false000135787400013578742024-01-072024-01-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 7, 2024 |

Precision BioSciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38841 |

20-4206017 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

302 East Pettigrew St. Suite A-100 |

|

Durham, North Carolina |

|

27701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 919 314-5512 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.000005 per share |

|

DTIL |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 7, 2024 (the “Effective Date”), Precision BioSciences, Inc. (the “Company”) entered into a License Agreement (the “License Agreement”) with TG Cell Therapy, Inc. (“TG Subsidiary”) and its parent company TG Therapeutics, Inc. (“TG Parent” and, together with TG Subsidiary, “TG Therapeutics”), pursuant to which the Company granted TG Subsidiary certain exclusive and non-exclusive license rights to develop, manufacture, and commercialize non-oncological applications of the Company’s allogeneic CAR T therapy azer-cel (collectively, the “Licensed Product”) pursuant to the terms of the License Agreement.

Under the License Agreement, the Company is entitled to receive an upfront cash payment of $10.0 million (the “Upfront Payment”), an additional cash payment of $7.5 million in the event that TG Therapeutics achieves a certain clinical milestone that is expected to be achieved in the near-term (the “Initial Milestone Payment”), and additional payments upon the achievement of additional specified milestones of up to $288.6 million (the “Additional Milestone Payments”). As described below, up to $10.0 million of the cash payments potentially payable to the Company are payable in exchange for the issuance (the “Company Stock Issuances”) to TG Subsidiary by the Company of shares of the Company’s common stock, par value $0.000005 per share (the “Shares”).

The Upfront Payment of $10.0 million is comprised of (i) a $5.25 million cash payment due within 30 days following the Effective Date, (ii) a $2.25 million cash payment due within 30 days following the Effective Date, payable in exchange for 2,920,816 Shares, based on a price per share equal to 200% of the volume-weighted-average-price (“VWAP”) of the Company’s common stock for the 30 trading days prior to the Effective Date, and (iii) a deferred cash payment of $2.5 million due within 12 months following the Effective Date, payable in exchange for such number of Shares determined based on a price per share equal to the greater of (A) 200% of the VWAP of the Company’s common stock for the 30 trading days prior to the date of payment or (B) the Minimum Price (as defined below).

The Initial Milestone Payment of $7.5 million, if payable, will consist of (i) a $5.25 million cash milestone payment and (ii) a $2.25 million cash payment payable in exchange for such number of Shares determined based on a price per share equal to the greater of (A) 200% of the VWAP of the Company’s common stock for the 30 trading days prior to the achievement of such milestone or (B) the Minimum Price.

The Additional Milestone Payments become due upon the achievement of certain milestones as specified in the License Agreement. Included within the Additional Milestone Payments is a potential payment of $3.0 million in connection with achievement of a milestone specified in the License Agreement, payable in exchange for such number of Shares determined based on a price per share equal to the greater of (A) 200% of the VWAP of the Company’s common stock for the 30 trading days prior to the achievement of such milestone or (B) the Minimum Price.

In no event will the price for any Share be less than the minimum price of $0.3722 (the “Minimum Price”), which was calculated in accordance with Nasdaq Listing Rule 5635(d). Pursuant to the License Agreement, subject to certain exceptions, TG Therapeutics may not sell the Shares without the Company’s approval for a period of three years following the Effective Date with respect to the Upfront Stock Issuance and two years following each of the other Company Stock Issuances. For a period of three years following the Effective Date, subject to certain exceptions set forth in the License Agreement, (i) TG Therapeutics has agreed to vote the Shares as instructed by the Company and has granted the Company an irrevocable proxy with respect to the foregoing, and (ii) TG Therapeutics and its affiliates may not (A) effect or otherwise participate in, directly or indirectly, any acquisition of any securities or material assets of the Company, any tender offer or exchange offer, merger or other business combination or change of control involving the Company, any recapitalization, restructuring, liquidation, dissolution or other extraordinary transaction with respect to the Company, or any solicitation of proxies or consents to vote any securities of the Company, or (B) act with any other person, or publicly disclose any intention, to do any of the foregoing.

Subject to the terms and conditions of the License Agreement, TG Therapeutics is permitted to pay up to 50% of the value of each Additional Milestone Payment (other than the Additional Milestone Payment described above that would, upon achievement, involve the issuance of $3.0 million of Shares by Precision) in freely tradable shares of common stock of TG Parent, valued based on the VWAP of the TG Parent shares of common stock on Nasdaq for the 30 trading days prior to the achievement of the applicable milestone. Precision will not be subject to any lockup provisions or other restrictions on resale with respect to any shares potentially issued by TG Parent under the License Agreement.

If the Licensed Product is approved and sold, TG Therapeutics is also required to pay the Company tiered royalties ranging from mid-single digit to low-double digit percentages on net sales of the Licensed Product. TG Therapeutics’ obligation to pay royalties to the Company expires on a country-by-country and Licensed Product-by-Licensed Product basis, upon the latest to occur of (i) the expiration of the last-to-expire valid claim in such country covering such Licensed Product; (ii) the expiration of any period of data, regulatory, or market exclusivity, or supplemental protection certificates (other than patents) covering the Licensed Product in such country; and (iii) a period of ten years following the first commercial sale of the respective Licensed Product in such country.

Unless earlier terminated, the License Agreement will remain in effect on a Licensed Product-by-Licensed Product and country-by-country basis until the expiration of a defined royalty term for each Licensed Product and country. The Company may terminate the

License Agreement if TG Therapeutics fails to initiate certain development activities with respect to the Licensed Product by a specified date or ceases active development of the Licensed Product for a specified period of time. In addition, the Company may terminate the License Agreement if TG Therapeutics or any of its affiliates or sublicensees challenges the validity of any patents controlled by the Company. Each of the Company and TG Therapeutics may terminate the License Agreement (i) for material breach by the other party and a failure to cure such breach within the time period specified in the License Agreement or (ii) the other party’s insolvency.

The above description of the License Agreement does not purport to be complete and is qualified in its entirety by reference to the License Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Item 2.02 Results of Operations and Financial Condition.

Although it has not finalized its full financial results for the year ended December 31, 2023, and as disclosed in the press release the Company issued on January 9, 2024, the full text of which is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 2.02, the Company expects to report that it had approximately $116 million in cash and cash equivalents as of December 31, 2023. This estimate is unaudited and preliminary and does not present all information necessary for an understanding of the Company’s financial condition as of December 31, 2023, and its results of operations for the year ended December 31, 2023. The audit of the Company’s financial statements for the year ended December 31, 2023 by the Company’s independent registered public accounting firm is ongoing and could result in changes to the information set forth above.

The Company expects that existing cash and cash equivalents, expected operational receipts, including upfront and potential near-term consideration to be received from TG Therapeutics, operational efficiencies gained from divestment of the CAR T business, availability of the Company’s at-the-market (“ATM”) facility, and available credit will be sufficient to fund its operating expenses and capital expenditure requirements into the first half of 2026. The Company expects its cash runway to be sufficient to achieve first-in-human Phase 1 clinical data for its lead in vivo gene editing programs.

The information under this Item 2.02 (including Exhibit 99.1) of this Current Report on Form 8-K is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Registration statements or other documents filed with the Securities and Exchange Commission (the “SEC”) shall not incorporate this information by reference, except as otherwise expressly stated in such filing.

Item 3.02. Unregistered Sales of Equity Securities.

The description of the License Agreement and the Company Stock Issuances thereunder set forth in Item 1.01 above is incorporated by reference into this Item 3.02. The Company Stock Issuances are being made in a private placement that is exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure.

On January 9, 2024, the Company issued a press release announcing the transactions described in Items 1.01 and 3.02 above. A copy of the press release, which is attached to this Current Report on Form 8-K as Exhibit 99.1, is furnished pursuant to this Item 7.01.

The information under this Item 7.01 (including Exhibit 99.1 hereto) of this Current Report on Form 8-K is not deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section. Registration statements or other documents filed with the SEC shall not incorporate this information by reference, except as otherwise expressly stated in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, the parties’ expected actions under the License Agreement; statements regarding the clinical development and expected safety, efficacy and benefit of our product candidates (including azer-cel) and gene editing approaches including editing efficiency and differentiating aspects; the suitability of azer-cel for oncology indications and non-oncology indications including immunological diseases; the suitability of ARCUS nucleases for gene insertion, large gene deletion, and other gene editing approaches; the expected timing of regulatory processes; expectations about our operational initiatives and business strategy; expectations around partnership opportunities; our expected cash runway; expectations about achievement of key milestones and receipt of any milestone, royalty, or other payments; expectations regarding our liquidity and capital resources; and anticipated timing of initial clinical data. In some cases, you can identify forward-looking statements by terms such as “aim,” “anticipate,” “approach,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “goal,” “intend,” “look,” “may,” “mission,” “plan,”

“possible,” “potential,” “predict,” “project,” “pursue,” “should,” “target,” “will,” “would,” or the negative thereof and similar words and expressions.

Forward-looking statements are based on management’s current expectations, beliefs and assumptions and on information currently available to us. These statements are neither promises nor guarantees, and involve a number of known and unknown risks, uncertainties and assumptions, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various important factors, including, but not limited to, our ability to become profitable; our ability to procure sufficient funding to advance our programs; risks associated with our capital requirements, anticipated cash runway, requirements under our current debt instruments and effects of restrictions thereunder, including our ability to raise additional capital due to market conditions and/or our market capitalization; our operating expenses and our ability to predict what those expenses will be; our limited operating history; the progression and success of our programs and product candidates in which we expend our resources; our limited ability or inability to assess the safety and efficacy of our product candidates; the risk that other genome-editing technologies may provide significant advantages over our ARCUS technology; our dependence on our ARCUS technology; the initiation, cost, timing, progress, achievement of milestones and results of research and development activities and preclinical and clinical studies, including clinical trial and investigational new drug applications; public perception about genome editing technology and its applications; competition in the genome editing, biopharmaceutical, and biotechnology fields; our or our collaborators’ or other licensees’ ability to identify, develop and commercialize product candidates; pending and potential product liability lawsuits and penalties against us or our collaborators or other licensees related to our technology and our product candidates; the U.S. and foreign regulatory landscape applicable to our and our collaborators’ or other licensees’ development of product candidates; our or our collaborators’ or other licensees’ ability to advance product candidates into, and successfully design, implement and complete, clinical or field trials; potential manufacturing problems associated with the development or commercialization of any of our product candidates; our ability to obtain an adequate supply of T cells from qualified donors; delays or difficulties in our and our collaborators’ and other licensees’ ability to enroll patients; changes in interim “top-line” and initial data that we announce or publish; if our product candidates do not work as intended or cause undesirable side effects; risks associated with applicable healthcare, data protection, privacy and security regulations and our compliance therewith; our or our licensees’ ability to obtain orphan drug designation or fast track designation for our product candidates or to realize the expected benefits of these designations; our or our collaborators’ or other licensees’ ability to obtain and maintain regulatory approval of our product candidates, and any related restrictions, limitations and/or warnings in the label of an approved product candidate; the rate and degree of market acceptance of any of our product candidates; our ability to effectively manage the growth of our operations; our ability to attract, retain, and motivate executives and personnel; effects of system failures and security breaches; insurance expenses and exposure to uninsured liabilities; effects of tax rules; effects of the COVID-19 pandemic and variants thereof, or any pandemic, epidemic, or outbreak of an infectious disease; the success of our existing collaboration agreements, and our ability to enter into new collaboration arrangements; our current and future relationships with and reliance on third parties including suppliers and manufacturers; our ability to obtain and maintain intellectual property protection for our technology and any of our product candidates; potential litigation relating to infringement or misappropriation of intellectual property rights; effects of natural and manmade disasters, public health emergencies and other natural catastrophic events; effects of sustained inflation, supply chain disruptions and major central bank policy actions; market and economic conditions; risks related to ownership of our common stock, including fluctuations in our stock price; our ability to meet the requirements of and maintain listing of our common stock on Nasdaq or other public stock exchanges; and other important factors discussed under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, as any such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website under SEC Filings at investor.precisionbiosciences.com.

All forward-looking statements speak only as of the date of this Current Report on Form 8-K and, except as required by applicable law, we have no obligation to update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Precision BioSciences, Inc. |

|

|

|

|

Date: |

January 11, 2024 |

By: |

/s/ John Alexander Kelly |

|

|

|

John Alexander Kelly

Chief Financial Officer |

Exhibit 99.1

Precision BioSciences Completes License Deal with TG Therapeutics for Cell Therapy Azer-Cel in Treatment of Autoimmune Diseases

-Precision to Receive $17.5 Million in Upfront and Near-Term Payments with Potential for up to $288 Million in Other Development Milestone Payments

-Upfront Cash and Near-Term Payments Expected to Extend Precision’s Cash Runway into the First Half of 2026 and Fund Precision’s Wholly-Owned In Vivo Gene Editing Programs Through PBGENE-HBV and PBGENE-PMM Phase I Clinical Data

DURHAM, N.C., January 9, 2024 -- Precision BioSciences, Inc. (Nasdaq: DTIL), an advanced gene editing company utilizing its novel proprietary ARCUS® platform to develop in vivo gene editing therapies for sophisticated gene edits, including gene elimination, insertion, and excision, today announced completion of a strategic transaction with TG Therapeutics, Inc. (Nasdaq: TGTX) for an exclusive license to develop Azercabtagene Zapreleucel (azer-cel) for autoimmune diseases, and other indications outside of cancer.

“We are excited to extend the utility of our allogeneic CAR T assets into immunology by collaborating with TG Therapeutics as they advance novel treatments for B-cell diseases. Key factors in our decision to partner with the TG team include their recent development, regulatory and commercial successes in the multiple sclerosis space, which we believe are strong indicators of the commitment and expertise they will bring to the development of azer-cel in autoimmune diseases,” said Michael Amoroso, President and Chief Executive Officer at Precision BioSciences. “As TG Therapeutics assumes development of azer-cel for immunology, Precision will remain focused on capitalizing on the utility of ARCUS for gene elimination and gene insertion, beginning with our wholly owned PBGENE-HBV program for chronic hepatitis B and PBGENE-PMM for primary mitochondrial myopathy.”

“After an extensive review of the CAR T products available for development in immunology, we are excited to bring azer-cel into our portfolio as we look to expand our offerings for patients suffering from autoimmune diseases,” said Michael S. Weiss, Chairman and Chief Executive Officer of TG Therapeutics. “We are pleased to partner with Precision BioSciences for azer-cel, and the equity investment we are making is indicative of our optimism in the near- and long-term opportunities for ARCUS for in vivo gene editing.”

In exchange for global rights to azer-cel for autoimmune diseases and indications outside of cancer, Precision will receive upfront and potential near-term economics valued at $17.5 million. The upfront payment of $7.5 million will consist of cash and the purchase of 2,920,816 shares of Precision common stock by TG Therapeutics at a price of $0.77 per share, a 100% premium to the 30-day volume-weighted average price (VWAP) prior to purchase. Precision will also receive $2.5 million within 12 months, as an equity investment in Precision’s common stock at 100% premium to the then 30-day VWAP prior to purchase. Upon the achievement of certain near-term clinical milestones, Precision will receive an additional $7.5 million payment in cash and the purchase of Precision common stock by TG Therapeutics at a 100% premium to the then current 30-day VWAP. Precision is eligible to receive up to $288 million in additional milestone payments based on the achievement of certain clinical, regulatory, and commercial milestones, in addition to high-single-digit to low-double-digit royalties on net sales.

“With this deal and the Imugene oncology collaboration for azer-cel announced in August 2023, Precision has now completed two cell therapy collaborations to realize value from our allogeneic CAR T platform while enabling development of azer-cel for patients in diseases with high unmet need. These transactions

are expected to extend our runway and will fund continued development of our wholly owned in vivo gene editing programs. As a result of these two accretive partnerships, Precision has received or is eligible to receive $47 million in upfront and potential near-term payments and has the potential to receive more than $900 million in development, regulatory and commercial milestone payments,” added Mr. Amoroso.

Although it has not finalized its full financial results for the year ended December 31, 2023, Precision expects to report that it had approximately $116 million in cash and cash equivalents as of December 31, 2023. Upfront and potential near-term cash from azer-cel transactions, along with existing cash and cash equivalents, expected operational receipts, continued fiscal and operating discipline, availability of Precision’s at-the-market (ATM) facility, and available credit are expected to extend Precision’s cash runway into the first half of 2026 and through clinical phase 1 readouts for its wholly owned HBV and PMM programs.

Precision will continue to evaluate potential partners for other assets from its allogeneic CAR T platform that are no longer being developed internally, including PBCAR19B stealth cell and BCMA targeting CAR T assets for multiple myeloma.

About Precision BioSciences, Inc.

Precision BioSciences, Inc. is an advanced gene editing company dedicated to improving life (DTIL) with its novel and proprietary ARCUS® genome editing platform that differs from other technologies in the way it cuts, its smaller size, and its simpler structure. Key capabilities and differentiating characteristics may enable ARCUS nucleases to drive more intended, defined therapeutic outcomes. Using ARCUS, the Company’s pipeline is comprised of in vivo gene editing candidates designed to deliver lasting cures for the broadest range of genetic and infectious diseases where no adequate treatments exist. For more information about Precision BioSciences, please visit www.precisionbiosciences.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the clinical development and expected safety, efficacy and benefit of our product candidates (including azer-cel) and gene editing approaches including editing efficiency and differentiating aspects; the suitability of azer-cel for oncology indications and non-oncology indications including immunological diseases; the suitability of ARCUS nucleases for gene insertion, large gene deletion, and other gene editing approaches; the expected timing of regulatory processes; expectations about our operational initiatives and business strategy; expectations around partnership opportunities; our expected cash runway; expectations about achievement of key milestones and receipt of any milestone, royalty, or other payments; expectations regarding our liquidity and capital resources; and anticipated timing of initial clinical data. In some cases, you can identify forward-looking statements by terms such as “aim,” “anticipate,” “approach,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “goal,” “intend,” “look,” “may,” “mission,” “plan,” “possible,” “potential,” “predict,” “project,” “pursue,” “should,” “target,” “will,” “would,” or the negative thereof and similar words and expressions.

Forward-looking statements are based on management’s current expectations, beliefs and assumptions and on information currently available to us. These statements are neither promises nor guarantees, and involve a number of known and unknown risks, uncertainties and assumptions, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various

important factors, including, but not limited to, our ability to become profitable; our ability to procure sufficient funding to advance our programs; risks associated with our capital requirements, anticipated cash runway, requirements under our current debt instruments and effects of restrictions thereunder, including our ability to raise additional capital due to market conditions and/or our market capitalization; our operating expenses and our ability to predict what those expenses will be; our limited operating history; the progression and success of our programs and product candidates in which we expend our resources; our limited ability or inability to assess the safety and efficacy of our product candidates; the risk that other genome-editing technologies may provide significant advantages over our ARCUS technology; our dependence on our ARCUS technology; the initiation, cost, timing, progress, achievement of milestones and results of research and development activities and preclinical and clinical studies, including clinical trial and investigational new drug applications; public perception about genome editing technology and its applications; competition in the genome editing, biopharmaceutical, and biotechnology fields; our or our collaborators’ or other licensees’ ability to identify, develop and commercialize product candidates; pending and potential product liability lawsuits and penalties against us or our collaborators or other licensees related to our technology and our product candidates; the U.S. and foreign regulatory landscape applicable to our and our collaborators’ or other licensees’ development of product candidates; our or our collaborators’ or other licensees’ ability to advance product candidates into, and successfully design, implement and complete, clinical or field trials; potential manufacturing problems associated with the development or commercialization of any of our product candidates; our ability to obtain an adequate supply of T cells from qualified donors; delays or difficulties in our and our collaborators’ and other licensees’ ability to enroll patients; changes in interim “top-line” and initial data that we announce or publish; if our product candidates do not work as intended or cause undesirable side effects; risks associated with applicable healthcare, data protection, privacy and security regulations and our compliance therewith; our or our licensees’ ability to obtain orphan drug designation or fast track designation for our product candidates or to realize the expected benefits of these designations; our or our collaborators’ or other licensees’ ability to obtain and maintain regulatory approval of our product candidates, and any related restrictions, limitations and/or warnings in the label of an approved product candidate; the rate and degree of market acceptance of any of our product candidates; our ability to effectively manage the growth of our operations; our ability to attract, retain, and motivate executives and personnel; effects of system failures and security breaches; insurance expenses and exposure to uninsured liabilities; effects of tax rules; effects of the COVID-19 pandemic and variants thereof, or any pandemic, epidemic, or outbreak of an infectious disease; the success of our existing collaboration agreements, and our ability to enter into new collaboration arrangements; our current and future relationships with and reliance on third parties including suppliers and manufacturers; our ability to obtain and maintain intellectual property protection for our technology and any of our product candidates; potential litigation relating to infringement or misappropriation of intellectual property rights; effects of natural and manmade disasters, public health emergencies and other natural catastrophic events; effects of sustained inflation, supply chain disruptions and major central bank policy actions; market and economic conditions; risks related to ownership of our common stock, including fluctuations in our stock price; our ability to meet the requirements of and maintain listing of our common stock on Nasdaq or other public stock exchanges; and other important factors discussed under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, as any such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website under SEC Filings at investor.precisionbiosciences.com.

All forward-looking statements speak only as of the date of this press release and, except as required by applicable law, we have no obligation to update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Investor and Media Contact:

Mei Burris

Senior Director of Finance and Controller

Mei.Burris@precisionbiosciences.com

v3.23.4

Document And Entity Information

|

Jan. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 07, 2024

|

| Entity Registrant Name |

Precision BioSciences, Inc.

|

| Entity Central Index Key |

0001357874

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-38841

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

20-4206017

|

| Entity Address, Address Line One |

302 East Pettigrew St.

|

| Entity Address, Address Line Two |

Suite A-100

|

| Entity Address, City or Town |

Durham

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27701

|

| City Area Code |

919

|

| Local Phone Number |

314-5512

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.000005 per share

|

| Trading Symbol |

DTIL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

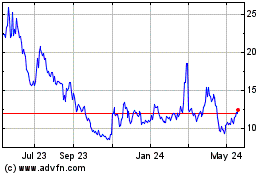

Precision BioSciences (NASDAQ:DTIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

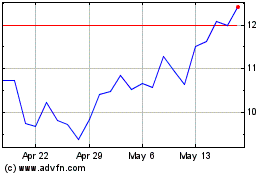

Precision BioSciences (NASDAQ:DTIL)

Historical Stock Chart

From Apr 2023 to Apr 2024