Regulatory News:

Colgate-Palmolive Company (NYSE:CL) today reported record net

income and diluted earnings per share in third quarter 2009 of $590

million and $1.12, respectively. Third quarter 2008 reported net

income and diluted earnings per share were $500 million and $.94,

respectively, which included $31 million of aftertax charges ($.05

per diluted share) related to the 2004 Restructuring Program.

Excluding restructuring charges (which pertain only to 2008), net

income and diluted earnings per share increased 11% and 13%,

respectively.

Worldwide sales as reported were $3,998 million, even with the

year ago quarter, and unit volume as reported increased 1.5%.

Excluding divested businesses, worldwide sales grew 0.5% and unit

volume increased 2.0%. Organic sales (excluding foreign exchange,

acquisitions and divestments) grew 7.0%. Global pricing increased

5.0% while foreign exchange was negative 6.5%.

Gross profit margin as reported increased to 59.2% in third

quarter 2009 from 56.1% in the year ago period. Excluding

restructuring charges in 2008, gross profit margin increased 280

basis points to 59.2% in third quarter 2009 from 56.4% in third

quarter 2008, reflecting the benefits of increased pricing and

cost-savings programs, which more than offset the impact of

negative foreign exchange.

Selling, general and administrative expenses were 35.1% and

35.5% of net sales in third quarter 2009 and 2008, respectively.

Excluding restructuring charges in 2008, selling, general and

administrative expenses increased to 35.1% of net sales in third

quarter 2009 from 35.0% of net sales in third quarter 2008.

Worldwide advertising costs declined 30 basis points as a

percentage to sales versus the year ago period from 11.0% to 10.7%,

largely brought about by lower media rates in most areas of the

world. Sequentially, advertising increased 20 basis points versus

second quarter 2009.

Operating profit was $926 million in third quarter 2009 compared

to $791 million as reported in third quarter 2008. Excluding

restructuring charges in 2008, operating profit rose 11% to $926

million in third quarter 2009 from $837 million in third quarter

2008, increasing to 23.2% from 21.0% as a percent to sales.

Net cash provided by operations year to date increased by 34% to

$2,375 million. Working capital decreased to 0.7% of sales versus

2.6% in the comparable 2008 period. These results reflect the

strength of the Company’s overall balance sheet and key ratios as

well as its tight focus on working capital.

Ian Cook, Chairman, President and Chief Executive Officer,

commented on the results excluding restructuring charges, “We are

delighted that our strong momentum continued this quarter with

operating profit, net income and earnings per share all increasing

double-digit and organic sales growing a healthy 7%, driven by

positive volume and higher pricing. Pleasingly, this momentum was

widespread with every operating division achieving operating profit

increases, both absolutely and as a percent to sales, as well as

positive organic sales growth.

“We are very pleased that gross profit margin increased by 280

basis points allowing for another quarter of sequentially higher

advertising spending behind Colgate’s brands. As expected, with

lower media rates, this spending level equated to a higher number

of consumer impressions versus the year ago quarter, which helped

to drive market share gains worldwide.

“Colgate’s global toothpaste leadership strengthened to 45.1%

during the quarter with market share gains in key countries around

the world including the United States, Mexico, Brazil, China, India

and Russia. Colgate also strengthened its global leadership in

manual toothbrushes, with its global market share in that category

reaching a record 30.8% year to date, up 0.4 share points versus

year ago.”

Mr. Cook continued, “Looking ahead, the excellent gross margin

should continue in the balance of the year driven by easing raw and

packaging material costs and continued benefit from both price

increases already implemented and our ongoing aggressive savings

programs. We expect gross profit margin should be at around the

same level in the fourth quarter as it was this quarter.

“Given the continued gross margin strength and our top-line

momentum, we are comfortable with external profit expectations for

both the fourth quarter and the year. While our 2010 budget process

is still in its initial stages, we anticipate another year of

double-digit earnings per share growth in 2010.”

At 11:00 a.m. ET today, Colgate will host a conference call to

elaborate on third quarter results. To access this call as a

webcast, please go to Colgate’s web site at http://www.colgate.com.

The following are comments about divisional performance. See

attached Geographic Sales Analysis and Segment Information

schedules for additional information on divisional sales and

operating profit.

North America (19% of Company

Sales)

North America sales grew 3.0% in the third quarter. Unit volume

increased 5.0% with 1.5% lower pricing and 0.5% negative foreign

exchange. Organic sales grew 3.5% during the quarter. North America

operating profit increased 32% during the quarter as increased

advertising was more than offset by higher sales driven by new

products, cost-savings programs and lower raw and packaging

material costs.

In the U.S., new product launches are contributing to market

share gains across categories. Market share gains year to date were

seen in toothpaste, manual toothbrushes, body washes, hand dish

liquid, liquid cleaners, liquid hand soaps and fabric conditioners.

Colgate’s toothpaste market share reached 36.6% year to date, up

0.6 share points versus year ago. Colgate Total Enamel Strength,

Colgate Sensitive Enamel Protect, Colgate Max Fresh with Mouthwash

Beads and Colgate Max White with Mini Bright Strips toothpastes

contributed to the share gains. Colgate’s share of the manual

toothbrush market reached a record 31.7% year to date, up 4.1 share

points versus year ago, including new Colgate Wisp mini-brush whose

market share reached 4.5% year to date and 5.6% for the third

quarter. Colgate 360° ActiFlex, Colgate Max Fresh and Colgate Max

White manual toothbrushes also contributed to the share gains.

Successful new products contributing to growth in the U.S. in

other categories include Softsoap Nutri Serums, Softsoap Body

Butter Apricot Scrub, Irish Spring Hair and Body and Cool Relief

body washes and Ajax Lime with Bleach Alternative dish liquid.

Looking ahead, the innovation pipeline in the U.S. is very

robust with an array of exciting introductions across categories

planned for launch in early 2010 including new Wisp Plus Whitening

mini-brush.

Latin America (29% of Company

Sales)

Latin American sales grew 5.0% and unit volume increased 3.0%.

Volume gains were achieved in most countries, led by a significant

increase in Venezuela. Higher pricing added 13.0% while foreign

exchange was negative 11.0%. Organic sales for Latin America grew

16.0% during the quarter. Latin America operating profit increased

11% during the quarter due to higher pricing, cost-saving

initiatives and lower advertising costs, partially offset by

negative foreign exchange.

Colgate continues to build its strong leadership in oral care

throughout Latin America with its regional toothpaste market share

at a record high of 78.5% year to date, driven by market share

gains in nearly every country. In Brazil, for example, Colgate’s

toothpaste market share reached 70.1% year to date, up 110 basis

points versus year ago. Strong sales of premium-priced offerings

such as Colgate Total Professional Sensitive, Colgate Total

Professional Whitening and Colgate Max Fresh Night toothpastes

drove share gains throughout the region. Colgate’s leading share of

the manual toothbrush market for the region is 40.1% year to date,

up 60 basis points versus year ago. Strong sales of Colgate 360°

Deep Clean and Colgate Max White manual toothbrushes throughout the

region contributed to this success.

In other product categories, Colgate Plax Complete Care

mouthwash, Fabuloso Oxy liquid cleaner, Lady Speed Stick Depil

Control and Speed Stick Waterproof deodorants, and Suavitel GoodBye

Ironing and Suavitel Magic Moments fabric conditioners contributed

to market share gains in the region.

Europe/South Pacific (22% of

Company Sales)

As reported, Europe/South Pacific sales declined 5.5% and unit

volume increased 2.5%. Excluding divested businesses, sales

declined 5.0% and unit volume increased 3.0% led by France,

Germany, the United Kingdom, Denmark, Greece, Portugal and the GABA

business. Pricing was even versus the year ago quarter while

foreign exchange was negative 8.0%. Organic sales for Europe/South

Pacific grew 3.0%. Operating profit for the region increased 6%

during the quarter due to lower raw and packaging material costs,

cost-savings initiatives and lower advertising costs, partially

offset by negative foreign exchange.

Colgate maintained its oral care leadership in the Europe/South

Pacific region with toothpaste share gains in Germany, Greece,

United Kingdom, Austria, Czech Republic and Slovakia. Successful

premium products driving share gains include Colgate Sensitive

Pro-Relief, Colgate Total Advanced Sensitive and Colgate Max Fresh

with Mouthwash Beads toothpastes. In the manual toothbrush

category, Colgate 360° ActiFlex, Colgate Max White and Colgate Zig

Zag toothbrushes contributed to share gains in key countries

throughout the region.

Recent premium innovations contributing to growth in other

product categories include Colgate Plax Alcohol Free and Colgate

Plax Ice mouth rinses, Palmolive Aromatherapy Morning Tonic and

Palmolive Thermal Spa Beauty Soft shower gels, Ajax Professional

bucket dilutable and Ajax Professional glass cleaners, Lady Speed

Stick Aloe spray deodorant and Soupline Magic Moments and Soupline

Aroma Tranquility fabric conditioners.

Greater Asia/Africa (17% of

Company Sales)

Greater Asia/Africa sales and unit volume declined 3.0% and

2.5%, respectively. Volume gains in India, Thailand and Turkey were

more than offset by volume declines in Russia, Philippines, South

Africa and Ukraine. Pricing increased 7.0% while foreign exchange

was negative 7.5%. Organic sales for Greater Asia/Africa increased

4.5%. Operating profit for the region increased 17% during the

quarter due to higher pricing and lower raw and packaging material

costs, partially offset by negative foreign exchange.

Colgate maintained its toothpaste leadership in Greater Asia

with market share gains in key countries throughout the region

including India, China, Russia, Turkey, Hong Kong, Philippines and

Malaysia. Successful new products driving the share gains

throughout the region include Colgate Total Professional Clean and

Colgate Sensitive Enamel Protect toothpastes.

New products contributing to growth in other categories in the

region include Colgate 360° ActiFlex, Colgate Max Fresh and Colgate

Extra Clean Gum Care manual toothbrushes, Colgate Plax Ice

mouthwash, Protex hand sanitizer, Protex Clean and Pure shower

cream and bar soap and Lady Speed Stick Cloud Freshness

deodorant.

Hill’s (13% of Company

Sales)

Hill’s sales grew 1.5% during the quarter as unit volume

decreased 2.5%. Pricing increased 4.5% while foreign exchange was

negative 0.5%. Hill’s organic sales rose 2.0% during the quarter.

Volume growth achieved in France, Mexico and Australia was more

than offset by volume declines in the U.S. Operating profit

increased 2% during the quarter due to higher pricing, cost-savings

programs and lower raw and packaging material costs more than

offsetting increased advertising.

Innovative new products succeeding in the U.S. specialty channel

include Science Diet Culinary Creations Feline and a significantly

expanded line of Science Diet Simple Essentials Treats Canine.

Available in seven varieties, the treats are formulated for a wide

range of special needs including oral care, mobility, immunity

support and healthy skin and coat.

New pet food products contributing to international sales

include Science Plan Simple Essentials Snacks Canine and Science

Plan Healthy Mobility Canine, a wellness diet that promotes active

mobility, supports joint flexibility and enhances ease of

movement.

* * *

About Colgate-Palmolive: Colgate-Palmolive is a leading global

consumer products company, tightly focused on Oral Care, Personal

Care, Home Care and Pet Nutrition. Colgate sells its products in

over 200 countries and territories around the world under such

internationally recognized brand names as Colgate, Palmolive,

Mennen, Softsoap, Irish Spring, Protex, Sorriso, Kolynos, Elmex,

Tom’s of Maine, Ajax, Axion, Fabuloso, Soupline and Suavitel, as

well as Hill’s Science Diet and Hill’s Prescription Diet. For more

information about Colgate’s global business, visit the Company's

web site at http://www.colgate.com.

Unless otherwise indicated, all market share data included in

this press release is as measured by ACNielsen.

Cautionary Statement on

Forward-Looking Statements

This press release and the related webcast (other than

historical information) may contain forward-looking statements.

Such statements may relate, for example, to sales or volume growth,

organic sales growth, profit and profit margin growth, earnings

growth, financial goals, cost-reduction plans, tax rates and new

product introductions. These statements are made on the basis of

our views and assumptions as of this time and we undertake no

obligation to update these statements. We caution investors that

any such forward-looking statements are not guarantees of future

performance and that actual events or results may differ materially

from those statements. Investors should consult the Company’s

filings with the Securities and Exchange Commission (including the

information set forth under the captions “Risk Factors” and

“Cautionary Statement on Forward-Looking Statements” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2008) for information about certain factors that could cause

such differences. Copies of these filings may be obtained upon

request from the Company’s Investor Relations Department or the

Company’s web site at http://www.colgate.com.

As required, the Company adopted the consolidation Topic of the

FASB Codification on January 1, 2009 and as a result of the

adoption, certain prior period amounts attributable to

noncontrolling interests in less-than-wholly-owned subsidiaries

were reclassified within the Condensed Consolidated Statements of

Income, Balance Sheets and Cash Flows. While the reclassification

had no impact on Net income or earnings per common share, it did

impact the previously reported Operating profit and effective tax

rate. A complete reconciliation to previously reported 2008 amounts

is available on Colgate’s web site.

Non-GAAP Financial

Measures

The following provides information regarding the non-GAAP

measures used in this earnings release:

To supplement Colgate's condensed consolidated income statements

presented in accordance with accounting principles generally

accepted in the United States of America (GAAP), the Company has

disclosed non-GAAP measures of operating results that exclude

certain items. Gross profit margin, selling, general and

administrative expenses, operating profit, operating profit margin,

net income and earnings per share are discussed in this release

both as reported (on a GAAP basis) and excluding the impact of

restructuring charges related to the restructuring program that

began in the fourth quarter of 2004 and was completed as of the end

of 2008 (the "2004 Restructuring Program"). These restructuring

charges include separation-related costs, incremental depreciation

and asset write-downs, and other costs related to the

implementation of the 2004 Restructuring Program. In light of their

nature and magnitude, the Company believes these items should be

presented separately to enhance an investor’s overall understanding

of its ongoing operations.

Management believes these non-GAAP financial measures provide

useful supplemental information to investors regarding the

underlying business trends and performance of the Company’s ongoing

operations and are useful for period-over-period comparisons of

such operations. See “Consolidated Income Statement and

Supplemental Information — Reconciliation Excluding the 2004

Restructuring Program” for the three and nine months ended

September 30, 2009 and 2008 included with this release for a

reconciliation of these financial measures to the related GAAP

measures.

Sales and unit volume growth, both worldwide and in relevant

geographic divisions, are discussed in this release both as

reported and excluding divestments. Management believes this

provides useful supplemental information to investors as it allows

comparisons of sales growth and volume growth from ongoing

operations on a period-over-period basis. This release also

discusses organic sales growth (excludes the impact of foreign

exchange, acquisitions and divestments). Management believes this

measure provides investors with useful supplemental information

regarding the Company’s underlying sales trends by presenting sales

growth excluding the external factor of foreign exchange as well as

the impact from acquisitions and divestments. See “Geographic Sales

Analysis, Percentage Changes – Third Quarter 2009 vs. 2008” for a

comparison of sales excluding divestments and organic sales to

sales as reported in accordance with GAAP.

The Company uses these financial measures internally in its

budgeting process and as factors in determining compensation. While

the Company believes that these financial measures are useful in

evaluating the Company’s business, this information should be

considered as supplemental in nature and is not meant to be

considered in isolation or as a substitute for the related

financial information prepared in accordance with GAAP. In

addition, these non-GAAP financial measures may not be the same as

similar measures presented by other companies.

The Company defines free cash flow before dividends as net cash

provided by operations less capital expenditures. As management

uses this measure to evaluate the Company’s ability to satisfy

current and future obligations, repurchase stock, pay dividends and

fund future business opportunities, the Company believes that it

provides useful information to investors. Free cash flow before

dividends is not a measure of cash available for discretionary

expenditures since the Company has certain non-discretionary

obligations such as debt service that are not deducted from the

measure. Free cash flow before dividends is not a GAAP measurement

and may not be comparable to similarly titled measures reported by

other companies. See “Condensed Consolidated Statements of Cash

Flows For the Nine Months Ended September 30, 2009 and 2008” for a

comparison of free cash flow before dividends to net cash provided

by operations as reported in accordance with GAAP.

(See attached tables for third

quarter results.)

Table 1

Colgate-Palmolive Company Consolidated Income

Statement and Supplemental Information Reconciliation

Excluding the 2004 Restructuring Program For the

Three Months Ended September 30, 2009 and 2008 (in

Millions Except Per Share Amounts) (Unaudited) 2009 2008

As Reported As Reported Restructuring

Excluding

Restructuring

Net sales $ 3,998 $ 3,988 $ - $ 3,988 Cost of sales

1,631 1,752 11 1,741 Gross profit 2,367 2,236 (11 ) 2,247

Gross profit margin 59.2% 56.1% 56.4% Selling,

general and administrative expenses 1,403 1,415 21 1,394

Other (income) expense, net 38 30 14 16 Operating profit 926

791 (46 ) 837 Operating profit margin 23.2% 19.8% 21.0%

Interest expense, net 17 23 - 23 Income before income

taxes 909 768 (46 ) 814 Provision for income taxes 292 246

(15 ) 261 Effective tax rate 32.1% 32.0% 32.1% Net

income including noncontrolling interests 617 522 (31 ) 553

Less: Net income attributable to noncontrolling interests* 27 22 -

22 Net income 590 500 (31 ) 531 Earnings per common

share Basic $ 1.17 $ 0.98 $ (0.06 ) $ 1.04 Diluted $ 1.12 $ 0.94 $

(0.05 ) $ 0.99 Average common shares outstanding Basic 499.1

505.5 505.5 505.5 Diluted 524.6 534.3 534.3 534.3

*

To conform to the current year

presentation required by the Consolidation Topic of the FASB

Codification, net income attributable to noncontrolling interests

in less-than-wholly-owned subsidiaries has been reclassified from

Other (income) expense, net to a new line below Operating profit

called Net income attributable to noncontrolling interests. The

reclassification had no effect on Net income or Earnings per common

share.

Refer to the Company's website for

a reconciliation to previously reported amounts for all quarters of

2008 as well as full year 2008 and 2007.

Note: The impact of

"Restructuring” on the basic and diluted earnings per share may not

necessarily equal the earnings per share if calculated

independently as a result of rounding.

Table 2

Colgate-Palmolive Company Consolidated Income

Statement and Supplemental Information Reconciliation

Excluding the 2004 Restructuring Program For the Nine

Months Ended September 30, 2009 and 2008 (in Millions

Except Per Share Amounts) (Unaudited) 2009 2008 As

Reported As Reported Restructuring

Excluding

Restructuring

Net sales $ 11,246 $ 11,666 $ - $ 11,666 Cost of

sales 4,665 5,090 48 5,042 Gross profit 6,581 6,576 (48 )

6,624 Gross profit margin 58.5% 56.4% 56.8% Selling,

general and administrative expenses 3,885 4,187 55 4,132

Other (income) expense, net 72 65 22 43 Operating profit

2,624 2,324 (125 ) 2,449 Operating profit margin 23.3% 19.9%

21.0% Interest expense, net 59 82 - 82 Income before

income taxes 2,565 2,242 (125 ) 2,367 Provision for income

taxes 824 717 (43 ) 760 Effective tax rate 32.1% 32.0% 32.1%

Net income including noncontrolling interests 1,741 1,525

(82 ) 1,607 Less: Net income attributable to noncontrolling

interests* 81 65 - 65 Net income 1,660 1,460 (82 ) 1,542

Earnings per common share Basic $ 3.27 $ 2.84 $ (0.16 ) $

3.00 Diluted $ 3.16 $ 2.72 $ (0.15 ) $ 2.87 Average common

shares outstanding Basic 500.2 507.2 507.2 507.2 Diluted 525.0

536.7 536.7 536.7

*

To conform to the current year

presentation required by the Consolidation Topic of the FASB

Codification, net income attributable to noncontrolling interests

in less-than-wholly-owned subsidiaries has been reclassified from

Other (income) expense, net to a new line below Operating profit

called Net income attributable to noncontrolling interests. The

reclassification had no effect on Net income or Earnings per common

share.

Refer to the Company's website for

a reconciliation to previously reported amounts for all quarters of

2008 as well as full year 2008 and 2007.

Note: The impact of

"Restructuring” on the basic and diluted earnings per share may not

necessarily equal the earnings per share if calculated

independently as a result of rounding.

Table 3

Colgate-Palmolive Company Condensed Consolidated

Balance Sheets As of September 30, 2009, December 31,

2008 and September 30, 2008 (Dollars in Millions)

(Unaudited) September 30, December 31, September 30,

2009 2008 2008 Cash and cash equivalents $ 847 $ 555 $ 635

Receivables, net 1,780 1,592 1,761 Inventories 1,241 1,197 1,306

Other current assets 336 366 385 Property, plant and equipment, net

3,351 3,119 3,047 Other assets, including goodwill and intangibles

3,512 3,150 3,421 Total

assets $ 11,067 $ 9,979 $ 10,555 Total

debt 3,263 3,783 3,518 Other current liabilities 3,211 2,754 3,022

Other non-current liabilities** 1,482 1,398

1,396 Total liabilities 7,956 7,935 7,936

Total Colgate-Palmolive Company shareholders' equity 2,952 1,923

2,468 Noncontrolling interests** 159 121

151 Total liabilities and shareholders’ equity

$ 11,067 $ 9,979 $ 10,555

Supplemental Balance Sheet Information Debt less cash, cash

equivalents and marketable securities* $ 2,378 $ 3,216 $ 2,861

Working capital % of sales 0.7 % 2.5 % 2.6 % *

Marketable securities of $38, $12

and $22 as of September 30, 2009, December 31, 2008 and September

30, 2008, respectively, are included in Other current assets.

**

To conform to the current year

presentation required by the Consolidation Topic of the FASB

Codification, prior period balances of accumulated undistributed

earning relating to noncontrolling interests in

less-than-wholly-owned subsidiaries have been reclassified from

Other non-current liabilities to a component of shareholders'

equity.

Refer to the Company's web site

for a reconciliation to previously reported amounts for all

quarters of 2008 as well as full year 2008 and 2007.

Table 4 Colgate-Palmolive Company Condensed

Consolidated Statements of Cash Flows For the Nine

Months Ended September 30, 2009 and 2008 (Dollars in

Millions) (Unaudited) 2009 2008*

Operating

Activities Net income $ 1,660 $ 1,460 Adjustments to reconcile

net income to net cash provided by operations: Restructuring, net

of cash (14 ) (36 ) Depreciation and amortization 262 261

Stock-based compensation expense 97 82 Deferred income taxes 16 38

Cash effects of changes in: Receivables (104 ) (132 ) Inventories

10 (176 ) Accounts payable and other accruals 355 162 Other

non-current assets and liabilities 93 118

Net cash provided by operations 2,375 1,777

Investing Activities Capital expenditures (347 ) (392 )

Sales (purchases) of marketable securities and investments (147 ) 1

Other 10 50 Net cash used in investing

activities (484 ) (341 )

Financing Activities

Principal payments on debt (3,011 ) (1,424 ) Proceeds from issuance

of debt 2,561 1,447 Dividends paid (702 ) (627 ) Purchases of

treasury shares (664 ) (833 ) Proceeds from exercise of stock

options and excess tax benefits 196 224

Net cash used in financing activities (1,620 ) (1,213 )

Effect of exchange rate changes on Cash and cash equivalents

21 (17 ) Net increase in Cash and cash equivalents

292 206 Cash and cash equivalents at beginning of period 555

429 Cash and cash equivalents at end of period

$ 847 $ 635

Supplemental Cash Flow

Information Free cash flow before dividends (Net cash provided

by operations less capital expenditures) Net cash provided by

operations $ 2,375 $ 1,777 Less: Capital expenditures (347 )

(392 ) Free cash flow before dividends $ 2,028 $

1,385 Income taxes paid $ 853 $ 662 *

To conform to the current year

presentation required by the Consolidation Topic of the FASB

Codification, certain reclassifications have been made to prior

year amounts.

Table 5 Colgate-Palmolive Company Segment

Information For the Three and Nine Months Ended

September 30, 2009 and 2008 (Dollars in Millions)

(Unaudited) Three Months Ended

September 30,

Nine Months Ended

September 30,

2009 2008 2009 2008

Net sales Oral, Personal and Home Care

North America $ 740 $ 718 $ 2,204 $ 2,142 Latin America

1,136 1,081 3,097 3,092 Europe/South Pacific 896 948 2,406 2,815

Greater Asia/Africa 695 717

1,972 2,043 Total Oral, Personal and

Home Care 3,467 3,464 9,679 10,092 Pet Nutrition 531

524 1,567 1,574

Total Net sales $ 3,998 $ 3,988 $ 11,246

$ 11,666 Three Months Ended

September 30,

Nine Months Ended

September 30,

2009 2008 2009 2008

Operating profit Oral, Personal and Home

Care North America $ 217 $ 164 $ 608 $ 497 Latin America 346

312 987 887 Europe/South Pacific 219 206 539 600 Greater

Asia/Africa* 161 138 457

392 Total Oral, Personal and Home Care 943 820

2,591 2,376 Pet Nutrition 136 133 407 391 Corporate

(153 ) (162 ) (374 ) (443 ) Total

Operating Profit $ 926 $ 791 $ 2,624 $ 2,324

* To conform to the current year presentation

required by the Consolidation Topic of the FASB Codification, the

amounts of net income attributable to noncontrolling interests in

less-than-wholly-owned subsidiaries of $22 and $65 for the three

and nine months ended September 30, 2008, respectively, which were

previously deducted from Greater Asia/Africa Operating profit, have

been reclassified to a new line below Operating profit.

Note: The Company evaluates segment performance based on several

factors, including Operating profit. The Company uses Operating

profit as a measure of the operating segment performance because it

excludes the impact of corporate-driven decisions related to

interest expense and income taxes. Corporate operations include

restructuring and related implementation costs, stock-based

compensation related to stock options and restricted stock awards,

research and development costs, Corporate overhead costs, and gains

and losses on sales of non-core product lines and assets.

For the three and nine months ended September 30, 2008, Corporate

operating expenses include $46 and $125 of charges related to the

Company’s 2004 Restructuring Program, respectively.

Table 6 Colgate-Palmolive Company

Geographic Sales Analysis Percentage Changes -

Third Quarter 2009 vs 2008 September 30, 2009

(Unaudited) COMPONENTS OF SALES CHANGE

COMPONENTS OF SALES CHANGE THIRD QUARTER NINE

MONTHS

Region

3rd Qtr

Sales

Change

As

Reported

3rd Qtr

Sales

Change

Ex-Divestment

3rd Qtr

Organic

Sales

Change

Ex-Divested

Volume

Pricing

Coupons

Consumer &

Trade

Incentives

Exchange

9 Months

Sales

Change

As

Reported

9 Months

Sales

Change

Ex-Divestment

9 Months

Organic

Sales

Change

Ex-Divested

Volume

Pricing

Coupons

Consumer &

Trade

Incentives

Exchange Total Company 0.0 % 0.5

% 7.0 % 2.0 % 5.0 % (6.5 %) (3.5 %) (3.5 %) 7.0 % 0.0 % 7.0 % (10.5

%)

Europe/South Pacific (5.5 %) (5.0 %) 3.0 % 3.0 %

0.0 % (8.0 %) (14.5 %) (14.0 %) 0.0 % (1.0 %) 1.0 % (14.0 %)

Latin America 5.0 % 5.0 % 16.0 % 3.0 % 13.0 % (11.0 %) 0.0 %

0.0 % 16.5 % 2.5 % 14.0 % (16.5 %)

Greater

Asia/Africa (3.0 %) (3.0 %) 4.5 % (2.5 %) 7.0 % (7.5 %) (3.5 %)

(3.0 %) 8.0 % 0.5 % 7.5 % (11.0 %)

Total

International (1.0 %) (0.5 %) 8.5 % 1.5 % 7.0 % (9.0 %) (6.0 %)

(5.5 %) 8.5 % 0.5 % 8.0 % (14.0 %)

North America 3.0

% 3.0 % 3.5 % 5.0 % (1.5 %) (0.5 %) 3.0 % 3.0 % 4.0 % 3.0 % 1.0 %

(1.0 %)

Total CP Products 0.0 % 0.5 % 8.0 % 2.5 % 5.5

% (7.5 %) (4.0 %) (4.0 %) 7.5 % 1.0 % 6.5 % (11.5 %)

Hill's 1.5 % 1.5 % 2.0 % (2.5 %) 4.5 % (0.5 %) (0.5 %) (0.5

%) 3.0 % (7.0 %) 10.0 % (3.5 %)

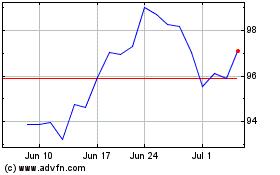

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Jun 2024 to Jul 2024

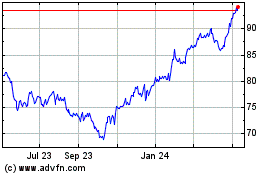

Colgate Palmolive (NYSE:CL)

Historical Stock Chart

From Jul 2023 to Jul 2024