UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT TO §

240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO § 240.13d-2(a)

(Amendment No. 1)*

Staffing 360 Solutions, Inc.

(Name of Issuer)

Common Stock, $0.00001 par value

per share

(Title of Class of Securities)

852387505

(CUSIP Number)

Satvinder Singh

Rscube Investment, LLC

24 Hayhurst Drive

Newtown, PA 18940

(732) 915-5937

(Name, Address and Telephone Number

of Person

Authorized to Receive Notices and

Communications)

August 17, 2023

(Date of Event Which Requires Filing

of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed in paper

format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other

parties to whom copies are to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

This Amendment No. 1, dated August

18, 2023, reflects more than a 1% change in beneficial ownership, which amends and supplements the original Schedule 13D filing,

dated August 10, 2023.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1 |

Names of Reporting Persons

Rscube Investment, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

WC |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant

to Item 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

Sole Voting Power

- 0 - |

| 8 |

Shared Voting Power

471,205 |

| 9 |

Sole Dispositive Power

- 0 - |

| 10 |

Shared Dispositive Power

471,205 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

471,205 |

| 12 |

Check if the Aggregate Amount in row (11) Excludes Certain Shares ¨ |

| 13 |

Percent of Class represented by Amount in Row (11)

10.9% 1 |

| 14 |

Type of reporting person

OO (Limited Liability Company) |

| |

|

|

|

1 The percentages reported in this Schedule 13D are calculated based upon

the 4,311,020 shares of common stock outstanding as of May 19, 2023, as reported in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission on May 19, 2023.

| 1 |

Names of Reporting Persons

Satvinder Singh |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

AF |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

United States of America |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

Sole Voting Power

- 0 - |

| 8 |

Shared Voting Power

471,205 |

| 9 |

Sole Dispositive Power

- 0 - |

| 10 |

Shared Dispositive Power

471,205 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

471,205 |

| 12 |

Check if the Aggregate Amount in row (11) Excludes Certain Shares ¨ |

| 13 |

Percent of Class represented by Amount in Row (11)

10.9% 1 |

| 14 |

Type of reporting person

IN |

| |

|

|

|

1 The percentages reported in this Schedule 13D are calculated based upon

the 4,311,020 shares of common stock outstanding as of May 19, 2023, as reported in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission on May 19, 2023.

| 1 |

Names of Reporting Persons

Anil Sharma |

| 2 |

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds

AF |

| 5 |

Check if Disclosure of Legal Proceedings is Required Pursuant to Item 2(d) or 2(e) ¨ |

| 6 |

Citizenship or Place of Organization

United States of America |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

Sole Voting Power

- 0 - |

| 8 |

Shared Voting Power

471,205 |

| 9 |

Sole Dispositive Power

- 0 - |

| 10 |

Shared Dispositive Power

471,205 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

471,205 |

| 12 |

Check if the Aggregate Amount in row (11) Excludes Certain Shares ¨ |

| 13 |

Percent of Class represented by Amount in Row (11)

10.9% 1 |

| 14 |

Type of reporting person

IN |

| |

|

|

|

1 The percentages reported in this Schedule 13D are calculated based upon

the 4,311,020 shares of common stock outstanding as of May 19, 2023, as reported in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission on May 19, 2023.

The following constitutes

the Schedule 13D filed by the undersigned (this “Schedule 13D”).

| Item 1. | Security and Issuer. |

This statement relates

to the common stock, par value $0.00001 per share (the “Shares”), of Staffing 360 Solutions, Inc., a Delaware corporation

(the “Issuer”). The principal executive offices of the Issuer are located at 757 3rd Avenue, 27th Floor, New York,

New York 10017.

| Item 2. | Identity and Background. |

(a) This

statement is filed by Rscube Investment, LLC, a Delaware limited liability company (“Rscube”), Satvinder Singh, an

individual natural person (“Mr. Singh”), and Anil Sharma, an individual natural person (“Mr. Sharma”).

Each of the foregoing is referred to as a “Reporting Person” and collectively as the “Reporting Persons.”

Mr. Singh beneficially

owns 50% of the outstanding Shares of Rscube. Mr. Sharma beneficially owns the remaining 50% of the outstanding Shares of Rscube. Accordingly,

for purposes of this Schedule 13D, each of Rscube, Mr. Singh and Mr. Sharma may be deemed to beneficially own the Shares owned directly

by Rscube.

(b) The principal

business address of Rscube is 24 Hayhurst Drive, Newtown, PA 18940. The principal business address of Messrs. Singh and Sharma is 8251

Greensboro Drive, McLean, VA 22102.

(c) The principal

business of Rscube is holding securities for the account of Messrs. Singh and Sharma. Messrs. Singh and Sharma are principally employed

by 22nd Century Technologies, Inc., a New Jersey corporation (“22nd Century”). The principal business address of 22nd

Century is 22nd Century Technologies, Inc., 8251 Greensboro Drive, McLean, VA 22102. 22nd Century is an information technology service

integrator and workforce solution company.

(d) No Reporting

Person has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) No Reporting

Person has, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Rscube

is a limited liability company organized under the laws of the State of Delaware. Each of Messrs. Singh and Sharma is a citizen of the

United States of America.

| Item 3. | Source and Amount of Funds or Other Consideration. |

During the period from July

12, 2023 to August 18, 2023, Rscube invested $388,058 in Shares of the Issuer. The source of these funds was the working capital of Rscube.

| Item 4. | Purpose of Transaction. |

This filing is to

reflect the change in ownership through purchases.

The Reporting Persons

purchased the Shares for investment purposes. The intent of the Reporting Persons is to influence the policies of the Issuer and assert

stockholder rights, with a goal of maximizing the value of the Shares.

Consistent with

their investment purpose, the Reporting Persons may engage in communications with one or more officers of the Issuer and/or one or more

members of the Board of Directors of the Issuer, and/or one or more representatives of the Issuer regarding the Issuer, including, but

not limited to its business, management, operations, assets, capitalization, financial condition, governance, strategy and future plans.

These discussions may include ideas that, if effectuated, may result in any of the following: a sale or transfer of a material amount

of assets of the Issuer, a merger and/or changes in the Board of Directors of the Issuer.

| Item 5. | Interest in Securities of the Issuer. |

(a) See Items

11 and 13 on the cover pages to this Schedule 13D for the aggregate number and percentage of the class of securities identified pursuant

to Item 1 owned by each Reporting Person.

(b) Number

of shares as to which each Reporting Person has:

i. Sole power

to vote or to direct the vote: See Item 7 on cover pages to this Statement.

ii. Shared power

to vote or to direct the vote: See Item 8 on cover pages to this Statement.

iii. Sole power

to dispose or direct the disposition: See Item 9 on cover pages to this Statement.

iv. Shared power

to dispose or direct the disposition: See Item 10 on cover pages to this Statement.

(c) See Schedule

A attached to this Schedule 13D.

(d) To the

knowledge of the Reporting Persons, no other person has the right to receive or the power to direct the receipt of dividends from, or

the proceeds from the sale of, the securities of Issuer covered by this Schedule 13D.

(e) Not applicable.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Pursuant to Rule

13d-1(k) promulgated under the Exchange Act, the Reporting Persons have entered into an agreement with respect to the joint filing of

this statement, and any amendment or amendments thereto. A copy of this agreement is attached as Exhibit 1 hereto and is incorporated

herein by reference.

Except as set forth

herein, there are no contracts, arrangements, understandings or relationships among the Reporting Persons, or between the Reporting Persons

and any other person, with respect to the securities of the Issuer.

| Item 7. | Material to be Filed as Exhibits. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

| |

Dated August 18, 2023 |

RSCUBE INVESTMENT, LLC |

| |

|

|

| |

|

By: |

/s/ Anil Sharma |

| |

|

Anil Sharma, Chief Executive Officer |

| |

|

|

| |

|

|

| |

|

/s/ Satvinder Singh |

| |

|

Satvinder Singh |

| |

|

|

| |

|

|

| |

|

/s/ Anil Sharma |

| |

|

Anil Sharma |

Exhibit 1

Joint Filing Agreement

In accordance with Rule 13d-1(k)(1)(iii)

under the Securities Exchange Act of 1934, as amended, the persons named below agree to the joint filing on behalf of each of them of

a Statement on Schedule 13D (including amendments thereto) with respect to the common stock, par value $0.00001 per share, of Staffing

360 Solutions, Inc. This Joint Filing Agreement shall be filed as an Exhibit to such Statement.

| |

Dated August 10, 2023 |

RSCUBE INVESTMENT, LLC |

| |

|

|

| |

|

By: |

/s/ Anil Sharma |

| |

|

Anil Sharma, Chief Executive Officer |

| |

|

|

| |

|

|

| |

|

/s/ Satvinder Singh |

| |

|

Satvinder Singh |

| |

|

|

| |

|

|

| |

|

/s/ Anil Sharma |

| |

|

Anil Sharma |

Schedule A

Transactions in the Shares in the Past Sixty

(60) Days

Nature of the

Transaction Securities |

Amount Purchased /

(Sold) |

Price ($) |

Date of Purchase / Sale |

| Common Stock |

6,703 |

0.661444 |

7/12/2023 |

| Common Stock |

157,779 |

0.732754 |

7/13/2023 |

| Common Stock |

31,001 |

0.799004 |

7/14/2023 |

| Common Stock |

15,217 |

0.796012 |

7/17/2023 |

| Common Stock |

26,670 |

0.743241 |

7/31/2023 |

| Common Stock |

13,440 |

0.781174 |

8/1/2023 |

| Common Stock |

17,528 |

0.790034 |

8/2/2023 |

| Common Stock |

2,201 |

0.79701 |

8/3/2023 |

| Common Stock |

32,002 |

0.83503 |

8/4/2023 |

| Common Stock |

5,985 |

0.88476 |

8/7/2023 |

| Common Stock |

4,656 |

0.891592 |

8/8/2023 |

| Common Stock |

10,785 |

0.9 |

8/9/2023 |

| Common Stock |

6,237 |

0.9 |

8/10/2023 |

| Common Stock |

7,645 |

0.899902 |

8/14/2023 |

| Common Stock |

14,093 |

0.890935 |

8/15/2023 |

| Common Stock |

4,971 |

0.9 |

8/16/2023 |

| Common Stock |

96,720 |

0.9 |

8/17/2023 |

| Common Stock |

17,572 |

0.89995 |

8/18/2023 |

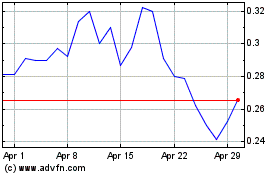

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2024 to May 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From May 2023 to May 2024