1934 Act Registration No. 1-31731

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Dated February 26, 2024

Chunghwa Telecom Co., Ltd.

(Translation of Registrant’s Name into English)

21-3 Xinyi Road Sec. 1,

Taipei, Taiwan, 100 R.O.C.

(Address of Principal Executive Office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of form 20-F or Form 40-F.)

Form 20-F ☒ Form 40-F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

(If “Yes” is marked, indicated below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable )

EXHIBIT INDEX

|

|

|

|

Exhibit |

|

Description |

|

99.1 99.2 99.3 99.4 99.5 99.6 |

|

Announcement on 2024/02/23 Announcement on 2024/02/23 Announcement on 2024/02/23 Announcement on 2024/02/23 Announcement on 2024/02/23 Announcement on 2024/02/23 |

The Company announced consolidated financial statements for the year ended December 31, 2023 approved by the Board of Directors Board of directors resolves to convene the Company's annual general meeting on May 31, 2024 The Board resolves the distribution of cash dividend Chunghwa Telecom announced the Board of Directors' resolution to invest in Newly established Cultural Content Industry Fund Chunghwa Telecom announced the Board of Directors' resolution to invest in Taiwania Hive Technology Fund L.P. Chunghwa Digital Cultural and Creative Management Consulting Co., Ltd the Company's subsidiary announces the acquisition of right-of-use assets from the Company |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant Chunghwa Telecom Co., Ltd. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Date: February 26, 2024 |

|

|

Chunghwa Telecom Co., Ltd. |

|

|

|

By: /s/Yu-Shen Chen |

|

Name: Yu-Shen Chen |

|

Title: Chief Financial Officer |

EXHIBIT 99.1

The Company announced consolidated financial statements for the year ended December 31, 2023 approved by the Board of Directors

Date of events: 2024/02/23

Content:

1.Date of submission to the board of directors or approval by the board of directors: 2024/02/23

2.Date of approval by the audit committee: 2024/02/21

3.Start and end dates of financial reports or annual self-assessed financial information of the reporting period (XXXX/XX/XX~XXXX/XX/XX):

2023/01/01~2023/12/31

4.Operating revenue accumulated from 1/1 to end of the period (thousand NTD): 223,199,260

5.Gross profit (loss) from operations accumulated from 1/1 to end of the period (thousand NTD): 81,432,542

6.Net operating income (loss) accumulated from 1/1 to end of the period (thousand NTD): 46,353,235

7.Profit (loss) before tax accumulated from 1/1 to end of the period (thousand NTD): 46,992,646

8.Profit (loss) accumulated from 1/1 to end of the period (thousand NTD): 37,990,536

9.Profit (loss) during the period attributable to owners of parent accumulated from 1/1 to end of the period (thousand NTD): 36,916,708

10.Basic earnings (loss) per share accumulated from 1/1 to end of the period (NTD): 4.76

11.Total assets end of the period (thousand NTD): 523,939,401

12.Total liabilities end of the period (thousand NTD): 129,035,061

13.Equity attributable to owners of parent end of the period (thousand NTD): 382,308,088

14.Any other matters that need to be specified: None

EXHIBIT 99.2

Board of directors resolves to convene the Company's annual general meeting on May 31, 2024

Date of events: 2024/02/23

Content:

1.Date of the board of directors' resolution: 2024/02/23

2.Shareholders meeting date: 2024/05/31

3.Shareholders meeting location:

Chunghwa Telecom Telecommunication Training Institute (No. 168, Minzu Road, Banchiao District, New Taipei City, Taiwan, R.O.C.)

4.Shareholders' meeting will be held by means of (physical shareholders' meeting/ hybrid shareholders' meeting / virtual-only shareholders' meeting): physical shareholders' meeting

5.Cause for convening the meeting (1) Reported matters:

b.2023 audit committee's review report

c.2023 compensation distribution to directors and employees

d.2023 directors' remuneration report

6.Cause for convening the meeting (2) Acknowledged matters:

a.Ratification of 2023 business report and financial statements

b.Ratification of 2023 earnings distribution proposal

7.Cause for convening the meeting (3) Matters for Discussion:

a.Amendments to the Articles of Incorporation

b.Release of non-competition restrictions on Directors

8.Cause for convening the meeting (4) Election matters: None

9.Cause for convening the meeting (5) Other Proposals: None

10.Cause for convening the meeting (6) Extemporary Motions: Extemporary Motions

11.Book closure starting date: 2024/04/02

12.Book closure ending date: 2024/05/31

13.Any other matters that need to be specified: None

EXHIBIT 99.3

The Board resolves the distribution of cash dividend

Date of events: 2024/02/23

Content:

1.Date of the board of directors resolution : 2024/02/23

2.Year or quarter which dividends belong to: Year 2023

3.Period which dividends belong to: 2023/01/01~2023/12/31

4.Appropriations of earnings in cash dividends to shareholders (NT$ per share): 4.758

5.Cash distributed from legal reserve and capital surplus to shareholders (NT$ per share): 0

6.Total amount of cash distributed to shareholders (NT$): 36,909,930,661

7.Appropriations of earnings in stock dividends to shareholders (NT$ per share): 0

8.Stock distributed from legal reserve and capital surplus to shareholders (NT$ per share): 0

9.Total amount of stock distributed to shareholders (shares): 0

10.Any other matters that need to be specified: None

11.Per value of common stock: NT$10

EXHIBIT 99.4

Chunghwa Telecom announced the Board of Directors' resolution to invest in Newly established Cultural Content Industry Fund

Date of events: 2024/02/23

Content:

1.Name and nature of the underlying assets (if preferred shares, the terms and conditions of issuance shall also be indicated, e.g., dividend yield, etc.): Cultural Content Industry Fund (tentatively name, hereinafter referred to as “Cultural Content Fund”)

2.Date of occurrence of the event: 2024/02/23

3.Amount, unit price, and total monetary amount of the transaction:

(1)Unit Price: N/A (due to the nature of Limited Partnership)

(2)Total monetary amount up to NT$1,200,000,000

4.Trading counterparty and its relationship with the Company (if the trading counterparty is a natural person and furthermore is not a related party of the Company, the name of the trading counterparty is not required to be disclosed):

(1)Trading Counterparty:Newly established ”Cultural Content Fund”

(2)Its relationship to the Company:None

5.Where the trading counterparty is a related party, announcement shall also be made of the reason for choosing the related party as trading counterparty and the identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer: N/A

6.Where an owner of the underlying assets within the past five years has been a related party of the Company, the announcement shall also include the date and price of acquisition and disposal by the related party, and its relationship with the Company at the time of the transaction: N/A

7.Matters related to the current disposal of creditors' rights (including types of collaterals of the disposed creditor’s rights; if creditor's rights over a related party, announcement shall be made of the name of the related party and the book amount of the creditor's rights, currently being disposed of, over such related party): N/A

8.Profit or loss from the disposal (not applicable in cases of acquisition of securities) (those with deferral should provide a table explaining recognition): N/A

9.Terms of delivery or payment (including payment period and monetary amount), restrictive covenants in the contract, and other important terms and conditions: According to the Limited Partnership Agreement

10.The manner of deciding on this transaction (such as invitation to tender, price comparison, or price negotiation), the reference basis for the decision on price, and the decision-making unit:

(1)The manner in which the current transaction was decided, the reference basis for the decision on price: According to the Limited Partnership Agreement

(2)The decision-making unit: Board of Directors

11.Net worth per share of the Company's underlying securities acquired or disposed of: N/A

12.Cumulative no. of shares held (including the current transaction), their monetary amount, shareholding percentage, and status of any restriction of rights (e.g., pledges), as of the present moment:

Total monetary amount up to NT$1,200,000,000 ; None

13.Current ratio of securities investment (including the current trade, as listed in article 3 of Regulations Governing the Acquisition and Disposal of Assets by Public Companies) to the total assets and equity attributable to owners of the parent as shown in the most recent financial statement and working capital as shown in the most recent financial statement as of the present:

(1)To the total assets: 5.62%

(2)To equity attributable to owners of the parent: 7.35%

(3)The working capital: NT$ 18,313,884 thousand

14.Broker and broker's fee: N/A

15.Concrete purpose or use of the acquisition or disposal: Investing in the emerging business

16.Any dissenting opinions of directors to the present transaction: None

17.Whether the counterparty of the current transaction is a related party: No

18.Date of the board of directors resolution: NA

19.Date of ratification by supervisors or approval by the Audit Committee: NA

20.Whether the CPA issued an unreasonable opinion regarding the current transaction: N/A

21.Name of the CPA firm: N/A

23.Practice certificate number of the CPA: N/A

24.Whether the transaction involved in change of business model: No

25.Details on change of business model: N/A

26.Details on transactions with the counterparty for the past year and the expected coming year: N/A

27.Source of funds: Working Capital

28.Any other matters that need to be specified: None

EXHIBIT 99.5

Chunghwa Telecom announced the Board of Directors' resolution to invest in Taiwania Hive Technology Fund L.P.

Date of events: 2024/02/23

Content:

1.Name and nature of the underlying assets (if preferred shares, the terms and conditions of issuance shall also be indicated, e.g., dividend yield, etc.): Taiwania Hive Technology Fund L.P.

2.Date of occurrence of the event: 2024/02/23

3.Amount, unit price, and total monetary amount of the transaction:

(1)Amount、Unit Price: N/A

(2)Total monetary amount: US$30 million

4.Trading counterparty and its relationship with the Company (if the trading counterparty is a natural person and furthermore is not a related party of the Company, the name of the trading counterparty is not required to be disclosed):

(1)Trading counterparty: Taiwania Hive Technology Fund L.P.

(2)The counterparty is not a related party of Chunghwa Telecom

5.Where the trading counterparty is a related party, announcement shall also be made of the reason for choosing the related party as trading counterparty and the identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer: N/A

6.Where an owner of the underlying assets within the past five years has been a related party of the Company, the announcement shall also include the date and price of acquisition and disposal by the related party, and its relationship with the Company at the time of the transaction: N/A

7.Matters related to the current disposal of creditors' rights (including types of collaterals of the disposed creditor’s rights; if creditor's rights over a related party, announcement shall be made of the name of the related party and the book amount of the creditor's rights, currently being disposed of, over such related party): N/A

8.Profit or loss from the disposal (not applicable in cases of acquisition of securities) (those with deferral should provide a table explaining recognition): N/A

9.Terms of delivery or payment (including payment period and monetary amount), restrictive covenants in the contract, and other important terms and conditions:

(1)Capital contributions according to the capital call notices

(2)Other important stipulations: According to the Limited Partnership Agreement

10.The manner of deciding on this transaction (such as invitation to tender, price comparison, or price negotiation), the reference basis for the decision on price, and the decision-making unit:

(1)The manner in which the current transaction was decided, the reference basis for the decision on price : According to the Limited Partnership Agreement

(2)The decision-making unit: Board of Directors

11.Net worth per share of the Company's underlying securities acquired or disposed of: N/A

12.Cumulative no. of shares held (including the current transaction), their monetary amount, shareholding percentage, and status of any restriction of rights (e.g., pledges), as of the present moment:

Total monetary amount US$30 million; None

13.Current ratio of securities investment (including the current trade, as listed in article 3 of Regulations Governing the Acquisition and Disposal of Assets by Public Companies) to the total assets and equity attributable to owners of the parent as shown in the most recent financial statement and working capital as shown in the most recent financial statement as of the present:

(1)To the total assets: 5.57%

(2)To equity attributable to owners of the parent: 7.28%

(3)working capital: NT$18,313,884 thousand

14.Broker and broker's fee: N/A

15.Concrete purpose or use of the acquisition or disposal: Investing in the emerging business

16.Any dissenting opinions of directors to the present transaction: None

17.Whether the counterparty of the current transaction is a related party: No

18.Date of the board of directors resolution: NA

19.Date of ratification by supervisors or approval by the Audit Committee: NA

20.Whether the CPA issued an unreasonable opinion regarding the current transaction: N/A

21.Name of the CPA firm: N/A

23.Practice certificate number of the CPA: N/A

24.Whether the transaction involved in change of business model: No

25.Details on change of business model: N/A

26.Details on transactions with the counterparty for the past year and the expected coming year: N/A

27.Source of funds: Working capital

28.Any other matters that need to be specified: Calculating with the exchange rate of 1 USD to 31.29 TWD on January 31st, 2024

EXHIBIT 99.6

Chunghwa Digital Cultural and Creative Management Consulting Co., Ltd the Company's subsidiary announces the acquisition of right-of-use assets from the Company

Date of events: 2024/02/23

Content:

1.Name and nature of the underlying asset (e.g., land located at Sublot XX, Lot XX, North District, Taichung City):

3F., No. *,Ln. 74, Sec. 4, Xinyi Rd., Da’an Dist., Taipei City

2.Date of occurrence of the event: 2024/02/23

3.Transaction unit amount (e.g.XX square meters, equivalent to XX ping), unit price, and total transaction price:

Transaction volume: 81.14 ping

Unit price: average NT$2,060 per ping per month (tax included)

Total transaction amount: NT$4,011,552 (tax included)

Right-of-use assets: NT$ 3,679,078

4.Trading counterparty and its relationship with the Company (if the trading counterparty is a natural person and furthermore is not a related party of the Company, the name of the trading counterparty is not required to be disclosed):

Trading counterparty: Chunghwa Telecom Co., Ltd.

Relationship with the company: parent company

5.Where the trading counterparty is a related party, announcement shall also be made of the reason for choosing the related party as trading counterparty and the identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer:

The reason for choosing the related party as trading counterparty: for the company’s overall business planning and requirements

The identity of the previous owner, its relationship with the Company and the trading counterparty, and the previous date and monetary amount of transfer: N/A

6.Where an owner of the underlying assets within the past five years has been a related party of the Company, the announcement shall also include the date and price of acquisition and disposal by the related party, and its relationship with the Company at the time of the transaction: N/A

7.Projected gain (or loss) through disposal (not applicable for acquisition of assets; those with deferral should provide a table explaining recognition): N/A

8.Terms of delivery or payment (including payment period and monetary amount), restrictive covenants in the contract, and other important terms and conditions:

Delivery or payment terms: monthly payment

Lease period: 2024/02/23~2026/04/30

Contractual restrictions and other important appointments: None

9.The manner of deciding on this transaction (such as invitation to tender, price comparison, or price negotiation), the reference basis for the decision on price, and the decision-making unit:

Trading decision method and price reference basis: bargaining according to market conditions

Decision-making unit: Board of Directors

10.Name of the professional appraisal firm or company and its appraisal price: N/A

11.Name of the professional appraiser: N/A

12.Practice certificate number of the professional appraiser: N/A

13.The appraisal report has a limited price, specific price, or special price: N/A

14.An appraisal report has not yet been obtained: N/A

15.Reason for an appraisal report not being obtained: N/A

16.Reason for any significant discrepancy with the appraisal reports and opinion of the CPA: N/A

17.Name of the CPA firm: N/A

19.Practice certificate number of the CPA: N/A

20.Broker and broker's fee: N/A

21.Concrete purpose or use of the acquisition or disposal: Office premises

22.Any dissenting opinions of directors to the present transaction: No

23.Whether the counterparty of the current transaction is a related party: Yes

24.Date of the board of directors resolution: 2024/02/23

25.Date of ratification by supervisors or approval by the audit committee: 2024/02/23

26.The transaction is to acquire a real property or right-of-use asset from a related party: Yes

27.The price assessed in accordance with the Article 16 of the Regulations Governing the Acquisition and Disposal of Assets by Public Companies: N/A

28.Where the above assessed price is lower than the transaction price, the price assessed in accordance with the Article 17 of the same regulations: N/A

29.Any other matters that need to be specified: None

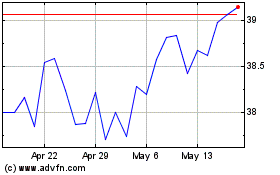

Chunghwa Telecom (NYSE:CHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

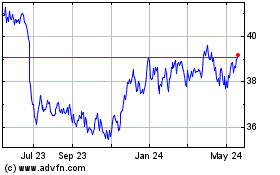

Chunghwa Telecom (NYSE:CHT)

Historical Stock Chart

From Apr 2023 to Apr 2024