Eaton EPS In Line, Misses Revenue - Analyst Blog

October 24 2011 - 4:09AM

Zacks

Industrial manufacturer Eaton Corporation (ETN)

has released its third quarter 2011 earnings results, which grew

37% year over year on a per-share basis, mainly on 11% end-market

growth.

Eaton’s operating earnings per share reached $1.08 in the

quarter, in line with the Zacks Consensus Estimate of $1.08 and

exceeded earnings of 79 cents in the year-ago period. On a reported

basis, the company clocked earnings of $1.07 versus 78 cents in the

year-ago period. The variance of a penny between operating and

reported earnings was due to acquisition-related charges for

Ontario-based inverter producer IE Power Inc. and German filtration

company E. Begerow GmbH & Co. KG.

Operating Statistics

In the reported quarter, Eaton has earned net quarterly revenues

of $4.12 billion, falling short of the Zacks Consensus Estimate of

$4.18 billion and up 15.5% from the year-ago comparable period.

Revenue growth in the quarter stemmed from an 11% rise in organic

sales, 2% from acquisitions and 2% from higher foreign exchange

rates. Eaton posted net income of $365 million in the third quarter

of 2011, up from $268 million in the year-ago quarter.

Segment Analysis

Electrical Americas: Within its Electrical

unit, Electrical Americas’ revenues improved 11% from the year-ago

quarter to $1.07 billion, while operating profit (excluding

acquisition integration charges) was up 13% at $159 million. Growth

in Electrical Americas’ revenues reflected growth of 11% in

end-markets and 21% in order bookings.

Electrical Rest of the World: The Electrical

Rest of the World segment’s sales were up 7% at $755 million.

Operating income of $62 million was down 23.5% from the year-ago

level, due to lower margins in the residential solar market and

decline in commodity prices during the last half of September 2011.

Segment bookings for the quarter saw a 9% dip due to a sharp drop

in orders for solar inverters. Overall, the company’s end-markets

grew 1% year-over-year.

Hydraulics: At $717 million, Hydraulics

segment’s sales rose 23% over the prior year, while operating

profits came in at $110 million, up 45% from the corresponding

quarter last year. Hydraulics markets grew 14%, of which U.S.

markets were up 18% and non-U.S. markets up 11%. Segment bookings

increased 20% in the second quarter.

Aerospace: Segmental sales in the third quarter

grew 8% to $420 million and operating profits grew 16% to $71

million. Aerospace markets were up 7% in the quarter. Aerospace

bookings rose 16%, reflecting improved bookings in commercial OEM

and aftermarket businesses.

Truck: The Truck segment posted a 34%

improvement in sales to reach $715 million. It earned an operating

income of $139 million during the quarter, compared to $74 million

in the year-ago quarter. Eaton benefited from a 25% increase in

truck production, with U.S. markets growing 51% and non-U.S.

markets being up 7%.

Automotive: Aided by an 8% growth in the global

auto markets, the segment’s third quarter sales grew 13% year over

year to $442 million. It posted an operating profit of $62 million,

reflecting an increase of 59% from the comparable quarter last

year.

Guidance

Eaton expects net income per share for the fourth quarter of

2011 to be in the range of $1.04 – $1.14. Operating earnings per

share for the fourth quarter, which exclude acquisition-related

charges, are anticipated to be in the range of $1.06 – $1.16.

For fiscal 2011, Eaton narrowed its operating earnings per share

guidance in the range of $3.95 – $4.05 from the earlier range of

$3.90 to $4.10.

Our View

Cleveland, Ohio-based diversified power management company,

Eaton Corporation, is a leading supplier of power accessories to

the aerospace industry with customers in 150 countries.

Eaton has gradually transformed itself from an automotive and

truck component manufacturer into a diversified industrial

enterprise with leading positions in its core electrical, hydraulic

and aerospace market segments. An improvement in global market

conditions should help boost the company’s bottom lines. Eaton’s

stable dividend program, which yields an impressive 3.2%, also

makes the stock attractive.

Eaton Corporation currently has a Zacks #3 Rank (short-term Hold

rating). Based on the short-term Zacks rank, the company fares

better than its closest peers Applied Industrial

Technologies, Inc. (AIT) andThe Babcock &

Wilcox Company (BWC). Both the companies carry the

short-term Zacks #4 Rank (Sell).

APPLD INDL TECH (AIT): Free Stock Analysis Report

BABCOCK&WILCOX (BWC): Free Stock Analysis Report

EATON CORP (ETN): Free Stock Analysis Report

Zacks Investment Research

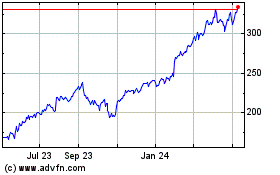

Eaton (NYSE:ETN)

Historical Stock Chart

From Oct 2024 to Nov 2024

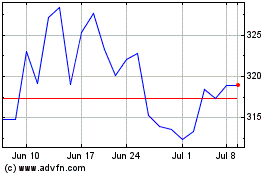

Eaton (NYSE:ETN)

Historical Stock Chart

From Nov 2023 to Nov 2024