Form 8-K - Current report

February 26 2024 - 9:00AM

Edgar (US Regulatory)

false

0001361113

0001361113

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 21, 2024

VARONIS SYSTEMS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-36324 |

|

57-1222280 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

1250 Broadway, 28th Floor

New York, NY |

|

10001 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(877) 292-8767

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

VRNS |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officer.

On February 21, 2024, as a result of

the continued growth of Varonis Systems, Inc. (the "Company" or "Varonis"), James O'Boyle was appointed as Vice Chairman

- Sales and will now be principally responsible for growth and management of strategic customer accounts, partnership relationships and

channel development. In connection with this change, Greg Pomeroy, the current Vice President of Sales - North America, was appointed

as Senior Vice President - Worldwide Sales and in addition to his current responsibilities will now also lead sales operations in additional

markets around the world.

Item 7.01. Regulation FD Disclosure.

The Company is reaffirming its first quarter 2024 and full-year 2024 guidance previously issued

on February 5, 2024.

Forward-Looking Statements

This Current Report on Form 8-K contains "forward-looking" statements, which are subject

to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including regarding the Company's growth rate and

its expectations regarding future revenues, operating income or loss or earnings or loss per share. These statements are not guarantees

of future performance but are based on management's expectations as of the date of this Report and assumptions that are inherently subject

to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any

future results, performance or achievements. Important factors that could cause actual results to differ materially from those expressed

or implied by these forward-looking statements include the following: the impact of potential information technology, cybersecurity or

data security breaches; risks associated with anticipated growth in Varonis’ addressable market; general economic and industry conditions,

such as foreign currency exchange rate fluctuations and expenditure trends for data and cybersecurity solutions; Varonis’ ability

to predict the timing and rate of subscription renewals and their impact on the Company’s future revenues and operating results;

risks associated with international operations; the impact of global conflicts on the budgets of our clients and on economic conditions

generally; competitive factors, including increased sales cycle time, changes in the competitive environment, pricing changes and increased

competition; the risk that Varonis may not be able to attract or retain employees, including sales personnel and engineers; Varonis’

ability to build and expand its direct sales efforts and reseller distribution channels; risks associated with the closing of large transactions,

including Varonis’ ability to close large transactions consistently on a quarterly basis; new product introductions and Varonis’

ability to develop and deliver innovative products; Varonis’ ability to provide high-quality service and support offerings; the

expansion of cloud-delivered services; and risks associated with our convertible notes and capped-call transaction. These and other important

risk factors are described more fully in Varonis’ reports and other documents filed with the Securities and Exchange Commission

and could cause actual results to vary from expectations. All information provided in this Report is as of the date hereof, and Varonis

undertakes no duty to update or revise this information, whether as a result of new information, new developments or otherwise, except

as required by law.

The information in this Report is furnished only, is not

"filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities

of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, regardless of any

general incorporation language in such a filing, except as expressly set forth by specific reference in that filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VARONIS SYSTEMS, INC. |

| |

|

| |

|

| Dated: February 26, 2024 |

By: /s/ Guy Melamed |

| |

Name: Guy Melamed |

| |

Title: Chief Financial Officer and Chief Operating Officer |

v3.24.0.1

Cover

|

Feb. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity File Number |

001-36324

|

| Entity Registrant Name |

VARONIS SYSTEMS, INC.

|

| Entity Central Index Key |

0001361113

|

| Entity Tax Identification Number |

57-1222280

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1250 Broadway

|

| Entity Address, Address Line Two |

28th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

(877)

|

| Local Phone Number |

292-8767

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

VRNS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

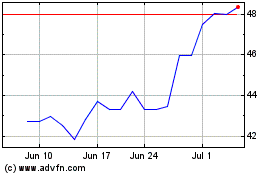

Varonis Systems (NASDAQ:VRNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

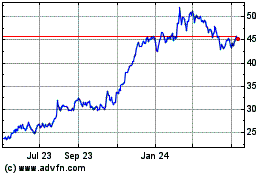

Varonis Systems (NASDAQ:VRNS)

Historical Stock Chart

From Apr 2023 to Apr 2024