NOTABLE ITEMS

INCLUDE:

- 10.0% INCREASE IN EARNINGS PER SHARE FOR THE

QUARTER AND 27.8% FOR THE SIX MONTHS OVER THE COMPARABLE PERIODS IN

2010

- LOAN PRODUCTION REMAINS STRONG AS LOANS HELD

FOR INVESTMENT, NET, INCREASED 9.0% DURING THE SIX MONTHS TO $902

MILLION

- DEPOSITS INCREASE 5.5% FOR THE SIX MONTHS TO

$1.449 BILLION

- NON-ACCRUING LOANS DECREASE FROM DECEMBER 31,

2010 TO $56.0 MILLION, AND REMAIN STABLE FROM MARCH 31,

2011

- ACCRUING LOANS 30 TO 89 DAYS DELINQUENT

CONTINUE TO DECLINE FOR THE QUARTER AND THE SIX MONTHS ENDED JUNE

30, 2011

- CAPITAL REMAINS STRONG AT OVER 17% OF TOTAL

ASSETS

- DECLARATION OF A $0.06 PER SHARE CASH

DIVIDEND

Northfield Bancorp, Inc.

(Nasdaq:NFBK), the holding company for Northfield Bank, reported

basic and diluted earnings per common share of $0.11 and $0.23 for

the quarter and six months ended June 30, 2011, respectively as

compared to $0.10 and $0.18 for the quarter and six months ended

June 30, 2010, respectively.

"Northfield is pleased to report continued strong financial

results. In addition to excellent earnings, we finished the quarter

with strong capital, and strong liquidity," said Chairman and CEO,

John Alexander. "The demand for loans has been good with total

loans increasing nine percent for the first six months of this

year. Credit quality continues to improve as approximately 50%

of our nonperforming loans are performing in accordance with either

original or restructured terms. We continue to experience low

loan charge-offs which reflects the strong underwriting and

collateral support in our portfolio, and loans that are accruing

but are 30-89 days delinquent continue to decline. These signs

are encouraging particularly in an economic environment where

unemployment remains high, the local economy remains sluggish, and

the world economy is in turmoil."

Mr. Alexander continued, "In addition to strong core earnings,

during the quarter we again reported substantial gains on

securities transactions resulting from the disposition of

securities to fund loan growth, from disposing of small balance

securities to improve execution, or from taking advantage of

pricing opportunities in the market."

"We also have worked aggressively to expand our deposit base and

the footprint of our franchise. Year to date our deposits have

increased over five percent. We now have 21 branches in our

retail network following the opening of our newest Brooklyn branch

in early June. Our expansion continues with three branches in

development in Brooklyn, one in Staten Island, and two in New

Jersey."

Mr. Alexander continued, "I am pleased to announce that the

Board of Directors has declared a quarterly cash dividend of $0.06

per common share, payable on August 24, 2011, to stockholders of

record as of August 10, 2011."

Financial Condition

Total assets increased $60.4 million, or 2.7%, to $2.3 billion

at June 30, 2011, from $2.2 billion at December 31, 2010. The

increase was primarily attributable to increases in loans held for

investment, net, of $75.0 million, or 9.1%, and interest-bearing

deposits in other financial institutions of $18.2 million, or

53.5%. These increases were partially offset by decreases in

securities available for sale, held to maturity securities, loans

held for sale, Federal Home Loan Bank of New York, stock, and

accrued interest receivable.

Loans held for investment, net, totaled $902.6 million at June

30, 2011, as compared to $827.6 million at December 31,

2010. The increase was primarily in multi-family real estate

loans, which increased $74.5 million, or 26.3%, to $358.1 million

at June 30, 2011, from $283.6 million at December 31,

2010. Insurance premium loans increased $14.5 million, or

32.6%, to $59.0 million, and home equity loans increased $2.1

million, or 7.4%, to $30.2 million at June 30, 2011. These

increases were partially offset by decreases in commercial real

estate, one-to-four family residential, land and construction, and

commercial and industrial loans. Currently, management is

focused on originating multi-family loans, with less emphasis on

other loan types.

The Company's securities portfolio totaled $1.2 billion at June

30, 2011, compared to $1.3 billion at December 31, 2010. At

June 30, 2011, $1.1 billion of the portfolio consisted of

residential mortgage-backed securities issued or guaranteed by

Fannie Mae, Freddie Mac, or Ginnie Mae. The Company also held

residential mortgage-backed securities not guaranteed by these

three entities, referred to as "private label securities." The

private label securities had an amortized cost of $48.3 million and

an estimated fair value of $49.8 million at June 30,

2011. These private label securities were in a net unrealized

gain position of $1.5 million at June 30, 2011, consisting of gross

unrealized gains of $2.3 million and gross unrealized losses of

$759,000. In addition to the above mortgage-backed securities,

the Company held $104.5 million in securities issued by corporate

entities which were all rated investment grade at June 30, 2011,

and $9.2 million of equity investments in mutual funds, which focus

on investments that qualify under the Community Reinvestment Act

and money market mutual funds.

Of the $48.3 million of private label securities, two securities

with an estimated fair value of $9.0 million (amortized cost of

$9.8 million) were rated less than investment grade at June 30,

2011. One of the two securities was rated CC and the other

security was rated Caa2. The ratings of the securities

detailed above represent the lowest rating for each security

received from the rating agencies of Moody's, Standard &

Poor's, and Fitch. The Company continues to receive principal

and interest payments in accordance with the contractual terms of

these securities. Management has evaluated, among other

things, delinquency status, location of collateral, estimated

prepayment speeds, and the estimated default rates and loss

severity in liquidating the underlying collateral for the

securities rated rate below investment grade at June 30,

2011. As a result of management's evaluation of these

securities, the Company recognized other-than-temporary impairment

of $991,000 on the securities rated below investment grade for the

quarter ended June 30, 2011. Since management does not have

the intent to sell the security, and believes it is more likely

than not that the Company will not be required to sell the

security, before its anticipated recovery, the credit component of

$248,000 was recognized in earnings for the quarter ended June 30,

2011, and the non-credit component of $743,000 was recorded as a

component of accumulated other comprehensive income, net of

tax. All other losses within the Company's investment

portfolio were deemed to be temporary at June 30, 2011, and as

such, were recorded as a component of accumulated other

comprehensive income, net of tax.

During the three months ended March 31, 2011, the Company

recognized an other-than-temporary impairment charge on an equity

investment in a mutual fund. The investment had been in a

continuous loss position for approximately ten months, and as a

result of management's evaluation of this security, the Company

believed that the unrealized loss of $161,000 was

other-than-temporary, and as such, recognized this charge in

earnings during the three months ended March 31, 2011. There was no

further impairment during the three months ended June 30,

2011.

Interest-bearing deposits in other financial institutions

totaled $52.2 million at June 30, 2011, as compared to $34.0

million at December 31, 2010. The Company routinely maintains

liquid assets in interest-bearing accounts in other

well-capitalized financial institutions.

Total liabilities increased $59.0 million from December 31,

2010. The increase was primarily attributable to an increase

in deposits of $75.7 million, or 5.5%, and an increase in

borrowings of $53.3 million, or 13.6%, partially offset by a

decrease of $70.7 million in amounts due to securities brokers for

securities purchased but not settled at period end.

The increase in deposits for the six months ended June 30, 2011

was due in part to an increase of certificates of deposit (issued

by the Bank) of $92.7 million, or 19.1% as compared to December 31,

2010. In addition, transaction accounts increased $18.5

million, or 9.9%, from December 31, 2010 to June 30,

2011. These increases were partially offset by a decrease of

$5.2 million in total savings deposits, and a decrease of $30.2

million in short-term certificates of deposit originated through

the CDARS® Network. Deposits originated through the CDARS®

Network totaled $38.2 million at June 30, 2011, and $68.4 million

at December 31, 2010. The Company utilizes the CDARS® Network as a

cost effective alternative to other short-term funding

sources. The increase in borrowings was primarily the result

of the Company taking advantage of the current lower interest rate

market to reduce interest rate risk, partially offset by maturities

during the six months ended June 30, 2011. The decrease in due

to securities brokers was the result of their not being any

security purchases occurring prior to June 30, 2011, and settling

after quarter end, as compared to $70.7 million at December 31,

2010.

Total stockholders' equity increased by $1.5 million to $398.2

million at June 30, 2011, from $396.7 million at December 31,

2010. The increase was primarily due to net income of $9.3

million for the six months ended June 30, 2011, and an increase of

$1.8 million in additional paid-in capital primarily related to the

recognition of compensation expense associated with equity awards,

and an increase in accumulated other comprehensive income of $4.7

million for the six months ended June 30, 2011. These

increases were partially offset by $12.8 million in stock

repurchases and the payment of approximately $1.8 million in cash

dividends.

Northfield Bank's (the Company's wholly-owned subsidiary) Tier 1

(core) capital ratio was approximately 13.57%, June 30,

2011. The Bank's total risk-based capital ratio was

approximately 27.51% at the same date. These ratios continue

to significantly exceed the required regulatory capital ratios

necessary to be considered "well capitalized" under current federal

capital regulations. Northfield Bancorp, Inc.'s consolidated

average total equity as a percentage of average total assets was

17.35% for the six months ended June 30, 2011, as compared to

19.11% for the six months ended June 30,

2010.

Asset Quality

Nonperforming loans totaled $58.0 million (6.4% of total loans)

as compared to $56.7 million (6.6% of total loans) at March 31,

2011, $60.9 million (7.4% of total loans) at December 31, 2010,

$55.4 million (6.9% of total loans) at September 30, 2010, and

$51.5 million (6.7% of total loans) at June 30, 2010. The

following table also shows, for the same dates, troubled debt

restructurings on which interest is accruing, and accruing loans

delinquent 30 to 89 days (dollars in thousands).

| (in thousands) |

|

|

|

|

|

| |

June 30, |

March 31, |

December 31, |

September 30, |

June 30, |

| |

2011 |

2011 |

2010 |

2010 |

2010 |

| Non-accruing loans |

$29,036 |

31,662 |

39,303 |

37,882 |

34,007 |

| Non-accruing loans subject to restructuring

agreements |

26,994 |

24,136 |

19,978 |

17,261 |

17,417 |

| Total non-accruing loans |

56,030 |

55,798 |

59,281 |

55,143 |

51,424 |

| Loans 90 days or more past due and still

accruing |

1,987 |

876 |

1,609 |

248 |

77 |

| Total non-performing loans |

58,017 |

56,674 |

60,890 |

55,391 |

51,501 |

| Other real estate owned |

118 |

521 |

171 |

171 |

1,362 |

| Total non-performing assets |

$58,135 |

57,195 |

61,061 |

55,562 |

52,863 |

| |

|

|

|

|

|

| Loans subject to restructuring agreements and

still accruing |

$15,622 |

12,259 |

11,198 |

11,218 |

10,708 |

| |

|

|

|

|

|

| Accruing loans 30 to 89 days delinquent |

$14,169 |

14,551 |

19,798 |

35,190 |

30,619 |

Total Non-Accruing Loans

Total non-accruing loans decreased $3.3 million, to $56.0

million at June 30, 2011, from $59.3 million at December 31,

2010. This decrease was primarily attributable to the

following loan types being returned to accrual status during the

six months ended June 30, 2011: $1.8 million of multifamily

loans, $942,000 of commercial real estate loans, and $332,000 of

one-to-four family residential loans. Loans returned to

accrual status were current as to principal and interest, and

factors indicating doubtful collection no longer existed, including

the borrower's performance under the original loan terms for at

least six months. Non-accrual loans also decreased as a result

of a $612,000 of pay-offs, the transfer of a $376,000 commercial

real estate loan to other real estate owned, an additional $1.4

million of charge-offs being recorded on existing and new

non-accrual loans, and principal pay-downs of approximately $2.6

million. The above decreases in non-accruing loans during the

six months ended June 30, 2011, were partially offset by the

following loan types being placed on non-accrual status during the

six months ended June 30, 2011: $1.9 million of commercial

real estate loans, $676,000 of commercial and industrial loans,

$405,000 of construction and land loans, home equity loans of

$155,000, and $1.7 million of one-to-four family loans.

Delinquency Status of Total Non-accruing Loans

Generally, loans are placed on non-accrual status when they

become 90 days or more delinquent, and remain on non-accrual status

until they are brought current, have a minimum of six months of

performance under the loan terms, and factors indicating reasonable

doubt about the timely collection of payments no longer

exist. Therefore, loans may be current in accordance with

their loan terms, or may be less than 90 days delinquent, and still

be in a non-accruing status.

The following tables detail the delinquency status of

non-accruing loans at June 30, 2011 and December 31, 2010 (dollars

in thousands).

| |

June 30, 2011 |

| |

Days Past Due |

|

| Real estate loans: |

0 to 29 |

30 to 89 |

90 or more |

Total |

| Commercial |

$25,237 |

3,986 |

15,647 |

44,870 |

| One-to-four family residential |

152 |

412 |

2,086 |

2,650 |

| Construction and land |

2,456 |

-- |

875 |

3,331 |

| Multifamily |

-- |

-- |

3,001 |

3,001 |

| Home equity and lines of credit |

-- |

-- |

337 |

337 |

| Commercial and industrial loans |

552 |

-- |

1,232 |

1,784 |

| Insurance premium loans |

-- |

-- |

57 |

57 |

| Total non-accruing loans |

$28,397 |

4,398 |

23,235 |

56,030 |

| |

|

| |

December 31, 2010 |

| |

Days Past Due |

|

| Real estate loans: |

0 to 29 |

30 to 89 |

90 or more |

Total |

| Commercial |

$13,679 |

15,050 |

17,659 |

46,388 |

| One-to-four family residential |

135 |

770 |

370 |

1,275 |

| Construction and land |

2,152 |

1,860 |

1,110 |

5,122 |

| Multifamily |

1,824 |

927 |

2,112 |

4,863 |

| Home equity and lines of credit |

-- |

-- |

181 |

181 |

| Commercial and industrial loans |

-- |

267 |

1,056 |

1,323 |

| Insurance premium loans |

-- |

-- |

129 |

129 |

| Total non-accruing loans |

$17,790 |

18,874 |

22,617 |

59,281 |

Loans Subject to Restructuring Agreements

Included in non-accruing loans are loans subject to

restructuring agreements totaling $27.0 million and $20.0 million

at June 30, 2011, and December 31, 2010, respectively. At June 30,

2011, $25.5 million, or 94.4% of the $27.0 million were performing

in accordance with their restructured terms.

The Company also holds loans subject to restructuring

agreements, and still accruing, which totaled $15.6 million and

$11.2 million at June 30, 2011 and December 31, 2010, respectively.

At June 30, 2011, $14.1 million, or 90.0% of the $15.6 million were

performing in accordance with their restructured terms.

The following table details the amounts and categories of the

loans subject to restructuring agreements by loan type as of June

30, 2011 and December 31, 2010 (dollars in thousands).

| |

At June 30, 2011 |

At December 31, 2010 |

| |

Non-Accruing |

Accruing |

Non-Accruing |

Accruing |

| Troubled debt restructurings: |

|

|

|

|

| Real estate loans: |

|

|

|

|

| Commercial |

$ 22,998 |

$ 10,770 |

$ 13,138 |

$ 7,879 |

| One-to-four family residential |

498 |

2,388 |

-- |

1,750 |

| Construction and land |

2,456 |

-- |

4,012 |

-- |

| Multifamily |

491 |

1,561 |

2,327 |

1,569 |

| Commercial and industrial |

551 |

903 |

501 |

-- |

| Total |

$ 26,994 |

$ 15,622 |

$ 19,978 |

$ 11,198 |

| |

|

|

|

|

| Performing in accordance

with restructured terms |

94.40% |

90.00% |

61.03% |

100.00% |

Loans 90 Days or More Past Due and Still Accruing and Other Real

Estate Owned

Loans 90 days or more past due and still accruing increased

$378,000 from $1.6 million at December 31, 2010 to $2.0 million at

June 30, 2011. Loans 90 days or more past due and still

accruing at June 30, 2011, are considered well-secured and in the

process of collection. Of the $2.0 million, $1.5 million made

payments on July 1, 2011, and $496,000 was past maturity, paying

interest in accordance with original loan terms, and in the process

of renewal.

Other real estate owned amounted to $118,000 at June 30, 2011,

as compared to $171,000 at December 31, 2010.

Delinquency Status of Accruing Loans 30-89 Days Delinquent

Loans 30 to 89 days delinquent and on accrual status at June 30,

2011, totaled $14.2 million, a decrease of $5.6 million, from the

December 31, 2010 balance of $19.8 million. The following

tables set forth delinquencies for accruing loans by type and by

amount at June 30, 2011 and December 31, 2010 (dollars in

thousands).

| |

June 30, 2011 |

| |

30 to 89 Days |

90 Days and Over |

Total |

| Real estate loans: |

|

|

|

| Commercial |

$ 7,552 |

$ 496 |

$ 8,048 |

| One-to-four family residential |

1,586 |

-- |

1,586 |

| Construction and land |

500 |

-- |

500 |

| Multifamily |

3,704 |

-- |

3,704 |

| Home equity and lines of credit |

94 |

1,491 |

1,585 |

| Commercial and industrial loans |

137 |

-- |

137 |

| Insurance premium loans |

527 |

-- |

527 |

| Other loans |

69 |

-- |

69 |

| Total delinquent accruing loans |

$ 14,169 |

$ 1,987 |

$ 16,156 |

| |

|

| |

December 31, 2010 |

| |

30 to 89 Days |

90 Days and Over |

Total |

| Real estate loans: |

|

|

|

| Commercial |

$ 8,970 |

$ -- |

$ 8,970 |

| One-to-four family residential |

2,575 |

1,108 |

3,683 |

| Construction and land |

499 |

404 |

903 |

| Multifamily |

6,194 |

-- |

6,194 |

| Home equity and lines of credit |

262 |

59 |

321 |

| Commercial and industrial loans |

536 |

38 |

574 |

| Insurance premium loans |

660 |

-- |

660 |

| Other loans |

102 |

-- |

102 |

| Total delinquent accruing loans |

$ 19,798 |

$ 1,609 |

$ 21,407 |

Results of Operations

Comparison of Operating Results for the Three Months Ended June

30, 2011 and 2010

Net income increased $161,000, or 3.9%, to $4.3 million for the

quarter ended June 30, 2011, as compared to $4.2 million for the

quarter ended June 30, 2010, due primarily to an increase of

$324,000 in non-interest income, and a $1.0 million decrease in the

provision for loan losses, partially offset by a decrease in net

interest income of $88,000 and an increase of $1.1 million in

non-interest expense.

Net interest income decreased $88,000, or 0.6%, as

interest-earning assets increased by 10.7% to $2.2 billion, and the

net interest margin decreased 10.2%, to 2.90%. The general

decline in interest rates has resulted in yields earned on interest

earning assets declining 35 basis points to 4.12% for the current

quarter as compared to 4.47% for the prior year comparable period,

while rates paid on interest-bearing liabilities decreased 9 basis

points to 1.47% for the current quarter as compared to 1.56% for

the prior year comparable period. The increase in average

interest earning assets was due primarily to increases in average

loans outstanding of $119.1 million and $239.6 million in

mortgage-backed securities, partially offset by decreases in other

securities and interest-earning assets in other financial

institutions. Other securities consist primarily of

investment-grade shorter-term corporate bonds, and

government-sponsored enterprise bonds.

Non-interest income increased $324,000, or 17.4%, to $2.2

million for the quarter ended June 30, 2011, as compared to $1.9

million for the quarter ended June 30, 2010. This increase was

primarily a result of a $101,000 increase in gains on security

sales, with $886,000 in gains on security sales for the current

year quarter as compared to $785,000 for the comparable quarter in

2010, a $114,000 increase in fees and service charges for customer

services, a $208,000 decrease in trading losses on securities

maintained in the Company's deferred compensation plan, and a

$232,000 increase of income earned on bank owned life insurance,

generated by increased cash surrender values, primarily resulting

from higher levels of bank owned life insurance. The Company

routinely sells securities when market pricing presents, in

management's assessment, an economic benefit that outweighs holding

such securities, and when smaller balance securities become cost

prohibitive to carry. These increases were partially offset by

a $248,000 other-than-temporary credit impairment charge recognized

on two private label mortgage-backed securities, and a decrease of

$83,000 in other income.

Non-interest expense increased $1.1 million, or 13.3%, for the

quarter ended June 30, 2011, as compared to the quarter ended June

30, 2010, due primarily to compensation and employee benefits

expense increasing $840,000 which resulted primarily from increases

in employees related to additional branch and operations personnel,

and to a lesser extent, salary adjustments effective January 1,

2011. Occupancy expense increased $142,000, or 12.0%, over the

same time period, primarily due to increases in rent and

amortization of leasehold improvements relating to new branches and

the renovation of existing branches. Professional fees

increased $153,000, over the same time period, primarily due to

increased costs related to loan workouts.

The provision for loan losses was $1.8 million for the quarter

ended June 30, 2011; a decrease of $1.0 million, or 37.5%, from the

$2.8 million provision recorded in the quarter ended June 30,

2010. The decrease in the provision for loan losses in the

current quarter was due primarily to a shift in the composition of

our loan portfolio to multi-family loans, which generally require

lower general reserves than other commercial real estate loans, and

decreased levels of delinquencies. During the quarter ended

June 30, 2011, the Company recorded net charge-offs of $245,000

compared to net charge-offs of $822,000 for the quarter ended June

30, 2010.

The Company recorded income tax expense of $2.3 million for the

quarters ended June 30, 2011, and 2010. The effective tax rate

for the quarter ended June 30, 2011, was 35.0%, as compared to

35.9% for the quarter ended June 30, 2010. The decrease in the

effective tax rate was primarily a result of an increase in bank

owned life insurance income.

Comparison of Operating Results for the Six Months Ended June

30, 2011 and 2010

Net income increased $1.8 million, or 23.1%, to $9.3 million for

the six months ended June 30, 2011, as compared to $7.6 million for

the six months ended June 30, 2010, due primarily to an increase of

$1.7 million in non-interest income, an increase in net interest

income of $1.1 million, and a $1.6 million decrease in the

provision for loan losses, partially offset by an increase of $2.0

million in non-interest expense, and an increase of $746,000 in

income tax expense.

Net interest income increased $1.1 million, or 3.7%, as

interest-earning assets increased by 9.8% to $2.2 billion, and the

net interest margin decreased 5.7%, to 2.96%. The general

decline in interest rates has resulted in yields earned on interest

earning assets declining 26 basis points to 4.17% for the current

six-months as compared to 4.43% for the prior year comparable

period, while rates paid on interest-bearing liabilities decreased

16 basis points to 1.47% for the current six months as compared to

1.63% for the prior year comparable period. The increase in

average interest earning assets was due primarily to increases in

average loans outstanding of $113.1 million and $200.6 million in

mortgage-backed securities, partially offset by decreases in other

securities and interest-earning assets in other financial

institutions. Other securities consist primarily of

investment-grade shorter-term corporate bonds, and

government-sponsored enterprise bonds.

Non-interest income increased $1.7 million, or 47.7%, to $5.3

million for the six months ended June 30, 2011, as compared to $3.6

million for the six months ended June 30, 2010. This increase

was primarily a result of a $1.5 million increase in gains on

security sales, with $2.5 million in gains on security sales for

the current six months as compared to $1.1 million for the

comparable six months in 2010, a $148,000 increase in fees and

service charges for customer services, and a $550,000 increase of

income earned on bank owned life insurance, generated by increased

cash surrender values, primarily resulting from higher levels of

bank owned life insurance. The Company routinely sells

securities when market pricing presents, in management's

assessment, an economic benefit that outweighs holding such

securities, and when smaller balance securities become cost

prohibitive to carry. These increases were partially offset by

a $409,000 other-than-temporary credit impairment charge recognized

on two private label mortgage backed securities and a equity mutual

fund and a decrease of $78,000 in other income.

Non-interest expense increased $2.0 million, or 11.1%, for the

six months ended June 30, 2011, as compared to the six months ended

June 30, 2010, due primarily to compensation and employee benefits

expense increasing $1.2 million which resulted primarily from

increases in employees related to additional branch and operations

personnel, and to a lesser extent, salary adjustments effective

January 1, 2011. Occupancy expense increased $440,000, or

18.5%, over the same time period, primarily due to increases in

rent and amortization of leasehold improvements relating to new

branches and the renovation of existing branches. Professional

fees increased $214,000, over the same time period, primarily due

to increased costs related to loan workouts.

The provision for loan losses was $3.1 million for the six

months ended June 30, 2011; a decrease of $1.6 million, or 34.1%,

from the $4.7 million provision recorded in the six months ended

June 30, 2010. The decrease in the provision for loan losses

in the current six months was due primarily to a shift in the

composition of our loan portfolio to multi-family loans, which

generally require lower general reserves than other commercial real

estate loans, and decreased levels of delinquencies. During

the six months ended June 30, 2011, the Company recorded net

charge-offs of $1.4 million compared to net charge-offs of $1.0

million for the six months ended June 30, 2010.

The Company recorded income tax expense of $4.9 million and $4.2

million for the six months ended June 30, 2011, and 2010,

respectively. The effective tax rate for the six months ended

June 30, 2011, was 34.6%, as compared to 35.6% for the six months

ended June 30, 2010. The decrease in the effective tax rate

was primarily a result of an increase in bank owned life insurance

income, partially offset by an increase in taxable

income.

About Northfield Bank

Northfield Bank, founded in 1887, operates 21 full service

banking offices in Staten Island and Brooklyn, New York and

Middlesex and Union counties, New Jersey. For more information

about Northfield Bank, please visit www.eNorthfield.com.

Forward-Looking Statements: This release may

contain certain "forward looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995, and may be

identified by the use of such words as "may," "believe," "expect,"

"anticipate," "should," "plan," "estimate," "predict," "continue,"

and "potential" or the negative of these terms or other comparable

terminology. Examples of forward-looking statements include,

but are not limited to, estimates with respect to the financial

condition, results of operations and business of Northfield

Bancorp, Inc. Any or all of the forward-looking statements in

this release and in any other public statements made by Northfield

Bancorp, Inc. may turn out to be wrong. They can be affected

by inaccurate assumptions Northfield Bancorp, Inc. might make or by

known or unknown risks and uncertainties as described in our SEC

filings, including, but not limited to, those related to general

economic conditions, particularly in the market areas in which the

Company operates, competition among depository and other financial

institutions, changes in laws or government regulations or policies

affecting financial institutions, including changes in regulatory

fees and capital requirements, inflation and changes in the

interest rate environment that reduce our margins or reduce the

fair value of financial instruments, our ability to successfully

integrate acquired entities, if any, and adverse changes in the

securities markets. Consequently, no forward-looking statement

can be guaranteed. Northfield Bancorp, Inc. does not intend to

update any of the forward-looking statements after the date of this

release, or conform these statements to actual events.

| NORTHFIELD BANCORP,

INC. |

| SELECTED CONSOLIDATED FINANCIAL

AND OTHER DATA |

| (Dollars in thousands, except

per share amounts) (unaudited) |

| |

|

|

| |

At |

At |

| |

June 30, 2011 |

December 31,

2010 |

| Selected Financial Condition

Data: |

|

|

| Total assets |

$ 2,307,571 |

$ 2,247,167 |

| Cash and cash equivalents |

62,907 |

43,852 |

| Trading securities |

4,439 |

4,095 |

| Securities available for sale, at estimated

fair value |

1,212,319 |

1,244,313 |

| Securities held to maturity |

4,421 |

5,060 |

| Loans held for investment, net |

902,564 |

827,591 |

| Allowance for loan losses |

(23,520) |

(21,819) |

| Net loans held for investment |

879,044 |

805,772 |

| Non-performing loans(1) |

58,017 |

60,890 |

| Other real estate owned |

118 |

171 |

| Bank owned life insurance |

76,292 |

74,805 |

| Federal Home Loan Bank of New York stock, at

cost |

8,631 |

9,784 |

| |

|

|

| Borrowed funds |

444,522 |

391,237 |

| Deposits |

1,448,569 |

1,372,842 |

| Total liabilities |

1,909,400 |

1,850,450 |

| Total stockholders' equity |

$ 398,171 |

$ 396,717 |

| |

|

|

| Total shares outstanding |

42,370,928 |

43,316,021 |

| |

|

|

| |

Quarter

Ended |

Six Months

Ended |

| |

June

30, |

June

30, |

| |

2011 |

2010 |

2011 |

2010 |

| Selected Operating

Data: |

|

|

|

|

| Interest income |

$ 22,438 |

$ 22,032 |

$ 44,436 |

$ 43,039 |

| Interest expense |

6,609 |

6,115 |

12,836 |

12,573 |

| Net interest income before provision for loan

losses |

15,829 |

15,917 |

31,600 |

30,466 |

| Provision for loan losses |

1,750 |

2,798 |

3,117 |

4,728 |

| Net interest income after provision for loan

losses |

14,079 |

13,119 |

28,483 |

25,738 |

| Non-interest income |

2,190 |

1,866 |

5,299 |

3,589 |

| Non-interest expense |

9,584 |

8,457 |

19,537 |

17,578 |

| Income before income tax expense |

6,685 |

6,528 |

14,245 |

11,749 |

| Income tax expense |

2,338 |

2,342 |

4,928 |

4,182 |

| Net income |

$ 4,347 |

$ 4,186 |

$ 9,317 |

$ 7,567 |

| |

|

|

|

|

| Basic earnings per share (2) |

$ 0.11 |

$ 0.10 |

$ 0.23 |

$ 0.18 |

| Diluted earnings per share (2) |

$ 0.11 |

$ 0.10 |

$ 0.23 |

$ 0.18 |

| |

| NORTHFIELD BANCORP,

INC. |

| SELECTED CONSOLIDATED FINANCIAL

AND OTHER DATA |

| (Dollars in thousands, except

per share amounts) (unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| |

At or For the

Three |

At or For the

Six |

| |

Months

Ended |

Months

Ended |

| |

June

30, |

June

30, |

| |

2011 |

2010 |

2011 |

2010 |

| Selected Financial

Ratios: |

|

|

|

|

| Performance Ratios(3): |

|

|

|

|

| Return on assets (ratio of net income to

average total assets) |

0.75 % |

0.80 % |

0.82 % |

0.74 % |

| Return on equity (ratio of net income to

average equity) |

4.40 |

4.23 |

4.74 |

3.86 |

| Average equity to average total

assets |

17.04 |

19.01 |

17.35 |

19.11 |

| Interest rate spread |

2.65 |

2.91 |

2.70 |

2.80 |

| Net interest margin |

2.90 |

3.23 |

2.96 |

3.14 |

| Efficiency ratio(4) |

53.19 |

47.56 |

52.95 |

51.62 |

| Non-interest expense to average total

assets |

1.65 |

1.62 |

1.72 |

1.71 |

| Average interest-earning assets to

average interest-bearing liabilities |

121.46 |

125.70 |

121.92 |

125.97 |

| Asset Quality Ratios: |

|

|

|

|

| Non-performing assets to total

assets |

2.52 |

2.39 |

2.52 |

2.39 |

| Non-performing loans to total loans held

for investment, net |

6.43 |

6.66 |

6.43 |

6.66 |

| Allowance for loan losses to

non-performing loans |

40.54 |

37.13 |

40.54 |

37.13 |

| Allowance for loan losses to total

loans |

2.61 |

2.47 |

2.61 |

2.47 |

| Annualized net charge-offs to total

average loans |

0.11 |

0.44 |

0.33 |

0.28 |

| Provision for loan losses as a multiple

of net charge-offs |

7.14 x |

3.40 x |

2.20 x |

4.64 x |

| |

|

|

|

|

| (1) Non-performing loans consist

of non-accruing loans and loans 90 days or more past due and still

accruing, and are included in loans held-for-investment, net. |

| (2) Basic net income per common

share is calculated based on 40,599,400 and 41,417,662 average

shares outstanding for the three months ended June 30, 2011, and

June 30, 2010, respectively. Basic net income per common share

is calculated based on 40,848,467 and 41,462,961 average shares

outstanding for the six months ended June 30, 2011, and June 30,

2010, respectively. Diluted earnings per share is calculated

based on 40,980,691 and 41,783,730 average shares outstanding

for the three months ended June 30, 2011 and June 30, 2010,

respectively. Diluted earnings per share is calculated based

on 41,260,032 and 41,803,306 average shares outstanding for

the six months ended June 30, 2011 and June 30, 2010,

respectively. |

| (3) Annualized when

appropriate. |

| (4) The efficiency ratio

represents non-interest expense divided by the sum of net interest

income and non-interest income. |

| |

| NORTHFIELD BANCORP,

INC. |

| ANALYSIS OF NET INTEREST

INCOME |

| (Dollars in thousands) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

For the Quarter

Ended June 30, |

| |

2011 |

2010 |

| |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

| |

|

|

|

|

|

|

| Interest-earning

assets: |

|

|

|

|

|

|

| Loans (5) |

$876,389 |

$12,778 |

5.85 % |

$757,240 |

$12,098 |

6.41 % |

| Mortgage-backed securities |

1,128,099 |

8,675 |

3.08 |

888,469 |

8,243 |

3.72 |

| Other securities |

119,161 |

787 |

2.65 |

255,392 |

1,567 |

2.46 |

| Federal Home Loan Bank of New York

stock |

10,104 |

121 |

4.80 |

6,475 |

63 |

3.90 |

| Interest-earning deposits in financial

institutions |

52,652 |

77 |

0.59 |

68,078 |

60 |

0.35 |

| Total interest-earning assets |

2,186,405 |

22,438 |

4.12 |

1,975,654 |

22,031 |

4.47 |

| Non-interest-earning assets |

141,330 |

|

|

112,605 |

|

|

| Total assets |

2,327,735 |

|

|

2,088,259 |

|

|

| |

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

| Savings, NOW, and money market

accounts |

700,613 |

1,164 |

0.67 |

670,371 |

1,265 |

0.76 |

| Certificates of deposit |

598,932 |

2,106 |

1.41 |

580,565 |

2,117 |

1.46 |

| Total interest-bearing

deposits |

1,299,545 |

3,270 |

1.01 |

1,250,936 |

3,382 |

1.08 |

| Borrowed funds |

500,548 |

3,339 |

2.68 |

320,783 |

2,733 |

3.42 |

| Total

interest-bearing liabilities |

1,800,093 |

6,609 |

1.47 |

1,571,719 |

6,115 |

1.56 |

| Non-interest bearing deposit accounts |

120,352 |

|

|

113,011 |

|

|

| Accrued expenses and other

liabilities |

10,723 |

|

|

6,457 |

|

|

| Total liabilities |

1,931,168 |

|

|

1,691,187 |

|

|

| Stockholders' equity |

396,567 |

|

|

397,072 |

|

|

| Total liabilities and stockholders'

equity |

2,327,735 |

|

|

2,088,259 |

|

|

| |

|

|

|

|

|

|

| Net interest income |

|

$15,829 |

|

|

$15,916 |

|

| Net interest rate spread (2) |

|

|

2.65 |

|

|

2.91 |

| Net interest-earning assets (3) |

$386,312 |

|

|

$403,935 |

|

|

| Net interest margin (4) |

|

|

2.90 % |

|

|

3.23 % |

| Average interest-earning assets

to interest-bearing liabilities |

|

|

121.46 |

|

|

125.70 |

| |

|

|

|

|

|

|

| (1) Average yields and rates for

the three months ended June 30, 2011, and 2010 are annualized. |

| (2) Net interest rate spread

represents the difference between the weighted average yield on

interest-earning assets and the weighted average cost of

interest-bearing liabilities. |

| (3) Net interest-earning assets

represent total interest-earning assets less total interest-bearing

liabilities. |

| (4) Net interest margin

represents net interest income divided by average total

interest-earning assets. |

| (5) Includes non-accruing

loans. |

| |

| NORTHFIELD BANCORP,

INC. |

| ANALYSIS OF NET

INTEREST INCOME |

| (Dollars in

thousands) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

For the Six

Months Ended June, |

| |

2011 |

2010 |

| |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

Average Outstanding

Balance |

Interest |

Average Yield/ Rate

(1) |

| |

|

|

|

|

|

|

| Interest-earning

assets: |

|

|

|

|

|

|

| Loans (5) |

$858,991 |

$25,252 |

5.93 % |

$745,891 |

$22,391 |

6.05 % |

| Mortgage-backed securities |

1,099,390 |

17,092 |

3.14 |

898,788 |

17,308 |

3.88 |

| Other securities |

134,822 |

1,757 |

2.63 |

241,014 |

3,068 |

2.57 |

| Federal Home Loan Bank of New York

stock |

10,469 |

230 |

4.43 |

6,272 |

158 |

5.08 |

| Interest-earning deposits in financial

institutions |

47,708 |

105 |

0.44 |

66,826 |

114 |

0.34 |

| Total interest-earning assets |

2,151,380 |

44,436 |

4.17 |

1,958,791 |

43,039 |

4.43 |

| Non-interest-earning assets |

134,861 |

|

|

111,381 |

|

|

| Total assets |

2,286,241 |

|

|

2,070,172 |

|

|

| |

|

|

|

|

|

|

| Interest-bearing

liabilities: |

|

|

|

|

|

|

| Savings, NOW, and money market

accounts |

697,955 |

2,298 |

0.66 |

654,026 |

2,685 |

0.83 |

| Certificates of deposit |

570,312 |

3,989 |

1.41 |

584,598 |

4,649 |

1.60 |

| Total interest-bearing

deposits |

1,268,267 |

6,287 |

1.00 |

1,238,624 |

7,334 |

1.19 |

| Borrowed funds |

496,276 |

6,549 |

2.66 |

316,315 |

5,239 |

3.34 |

| Total

interest-bearing liabilities |

1,764,543 |

12,836 |

1.47 |

1,554,939 |

12,573 |

1.63 |

| Non-interest bearing deposit accounts |

115,346 |

|

|

111,335 |

|

|

| Accrued expenses and other

liabilities |

9,706 |

|

|

8,278 |

|

|

| Total liabilities |

1,889,595 |

|

|

1,674,552 |

|

|

| Stockholders' equity |

396,646 |

|

|

395,620 |

|

|

| Total liabilities and stockholders'

equity |

2,286,241 |

|

|

2,070,172 |

|

|

| |

|

|

|

|

|

|

| Net interest income |

|

$31,600 |

|

|

$30,466 |

|

| Net interest rate spread (2) |

|

|

2.70 |

|

|

2.80 |

| Net interest-earning assets (3) |

$386,837 |

|

|

$403,852 |

|

|

| Net interest margin (4) |

|

|

2.96 % |

|

|

3.14 % |

| Average interest-earning

assets to interest-bearing liabilities |

|

121.92 |

|

|

125.97 |

| |

|

|

|

|

|

|

| (1) Average yields and rates for

the six months ended June 30, 2011, and 2010 are annualized. |

| (2) Net interest rate spread

represents the difference between the weighted average yield on

interest-earning assets and the weighted average cost of

interest-bearing liabilities. |

| (3) Net interest-earning assets

represent total interest-earning assets less total interest-bearing

liabilities. |

| (4) Net interest margin

represents net interest income divided by average total

interest-earning assets. |

| (5) Includes non-accruing

loans. |

CONTACT: Steven M. Klein

Chief Financial Officer

Tel: (732) 499-7200 ext. 2510

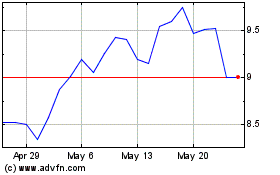

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From May 2024 to Jun 2024

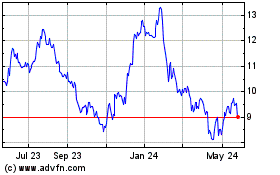

Northfield Bancorp (NASDAQ:NFBK)

Historical Stock Chart

From Jun 2023 to Jun 2024