PayPal to Buy Honey Science for $4 Billion -- Update

November 20 2019 - 7:53PM

Dow Jones News

By Maria Armental

PayPal Holdings Inc. has reached a roughly $4 billion deal to

buy shopping and rewards platform Honey Science Corp., as it pushes

to offer a broader array of services.

PayPal executives, in a conference call with analysts, said the

proposed deal -- PayPal's largest to date -- would serve as "a

springboard for PayPal's broader commerce initiatives."

PayPal was spun off in 2015 from eBay Inc., which remains one of

its biggest sources of payments volume but is due to switch payment

processing to Adyen NV next year.

Honey, which is profitable and generated more than $100 million

in revenue in 2018, helps people find discount codes online,

working with the likes of AliExpress, the retail arm of Alibaba

Group Holding Ltd.; Walmart Inc.; Adidas AG; and LVMH Moët Hennessy

Louis Vuitton SE's Sephora.

It also helps merchants target consumers by developing

personalized offers.

PayPal executives say that Honey, which will be embedded into

its apps, would help drive deeper engagement with its 300 million

customers while helping merchants target new customer segments.

Honey's roughly 17 million active monthly users, they said, skew

young and overlap to some extent with PayPal's digital

money-transfer service, Venmo.

The deal is expected to close in the first quarter and add to

earnings, on an adjusted basis, starting in 2021.

Josh Beckerman contributed to this article.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

November 20, 2019 19:38 ET (00:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

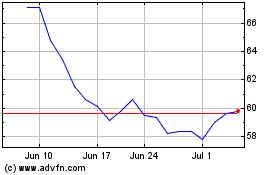

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024