Five Columbia Management funds have received 2012 Lipper Fund

Awards as top-performing mutual funds in their respective Lipper

categories as of December 31, 2011:

- Columbia Acorn International

Fund (Z shares)

International Small/Mid-Cap Growth category

(41 funds) – 10 years

- Columbia California Intermediate

Municipal Bond Fund (Z shares)

California Intermediate Municipal Debt

category (32 funds) – 5 years

- Columbia European Equity Fund (I

shares)

European Region category (68 funds) – 5

years

- Columbia Select Large Cap Value

Fund (R5 shares)

Large Cap Value category (402 funds) – 5

years

- Columbia U.S. Government Mortgage

Fund (I shares)

U.S. Mortgage category (78 funds) – 3

years

A Lipper Fund Award is presented to one fund in each Lipper

category for achieving the strongest trend of consistent

risk-adjusted performance versus category peers over three, five or

10 years for the period ending December 31, 2011.

“This recognition from Lipper is a testament to the disciplined

investment processes and in-depth research of our investment

management teams,” said Colin Moore, Chief Investment Officer. “Our

goal is to continue delivering consistent, competitive performance

for our institutional clients, financial advisors and individual

investors.”

About Columbia Management:Columbia Management is the

eighth largest manager of long-term mutual fund assets with $326

billion under management as of December 31, 2011. Columbia

Management is a subsidiary of Ameriprise Financial, Inc. (NYSE:

AMP). For more information, visit columbiamangement.com.

About Ameriprise Financial:At Ameriprise Financial, we

have been helping people feel confident about their financial

future for over 115 years. With outstanding asset management,

advisory and insurance capabilities and a nationwide network of

10,000 financial advisors, we have the strength and expertise to

serve the full range of individual and institutional investors'

financial needs. For more information, or to find an Ameriprise

financial advisor, visit ameriprise.com.

Performance Chart

Average

annual total returns as of 12/31/11 1 year

3 Year 5 Year 10 Year

Since Inception Inception

Date

Total Net Annual Operating Expenses

Maximum Front-end sales charge

Columbia Acorn International

(Z shares)

-14.06 16.76 0.20 10.27 10.63

09/23/1992 0.98% -- Columbia California

Intermediate Municipal Bond Fund (Z Shares) 10.49

7.70 5.03 -- 4.24 08/19/2002

0.48% -- Columbia European Equity1

(I shares2)

-11.32 12.33 -0.18 5.58 1.78

07/15/2004* 1.00% -- Columbia Select Large Cap

Value

(R5 shares2)

-0.62 14.99 1.03 3.92 6.14

11/30/2001 0.98% -- Columbia U.S. Government

Mortgage1

(I shares2)

9.20 10.89 6.98 -- 5.69

3/4/2004* 0.48% --

Source: Lipper, as of 12/31/11.

1 The returns shown for periods prior to each fund’s share class

inception date include the returns of the oldest share class of the

fund, adjusted to reflect higher class-related operating expenses,

as applicable. In addition, the returns shown include the returns

of any predecessor to the fund. Please visit

columbiamanagement.com/institutional/strategies-and-products/appended-performance

for more information.

2 Class Z, I and R5 shares are available only to eligible

investors. See the prospectus for eligibility requirements and

other important information.

*The since inception returns shown are since fund inception, and

for newer share classes, include the returns of the fund’s oldest

share class, adjusted to reflect higher class-related operating

expenses, as applicable.

The performance information shown represents past performance

and is not a guarantee of future results. The investment return and

principal value of an investment will fluctuate so that the shares,

when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance

information shown. You may obtain performance information current

to the most recent month-end by visiting riversource.com/funds.

The investment manager and certain of its affiliates have

contractually (for at least the current fiscal year) and/or

voluntarily agreed to waive certain fees and/or to reimburse

certain expenses of the Fund, as described in the Fund's

prospectus, unless sooner terminated at the sole discretion of the

Fund's board. Net expense ratios reflect this fee waiver/expense

cap. Fee waivers/expense caps would limit the impact that any

decrease in assets would have on net expense ratios in the current

fiscal year. Voluntary waivers/reimbursement arrangements, if any,

may be discontinued at any time.

The Lipper Fund Awards are part of the Thomson Reuters Awards

for Excellence, a global family of awards that celebrate

exceptional performance throughout the professional investment

community. The Thomson Reuters Awards for Excellence recognize the

world's top funds, fund management firms, sell-side firms, research

analysts, and investor relations teams. The Thomson Reuters Awards

for Excellence also include the Extel Survey Awards, the StarMine

Analyst Awards, and the StarMine Broker Rankings. For more

information, please contact markets.awards@thomsonreuters.com or

visit excellence.thomsonreuters.com.

Investors should consider the investment objectives, risks,

charges and expenses of a mutual fund carefully before investing.

For a free prospectus which contains this and other important

information about the funds, please visit columbiamanagement.com.

The prospectus should be read carefully before investing.

Investment products, including shares of mutual funds, are not

federally or FDIC-insured, are not deposits or obligations of, or

guaranteed by any financial institution, and involve investment

risks including possible loss of principal and fluctuation in

value. Investing in certain funds involves special risk, such as

those related to investments in foreign securities, small- and

mid-capitalization stocks, fixed income securities (especially

high-yield securities), and funds which focus their investments in

a particular sector, such as real estate, technology, and precious

metals. See each fund’s prospectus for specific risks associated

with the Fund.

Columbia Funds are distributed by Columbia Management Investment

Distributors, Inc., member FINRA, and managed by Columbia

Management Investment Advisers, LLC.

© 2012 Columbia Management Investment Advisers, LLC. All rights

reserved.

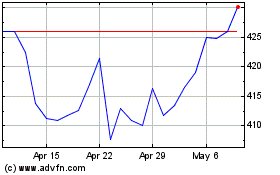

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Sep 2023 to Sep 2024