Chemed Corporation (Chemed) (NYSE:CHE), which operates VITAS

Healthcare Corporation (VITAS), the nation�s largest provider of

end-of-life care, and Roto-Rooter, the nation�s largest commercial

and residential plumbing and drain cleaning services provider,

today reported on several issues impacting operating results for

the third quarter of 2006. The Company announced VITAS is exiting

the hospice market in Phoenix, Arizona. VITAS has been successful

in growing admissions of terminally ill patients who reside

primarily in assisted living settings within the Phoenix community.

Patients residing in these types of facilities tend to exit

curative care and enter into hospice relatively early into their

terminal illness diagnosis. The current Medicare hospice

reimbursement program limits payment for hospice care when a

significant portion of the patient census enters into hospice early

into their terminal diagnosis. Although VITAS, on average, has

relatively short average and median lengths-of-stay in the majority

of its programs, each program is measured separately and cannot be

considered in aggregate of its hospice programs under common

control and ownership. The Phoenix program currently provides

hospice care to approximately 200 terminally ill patients per day.

Revenue and operating losses for Phoenix in the first six months of

2006 aggregated $3.0 million and $0.9 million, respectively,

including $1.7 million of revenue reduction for Medicare billing

limitations, or Medicare Cap. Full-year revenue and operating loss

projections for Phoenix are estimated at $3.7 million and $4.3

million, including $6.3 million in revenue reductions for Medicare

Cap. The after-tax cost to exit the Phoenix market, excluding the

operating losses noted above, is estimated to range from $4.5 to

$5.5 million. VITAS announced in the second quarter of 2006 that

two programs, excluding Phoenix, were anticipated to be in

contractual billing limitations with Medicare in calendar year

2006. Based upon current trends, the total Medicare Cap for these

two programs in calendar year 2006 is estimated to range between

$4.7 and $7.6 million, with $0.6 million being recorded in the

second quarter of 2006, $2.0 million to $3.0 million estimated to

be recorded in the third quarter of 2006 and $2.1 million to $4.0

million to be recorded in the fourth quarter of the year. These

estimates assume a modest deterioration in admission and discharge

metrics in these two programs through the end of 2006. These two

programs are estimated to generate over $3 million in operating

profit in 2006. The third-quarter 2006 Medicare Cap accrual will

also include an additional $1.0 million for estimated prior-year

billing limitations resulting from the Fiscal Intermediary

reallocating admissions for deceased Medicare patients who received

hospice care from multiple providers. Of this prior-year billing,

$0.5 million is for one of the programs noted above and $0.5

million is estimated for a program not anticipated to have a

billing restriction in calendar year 2006. VITAS also released

interim third quarter operating metrics. Through July and August

2006, VITAS had an Average Daily Census of 11,194, an increase of

9.7%, and admissions growth of 4.2%, when compared to the

equivalent prior year period. August 2006 year-to-date ADC and

admissions, excluding Phoenix, have increased 10.6% and 5.3%,

respectively. Chemed announced that it has reached a preliminary

agreement in regard to litigation related to the divestiture of its

Patient Care business segment. As part of this agreement, the

company will convert $2.6 million of the current receivable due

from Patient Care into a promissory note due October 2007. This

note will bear interest quarterly at a 9.5% annual interest rate.

The company will take an after-tax charge of $1.7 million

representing a write-off of the remaining receivable balance as

well as costs associated with certain contingent insurance claims

and other items related to the Patient Care business. Chemed

received Patient Care warrants with a value of $1.4 million at the

time of the divestiture. The company has determined the valuation

of these warrants is impaired. This impairment will result in a

third quarter 2006 after-tax charge of $0.9 million. Guidance for

2006 VITAS is estimated to generate full-year revenue growth from

continuing operations, prior to Medicare Cap, of 14.0% to 14.5%,

increased admissions of 5.0% to 5.5%, increased ADC of 10.0% to

11.0% and adjusted EBITDA margins, prior to Medicare Cap, of 12.9%

to 13.2%. This guidance assumes a Medicare price increase that will

average 3.8% in the fourth quarter of 2006. Full-year Medicare

contractual billing limitations, excluding Phoenix, which is

anticipated to be classified as a discontinued operation in 2006,

are estimated to range from $5.7 million to $8.6 million, which

equates to revenue reduction of 80 to 120 basis points. Roto-Rooter

is estimated to generate a 6.0% to 7.0% increase in revenue in

2006, job count growth between 0.5% and 1.0% and adjusted EBITDA

margins averaging between 16.5% and 17.0%. Based upon these

factors, an effective tax rate of 39% and average diluted share

count of 26.7 million in the second half of 2006, our expectation

is that full-year 2006 earnings per diluted share from continuing

operations, excluding any charges or credits not indicative of

ongoing operations, and excluding expense for stock options, will

be in the range of $2.00 to $2.10. This earnings per share guidance

includes $.13 to $.20 for the after-tax impact of Medicare Cap

related to continuing operations. Conference Call Chemed will host

a conference call and webcast at 9:00 a.m., ET, on Friday,

September 29, 2006, to discuss this press release and provide an

update on its business. The dial-in number for the conference call

is (800) 561-2601 for U.S. and Canadian participants and (617)

614-3518 for international participants. The participant pass code

is 50409048. A live webcast of the call can be accessed on Chemed's

website at www.chemed.com by clicking on Investor Relations Home. A

taped replay of the conference call will be available beginning

approximately two hours after the call's conclusion. It can be

accessed by dialing (888) 286-8010 for U.S. and Canadian callers

and (617) 801-6888 for international callers and will be available

for one week following the live call. The replay pass code is

79291237. An archived webcast will also be available at

www.chemed.com and will remain available for 14 days following the

live call. Chemed Corporation operates in the healthcare field

through its VITAS Healthcare Corporation subsidiary. VITAS provides

daily hospice services to over 11,000 patients with severe,

life-limiting illnesses. This type of care is focused on making the

terminally ill patient's final days as comfortable and pain-free as

possible. Chemed operates in the residential and commercial

plumbing and drain cleaning industry under the brand name

Roto-Rooter. Roto-Rooter provides plumbing and drain service

through company-owned branches, independent contractors and

franchisees in the United States and Canada. Roto-Rooter also has

licensed master franchisees in Indonesia, Singapore, Japan, Mexico,

and the Philippines. Forward-Looking Statements Certain statements

contained in this press release and the accompanying tables are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The words "believe,"

"expect," "hope," "anticipate," "plan" and similar expressions

identify forward-looking statements, which speak only as of the

date the statement was made. Chemed does not undertake and

specifically disclaims any obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. These statements are based

on current expectations and assumptions and involve various risks

and uncertainties, which could cause Chemed's actual results to

differ from those expressed in such forward-looking statements.

These risks and uncertainties arise from, among other things,

possible changes in regulations governing the hospice care or

plumbing and drain cleaning industries; periodic changes in

reimbursement levels and procedures under Medicare and Medicaid

programs; difficulties predicting patient length of stay and

estimating potential Medicare reimbursement obligations; challenges

inherent in Chemed's growth strategy; the current shortage of

qualified nurses, other healthcare professionals and licensed

plumbing and drain cleaning technicians; Chemed�s dependence on

patient referral sources; and other factors detailed under the

caption "Description of Business by Segment" or "Risk Factors" in

Chemed�s most recent report on form 10-Q or 10-K and its other

filings with the Securities and Exchange Commission. You are

cautioned not to place undue reliance on such forward-looking

statements and there are no assurances that the matters contained

in such statements will be achieved. Chemed Corporation (Chemed)

(NYSE:CHE), which operates VITAS Healthcare Corporation (VITAS),

the nation's largest provider of end-of-life care, and Roto-Rooter,

the nation's largest commercial and residential plumbing and drain

cleaning services provider, today reported on several issues

impacting operating results for the third quarter of 2006. The

Company announced VITAS is exiting the hospice market in Phoenix,

Arizona. VITAS has been successful in growing admissions of

terminally ill patients who reside primarily in assisted living

settings within the Phoenix community. Patients residing in these

types of facilities tend to exit curative care and enter into

hospice relatively early into their terminal illness diagnosis. The

current Medicare hospice reimbursement program limits payment for

hospice care when a significant portion of the patient census

enters into hospice early into their terminal diagnosis. Although

VITAS, on average, has relatively short average and median

lengths-of-stay in the majority of its programs, each program is

measured separately and cannot be considered in aggregate of its

hospice programs under common control and ownership. The Phoenix

program currently provides hospice care to approximately 200

terminally ill patients per day. Revenue and operating losses for

Phoenix in the first six months of 2006 aggregated $3.0 million and

$0.9 million, respectively, including $1.7 million of revenue

reduction for Medicare billing limitations, or Medicare Cap.

Full-year revenue and operating loss projections for Phoenix are

estimated at $3.7 million and $4.3 million, including $6.3 million

in revenue reductions for Medicare Cap. The after-tax cost to exit

the Phoenix market, excluding the operating losses noted above, is

estimated to range from $4.5 to $5.5 million. VITAS announced in

the second quarter of 2006 that two programs, excluding Phoenix,

were anticipated to be in contractual billing limitations with

Medicare in calendar year 2006. Based upon current trends, the

total Medicare Cap for these two programs in calendar year 2006 is

estimated to range between $4.7 and $7.6 million, with $0.6 million

being recorded in the second quarter of 2006, $2.0 million to $3.0

million estimated to be recorded in the third quarter of 2006 and

$2.1 million to $4.0 million to be recorded in the fourth quarter

of the year. These estimates assume a modest deterioration in

admission and discharge metrics in these two programs through the

end of 2006. These two programs are estimated to generate over $3

million in operating profit in 2006. The third-quarter 2006

Medicare Cap accrual will also include an additional $1.0 million

for estimated prior-year billing limitations resulting from the

Fiscal Intermediary reallocating admissions for deceased Medicare

patients who received hospice care from multiple providers. Of this

prior-year billing, $0.5 million is for one of the programs noted

above and $0.5 million is estimated for a program not anticipated

to have a billing restriction in calendar year 2006. VITAS also

released interim third quarter operating metrics. Through July and

August 2006, VITAS had an Average Daily Census of 11,194, an

increase of 9.7%, and admissions growth of 4.2%, when compared to

the equivalent prior year period. August 2006 year-to-date ADC and

admissions, excluding Phoenix, have increased 10.6% and 5.3%,

respectively. Chemed announced that it has reached a preliminary

agreement in regard to litigation related to the divestiture of its

Patient Care business segment. As part of this agreement, the

company will convert $2.6 million of the current receivable due

from Patient Care into a promissory note due October 2007. This

note will bear interest quarterly at a 9.5% annual interest rate.

The company will take an after-tax charge of $1.7 million

representing a write-off of the remaining receivable balance as

well as costs associated with certain contingent insurance claims

and other items related to the Patient Care business. Chemed

received Patient Care warrants with a value of $1.4 million at the

time of the divestiture. The company has determined the valuation

of these warrants is impaired. This impairment will result in a

third quarter 2006 after-tax charge of $0.9 million. Guidance for

2006 VITAS is estimated to generate full-year revenue growth from

continuing operations, prior to Medicare Cap, of 14.0% to 14.5%,

increased admissions of 5.0% to 5.5%, increased ADC of 10.0% to

11.0% and adjusted EBITDA margins, prior to Medicare Cap, of 12.9%

to 13.2%. This guidance assumes a Medicare price increase that will

average 3.8% in the fourth quarter of 2006. Full-year Medicare

contractual billing limitations, excluding Phoenix, which is

anticipated to be classified as a discontinued operation in 2006,

are estimated to range from $5.7 million to $8.6 million, which

equates to revenue reduction of 80 to 120 basis points. Roto-Rooter

is estimated to generate a 6.0% to 7.0% increase in revenue in

2006, job count growth between 0.5% and 1.0% and adjusted EBITDA

margins averaging between 16.5% and 17.0%. Based upon these

factors, an effective tax rate of 39% and average diluted share

count of 26.7 million in the second half of 2006, our expectation

is that full-year 2006 earnings per diluted share from continuing

operations, excluding any charges or credits not indicative of

ongoing operations, and excluding expense for stock options, will

be in the range of $2.00 to $2.10. This earnings per share guidance

includes $.13 to $.20 for the after-tax impact of Medicare Cap

related to continuing operations. Conference Call Chemed will host

a conference call and webcast at 9:00 a.m., ET, on Friday,

September 29, 2006, to discuss this press release and provide an

update on its business. The dial-in number for the conference call

is (800) 561-2601 for U.S. and Canadian participants and (617)

614-3518 for international participants. The participant pass code

is 50409048. A live webcast of the call can be accessed on Chemed's

website at www.chemed.com by clicking on Investor Relations Home. A

taped replay of the conference call will be available beginning

approximately two hours after the call's conclusion. It can be

accessed by dialing (888) 286-8010 for U.S. and Canadian callers

and (617) 801-6888 for international callers and will be available

for one week following the live call. The replay pass code is

79291237. An archived webcast will also be available at

www.chemed.com and will remain available for 14 days following the

live call. Chemed Corporation operates in the healthcare field

through its VITAS Healthcare Corporation subsidiary. VITAS provides

daily hospice services to over 11,000 patients with severe,

life-limiting illnesses. This type of care is focused on making the

terminally ill patient's final days as comfortable and pain-free as

possible. Chemed operates in the residential and commercial

plumbing and drain cleaning industry under the brand name

Roto-Rooter. Roto-Rooter provides plumbing and drain service

through company-owned branches, independent contractors and

franchisees in the United States and Canada. Roto-Rooter also has

licensed master franchisees in Indonesia, Singapore, Japan, Mexico,

and the Philippines. Forward-Looking Statements Certain statements

contained in this press release and the accompanying tables are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The words "believe,"

"expect," "hope," "anticipate," "plan" and similar expressions

identify forward-looking statements, which speak only as of the

date the statement was made. Chemed does not undertake and

specifically disclaims any obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. These statements are based

on current expectations and assumptions and involve various risks

and uncertainties, which could cause Chemed's actual results to

differ from those expressed in such forward-looking statements.

These risks and uncertainties arise from, among other things,

possible changes in regulations governing the hospice care or

plumbing and drain cleaning industries; periodic changes in

reimbursement levels and procedures under Medicare and Medicaid

programs; difficulties predicting patient length of stay and

estimating potential Medicare reimbursement obligations; challenges

inherent in Chemed's growth strategy; the current shortage of

qualified nurses, other healthcare professionals and licensed

plumbing and drain cleaning technicians; Chemed's dependence on

patient referral sources; and other factors detailed under the

caption "Description of Business by Segment" or "Risk Factors" in

Chemed's most recent report on form 10-Q or 10-K and its other

filings with the Securities and Exchange Commission. You are

cautioned not to place undue reliance on such forward-looking

statements and there are no assurances that the matters contained

in such statements will be achieved.

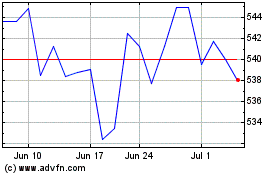

Chemed (NYSE:CHE)

Historical Stock Chart

From Jun 2024 to Jul 2024

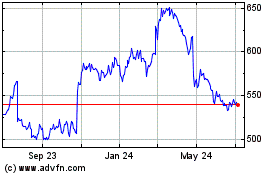

Chemed (NYSE:CHE)

Historical Stock Chart

From Jul 2023 to Jul 2024