Greif, Inc. Reports Fiscal Second Quarter 2005 Results DELAWARE,

Ohio, June 2 /PRNewswire-FirstCall/ -- Greif, Inc.

(NYSE:GEFNYSE:GEF.B), a global leader in industrial packaging with

niche businesses in paper, corrugated packaging and timber, today

announced results for its second quarter ended April 30, 2005. Net

income before restructuring charges, debt extinguishment charge and

timberland gains (special items) was $23.9 million for the second

quarter of 2005 compared with $16.0 million for the second quarter

of last year. Diluted earnings per share before special items were

$0.81 versus $0.56 per Class A share and $1.25 versus $0.85 per

Class B share for the second quarter of 2005 and 2004,

respectively. The Company reported GAAP net income of $16.8

million, or $0.57 per diluted Class A share and $0.88 per diluted

Class B share, for the second quarter of 2005 versus $8.4 million,

or $0.30 per diluted Class A share and $0.45 per diluted Class B

share, for the same quarter last year. The Company's second quarter

2005 results were positively impacted by a higher gross profit

($8.7 million increase), a lower level of restructuring charges

($1.7 million decrease) and higher timberland gains ($2.0 million

increase) compared to the second quarter of 2004. These positive

impacts were partially offset by a debt extinguishment charge ($2.8

million) in the second quarter of 2005. Michael J. Gasser, chairman

and chief executive officer, said, "Operating results for the

second quarter of 2005 are in line with our expectations, despite

continued competitive pressures and higher input costs. During

fiscal 2005, the Greif Business System, which is the way we do

business, will continue to benefit our operations as we strive to

sustain the positive results already achieved and look for new

opportunities to further enhance shareholder value." A

reconciliation of the differences between all non-GAAP financial

measures disclosed in this release with the most directly

comparable GAAP financial measures is included in the financial

schedules that are a part of this release. Consolidated Results Net

sales rose 13 percent (10 percent excluding the impact of foreign

currency translation) to $613.0 million for the second quarter of

2005 from $542.2 million for the same quarter of 2004. The net

sales improvement was attributable to the Industrial Packaging

& Services segment ($58.7 million increase) and the Paper,

Packaging & Services segment ($12.0 million increase). Higher

selling prices, primarily in response to increased costs of steel

and resin, drove this improvement. Gross profit was $97.9 million,

or 16.0 percent of net sales, for the second quarter of 2005 versus

$89.3 million, or 16.5 percent of net sales, for the second quarter

of 2004. The deterioration in gross profit margin compared to a

year ago was principally due to generally lower sales volumes and

higher raw material costs, partially offset by improved selling

prices and labor and other manufacturing efficiencies related to

the ongoing transformation initiatives. See "Transformation to the

Greif Business System" below. Selling, general and administrative

(SG&A) expenses were $56.1 million, or 9.1 percent of net

sales, for the second quarter of 2005 compared to $55.7 million, or

10.3 percent of net sales, for the same period a year ago. While

certain SG&A expenses, such as employee benefits and

professional fees, primarily related to compliance matters

regarding Section 404 of the Sarbanes- Oxley Act of 2002, were

higher on a quarter-over-quarter comparison, certain other SG&A

expenses were reduced compared to the second quarter of 2004.

Operating profit before restructuring charges and timberland gains

increased 28 percent to $42.7 million for the second quarter of

2005 compared with $33.3 million for the second quarter of 2004.

This increase was primarily attributable to the Paper, Packaging

& Services segment ($7.9 million increase) and the Industrial

Packaging & Services segment ($1.7 million increase), partially

offset by the Timber segment ($0.2 million decrease). There were

$10.6 million and $12.3 million of restructuring charges and $3.4

million and $1.4 million of timberland gains during the second

quarter of 2005 and 2004, respectively. GAAP operating profit was

$35.4 million for the second quarter of 2005 compared with $22.4

million for the same period last year. Business Group Results

Industrial Packaging & Services In the Industrial Packaging

& Services segment, the Company offers a comprehensive line of

industrial packaging products, such as steel, fibre and plastic

drums, intermediate bulk containers, closure systems for industrial

packaging products and polycarbonate water bottles throughout the

world. The key factors influencing profitability in the second

quarter of 2005 compared to the second quarter of 2004 in the

Industrial Packaging & Services segment were: - Higher selling

prices; - Generally lower sales volumes for steel and fibre drums;

- Benefits from transformation initiatives; - Higher raw material

costs, especially steel and resin; - Lower restructuring charges;

and - Impact of foreign currency translation. In this segment, net

sales rose 15 percent (11 percent excluding the impact of foreign

currency translation) to $458.4 million for the second quarter of

2005 from $399.7 million for the same period last year. Selling

prices rose primarily in response to higher raw material costs,

especially steel and resin, compared to the same quarter last year.

However, sales volumes were generally lower for steel and fibre

drums. Operating profit before restructuring charges rose to $29.4

million for the second quarter of 2005 from $27.8 million for the

same period a year ago. Restructuring charges were $8.8 million for

the second quarter of 2005 compared with $9.5 million a year ago.

The Industrial Packaging & Services segment's gross profit

margin declined to 15.6 percent in the second quarter of 2005

versus 17.8 percent in the second quarter of 2004 due to generally

lower sales volumes and higher raw material costs, partially offset

by improved selling prices and labor and other manufacturing

efficiencies related to the transformation initiatives. GAAP

operating profit was $20.6 million for the second quarter of 2005

compared with $18.2 million for the second quarter of 2004. Paper,

Packaging & Services In the Paper, Packaging & Services

segment, the Company sells containerboard, corrugated sheets and

other corrugated products and multiwall bags in North America. The

key factors influencing profitability in the second quarter of 2005

compared to the second quarter of 2004 in the Paper, Packaging

& Services segment were: - Higher selling prices; - Generally

lower sales volumes for containerboard, corrugated sheets and

corrugated containers; and - Lower restructuring charges. In this

segment, net sales rose 9 percent to $150.0 million for the second

quarter of 2005 from $138.0 million for the same period last year

due to improved selling prices for this segment's products. Sales

volumes for containerboard, corrugated sheets and corrugated

containers were down on a quarter-over-quarter comparison.

Operating profit before restructuring charges was $10.4 million for

the second quarter of 2005 compared with $2.4 million the prior

year. Restructuring charges were $1.8 million for the second

quarter of 2005 versus $2.7 million a year ago. The increase in

operating profit before restructuring charges was primarily due to

improved selling prices, partially offset by generally lower sales

volumes and higher transportation and energy costs in the

containerboard operations. GAAP operating profit was $8.6 million

for the second quarter of 2005 compared with a loss of $0.2 million

for the second quarter of 2004. Timber As of April 30, 2005, the

Company owned approximately 281,000 acres of timber properties in

southeastern United States, which were actively harvested and

regenerated, and approximately 35,000 acres in Canada. The key

factors influencing profitability in the second quarter of 2005

compared to the second quarter of 2004 in the Timber segment were:

- Consistent level of timber sales; and - Higher gain on sale of

timberland. Timber net sales were $4.5 million for the second

quarter of 2005 and 2004. Operating profit before restructuring

charges and timberland gains was $2.9 million for the second

quarter of 2005 compared to $3.1 million a year ago. Restructuring

charges were insignificant for the second quarter in both years.

Timberland gains were $3.4 million for the second quarter of 2005

and $1.4 million for the same quarter last year. GAAP operating

profit was $6.2 million for the second quarter of 2005 compared

with $4.4 million for the second quarter of 2004. As previously

reported, in May 2005, the Company completed the first phase of the

sale of 56,000 acres of timberland, timber and associated assets

for $90 million. In this first phase, 35,000 acres of the Company's

timberland holdings in Florida, Georgia and Alabama were sold for

approximately $51 million in the third quarter of 2005. The second

phase of this transaction is expected to occur in several

installments during the Company's 2006 fiscal year. The Company

will recognize significant timberland gains in its consolidated

statements of income in the periods that these transactions occur.

Transformation to the Greif Business System The Company's

transformation to the Greif Business System continues to enhance

long-term organic sales growth, generate productivity improvements

and achieve permanent cost reductions. The transformation, which

began in fiscal 2003, delivered annualized benefits of

approximately $80 million through the end of fiscal 2004.

Additional annualized benefits of approximately $35 million are

expected during fiscal 2005. The opportunities continue to include,

but are not limited to, improved labor productivity, material yield

and other manufacturing efficiencies, coupled with further

footprint consolidation. In addition, the Company has launched a

strategic sourcing initiative to more effectively leverage its

global spend and lay the foundation for a world-class sourcing and

supply chain capability. In the second quarter of 2005, the Company

recorded restructuring charges of $6.8 million related to

transformation activities begun prior to October 31, 2004. These

restructuring charges totaled $14.0 million for the first half of

2005. Management is pleased with the progress of the transformation

initiatives to-date and is continuing to evaluate future

rationalization options based on that progress. In the second

quarter of 2005, the Company also recorded $3.8 million of

restructuring charges related to the impairment of two facilities,

currently held for sale, that were closed during previous

restructuring programs. Financing Arrangements Total debt

outstanding was $490 million at April 30, 2005 compared to $469

million at October 31, 2004 and $644 million at April 30, 2004.

Total debt to total capitalization was 42.1 percent at April 30,

2005 compared to 42.7 percent at October 31, 2004 and 52.5 percent

at April 30, 2004. Interest expense was $10.7 million for the

second quarter of 2005 and 2004. Lower average debt outstanding was

offset by higher interest rates during the second quarter of 2005

compared to the second quarter of 2004. During the second quarter

of 2005, the Company entered into a new revolving credit facility

to improve pricing and financial flexibility. As a result, the

Company recorded a $2.8 million debt extinguishment charge. Capital

Expenditures Capital expenditures were $16.2 million, excluding

timberland purchases of $1.3 million, for the second quarter of

2005 compared with capital expenditures of $16.3 million, excluding

timberland purchases of $1.9 million, during the same period last

year. For fiscal 2005, capital expenditures are expected to be

approximately $75 million, excluding timberland purchases, which

would be approximately $25 million below the Company's anticipated

depreciation expense of approximately $100 million. Company Outlook

Ongoing benefits from the transformation initiatives, which include

incremental savings of $35 million to be realized in fiscal 2005,

favorable comparisons for the Paper, Packaging & Services

segment and generally better results in the international

operations of the Industrial Packaging & Services segment are

expected to drive earnings improvement. These positive factors will

be partially offset by lower planned timber sales coupled with

downward pricing pressure and lower than planned sales volumes

during the second half of fiscal 2005. The second quarter results

were in line with expectations and management reaffirms previous

earnings guidance, before special items, in the range of $3.50 to

$3.60 per Class A share for fiscal 2005. Conference Call The

Company will host a conference call to discuss its second quarter

of 2005 results on Friday, June 3, 2005 at 10:00 a.m. ET at (800)

218-9073. For international callers, the number is +1 (303)

262-2130. The conference call will also be available through a live

webcast, including slides, which can be accessed at

http://www.greif.com/. A replay of the conference call will be

available on the Company's Web site approximately one hour

following the call. About Greif Greif is a world leader in

industrial packaging products and services. The Company provides

extensive expertise in steel, plastic, fibre, corrugated and

multiwall containers for a wide range of industries. Greif also

produces containerboard and manages timber properties in the United

States. Greif is strategically positioned in more than 40 countries

to serve multinational as well as regional customers. Additional

information is on the Company's Web site at http://www.greif.com/.

Forward-Looking Statements All statements other than statements of

historical facts included in this news release, including, without

limitation, statements regarding the Company's future financial

position, business strategy, budgets, projected costs, goals and

plans and objectives of management for future operations, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements generally can be identified by the use of

forward-looking terminology such as "may," "will," "expect,"

"intend," "estimate," "anticipate," "project," "believe,"

"continue" or "target" or the negative thereof or variations

thereon or similar terminology. All forward-looking statements made

in this news release are based on information currently available

to management. Although the Company believes that the expectations

reflected in forward-looking statements have a reasonable basis,

the Company can give no assurance that these expectations will

prove to be correct. Forward-looking statements are subject to

risks and uncertainties that could cause actual events or results

to differ materially from those expressed in or implied by the

statements. Such risks and uncertainties that might cause a

difference include, but are not limited to: general economic or

business conditions, including a prolonged or substantial economic

downturn; changing trends and demands in the industries in which

the Company competes, including industry over-capacity; industry

competition; the continuing consolidation of the Company's customer

base for its industrial packaging, containerboard and corrugated

products; political instability in those foreign countries where

the Company manufactures and sells its products; foreign currency

fluctuations and devaluations; availability and costs of raw

materials for the manufacture of the Company's products,

particularly steel, resin and old corrugated containers, and price

fluctuations in energy costs; costs associated with litigation or

claims against the Company pertaining to environmental, safety and

health, product liability and other matters; work stoppages and

other labor relations matters; property loss resulting from wars,

acts of terrorism or natural disasters; the Company's ability to

integrate its newly acquired operations effectively with its

existing business; the Company's ability to achieve improved

operating efficiencies and capabilities; the frequency and volume

of sales of the Company's timber and timberland; and the deviation

of actual results from the estimates and/or assumptions used by the

Company in the application of its significant accounting policies.

These and other risks and uncertainties that could materially

affect the Company's consolidated financial results are further

discussed in its filings with the Securities and Exchange

Commission, including its Form 10-K for the year ended October 31,

2004. The Company assumes no obligation to update any

forward-looking statements. GREIF, INC. AND SUBSIDIARY COMPANIES

CONSOLIDATED STATEMENTS OF INCOME UNAUDITED (Dollars in thousands,

except per share amounts) Three months ended Six months ended April

30, April 30, 2005 2004 2005 2004 Net sales $612,960 $542,189

$1,195,524 $1,011,049 Cost of products sold 515,042 452,928

1,008,880 852,338 Gross profit 97,918 89,261 186,644 158,711

Selling, general and administrative expenses 56,068 55,745 115,789

106,770 Restructuring charges 10,621 12,278 17,807 27,537 Gain on

sale of assets 4,194 1,122 14,538 5,231 Operating profit 35,423

22,360 67,586 29,635 Interest expense, net 10,693 10,716 20,786

22,963 Debt extinguishment charge 2,828 -- 2,828 -- Other income,

net 1,973 694 1,207 916 Income before income tax expense and equity

in earnings of affiliates and minority interests 23,875 12,338

45,179 7,588 Income tax expense 7,001 3,800 12,966 2,337 Equity in

earnings of affiliates and minority interests (107) (89) (310)

(168) Net income $16,767 $8,449 $31,903 $5,083 Basic earnings per

share: Class A Common Stock $0.58 $0.30 $1.12 $0.18 Class B Common

Stock $0.88 $0.45 $1.67 $0.27 Diluted earnings per share: Class A

Common Stock $0.57 $0.30 $1.09 $0.18 Class B Common Stock $0.88

$0.45 $1.67 $0.27 GREIF, INC. AND SUBSIDIARY COMPANIES SEGMENT DATA

UNAUDITED (Dollars in thousands) Three months ended Six months

ended April 30, April 30, 2005 2004 2005 2004 Net sales Industrial

Packaging & Services $458,404 $399,689 $887,446 $737,080 Paper,

Packaging & Services 150,034 138,043 298,239 263,337 Timber

4,522 4,457 9,839 10,632 Total $612,960 $542,189 $1,195,524

$1,011,049 Operating profit Operating profit before restructuring

charges and timberland gains: Industrial Packaging & Services

$29,411 $27,760 $47,090 $36,611 Paper, Packaging & Services

10,372 2,435 19,963 7,788 Timber 2,868 3,079 6,875 7,475 Total

operating profit before restructuring charges and timberland gains

42,651 33,274 73,928 51,874 Restructuring charges: Industrial

Packaging & Services 8,809 9,540 15,607 21,563 Paper, Packaging

& Services 1,764 2,665 2,141 5,834 Timber 48 73 59 140

Restructuring charges 10,621 12,278 17,807 27,537 Timberland gains:

Timber 3,393 1,364 11,465 5,298 Total $35,423 $22,360 $67,586

$29,635 Depreciation, depletion and amortization expense Industrial

Packaging & Services $16,176 $17,019 $32,312 $34,078 Paper,

Packaging & Services 8,322 8,486 16,774 17,311 Timber 694 592

1,088 1,418 Total $25,192 $26,097 $50,174 $52,807 GREIF, INC. AND

SUBSIDIARY COMPANIES GEOGRAPHIC DATA UNAUDITED (Dollars in

thousands) Three months ended Six months ended April 30, April 30,

2005 2004 2005 2004 Net sales North America $332,515 $305,470

$649,691 $573,494 Europe 191,316 159,001 367,486 291,947 Other

89,129 77,718 178,347 145,608 Total $612,960 $542,189 $1,195,524

$1,011,049 Operating profit Operating profit before restructuring

charges and timberland gains: North America $19,303 $13,672 $36,940

$22,156 Europe 13,883 12,993 19,923 17,304 Other 9,465 6,609 17,065

12,414 Operating profit before restructuring charges and timberland

gains 42,651 33,274 73,928 51,874 Restructuring charges 10,621

12,278 17,807 27,537 Timberland gains 3,393 1,364 11,465 5,298

Total $35,423 $22,360 $67,586 $29,635 GREIF, INC. AND SUBSIDIARY

COMPANIES CONDENSED CONSOLIDATED BALANCE SHEETS (Dollars in

thousands) April 30, 2005 October 31, 2004 (Unaudited) ASSETS

CURRENT ASSETS Cash and cash equivalents $52,029 $38,109 Trade

accounts receivable 282,564 307,750 Inventories 222,149 191,457

Other current assets 86,935 75,366 643,677 612,682 LONG-TERM ASSETS

Goodwill 228,571 237,803 Intangible assets 25,454 27,524 Other

long-term assets 56,363 54,547 310,388 319,874 PROPERTIES, PLANTS

AND EQUIPMENT 857,014 880,682 $1,811,079 $1,813,238 LIABILITIES AND

SHAREHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable $241,930

$281,265 Short-term borrowings 23,506 11,621 Other current

liabilities 133,534 144,332 398,970 437,218 LONG-TERM LIABILITIES

Long-term debt 466,215 457,415 Other long-term liabilities 272,299

287,786 738,514 745,201 MINORITY INTEREST 1,290 1,725 SHAREHOLDERS'

EQUITY 672,305 629,094 $1,811,079 $1,813,238 GREIF, INC. AND

SUBSIDIARY COMPANIES GAAP TO NON-GAAP RECONCILIATION UNAUDITED

(Dollars in thousands, except per share amounts) Three months ended

Three months ended April 30, 2005 April 30, 2004 Diluted per

Diluted per share amounts share amounts Class A Class B Class A

Class B GAAP - operating profit $35,423 $22,360 Restructuring

charges 10,621 12,278 Timberland gains (3,393) (1,364) Non-GAAP -

operating profit before restructuring charges and timberland gains

$42,651 $33,274 GAAP - net income $16,767 $0.57 $0.88 $8,449 $0.30

$0.45 Restructuring charges, net of tax 7,506 0.25 0.40 8,496 0.29

0.45 Timberland gains, net of tax (2,398) (0.08) (0.13) (944)

(0.03) (0.05) Debt extinguishment charge, net of tax 1,999 0.07

0.10 -- -- -- Non-GAAP - net income before restructuring charges,

debt extinguishment charge and timberland gains $23,874 $0.81 $1.25

$16,001 $0.56 $0.85 Six months ended Six months ended April 30,

2005 April 30, 2004 Diluted per Diluted per share amounts share

amounts Class A Class B Class A Class B GAAP - operating profit

$67,586 $29,635 Restructuring charges 17,807 27,537 Timberland

gains (11,465) (5,298) Non-GAAP - operating profit before

restructuring charges and timberland gains $73,928 $51,874 GAAP -

net income $31,903 $1.09 $1.67 $5,083 $0.18 $0.27 Restructuring

charges, net of tax 12,696 0.43 0.66 19,056 0.67 1.02 Timberland

gains, net of tax (8,175) (0.28) (0.43) (3,666) (0.13) (0.20) Debt

extinguishment charge, net of tax 2,016 0.07 0.11 -- -- -- Non-GAAP

- net income before restructuring charges, debt extinguishment

charge and timberland gains $38,441 $1.31 $2.01 $20,473 $0.72 $1.09

GREIF, INC. AND SUBSIDIARY COMPANIES GAAP TO NON-GAAP

RECONCILIATION (CONTINUED) UNAUDITED (Dollars in thousands) Three

months ended Six months ended April 30, April 30, 2005 2004 2005

2004 Industrial Packaging & Services GAAP - operating profit

$20,602 $18,220 $31,483 $15,048 Restructuring charges 8,809 9,540

15,607 21,563 Non-GAAP - operating profit before restructuring

charges $29,411 $27,760 $47,090 $36,611 Paper, Packaging &

Services GAAP - operating profit (loss) $8,608 $(230) $17,822

$1,954 Restructuring charges 1,764 2,665 2,141 5,834 Non-GAAP -

operating profit before restructuring charges $10,372 $2,435

$19,963 $7,788 Timber GAAP - operating profit $6,213 $4,370 $18,281

$12,633 Restructuring charges 48 73 59 140 Timberland gains (3,393)

(1,364) (11,465) (5,298) Non-GAAP - operating profit before

restructuring charges and timberland gains $2,868 $3,079 $6,875

$7,475 DATASOURCE: Greif, Inc. CONTACT: Analysts, Robert Lentz,

+1-614-876-2000, for Greif, Inc.; or Media, Deb Strohmaier of

Greif, Inc., +1-740-549-6074 Web site: http://www.greif.com/

Copyright

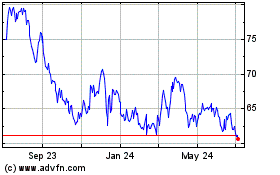

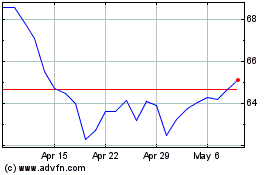

Greif (NYSE:GEF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

Greif (NYSE:GEF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024