Virco Announces First Quarter Results

June 08 2010 - 9:00AM

Virco Mfg. Corporation (Nasdaq:VIRC) today announced first quarter

results in the following letter to stockholders from Robert A.

Virtue, President and CEO:

Our first quarter results reflect the continued softness in

state and municipal funding in general and public school funding in

particular. Although this niche of the institutional furniture

market has held up relatively well compared to other sectors such

as office furnishings, our customers are still feeling the lagging

effects of the 2008-2009 recession. Until the private sector

recovers fully and begins pumping tax receipts into state and local

coffers, we believe spending for new schools and new school

furniture will remain below the levels of a few years ago. We

remind investors that our first quarter is seasonally light and

therefore not a proportional representation for the full year; in a

typical month of June, when public schools are out of session, our

shipping volume will match or exceed the volume of the entire first

quarter. Here are our results for the first quarter ended

April 30, 2010, and the comparable period last year:

| |

|

| |

Three Months Ended |

| |

4/30/2010 |

4/30/2009 |

| |

(In thousands, except per share

data) |

| |

|

|

| Net sales |

$ 24,860 |

$ 27,049 |

| Cost of sales |

18,589 |

18,749 |

| Gross profit |

6,271 |

8,300 |

| Selling, general administrative

& other expense |

12,765 |

13,187 |

| Loss before income taxes |

(6,494) |

(4,887) |

| Income tax benefit |

(1,413) |

(1,900) |

| Net loss |

$ (5,081) |

$ (2,987) |

| |

|

|

| Cash dividend declared |

$ 0.05 |

$ 0.05 |

| |

|

|

| Net loss per share – basic and

diluted (a) |

$ (0.36) |

$ (0.21) |

| |

|

|

| Weighted average shares

outstanding – basic and diluted |

14,157 |

14,231 |

| |

|

|

| (a) Net loss per share

was calculated based on basic shares outstanding due to the

anti-dilutive effect on the inclusion of common stock equivalent

shares. |

| |

|

|

|

| |

4/30/2010 |

1/31/2010 |

4/30/2009 |

| Current assets |

$ 72,170 |

$ 56,906 |

$ 70,033 |

| Non-current assets |

60,600 |

61,194 |

60,031 |

| Current liabilities |

41,697 |

22,926 |

31,817 |

| Non-current liabilities |

31,872 |

30,236 |

35,889 |

| Stockholders' equity |

59,201 |

64,938 |

62,358 |

| |

|

|

|

Gross profit declined from 30.7% of sales to 25.2%, due to a

combination of lower factory utilization, higher raw material

costs, and lower selling prices. Beginning in last year's

fourth quarter and continuing through the publication of this

earnings release, we have responded to reduced market demand with

very aggressive pricing, which has resulted in lower gross margins

but stable rates of incoming orders. Through early June,

incoming orders were approximately even with the same period last

year and our backlog was slightly higher. In keeping with our

policy of not issuing financial guidance, we caution investors

against extrapolating stable incoming order rates or first quarter

operating margins to full-year results. Our market remains

highly volatile and current trends could deteriorate or improve as

the year progresses.

On a more positive note, given what we know of our market, we

believe the current stability of our incoming orders represents an

ongoing, albeit modest, gain in market share. Unit sales

volume is also on an upward trajectory that appears likely to

continue through this year's summer delivery season. We

continue to see strong interest in our many new products as well as

our turnkey project management service - PlanSCAPE® - which helps

educators fully equip new campuses, or refurbish existing schools,

within the tight delivery window that typifies such

projects.

We're actively using the custom manufacturing capabilities of

our domestic factories to offer educators the colors, features, and

special designs that are much harder if not impossible to acquire

through an offshore supply chain. Whereas a few years ago the

conventional wisdom was that "offshoring" offered the only

competitive business model, we're now seeing a reverse trend,

sometimes called "onshoring," that reflects the quality risks,

logistical complexities, and financial implications of

long-lead-time extended supply chains. For this reason we are

continuing to reinvest in our U.S. factories, primarily to support

new product designs but also in the belief that the quality and

reliability of domestically fabricated furniture will ultimately

play a role in its selection for use in American classrooms.

Longer-term, despite underlying demographic strength as

reflected in live births, the domestic market for classroom

furniture seems likely to remain soft for some time.

Annual live births in the U.S. are now slightly above their average

of 4 million during each of the 19 years of the famed "Baby Boom"

(1945-1964). Unfortunately, the state and local tax receipts

that provide funding for public schools are recovering only slowly

from their record lows of several months ago. So although the

long-term demographic trends are as favorable as at any time since

the early 1960s, short- to mid-term funding challenges may continue

to restrict growth in our market.

We continue to believe that these current funding challenges

will be satisfactorily addressed and that underlying growth in the

student population will eventually drive higher demand for our

products. Certain international markets are well-funded

and growing rapidly, so we're placing additional emphasis on the

identification and development of these opportunities. We're

also having success in higher education and vocational training

classrooms with some of our most recently introduced new products

such as Sage™ seating and Text® tables, and Parameter™, an entire

new family of teacher desks and administrative support

furniture. As with all of our recently introduced products,

this furniture is made in our own U.S. factories, giving us the

crucial ability to integrate colors, frame finishes, and provide

optional configurations to support campus-wide design

schemes. As unit sales of these new products continue to

grow, they also provide much-needed absorption of overhead.

We're currently in the process of performing a number of program

evaluations where our furniture is being tested within new and

innovative curriculum regimes by educators who specialize in

certain kinds of learning disabilities. We're also supporting

trials in various styles of collaborative learning and interactive

classroom technologies. These program evaluations provide us

with crucial insights into the evolving needs of students,

educators, parents, and communities, ensuring that our designs and

services remain relevant in the important work of education.

The Virco Mfg. Corporation Logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=521

This news release contains "forward-looking statements" as

defined by the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to,

statements regarding: availability of funding for educational

institution; business strategies; the Company's ability to continue

to control costs; the cost and availability of steel and other raw

materials; the costs of utilities and freight;; market demand and

acceptance of new products; development of new distribution

channels; growth of international sales; importance to consumers of

domestically produced products; pricing; and seasonality.

Forward-looking statements are based on current expectations

and beliefs about future events or circumstances, and you should

not place undue reliance on these statements. Such statements

involve known and unknown risks, uncertainties, assumptions and

other factors, many of which are out of our control and difficult

to forecast. These factors may cause actual results to differ

materially from those which are anticipated. Such factors

include, but are not limited to: changes in general economic

conditions including raw material, energy and freight costs; the

seasonality of our markets; the markets for school and office

furniture generally; the specific markets and customers with which

we conduct our principal business; the rate of approval of school

bonds for construction of new schools and the extent to which

existing schools order replacement furniture; ability of school

districts to obtain sufficient funding to purchase our products;

customer confidence; and competition. See our Annual Report

on Form 10-K for the year ended January 31, 2010, and other

materials filed with the Securities and Exchange Commission for a

further description of these and other risks and uncertainties

applicable to our business. We assume no, and hereby disclaim

any, obligation to update any of our forward-looking

statements. We nonetheless reserve the right to make such

updates from time to time by press release, periodic reports or

other methods of public disclosure without the need for specific

reference to this press release. No such update shall be

deemed to indicate that other statements which are not addressed by

such an update remain correct or create an obligation to provide

any other updates.

CONTACT: Virco Mfg. Corporation

Robert A. Virtue, President

Douglas A. Virtue, Executive Vice President

Robert E. Dose, Vice President Finance

(310) 533-0474

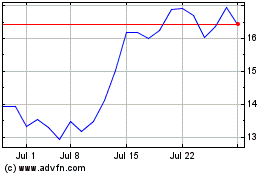

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From May 2024 to Jun 2024

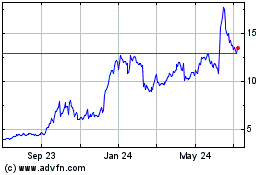

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Jun 2023 to Jun 2024