Current Report Filing (8-k)

October 25 2021 - 5:04PM

Edgar (US Regulatory)

false

0000878927

0000878927

2021-10-20

2021-10-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 20, 2021

OLD DOMINION FREIGHT LINE, INC.

(Exact name of Registrant as Specified in Its Charter)

|

Virginia

|

0-19582

|

56-0751714

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

500 Old Dominion Way

Thomasville, NC 27360

|

|

|

|

(Address of Principal Executive Offices)

(Zip Code)

|

|

Registrant’s Telephone Number, Including Area Code: (336) 889-5000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock ($0.10 par value)

|

ODFL

|

The Nasdaq Stock Market LLC (Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 20, 2021, the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of Old Dominion Freight Line, Inc. (the “Company”) reviewed the compensation of the Company’s named executive officers and approved certain material changes, effective January 1, 2022, to the compensation arrangements for each of: (i) Greg C. Gantt, President and Chief Executive Officer of the Company and a member of the Board; (ii) Earl E. Congdon, Chairman Emeritus and Senior Advisor to the Company; and (iii) David S. Congdon, the Company’s Executive Chairman of the Board, as described below. For Messrs. Earl Congdon and David Congdon, the changes are further modifications to the previously disclosed multi-year approach of reduced pay levels across all pay components as part of the Company’s long-term succession planning.

With respect to Mr. Gantt, the Committee approved an increase in his base salary to $920,000, to better align his base salary with competitive market levels for chief executive officers in the Company’s peer group.

With respect to Mr. Earl Congdon, the Committee approved the following changes:

(i)His base salary will be reduced by 33% from its 2021 level;

(ii)His participation factor in the Company’s Performance Incentive Plan (the “PIP Factor”) used to determine his short-term cash incentive compensation (the “Short-Term Incentive Compensation”) will be reduced by 52% from its 2021 level; and

(iii)He will no longer receive stock-based compensation under the Company’s 2016 Stock Incentive Plan.

With respect to Mr. David Congdon, the Committee approved the following changes:

(i)His base salary will be reduced by 24% from its 2021 level;

(ii)His PIP Factor used to determine his Short-Term Incentive Compensation will be reduced by 46% from its 2021 level; and

(iii)He will no longer receive stock-based compensation under the Company’s 2016 Stock Incentive Plan.

The amount of Short-Term Incentive Compensation that may be earned by either Mr. Earl Congdon or Mr. David Congdon remains variable, which means that the amount earned in 2022 may differ materially from the amount earned in prior years depending on the performance of the Company.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

OLD DOMINION FREIGHT LINE, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Kimberly S. Maready

|

|

|

|

|

Kimberly S. Maready

|

|

|

|

|

Vice President – Accounting & Finance

|

|

|

|

|

(Principal Accounting Officer)

|

Date: October 25, 2021

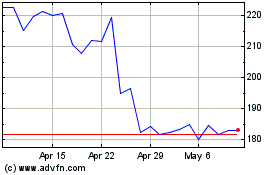

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Jul 2024 to Aug 2024

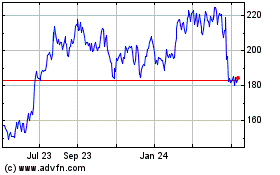

Old Dominion Freight Line (NASDAQ:ODFL)

Historical Stock Chart

From Aug 2023 to Aug 2024