BlackRock Boosts Shareholder Value - Analyst Blog

February 27 2012 - 7:15AM

Zacks

Last week, BlackRock Inc. (BLK) announced a 9%

increase in its quarterly cash dividend to $1.50 per share. The

dividend will be paid on March 23, 2012 to the stockholders of

record as of March 7, 2012.

BlackRock has been consistent in enhancing shareholder value

through dividend hikes. Since 2005, the company has increased its

quarterly dividend by nearly 500% from 30 cents per to the current

level.

Last year, BlackRock had increased its quarterly cash dividend

from $1.00 per share to $1.375. Even during the financial crisis in

2008, the company confirmed its strong financial backbone by paying

78 cents as quarterly dividend for two years.

Concurrent with the dividend rise, BlackRock’s board of

directors has also authorized the repurchase of additional 1.4

million shares from the open market. There were 3.6 million shares

left under the prior authorization as of December 31, 2011, thereby

bringing the total share repurchase authorization to 5.0 million.

During 2011, the company had repurchased about 14.2 million

shares.

Similar to BlackRock, one of the industry participants –

Ameriprise Financial Inc. (AMP) is also doing well

with respect to enhancing shareholder value through dividend hikes.

Ameriprise has been successfully increasing its dividend at regular

intervals. Since 2005, it has also hiked its quarterly dividend by

about 150% from 11 cents per share to the present 28 cents.

Our Viewpoint on Dividend Rise

Increasing dividend payment at regular intervals mainly reflects

the company’s sound financial position, defined future prospects

and the company’s commitment towards its shareholders.

Though dividend rise is an extremely encouraging step, we cannot

neglect the other aspects before becoming optimistic on BlackRock.

Two things that should be taken into consideration are the dividend

yield (annual dividend per share/stock’s price per share) and the

dividend payout ratio (annual dividend per share/annual earnings

per share).

BlackRock previously had a dividend yield of 2.80%. With

dividend increasing to $1.50, the dividend yield increased to

3.04%. As the company’s share price has remained almost stable over

the last 90 days, yield did not increase due to price rise, leading

to the conclusion that the shareholders will actually be benefited

from a dividend hike.

On the other hand, BlackRock’s payout ratio was nearly 50% when

its previous annual dividend was $5.50. For fiscal 2012,

considering the Zacks Consensus Estimate of $13.16 per share and

the increased dividend, the payout ratio is expected to be about

46%. An almost stable payout ratio signifies improved shareholder

value.

Therefore, we believe that this dividend rise will definitely

increase the confidence level of the BlackRock shareholders.

BlackRock currently retains a Zacks # 3 Rank, which translates

into a short-term ‘Hold’ rating.

AMERIPRISE FINL (AMP): Free Stock Analysis Report

BLACKROCK INC (BLK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

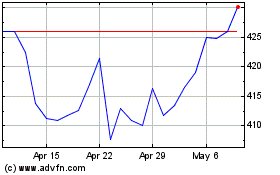

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jul 2023 to Jul 2024