UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 23, 2024 (August 23, 2024)

SIRIUS XM HOLDINGS INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-34295 |

38-3916511 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

| 1221 Avenue of the Americas, 35th Fl., New York, NY |

10020 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| Registrant's

telephone number, including area code: (212)

584-5100 |

| |

| (Former

Name or Former Address, if Changed Since Last Report): N/A |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| |

|

|

| Common Stock, par value $0.001 per share |

SIRI |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

As previously disclosed, Sirius XM Holdings Inc.,

a Delaware corporation (“SiriusXM”), previously entered into that certain (i) Reorganization Agreement, dated

as of December 11, 2023, by and among Liberty Media Corporation, a Delaware corporation (“Liberty Media”), Liberty

Sirius XM Holdings Inc., a newly formed Delaware corporation and wholly-owned subsidiary of Liberty Media (“SplitCo”),

and SiriusXM, as amended by that certain First Amendment to the Reorganization Agreement, dated as of June 16, 2024, by and among

Liberty Media, SplitCo and SiriusXM (collectively and as amended from time to time, the “Reorganization Agreement”)

and (ii) Agreement and Plan of Merger, dated as of December 11, 2023, by and among Liberty Media, SplitCo, SiriusXM and Radio

Merger Sub, LLC, a Delaware limited liability company and wholly-owned subsidiary of SplitCo (“Merger Sub”), as amended

by that certain First Amendment to the Agreement and Plan of Merger, dated as of June 16, 2024, by and among Liberty Media, SplitCo,

SiriusXM and Merger Sub (collectively and as amended from time to time, the “Merger Agreement”).

Liberty

Media has announced that at a special meeting held today of the holders of Series A Liberty SiriusXM common stock

(“LSXMA”) and Series B Liberty SiriusXM common stock (“LSXMB”),

based on preliminary results of such special meeting, those holders approved the redemption by Liberty Media of each

outstanding share of LSXMA, LSXMB and Series C Liberty SiriusXM common stock (“LSXMK”)

in exchange for a number of shares of common stock of SplitCo, equal to the Exchange Ratio (as defined in the Reorganization

Agreement).

Assuming the conditions to the redemptive split-off

set forth in the Reorganization Agreement (the “Split-Off”) and the conditions to the merger of Merger Sub with and

into SiriusXM, with SiriusXM surviving as a wholly-owned subsidiary of SplitCo, set forth in the Merger Agreement (the “Merger”

and together with the Split-Off, the “Transactions”) are satisfied or waived, as applicable, the parties intend that

the Split-Off will be completed and effective as of 4:05 p.m., New York City time, on September 9, 2024 and that the Merger will

be completed and effective as of 6:00 p.m., New York City time, on September 9, 2024. As part of the Transactions SplitCo will change

its name to Sirius XM Holdings Inc. (“New SiriusXM”). SiriusXM expects that the common stock of New SiriusXM will begin

trading on Nasdaq under the ticker symbol “SIRI” as of September 10, 2024.

* * *

Forward-Looking Statements

This Current Report on Form 8-K includes certain

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including certain statements relating

to the Transactions and their proposed timing and other matters related to the Transactions. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and state securities laws. These forward-looking statements

generally can be identified by phrases such as “possible,” “potential,” “intends” or “expects”

or other words or phrases of similar import or future or conditional verbs such as “will,” “may,” “might,”

“should,” “would,” “could,” or similar variations. These forward-looking statements involve many risks

and uncertainties that could cause actual results and the timing of events to differ materially from those expressed or implied by such

statements, including, without limitation, the satisfaction of conditions to the Transactions. These forward-looking statements speak

only as of the date of this Current Report on Form 8-K, and SiriusXM expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained herein to reflect any change in SiriusXM’s expectations with

regard thereto or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly

filed documents of SiriusXM and its most recent Forms 10-K and 10-Q, as such risk factors may be amended, supplemented or superseded from

time to time by other reports SiriusXM subsequently files with the SEC, for additional information about SiriusXM and about the risks

and uncertainties related to SiriusXM’s business which may affect the statements made in this Current Report on Form 8-K.

Additional Information

Nothing in this Current Report on Form 8-K

shall constitute a solicitation to buy or an offer to sell shares of common stock of Liberty Media, SiriusXM or SplitCo. The proposed

offer and issuance of shares of SplitCo common stock in the Transactions will be made only pursuant to SplitCo’s effective registration

statement on Form S-4, which includes a prospectus of SplitCo. Liberty Media and SiriusXM stockholders and other investors are urged

to read the registration statement, Liberty Media’s definitive proxy statement and SiriusXM’s information statement, together

with all relevant Securities and Exchange Commission (“SEC”) filings regarding the Transactions, and any other relevant

documents filed as exhibits therewith, as well as any amendments or supplements to those documents, because they contain important information

about the Transactions. The prospectus/proxy statement/information statement and other relevant materials for the proposed Transactions

have previously been provided to all LSXMA, LSXMB and SiriusXM stockholders. Copies of these SEC filings are available, free of charge,

at the SEC's website (http://www.sec.gov). Copies of the filings together with the materials incorporated by reference therein are available,

without charge, by directing a request to Liberty Media Corporation, 12300 Liberty Boulevard, Englewood, Colorado 80112, Attention: Investor

Relations, Telephone: (877) 772-1518 or Sirius XM Holdings Inc., 1221 Avenue of the Americas, 35th Floor, New York, New York 10020, Attention:

Investor Relations, (212) 584-5100.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | SIRIUS XM HOLDINGS INC. |

| | | |

| | | By: |

/s/

Patrick L. Donnelly |

| | | |

Patrick L. Donnelly |

| | | |

Executive Vice President, General Counsel and Secretary |

Dated: August 23, 2024

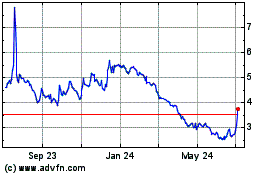

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Aug 2024 to Sep 2024

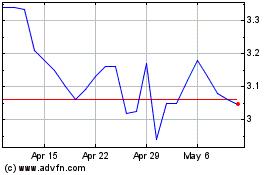

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Sep 2023 to Sep 2024