442.8

|

|

|

|

4,666.1

|

|

|

Other notes payable, net of current portion

|

|

|

-

|

|

|

|

1,288.4

|

|

|

Derivative financial instruments

|

|

|

392.6

|

|

|

|

-

|

|

|

Income taxes payable

|

|

|

1,736.6

|

|

|

|

3,141.4

|

|

|

Deferred income tax liabilities

|

|

|

7,885.5

|

|

|

|

8,390.5

|

|

|

Post-employment benefits

|

|

|

1,051.9

|

|

|

|

962.5

|

|

|

Other long-term liabilities

|

|

|

4,502.4

|

|

|

|

4,676.0

|

|

|

Total non-current liabilities

|

|

|

148,295.1

|

|

|

|

144,108.5

|

|

|

Total liabilities

|

|

|

205,743.1

|

|

|

|

192,640.0

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

Capital stock

|

|

|

4,907.8

|

|

|

|

4,907.8

|

|

|

Additional paid-in-capital

|

|

|

15,889.8

|

|

|

|

15,889.8

|

|

|

|

|

|

20,797.6

|

|

|

|

20,797.6

|

|

|

Retained earnings:

|

|

|

|

|

|

|

|

|

|

Legal reserve

|

|

|

2,139.0

|

|

|

|

2,139.0

|

|

|

Unappropriated earnings

|

|

|

75,568.7

|

|

|

|

70,362.5

|

|

|

Net income for the period

|

|

|

2,216.0

|

|

|

|

6,009.4

|

|

|

|

|

|

79,923.7

|

|

|

|

78,510.9

|

|

|

Accumulated other comprehensive income, net

|

|

|

2,270.5

|

|

|

|

4,427.4

|

|

|

Shares repurchased

|

|

|

(14,618.9

|

)

|

|

|

(14,219.1

|

)

|

|

|

|

|

67,575.3

|

|

|

|

68,719.2

|

|

|

Equity attributable to stockholders of the Company

|

|

|

88,372.9

|

|

|

|

89,516.8

|

|

|

Non-controlling interests

|

|

|

14,523.7

|

|

|

|

15,013.8

|

|

|

Total equity

|

|

|

102,896.6

|

|

|

|

104,530.6

|

|

|

Total liabilities and equity

|

|

Ps.

|

308,639.7

|

|

|

Ps.

|

297,170.6

|

|

|

|

|

|

|

|

|

|

|

|

GRUPO TELEVISA, S.A.B.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE THREE AND

NINE MONTHS ENDED SEPTEMBER 30, 2019 AND 2018

(Millions of Mexican Pesos)

|

|

|

Three months ended September 30,

|

|

|

Nine months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

2019

|

|

|

2018

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

Ps.

|

25,786.1

|

|

|

Ps.

|

25,033.2

|

|

|

Ps.

|

73,489.0

|

|

|

Ps.

|

74,547.1

|

|

|

Cost of sales

|

|

|

14,946.5

|

|

|

|

14,208.5

|

|

|

|

42,025.9

|

|

|

|

42,348.9

|

|

|

Selling expenses

|

|

|

2,797.2

|

|

|

|

2,609.7

|

|

|

|

8,344.2

|

|

|

|

8,037.4

|

|

|

Administrative expenses

|

|

|

3,057.3

|

|

|

|

3,440.7

|

|

|

|

10,081.5

|

|

|

|

10,223.8

|

|

|

Income before other expense

|

|

|

4,985.1

|

|

|

|

4,774.3

|

|

|

|

13,037.4

|

|

|

|

13,937.0

|

|

|

Other (expense) income, net

|

|

|

(389.4

|

)

|

|

|

(432.5

|

)

|

|

|

(861.3

|

)

|

|

|

2,651.3

|

|

|

Operating income

|

|

|

4,595.7

|

|

|

|

4,341.8

|

|

|

|

12,176.1

|

|

|

|

16,588.3

|

|

|

Finance expense

|

|

|

(3,791.0

|

)

|

|

|

(2,925.6

|

)

|

|

|

(8,623.6

|

)

|

|

|

(8,150.4

|

)

|

|

Finance income

|

|

|

920.8

|

|

|

|

436.3

|

|

|

|

1,210.8

|

|

|

|

1,685.2

|

|

|

Finance expense, net

|

|

|

(2,870.2

|

)

|

|

|

(2,489.3

|

)

|

|

|

(7,412.8

|

)

|

|

|

(6,465.2

|

)

|

|

Share of income of associates and joint

ventures, net

|

|

|

159.9

|

|

|

|

326.6

|

|

|

|

489.6

|

|

|

|

910.9

|

|

|

Income before income taxes

|

|

|

1,885.4

|

|

|

|

2,179.1

|

|

|

|

5,252.9

|

|

|

|

11,034.0

|

|

|

Income taxes

|

|

|

726.8

|

|

|

|

699.5

|

|

|

|

1,972.8

|

|

|

|

3,798.7

|

|

|

Net income

|

|

Ps.

|

1,158.6

|

|

|

Ps.

|

1,479.6

|

|

|

Ps.

|

3,280.1

|

|

|

Ps.

|

7,235.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders of the Company

|

|

Ps.

|

755.2

|

|

|

Ps.

|

978.0

|

|

|

Ps.

|

2,216.0

|

|

|

Ps.

|

5,952.9

|

|

|

Non-controlling interests

|

|

|

403.4

|

|

|

|

501.6

|

|

|

|

1,064.1

|

|

|

|

1,282.4

|

|

|

Net income

|

|

Ps.

|

1,158.6

|

|

|

Ps.

|

1,479.6

|

|

|

Ps.

|

3,280.1

|

|

|

Ps.

|

7,235.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per CPO attributable to

stockholders of the Company

|

|

$

|

0.26

|

|

|

$

|

0.34

|

|

|

$

|

0.77

|

|

|

$

|

2.05

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

GRUPO TELEVISA, S.A.B.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Dated: October 29, 2019

|

|

|

|

By

|

|

/s/ Luis Alejandro Bustos Olivares

|

|

|

|

|

|

Name:

|

|

Luis Alejandro Bustos Olivares

|

|

|

|

|

|

Title:

|

|

Legal Vice President and General Counsel

|

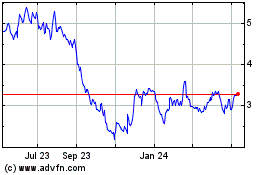

Grupo Televisa (NYSE:TV)

Historical Stock Chart

From Mar 2024 to Apr 2024

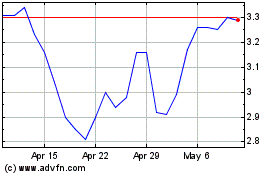

Grupo Televisa (NYSE:TV)

Historical Stock Chart

From Apr 2023 to Apr 2024