- Amended Statement of Beneficial Ownership (SC 13D/A)

December 29 2010 - 6:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO.5)*

NOVA MEASURING INSTRUMENTS LTD.

--------------------------------------------------------------------------------

(Name of Issuer)

ORDINARY SHARES, PAR VALUE NIS 0.01 PER SHARE

--------------------------------------------------------------------------------

(Title of Class of Securities)

M7516K103

--------------------------------------------------------------------------------

(CUSIP Number)

NUFAR MALOVANI, ADV.

CORPORATE SECRETARY

CLAL INDUSTRIES AND INVESTMENTS LTD.

3 AZRIELI CENTER, THE TRIANGULAR TOWER,

45TH FLOOR,

TEL-AVIV 67023,

ISRAEL

TEL: +972-3-607-5794

--------------------------------------------------------------------------------

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications)

DECEMBER 10, 2010

--------------------------------------------------------------------------------

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report

the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of ss.ss.240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box [_].

NOTE: Schedules filed in paper format shall include a signed original and five

copies of the schedule, including all exhibits. See Rule 13d-7 for other parties

to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter

disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed

to be "filed" for the purpose of section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the

Notes).

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

Clal Electronics Industries Ltd.

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[_]

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

CO

--------------------------------------------------------------------------------

Page 2 of 14 pages

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

Clal Industries and Investments Ltd.

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[_]

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

CO

--------------------------------------------------------------------------------

Page 3 of 14 pages

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

IDB Development Corporation Ltd.

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares*

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares*

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares*

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[X]*

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

CO

--------------------------------------------------------------------------------

* Does not include (i) 303,162 Ordinary Shares (the "CIEH Shares") held for

members of the public through, among others, provident funds and/or mutual funds

and/or pension funds and/or exchange traded funds and/or insurance policies,

which are managed by subsidiaries of Clal Insurance Enterprises Holdings Ltd., a

subsidiary of IDB Development Corporation Ltd. and (ii) 75,679 Ordinary Shares

(the "Epsilon Shares") held for members of the public through, among others,

mutual funds managed by Epsilon Investment House Ltd. ("Epsilon"), an indirect

subsidiary of IDB Development Corporation Ltd., and/or held in unaffiliated

third-party client accounts managed by Epsilon as portfolio manager. The

Reporting Person disclaims beneficial ownership of the CIEH and Epsilon Shares.

Page 4 of 14 pages

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

IDB Holding Corporation Ltd.

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares*

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares*

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares*

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[X]*

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

CO

--------------------------------------------------------------------------------

* Does not include the CIEH and Epsilon Shares. The Reporting Person disclaims

beneficial ownership of the CIEH and Epsilon Shares.

Page 5 of 14 pages

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

Nochi Dankner

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares*

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares*

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares*

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[X]*

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

IN

--------------------------------------------------------------------------------

* Does not include the CIEH and Epsilon Shares. The Reporting Person disclaims

beneficial ownership of the CIEH and Epsilon Shares.

Page 6 of 14 pages

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

Shelly Bergman

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares*

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares*

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares*

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[X]*

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

IN

--------------------------------------------------------------------------------

* Does not include the CIEH and Epsilon Shares. The Reporting Person disclaims

beneficial ownership of the CIEH and Epsilon Shares.

Page 7 of 14 pages

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

Avraham Livnat

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares*

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares*

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares*

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[X]*

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

IN

--------------------------------------------------------------------------------

* Does not include the CIEH and Epsilon Shares. The Reporting Person disclaims

beneficial ownership of the CIEH and Epsilon Shares.

Page 8 of 14 pages

SCHEDULE 13D

------------------- -------------------

CUSIP NO. M7516K103

------------------- -------------------

--------------------------------------------------------------------------------

1 NAME OF REPORTING PERSONS

Ruth Manor

--------------------------------------------------------------------------------

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(A) [X]

(B) [_]

--------------------------------------------------------------------------------

3 SEC USE ONLY

--------------------------------------------------------------------------------

4 SOURCE OF FUNDS

Not Applicable

--------------------------------------------------------------------------------

5 CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2 (D) OR 2 (E) [_]

--------------------------------------------------------------------------------

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Israel

--------------------------------------------------------------------------------

7 SOLE VOTING POWER

0

NUMBER OF -------------------------------------------------------------

SHARES 8 SHARED VOTING POWER

BENEFICIALLY 2,824,476 shares*

OWNED BY -------------------------------------------------------------

EACH 9 SOLE DISPOSITIVE POWER

REPORTING 0

PERSON WITH -------------------------------------------------------------

10 SHARED DISPOSITIVE POWER

2,824,476 shares*

--------------------------------------------------------------------------------

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,824,476 shares*

--------------------------------------------------------------------------------

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[X]*

--------------------------------------------------------------------------------

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.25%

--------------------------------------------------------------------------------

14 TYPE OF REPORTING PERSON

IN

--------------------------------------------------------------------------------

* Does not include the CIEH and Epsilon Shares. The Reporting Person disclaims

beneficial ownership of the CIEH and Epsilon Shares.

Page 9 of 14 pages

This Amendment No. 5 amends and supplements the Statement on Schedule 13D

(as amended from time to time, the "Statement") in respect of the Ordinary

Shares, par value New Israeli Shekel 0.01 per share, (the "Ordinary Shares"), of

Nova Measuring Instruments Ltd. (the "Issuer"), previously filed with the

Securities and Exchange Commission (the "SEC") by the Reporting Persons, the

last amendment of which was filed with the SEC on March 25, 2010.

Unless otherwise defined in this Amendment No. 5, capitalized terms have

the meanings given to them in the Statement.

The following amends and supplements Items 2, 5 and 7 of the Statement.

ITEM 2. IDENTITY AND BACKGROUND

Item 2 of the Statement is hereby amended and supplemented as follows:

(a), (b) and (c): The Reporting Persons.

As of December 10, 2010:

IDB Holding owned all (100%) of the outstanding shares of IDB Development.

Nochi Dankner (together with a private company controlled by him) and his

sister Shelly Bergman owned approximately 56.3% and 12.4% respectively of the

outstanding shares of, and control, Ganden Holdings Ltd. ("Ganden Holdings"), a

private Israeli company.Other than Shelly Bergman, only one of Ganden Holdings'

other shareholders, owning approximately 1.7% of Ganden Holdings' outstanding

shares, has a tag along right granted to it by Nochi Dankner to participate in

certain sales of Ganden Holdings' shares by Nochi Dankner, and such shareholder

agreed to vote all its shares of Ganden Holdings in accordance with Nochi

Dankner's instructions.

Ganden Holdings owned approximately 54.7% of the outstanding shares of IDB

Holding, including approximately 37.2% of the outstanding shares of IDB Holding

owned through Ganden Investments I.D.B. Ltd. ("Ganden"), a private Israeli

company, which is a wholly owned subsidiary of Ganden Holdings. Approximately

31% of the outstanding shares of IDB Holding owned by Ganden are subject to the

Shareholders Agreement. The additional shares of IDB Holding owned by Ganden and

Ganden Holdings are not subject to the Shareholders Agreement. Substantially all

of the shares of IDB Holding owned by Ganden and Ganden Holdings have been

pledged to financial institutions as collateral for loans taken to finance the

purchase of these shares. Upon certain events of default, these financial

institutions may foreclose on the loans and assume ownership of or sell these

shares.

Shelly Bergman holds, through a wholly owned private Israeli corporation,

approximately 4.2% of the outstanding shares of IDB Holding. These shares of IDB

Holding are not subject to the IDB Shareholders Agreement.

Ruth Manor owned through a private Israeli corporation which is controlled

by her approximately 13.3% of the outstanding shares of IDB Holding, including

approximately 10.2% of the outstanding shares of IDB Holding owned through Manor

Investments - IDB Ltd. ("Manor"), which is a majority owned subsidiary of the

above-mentioned private corporation. Approximately 10.3% of the outstanding

shares of IDB Holding owned by Manor are subject to the Shareholders Agreement.

The additional shares of IDB Holding owned by these corporations are not subject

to the Shareholders Agreement.

Page 10 of 14 pages

Avraham Livnat owned through a private Israeli corporation which is

controlled by him approximately 13.3% of the outstanding shares of IDB Holding,

including approximately 10.2% of the outstanding shares of IDB Holding owned

through Avraham Livnat Investments (2002) Ltd., which is a wholly owned

subsidiary of the above-mentioned private corporation. Approximately 10.3% of

the outstanding shares of IDB Holding owned by Livnat are subject to the

Shareholders Agreement. The additional shares of IDB Holding owned these

corporations are not subject to the Shareholders Agreement.

The name, citizenship, residence or business address and present principal

occupation of the directors and executive officers of IDB Development is set

forth in Exhibit 3 attached hereto, and incorporated herein by reference. This

Exhibit 3 replaces Exhibit 3 previously attached to the Statement.

(d) None of the Reporting Persons or, to the knowledge of the Reporting

Persons, any of the persons named in Exhibits 1 through 4 to this Statement,

has, during the last five years, been convicted in a criminal proceeding

(excluding traffic violations and similar misdemeanors).

(e) None of the Reporting Persons or, to the knowledge of the Reporting

Persons, any of the persons named in Exhibits 1 through 4 to this Statement has,

during the last five years, been a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or

state securities laws or finding any violation with respect to such laws.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

Item 5 of the Statements is hereby amended and restated in its entirety as

follows:

The percentages of Ordinary Shares outstanding set forth in this Statement are

based on 25,110,441 Ordinary Shares outstanding as of December 7, 2010 as the

Issuer advised the Reporting Persons.

(a), (b) As of December 10, 2010:

Clal Industries and Clal Electronics beneficially own, and may be deemed to

share the power to vote and dispose of, 2,824,476 Ordinary Shares, constituting

approximately 11.25% of the outstanding Ordinary Shares of the Issuer.

IDB Development may be deemed the beneficial owner of, and to share the

power to vote and dispose of the 2,824,476 Ordinary Shares beneficially owned by

Clal Industries, constituting, in the aggregate, approximately 11.25% of the

outstanding Ordinary Shares of the Issuer. IDB Development disclaims beneficial

ownership of all of the 2,824,476 Ordinary Shares reported in this Statement.

IDB Holding and the Reporting Persons who are natural persons may be deemed

to be the beneficial owners of, and to share the power to vote and dispose of

the 2,824,476 Ordinary Shares beneficially owned by IDB Development,

constituting approximately 11.25% of the outstanding Ordinary Shares of the

Issuer. IDB Holding and the Reporting Persons who are natural persons disclaim

beneficial ownership of such shares.

Page 11 of 14 pages

Based on information furnished to the Reporting Persons, the Reporting

Persons are not aware of any executive officer or director named in Exhibit 1

through 4 to the Statement, beneficially owning any Ordinary Shares.

(c) None of the Reporting Persons or, to the Reporting Persons' knowledge,

any of the executive officers and directors named in Exhibits 1 through 4 to

this Statement, purchased or sold any Ordinary Shares in the past sixty days,

except as set forth below:

During the period from December 7, 2010 through December 17, 2010, Clal

Electronics made the following sales of Ordinary Shares, totaling 650,000

Ordinary Shares, all of which were made in open market transactions on the

NASDAQ:

---------------------- -------------------- ------------------------

DATE PRICE PER SHARE NUMBER OF

(DD/MM/YY) (US$) SHARES SOLD

---------------------- -------------------- ------------------------

7/12/10 7.731 49,599

---------------------- -------------------- ------------------------

8/12/10 7.607 115,401

---------------------- -------------------- ------------------------

9/12/10 7.585 85,000

---------------------- -------------------- ------------------------

10/12/10 7.698 89,281

---------------------- -------------------- ------------------------

13/12/10 7.635 130,719

---------------------- -------------------- ------------------------

14/12/10 7.502 30,000

---------------------- -------------------- ------------------------

14/12/10 7.502 52,168

---------------------- -------------------- ------------------------

15/12/10 7.394 35,208

---------------------- -------------------- ------------------------

16/12/10 7.307 12,624

---------------------- -------------------- ------------------------

17/12/10 7.285 50,000

---------------------- -------------------- ------------------------

(d) Not applicable.

(e) Not applicable.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

EXHIBIT # DESCRIPTION

Exhibits 1, 2 Name, citizenship, business address, present principal

and 4 occupation and employer of executive officers and directors

of Clal Electronics Industries Ltd. (Exhibit 1), Clal

Industries and Investments Ltd. (Exhibit 2), and IDB Holding

(Exhibit 4). (*)

Exhibit 3 Name, citizenship, business address, present principal

occupation and employer of executive officers and directors

of IDB Development.

Exhibit 5 Joint Filing Agreement between Clal Industries and

Investments Ltd. and Clal Electronics Industries Ltd.

authorizing Clal Industries and Investments Ltd. to file

this Schedule 13D and any amendments hereto. (**)

Exhibit 6 Joint Filing Agreement between Clal Industries and

Investments Ltd. and IDB Development authorizing Clal

Industries and Investments Ltd. to file this Schedule 13D

and any amendments hereto. (**)

Page 12 of 14 pages

Exhibit 7 Joint Filing Agreement between Clal Industries and

Investments Ltd. and IDB Holding authorizing Clal Industries

and Investments Ltd. to file this Schedule 13D and any

amendments hereto. (**)

Exhibit 8 Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mr. Dankner authorizing Clal Industries

and Investments Ltd. to file this Schedule 13D and any

amendments hereto. (**)

Exhibit 9 Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mrs. Bergman authorizing Clal

Industries and Investments Ltd. to file this Schedule 13D

and any amendments hereto. (**)

Exhibit 10 Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mrs. Manor authorizing Clal Industries

and Investments Ltd. to file this Schedule 13D and any

amendments hereto. (**)

Exhibit 11 Joint Filing Agreement between Clal Industries and

Investments Ltd. and Mr. Livnat authorizing Clal Industries

and Investments Ltd. to file this Schedule 13D and any

amendments hereto. (**)

(*) Previously filed as Exhibits 1, 2 and 4 to Amendment No. 4 to the Schedule

13D filed with the SEC on March 25, 2010, and incorporated herein by reference.

(**) Previously filed as Exhibits 5-11 to Amendment No. 3 to the Schedule 13D

filed with the SEC on December 11, 2007, and incorporated herein by reference.

Page 13 of 14 pages

SIGNATURE

After reasonable inquiry and to the best of our knowledge and belief, we

certify that the information set forth in this statement is true, complete and

correct.

Dated: December 29, 2010

CLAL ELECTRONICS INDUSTRIES LTD.

CLAL INDUSTRIES AND INVESTMENTS LTD.

IDB DEVELOPMENT CORPORATION LTD.

IDB HOLDING CORPORATION LTD.

NOCHI DANKNER

SHELLY BERGMAN

RUTH MANOR

AVRAHAM LIVNAT

BY: CLAL INDUSTRIES AND INVESTMENTS LTD.

By: /s/ Yehuda Ben Ezra, /s/ Gonen Bieber

-------------------------------------

Yehuda Ben Ezra, and Gonen Bieber authorized signatories of

Clal Industries and Investments Ltd. for itself and on

behalf of IDB Holding Corporation Ltd, IDB Development

Corporation Ltd., Nochi Dankner, Shelly Bergman, Ruth Manor

and Avraham Livnat pursuant to the agreements annexed as

Exhibits 5-11 to this Schedule 13D.

Page 14 of 14 pages

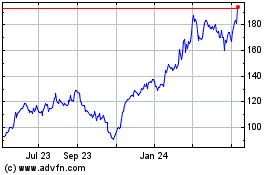

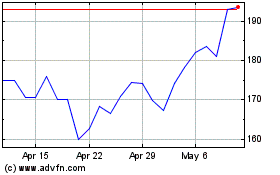

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Jul 2023 to Jul 2024