Radware® (NASDAQ: RDWR), a leading provider of cyber security and

application delivery solutions, today announced its consolidated

financial results for the quarter ended September 30, 2019.

“The third quarter was another solid quarter for Radware, with

continued revenue growth and strong profitability,” said Roy

Zisapel, Radware President & CEO. “Our market position is

strong, and our solution portfolio meets our customers’ evolving

needs. We combine superior attack detection and mitigation

capabilities, with agility and flexibility in deploying them across

private, hybrid and public clouds. We look forward to continued

growth.”

Financial Highlights for the

Third Quarter of 2019

Revenues for the third quarter of 2019 totaled

$62.9 million, up 7% from revenues of $58.8 million for the third

quarter of 2018. Revenues for the first nine months of 2019 totaled

$184.7 million, up 8% from revenues of $170.6 million for the first

nine months of 2018:

- Revenues in the Americas region

were $24.5 million for the third quarter of 2019, compared with

revenues of $26.7 million in the third quarter of 2018. For the

first nine months of 2019, revenues in the Americas region

increased 3% over the same period in 2018.

- Revenues in the Europe, Middle East

and Africa (“EMEA”) region were $19.4 million for the third quarter

of 2019, up 10% from revenues of $17.7 million in the third quarter

of 2018. For the first nine months of 2019, revenues in the EMEA

region increased 4% over the same period of 2018.

- Revenues in the Asia-Pacific

(“APAC”) region were $19.0 million for the third quarter of 2019,

up 32% from revenues of $14.4 million in the third quarter of 2018.

For the first nine months of 2019, revenues in the APAC region

increased 23% over the same period of 2018.

Net income on a GAAP basis for the third quarter

of 2019 was $7.1 million, or $0.15 per diluted share, compared with

net income of $3.1 million, or $0.06 per diluted share for the

third quarter of 2018.

Non-GAAP net income for the third quarter of

2019 was $11.9 million, or $0.25 per diluted share, compared with

non- GAAP net income of $7.1 million, or $0.15 per diluted share

for the third quarter of 2018.

Non-GAAP results are calculated excluding, as

applicable, the impact of stock-based compensation expenses,

amortization of intangible assets, acquisition costs, litigation

costs, exchange rate differences, net on balance sheet items

included in finance income, other gain adjustment and tax effect

related to amortization of deferred tax liability related to

intangible assets and other gain adjustment. A reconciliation of

each of the Company’s non-GAAP measures to the comparable GAAP

measure is included at the end of this press release.

As of September 30, 2019, the Company had cash,

cash equivalents, short-term and long-term bank deposits and

marketable securities of $428.6 million, compared with $401.1

million as of December 31, 2018. Net cash provided by operating

activities in the third quarter of 2019 totaled $20.3 million. Net

cash provided by operating activities in the last 12 months totaled

$74.6 million.

Conference Call

Radware management will host a call on

Wednesday, November 6, 2019 at 8:30 a.m. ET to discuss its third

quarter 2019 results and the Company’s outlook for the fourth

quarter of 2019.

Participants in the US call: Toll Free 833-241-4257

Participants Internationally call: +1-647-689-4208

Conference ID: 3959748

A replay will be available for two days, starting two hours

after the end of the call, at telephone number +1-416-621-4642 or

(US toll-free) 800-585-8367.

A live webcast of the conference call can also

be heard by accessing the Company’s website at:

http://www.radware.com/IR/. The webcast will remain available for

replay during the next 12 months.

Use of Non-GAAP Financial

MeasuresIn addition to reporting financial results in

accordance with generally accepted accounting principles (GAAP),

Radware uses non-GAAP measures of gross profit, research and

development expense, sales and marketing expense, general and

administrative expense, other income, total operating expenses,

operating income, financial income, income before taxes on income,

net income and earnings per share, which are adjustments from

results based on GAAP to exclude stock-based compensation expenses,

amortization of intangible assets, acquisition costs, litigation

costs, exchange rate differences, net on balance sheet items

included in finance income, other gain adjustment and tax effect

related to amortization of deferred tax liability related to

intangible assets and other gain adjustment. Management believes

that exclusion of these charges allows for meaningful comparisons

of operating results across past, present and future periods.

Radware’s management believes the non-GAAP financial measures

provided in this release are useful to investors for the purpose of

understanding and assessing Radware’s ongoing operations. The

presentation of these non-GAAP financial measures is not intended

to be considered in isolation or as a substitute for results

prepared in accordance with GAAP. A reconciliation of each non-GAAP

financial measure to the most directly comparable GAAP financial

measures is included with the financial information contained in

this press release. Management uses both GAAP and non-GAAP

financial measures in evaluating and operating the business and, as

such, has determined that it is important to provide this

information to investors.

Safe Harbor Statement

This press release includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Any statements made herein that are not

statements of historical fact, including statements about Radware’s

plans, outlook, beliefs or opinions, are forward-looking

statements. Generally, forward-looking statements may be identified

by words such as “believes,” “expects,” “anticipates,” “intends,”

“estimates,” “plans,” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” “may” and

“could.” Because such statements deal with future events, they are

subject to various risks and uncertainties, and actual results,

expressed or implied by such forward-looking statements, could

differ materially from Radware’s current forecasts and estimates.

Factors that could cause or contribute to such differences include,

but are not limited to: the impact of global economic conditions

and volatility of the market for our products; changes in the

competitive landscape; inability to realize our investment

objectives; timely availability and customer acceptance of our new

and existing products; risks and uncertainties relating to

acquisitions or other investments; the impact of economic and

political uncertainties and weaknesses in various regions of the

world, including the commencement or escalation of hostilities or

acts of terrorism; intense competition in the market for

Application Delivery and Network Security solutions and in our

industry in general; changes in government regulation; outages,

interruptions or delays in hosting services or our internal network

system; compliance with open source and third party licenses; the

risk that our intangible assets or goodwill may become impaired;

our dependence on independent distributors to sell our products;

long sales cycles for our solutions; changes in foreign currency

exchange rates; undetected defects or errors in our products or a

failure of our products to protect against malicious attacks; the

availability of components and manufacturing capacity; the ability

of vendors to provide our hardware platforms and components for our

main accessories; our ability to protect our proprietary

technology; intellectual property infringement claims made by third

parties; changes in tax laws; our ability to attract, train and

retain highly qualified personnel; and other factors and risks over

which we may have little or no control. This list is intended to

identify only certain of the principal factors that could cause

actual results to differ. For a more detailed description of the

risks and uncertainties affecting Radware, refer to Radware’s

Annual Report on Form 20-F, filed with the Securities and Exchange

Commission (SEC) and the other risk factors discussed from time to

time by Radware in reports filed with, or furnished to, the SEC.

Forward-looking statements speak only as of the date on which they

are made and, except as required by applicable law, Radware

undertakes no commitment to revise or update any forward-looking

statement in order to reflect events or circumstances after the

date any such statement is made. Radware’s public filings are

available from the SEC’s website at www.sec.gov or may be obtained

on Radware’s website at www.radware.com.

About Radware

Radware® (NASDAQ: RDWR) is a global leader of

cyber security and application delivery solutions for physical,

cloud, and software defined data centers. Its award-winning

solutions portfolio secures the digital experience by providing

infrastructure, application, and corporate IT protection and

availability services to enterprises globally. Radware’s solutions

empower more than 12,500 enterprise and carrier customers worldwide

to adapt to market challenges quickly, maintain business continuity

and achieve maximum productivity while keeping costs down. For more

information, please visit www.radware.com.

©2019 Radware Ltd. All rights reserved. The

Radware products and solutions mentioned in this press release are

protected by trademarks, patents and pending patent applications of

Radware in the U.S. and other countries. For more details please

see: https://www.radware.com/LegalNotice/. All other trademarks and

names are property of their respective owners.

CONTACTS

Investor Relations:Anat Earon-Heilborn+972

723917548ir@radware.com

Media Contacts:Deborah

SzajngartenRadware201-785-3206deborah.szajngarten@radware.com

|

Radware Ltd. |

|

Condensed Consolidated Balance Sheets |

|

(U.S. Dollars in thousands) |

| |

|

|

|

| |

September 30, |

|

December 31, |

| |

2019 |

|

2018 |

| |

(Unaudited) |

|

(Unaudited) |

| Assets |

|

|

|

| |

|

|

|

| Current

assets |

|

|

|

|

Cash and cash equivalents |

39,955 |

|

|

45,203 |

|

| Available-for-sale marketable

securities |

28,177 |

|

|

15,742 |

|

| Short-term bank deposits |

153,812 |

|

|

255,454 |

|

| Trade receivables, net |

12,366 |

|

|

17,166 |

|

| Other receivables and prepaid

expenses |

9,390 |

|

|

7,071 |

|

| Inventories |

15,083 |

|

|

18,401 |

|

| |

258,783 |

|

|

359,037 |

|

| |

|

|

|

| Long-term

investments |

|

|

|

| Available-for-sale marketable

securities |

120,326 |

|

|

84,669 |

|

| Long-term bank deposits |

86,342 |

|

|

0 |

|

| Severance pay funds |

2,313 |

|

|

2,973 |

|

| |

208,981 |

|

|

87,642 |

|

| |

|

|

|

| |

|

|

|

| Property and equipment,

net |

23,256 |

|

|

23,677 |

|

| Other long-term assets |

21,495 |

|

|

20,724 |

|

| Operating lease right-of-use

assets |

18,849 |

|

|

0 |

|

| Goodwill and intangible

assets, net |

56,127 |

|

|

41,641 |

|

| Total assets |

587,491 |

|

|

532,721 |

|

| |

|

|

|

| |

|

|

|

| Liabilities and

shareholders' equity |

|

|

|

| |

|

|

|

| Current

Liabilities |

|

|

|

| Trade payables |

4,005 |

|

|

4,483 |

|

| Deferred revenues |

81,987 |

|

|

83,955 |

|

| Operating lease

liabilities |

5,183 |

|

|

0 |

|

| Other payables and accrued

expenses |

28,089 |

|

|

29,596 |

|

| |

119,264 |

|

|

118,034 |

|

| |

|

|

|

| Long-term

liabilities |

|

|

|

| Deferred revenues |

54,556 |

|

|

43,796 |

|

| Operating lease

liabilities |

14,520 |

|

|

0 |

|

| Other long-term

liabilities |

12,343 |

|

|

6,934 |

|

| |

81,419 |

|

|

50,730 |

|

| |

|

|

|

| Shareholders'

equity |

|

|

|

| Share capital |

707 |

|

|

693 |

|

| Additional paid-in

capital |

407,897 |

|

|

383,536 |

|

| Accumulated other

comprehensive income (loss), net of tax |

1,026 |

|

|

(1,110 |

) |

| Treasury stock, at cost |

(139,612 |

) |

|

(120,717 |

) |

| Retained earnings |

116,790 |

|

|

101,555 |

|

| Total shareholders'

equity |

386,808 |

|

|

363,957 |

|

| |

|

|

|

| Total liabilities and

shareholders' equity |

587,491 |

|

|

532,721 |

|

| |

|

|

|

|

Radware Ltd. |

|

Condensed Consolidated Statements of Income |

|

(U.S Dollars in thousands, except share and per share

data) |

| |

|

|

|

|

|

|

|

| |

For the three months ended |

|

For the nine months ended |

| |

September 30, |

|

September 30, |

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

Revenues |

62,859 |

|

|

58,764 |

|

184,710 |

|

170,587 |

| Cost of revenues |

11,527 |

|

|

10,278 |

|

33,180 |

|

30,558 |

| Gross profit |

51,332 |

|

|

48,486 |

|

151,530 |

|

140,029 |

| |

|

|

|

|

|

|

|

| Operating expenses, net: |

|

|

|

|

|

|

|

| Research and development,

net |

15,108 |

|

|

14,434 |

|

45,738 |

|

43,729 |

| Selling and marketing |

27,094 |

|

|

27,263 |

|

80,435 |

|

83,249 |

| General and

administrative |

4,403 |

|

|

3,985 |

|

14,209 |

|

11,851 |

| Total operating expenses,

net |

46,605 |

|

|

45,682 |

|

140,382 |

|

138,829 |

| |

|

|

|

|

|

|

|

| Operating income |

4,727 |

|

|

2,804 |

|

11,148 |

|

1,200 |

| Financial income, net |

2,137 |

|

|

1,487 |

|

6,047 |

|

4,877 |

| Income before taxes on

income |

6,864 |

|

|

4,291 |

|

17,195 |

|

6,077 |

| Taxes on income (tax

benefit) |

(257 |

) |

|

1,178 |

|

1,960 |

|

2,285 |

| Net income |

7,121 |

|

|

3,113 |

|

15,235 |

|

3,792 |

| |

|

|

|

|

|

|

|

| Basic net earnings per

share |

0.15 |

|

|

0.07 |

|

0.33 |

|

0.08 |

| |

|

|

|

|

|

|

|

|

Weighted average number of shares used to compute basic net

earnings per share |

46,850,137 |

|

|

45,537,801 |

|

46,788,870 |

|

45,030,328 |

| |

|

|

|

|

|

|

|

| Diluted net earnings per

share |

0.15 |

|

|

0.06 |

|

0.31 |

|

0.08 |

| |

|

|

|

|

|

|

|

|

Weighted average number of shares used to compute diluted net

earnings per share |

48,488,313 |

|

|

48,519,880 |

|

48,595,899 |

|

48,012,407 |

| |

|

|

|

|

|

|

|

|

| Radware

Ltd. |

|

Reconciliation of GAAP to Non-GAAP Financial

Information |

| (U.S Dollars

in thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

For the

three months ended |

|

For the nine

months ended |

|

|

September 30, |

|

September 30, |

|

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| GAAP gross

profit |

51,332 |

|

|

48,486 |

|

151,530 |

|

|

140,029 |

|

Stock-based compensation |

57 |

|

|

54 |

|

171 |

|

|

171 |

|

Amortization of intangible assets |

997 |

|

|

212 |

|

1,818 |

|

|

654 |

| Non-GAAP gross profit |

52,386 |

|

|

48,752 |

|

153,519 |

|

|

140,854 |

| |

|

|

|

|

|

|

|

| GAAP research and development, net |

15,108 |

|

|

14,434 |

|

45,738 |

|

|

43,729 |

|

Stock-based compensation |

640 |

|

|

819 |

|

2,064 |

|

|

2,429 |

| Non-GAAP Research and development, net |

14,468 |

|

|

13,615 |

|

43,674 |

|

|

41,300 |

| |

|

|

|

|

|

|

|

| GAAP selling and marketing |

27,094 |

|

|

27,263 |

|

80,435 |

|

|

83,249 |

|

Stock-based compensation |

1,954 |

|

|

1,666 |

|

5,258 |

|

|

5,344 |

|

Amortization of intangible assets |

17 |

|

|

20 |

|

52 |

|

|

61 |

| Non-GAAP selling and marketing |

25,123 |

|

|

25,577 |

|

75,125 |

|

|

77,844 |

| |

|

|

|

|

|

|

|

| GAAP general and administrative |

4,403 |

|

|

3,985 |

|

14,209 |

|

|

11,851 |

|

Stock-based compensation |

741 |

|

|

527 |

|

2,290 |

|

|

1,312 |

|

Acquisition costs |

- |

|

|

- |

|

264 |

|

|

- |

|

Litigation costs |

24 |

|

|

214 |

|

883 |

|

|

627 |

| Non-GAAP general and administrative |

3,638 |

|

|

3,244 |

|

10,772 |

|

|

9,912 |

| |

|

|

|

|

|

|

|

| GAAP total operating expenses, net |

46,605 |

|

|

45,682 |

|

140,382 |

|

|

138,829 |

|

Stock-based compensation |

3,335 |

|

|

3,012 |

|

9,612 |

|

|

9,085 |

|

Acquisition costs |

- |

|

|

- |

|

264 |

|

|

- |

|

Amortization of intangible assets |

17 |

|

|

20 |

|

52 |

|

|

61 |

|

Litigation costs |

24 |

|

|

214 |

|

883 |

|

|

627 |

| Non-GAAP total operating expenses, net |

43,229 |

|

|

42,436 |

|

129,571 |

|

|

129,056 |

| |

|

|

|

|

|

|

|

| GAAP operating income |

4,727 |

|

|

2,804 |

|

11,148 |

|

|

1,200 |

|

Stock-based compensation |

3,392 |

|

|

3,066 |

|

9,783 |

|

|

9,256 |

|

Acquisition costs |

- |

|

|

- |

|

264 |

|

|

- |

|

Amortization of intangible assets |

1,014 |

|

|

232 |

|

1,870 |

|

|

715 |

|

Litigation costs |

24 |

|

|

214 |

|

883 |

|

|

627 |

| Non-GAAP operating income |

9,157 |

|

|

6,316 |

|

23,948 |

|

|

11,798 |

| |

|

|

|

|

|

|

|

| GAAP financial income, net |

2,137 |

|

|

1,487 |

|

6,047 |

|

|

4,877 |

|

Other gain adjustment |

(253 |

) |

|

- |

|

(563 |

) |

|

- |

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

878 |

|

|

432 |

|

2,418 |

|

|

255 |

| Non-GAAP financial income, net |

2,762 |

|

|

1,919 |

|

7,902 |

|

|

5,132 |

| |

|

|

|

|

|

|

|

| GAAP income before taxes on income (tax benefit) |

6,864 |

|

|

4,291 |

|

17,195 |

|

|

6,077 |

|

Stock-based compensation |

3,392 |

|

|

3,066 |

|

9,783 |

|

|

9,256 |

|

Acquisition costs |

- |

|

|

- |

|

264 |

|

|

- |

|

Amortization of intangible assets |

1,014 |

|

|

232 |

|

1,870 |

|

|

715 |

|

Litigation costs |

24 |

|

|

214 |

|

883 |

|

|

627 |

|

Other gain adjustment |

(253 |

) |

|

- |

|

(563 |

) |

|

- |

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

878 |

|

|

432 |

|

2,418 |

|

|

255 |

| Non-GAAP income before taxes on income |

11,919 |

|

|

8,235 |

|

31,850 |

|

|

16,930 |

| |

|

|

|

|

|

|

|

| GAAP taxes on income (tax benefit) |

(257 |

) |

|

1,178 |

|

1,960 |

|

|

2,285 |

|

Amortization of deferred tax liability related to intangible

assets |

247 |

|

|

- |

|

247 |

|

|

- |

|

Tax related to other gain adjustment |

19 |

|

|

- |

|

(52 |

) |

|

- |

| Non-GAAP taxes on income |

9 |

|

|

1,178 |

|

2,155 |

|

|

2,285 |

| |

|

|

|

|

|

|

|

| GAAP net income |

7,121 |

|

|

3,113 |

|

15,235 |

|

|

3,792 |

|

Stock-based compensation |

3,392 |

|

|

3,066 |

|

9,783 |

|

|

9,256 |

|

Acquisition costs |

- |

|

|

- |

|

264 |

|

|

- |

|

Amortization of intangible assets |

1,014 |

|

|

232 |

|

1,870 |

|

|

715 |

|

Litigation costs |

24 |

|

|

214 |

|

883 |

|

|

627 |

|

Other gain adjustment |

(253 |

) |

|

- |

|

(563 |

) |

|

- |

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

878 |

|

|

432 |

|

2,418 |

|

|

255 |

|

Amortization of deferred tax liability related to intangible

assets |

(247 |

) |

|

- |

|

(247 |

) |

|

- |

|

Tax related to other gain adjustment |

(19 |

) |

|

- |

|

52 |

|

|

- |

| Non-GAAP net income |

11,910 |

|

|

7,057 |

|

29,695 |

|

|

14,645 |

| |

|

|

|

|

|

|

|

| GAAP diluted net earnings per share |

0.15 |

|

|

0.06 |

|

0.31 |

|

|

0.08 |

|

Stock-based compensation |

0.07 |

|

|

0.06 |

|

0.20 |

|

|

0.19 |

|

Acquisition costs |

0.00 |

|

|

0.00 |

|

0.01 |

|

|

0.00 |

|

Amortization of intangible assets |

0.02 |

|

|

0.01 |

|

0.04 |

|

|

0.02 |

|

Litigation costs |

0.00 |

|

|

0.01 |

|

0.02 |

|

|

0.01 |

|

Other gain adjustment |

(0.01 |

) |

|

0.00 |

|

(0.01 |

) |

|

0.00 |

|

Exchange rate differences, net on balance sheet items included in

financial income, net |

0.02 |

|

|

0.01 |

|

0.05 |

|

|

0.01 |

|

Amortization of deferred tax liability related to intangible

assets |

(0.01 |

) |

|

0.00 |

|

(0.01 |

) |

|

0.00 |

|

Tax related to other gain adjustment |

(0.00 |

) |

|

0.00 |

|

0.00 |

|

|

0.00 |

| Non-GAAP diluted net earnings per share |

0.25 |

|

|

0.15 |

|

0.61 |

|

|

0.31 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted average number of shares used to compute Non-GAAP

diluted net earnings per share |

48,488,313 |

|

|

48,519,880 |

|

48,595,899 |

|

|

48,012,407 |

| |

|

|

|

|

|

|

|

|

|

| Radware

Ltd. |

| Condensed

Consolidated Statements of Cash Flow |

| (U.S.

Dollars in thousands) |

| |

|

|

|

|

|

|

|

| |

For the

three months ended |

|

For the nine

months ended |

| |

September 30, |

|

September 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Cash flow from operating activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net

income |

7,121 |

|

|

3,113 |

|

|

15,235 |

|

|

3,792 |

|

| Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

| Depreciation and amortization |

3,106 |

|

|

2,433 |

|

|

8,494 |

|

|

7,380 |

|

| Stock based compensation |

3,392 |

|

|

3,066 |

|

|

9,783 |

|

|

9,256 |

|

| Amortization of premium, accretion of discounts and accrued

interest on available-for-sale marketable securities, net |

141 |

|

|

192 |

|

|

468 |

|

|

882 |

|

| Other gain |

(253 |

) |

|

0 |

|

|

(563 |

) |

|

0 |

|

| Accrued interest on bank deposits |

(804 |

) |

|

(1,217 |

) |

|

1,527 |

|

|

(1,429 |

) |

| Increase (decrease) in accrued severance pay, net |

(109 |

) |

|

(8 |

) |

|

824 |

|

|

134 |

|

| Decrease (increase) in trade receivables, net |

2,621 |

|

|

107 |

|

|

5,150 |

|

|

(2,494 |

) |

| Decrease (increase) in other receivables and prepaid expenses

and other long-term assets |

(1,163 |

) |

|

(206 |

) |

|

(4,849 |

) |

|

4,493 |

|

| Decrease (increase) in inventories |

881 |

|

|

(2,020 |

) |

|

3,318 |

|

|

(1,691 |

) |

| Decrease (increase) in trade payables |

203 |

|

|

680 |

|

|

(535 |

) |

|

57 |

|

| Increase (decrease) in deferred revenues |

4,893 |

|

|

(2,774 |

) |

|

8,676 |

|

|

4,392 |

|

| Increase (decrease) in other payables and accrued expenses |

39 |

|

|

5,465 |

|

|

511 |

|

|

(1,217 |

) |

| Operating lease liabilities, net |

194 |

|

|

0 |

|

|

854 |

|

|

0 |

|

| Net cash provided by operating activities |

20,262 |

|

|

8,831 |

|

|

48,893 |

|

|

23,555 |

|

| |

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Purchase of property and equipment |

(1,810 |

) |

|

(1,595 |

) |

|

(6,153 |

) |

|

(4,870 |

) |

| Proceeds from other long-term assets, net |

73 |

|

|

0 |

|

|

11 |

|

|

38 |

|

| Proceeds from (investment in) bank deposits, net |

(5,674 |

) |

|

(15,000 |

) |

|

13,773 |

|

|

(41,067 |

) |

| Investment in sale, redemption of and purchase of

available-for-sale marketable securities, net |

(1,997 |

) |

|

(1,035 |

) |

|

(45,232 |

) |

|

(2,907 |

) |

| Payment for acquisition of subsidiary, net of cash

acquired |

0 |

|

|

0 |

|

|

(12,239 |

) |

|

0 |

|

| Net cash used in investing activities |

(9,408 |

) |

|

(17,630 |

) |

|

(49,840 |

) |

|

(48,806 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Proceeds from exercise of stock options |

3,751 |

|

|

6,688 |

|

|

14,593 |

|

|

19,579 |

|

| Repurchase of shares |

(8,841 |

) |

|

0 |

|

|

(18,894 |

) |

|

0 |

|

| Net cash provided by (used in) financing activities |

(5,090 |

) |

|

6,688 |

|

|

(4,301 |

) |

|

19,579 |

|

| |

|

|

|

|

|

|

|

| Increase (decrease) in cash and cash equivalents |

5,764 |

|

|

(2,111 |

) |

|

(5,248 |

) |

|

(5,672 |

) |

| Cash and cash equivalents at the beginning of the period |

34,191 |

|

|

61,676 |

|

|

45,203 |

|

|

65,237 |

|

| Cash and cash equivalents at the end of the period |

39,955 |

|

|

59,565 |

|

|

39,955 |

|

|

59,565 |

|

| |

|

|

|

|

|

|

|

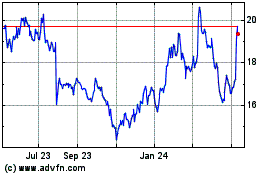

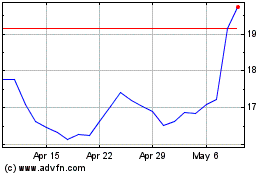

RADWARE (NASDAQ:RDWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

RADWARE (NASDAQ:RDWR)

Historical Stock Chart

From Apr 2023 to Apr 2024