nCino, Inc. (NASDAQ: NCNO), a pioneer in cloud banking for the

global financial services industry, today announced financial

results for the second quarter of fiscal year 2024, ended

July 31, 2023.

“We are very pleased with our second quarter results and in

particular, the strong rebound in sales activity we saw across the

business,” said Pierre Naudé, Chairman and CEO of nCino. “Our

profitability again exceeded expectations even as we continue to

strategically invest in expanding our platform and solutions. With

the liquidity crisis in the U.S. banking industry largely behind

us, and financial institutions around the world focused on

improving their operational efficiency and customer experience, we

look for the momentum we saw in the second quarter to continue for

the balance of the year and beyond.”

Financial Highlights

- Revenues: Total revenues for the second

quarter of fiscal 2024 were $117.2 million, an 18% increase from

$99.6 million in the second quarter of fiscal 2023. Subscription

revenues for the second quarter were $99.9 million, up from $84.4

million one year ago, an increase of 18%.

- Income (Loss) from Operations: GAAP loss from

operations in the second quarter of fiscal 2024 was $(14.8) million

compared to $(25.0) million in the same quarter of fiscal 2023.

Non-GAAP operating income (loss) in the second quarter was $11.2

million compared to $(2.8) million in the second quarter of fiscal

2023.

- Net Income (Loss) Attributable to nCino: GAAP

net loss attributable to nCino in the second quarter of fiscal 2024

was $(15.9) million compared to $(27.2) million in the second

quarter of fiscal 2023. Non-GAAP net income attributable to nCino

in the second quarter was $9.9 million compared to a $(4.9) million

net loss in the second quarter of fiscal 2023.

- Net Income (Loss) Attributable to nCino per

Share: GAAP net loss attributable to nCino in the second

quarter of fiscal 2024 was $(0.14) per basic and diluted share

compared to $(0.25) per basic and diluted share in the second

quarter of fiscal 2023. Non-GAAP net income attributable to nCino

in the second quarter was $0.09 per diluted share compared to a net

loss of $(0.04) per basic and diluted share in the second quarter

of fiscal 2023.

- Remaining Performance Obligation: Total

Remaining Performance Obligation (RPO) as of July 31, 2023,

was $928.6 million, an increase of 2% from July 31, 2022. RPO

expected to be recognized in the next 24 months was $636.2 million,

an increase of 8% from July 31, 2022.

- Cash: Cash, cash equivalents, and restricted

cash were $103.4 million as of July 31, 2023. During the

second quarter, the Company repaid $15 million under its revolving

credit facility and has no outstanding balance thereunder.

Recent Business Highlights

- Signed first customer in the Middle East:

Working with Accenture, one of the largest banks in the UAE

selected nCino for its Corporate, Commercial and Private Banking

Services.

- Signed a top-10 bank in Australia: Added a

greenfield, top-10 Australian bank for commercial lending and

Commercial Pricing & Profitability.

- Signed a significant expansion deal with a top-10 U.S.

mortgage lender: Expanded our relationship with nCino’s

largest mortgage point-of-sale customer.

- Renewed and expanded agreement with an enterprise bank

in the Netherlands: Signed a 5-year renewal with an

enterprise bank in the Netherlands, expanding their adoption of

nCino for commercial lending.

Financial Outlook nCino is providing

guidance for its third quarter

ending October 31, 2023, as

follows:

- Total revenues between $120.0 million and $121.0 million.

- Subscription revenues between $102.5 million and $103.5

million.

- Non-GAAP operating income between $13.0 million and $15.0

million.

- Non-GAAP net income attributable to nCino per share of $0.10

and $0.12.

nCino is providing guidance for its fiscal year

2024 ending

January 31, 2024, as

follows:

- Total revenues between $475.0 million and $478.5 million.

- Subscription revenues between $406.0 million and $409.0

million.

- Non-GAAP operating income between $51.0 million and $54.0

million.

- Non-GAAP net income attributable to nCino per share of $0.38 to

$0.41.

Conference CallnCino will host a conference

call at 4:30 p.m. ET today to discuss its financial results and

outlook. The conference call will be available via live webcast and

replay at the Investor Relations section of nCino’s website:

https://investor.ncino.com/news-events/events-and-presentations.

About nCinonCino (NASDAQ: NCNO) is the

worldwide leader in cloud banking. Through its single

software-as-a-service (SaaS) platform, nCino helps financial

institutions serving corporate and commercial, small business,

consumer, and mortgage customers modernize and more effectively

onboard clients, make loans, manage the loan lifecycle, and open

accounts. Transforming how financial institutions operate through

innovation, reputation and speed, nCino is partnered with more than

1,850 financial services providers globally. For more information,

visit www.ncino.com.

Forward-Looking Statements:This press release

contains forward-looking statements about nCino's financial and

operating results, which include statements regarding nCino’s

future performance, outlook, guidance, the assumptions underlying

those statements, the benefits from the use of nCino’s solutions,

our strategies, and general business conditions. Forward-looking

statements generally include actions, events, results, strategies

and expectations and are often identifiable by use of the words

“believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,”

“estimates,” “projects,” “may,” “will,” “could,” “might,” or

“continues” or similar expressions and the negatives thereof. Any

forward-looking statements contained in this press release are

based upon nCino’s historical performance and its current plans,

estimates, and expectations and are not a representation that such

plans, estimates, or expectations will be achieved. These

forward-looking statements represent nCino’s expectations as of the

date of this press release. Subsequent events may cause these

expectations to change and, except as may be required by law, nCino

does not undertake any obligation to update or revise these

forward-looking statements. These forward-looking statements are

subject to known and unknown risks and uncertainties that may cause

actual results to differ materially including, but not limited to

risks associated with (i) adverse changes in the financial services

industry, including as a result of customer consolidation or bank

failures; (ii) adverse changes in economic, regulatory, or market

conditions, including as a direct or indirect consequence of higher

interest rates; (iii) risks associated with the acquisition of

SimpleNexus, (iv) breaches in our security measures or unauthorized

access to our customers’ or their clients' data; (v) the accuracy

of management’s assumptions and estimates; (vi) our ability to

attract new customers and succeed in having current customers

expand their use of our solution; (vii) competitive factors,

including pricing pressures, consolidation among competitors, entry

of new competitors, the launch of new products and marketing

initiatives by our competitors, and difficulty securing rights to

access or integrate with third party products or data used by our

customers; (viii) the rate of adoption of our newer solutions and

the results of our efforts to sustain or expand the use and

adoption of our more established solutions; (ix) fluctuation of our

results of operations, which may make period-to-period comparisons

less meaningful; (x) our ability to manage our growth effectively

including expanding outside of the United States; (xi) adverse

changes in our relationship with Salesforce; (xii) our ability to

successfully acquire new companies and/or integrate acquisitions

into our existing organization, including SimpleNexus; (xiii) the

loss of one or more customers, particularly any of our larger

customers, or a reduction in the number of users our customers

purchase access and use rights for; (xiv) system unavailability,

system performance problems, or loss of data due to disruptions or

other problems with our computing infrastructure or the

infrastructure we rely on that is operated by third parties; (xv)

our ability to maintain our corporate culture and attract and

retain highly skilled employees; and (xvi) the outcome and impact

of legal proceedings and related fees and expenses.

Additional risks and uncertainties that could affect nCino’s

business and financial results are included in our reports filed

with the U.S. Securities and Exchange Commission (available on our

web site at www.ncino.com or the SEC's web site at www.sec.gov).

Further information on potential risks that could affect actual

results will be included in other filings nCino makes with the SEC

from time to time.

nCino, Inc.CONDENSED

CONSOLIDATED BALANCE SHEETS(In thousands)(Unaudited)

| |

January 31, 2023 |

|

July 31, 2023 |

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

82,036 |

|

|

$ |

98,003 |

|

|

Accounts receivable, net |

|

99,497 |

|

|

|

80,901 |

|

|

Costs capitalized to obtain revenue contracts, current portion,

net |

|

9,386 |

|

|

|

9,495 |

|

|

Prepaid expenses and other current assets |

|

16,274 |

|

|

|

20,976 |

|

|

Total current assets |

|

207,193 |

|

|

|

209,375 |

|

| Property and equipment,

net |

|

84,442 |

|

|

|

81,938 |

|

| Operating lease right-of-use

assets, net |

|

10,508 |

|

|

|

8,232 |

|

| Costs capitalized to obtain

revenue contracts, noncurrent, net |

|

18,229 |

|

|

|

16,263 |

|

| Goodwill |

|

839,440 |

|

|

|

839,042 |

|

| Intangible assets, net |

|

152,825 |

|

|

|

138,655 |

|

| Investments |

|

6,531 |

|

|

|

6,531 |

|

| Long-term prepaid expenses and

other assets |

|

8,101 |

|

|

|

1,579 |

|

|

Total assets |

$ |

1,327,269 |

|

|

$ |

1,301,615 |

|

| Liabilities,

redeemable non-controlling interest, and stockholders’

equity |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

11,878 |

|

|

$ |

9,783 |

|

|

Accrued compensation and benefits |

|

22,623 |

|

|

|

12,385 |

|

|

Accrued expenses and other current liabilities |

|

10,897 |

|

|

|

11,995 |

|

|

Deferred revenue, current portion |

|

154,871 |

|

|

|

169,314 |

|

|

Financing obligations, current portion |

|

1,015 |

|

|

|

1,384 |

|

|

Operating lease liabilities, current portion |

|

3,874 |

|

|

|

3,446 |

|

|

Total current liabilities |

|

205,158 |

|

|

|

208,307 |

|

| Operating lease liabilities,

noncurrent |

|

7,282 |

|

|

|

5,821 |

|

| Deferred income taxes,

noncurrent |

|

2,797 |

|

|

|

2,919 |

|

| Revolving credit facility,

noncurrent |

|

30,000 |

|

|

|

— |

|

| Financing obligations,

noncurrent |

|

54,365 |

|

|

|

53,432 |

|

|

Total liabilities |

|

299,602 |

|

|

|

270,479 |

|

| Commitments and

contingencies |

|

|

|

| Redeemable non-controlling

interest |

|

3,589 |

|

|

|

2,995 |

|

| Stockholders’ equity |

|

|

|

|

Common stock |

|

56 |

|

|

|

56 |

|

|

Additional paid-in capital |

|

1,333,669 |

|

|

|

1,364,757 |

|

|

Accumulated other comprehensive income |

|

694 |

|

|

|

844 |

|

|

Accumulated deficit |

|

(310,341 |

) |

|

|

(337,516 |

) |

|

Total stockholders’ equity |

|

1,024,078 |

|

|

|

1,028,141 |

|

|

Total liabilities, redeemable non-controlling interest, and

stockholders’ equity |

$ |

1,327,269 |

|

|

$ |

1,301,615 |

|

nCino, Inc.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In thousands, except

share and per share data)(Unaudited)

| |

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

|

|

Subscription |

$ |

84,445 |

|

|

$ |

99,897 |

|

|

$ |

163,634 |

|

|

$ |

197,237 |

|

|

Professional services and other |

|

15,182 |

|

|

|

17,339 |

|

|

|

30,204 |

|

|

|

33,671 |

|

|

Total revenues |

|

99,627 |

|

|

|

117,236 |

|

|

|

193,838 |

|

|

|

230,908 |

|

| Cost of

revenues |

|

|

|

|

|

|

|

|

Subscription |

|

26,145 |

|

|

|

29,719 |

|

|

|

51,655 |

|

|

|

58,876 |

|

|

Professional services and other |

|

15,076 |

|

|

|

18,328 |

|

|

|

29,868 |

|

|

|

35,359 |

|

|

Total cost of revenues |

|

41,221 |

|

|

|

48,047 |

|

|

|

81,523 |

|

|

|

94,235 |

|

|

Gross profit |

|

58,406 |

|

|

|

69,189 |

|

|

|

112,315 |

|

|

|

136,673 |

|

|

Gross margin % |

|

59 |

% |

|

|

59 |

% |

|

|

58 |

% |

|

|

59 |

% |

| Operating

expenses |

|

|

|

|

|

|

|

|

Sales and marketing |

|

32,512 |

|

|

|

32,164 |

|

|

|

61,851 |

|

|

|

62,105 |

|

|

Research and development |

|

29,701 |

|

|

|

29,889 |

|

|

|

58,816 |

|

|

|

58,084 |

|

|

General and administrative |

|

21,199 |

|

|

|

21,930 |

|

|

|

43,885 |

|

|

|

39,905 |

|

|

Total operating expenses |

|

83,412 |

|

|

|

83,983 |

|

|

|

164,552 |

|

|

|

160,094 |

|

|

Loss from operations |

|

(25,006 |

) |

|

|

(14,794 |

) |

|

|

(52,237 |

) |

|

|

(23,421 |

) |

| Non-operating income

(expense) |

|

|

|

|

|

|

|

|

Interest income |

|

26 |

|

|

|

835 |

|

|

|

28 |

|

|

|

1,372 |

|

|

Interest expense |

|

(631 |

) |

|

|

(1,044 |

) |

|

|

(1,269 |

) |

|

|

(2,423 |

) |

|

Other income (expense), net |

|

(1,014 |

) |

|

|

469 |

|

|

|

(2,587 |

) |

|

|

(313 |

) |

|

Loss before income taxes |

|

(26,625 |

) |

|

|

(14,534 |

) |

|

|

(56,065 |

) |

|

|

(24,785 |

) |

|

Income tax provision |

|

799 |

|

|

|

1,545 |

|

|

|

1,362 |

|

|

|

2,938 |

|

|

Net loss |

|

(27,424 |

) |

|

|

(16,079 |

) |

|

|

(57,427 |

) |

|

|

(27,723 |

) |

|

Net loss attributable to redeemable non-controlling interest |

|

(307 |

) |

|

|

(268 |

) |

|

|

(651 |

) |

|

|

(548 |

) |

|

Adjustment attributable to redeemable non-controlling interest |

|

128 |

|

|

|

73 |

|

|

|

1,157 |

|

|

|

(48 |

) |

|

Net loss attributable to nCino, Inc. |

$ |

(27,245 |

) |

|

$ |

(15,884 |

) |

|

$ |

(57,933 |

) |

|

$ |

(27,127 |

) |

| Net loss per share

attributable to nCino, Inc.: |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.25 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.24 |

) |

| Weighted average

number of common shares outstanding: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

110,391,865 |

|

|

|

112,396,716 |

|

|

|

110,198,509 |

|

|

|

112,262,527 |

|

nCino, Inc.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In

thousands)(Unaudited)

| |

Six Months Ended July 31, |

|

|

|

2022 |

|

|

|

2023 |

|

| Cash flows from operating

activities |

|

|

|

|

Net loss attributable to nCino, Inc. |

$ |

(57,933 |

) |

|

$ |

(27,127 |

) |

|

Net loss and adjustment attributable to redeemable non-controlling

interest |

|

506 |

|

|

|

(596 |

) |

|

Net loss |

|

(57,427 |

) |

|

|

(27,723 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

|

16,882 |

|

|

|

18,297 |

|

|

Non-cash operating lease costs |

|

2,001 |

|

|

|

2,421 |

|

|

Amortization of costs capitalized to obtain revenue contracts |

|

4,031 |

|

|

|

4,869 |

|

|

Amortization of debt issuance costs |

|

85 |

|

|

|

92 |

|

|

Stock-based compensation |

|

25,971 |

|

|

|

26,146 |

|

|

Deferred income taxes |

|

480 |

|

|

|

790 |

|

|

Provision for bad debt |

|

154 |

|

|

|

756 |

|

|

Net foreign currency losses (gains) |

|

2,635 |

|

|

|

(38 |

) |

|

Loss on disposal of property and equipment |

|

— |

|

|

|

144 |

|

|

Change in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

5,415 |

|

|

|

18,446 |

|

|

Costs capitalized to obtain revenue contracts |

|

(4,571 |

) |

|

|

(3,002 |

) |

|

Prepaid expenses and other assets |

|

(1,651 |

) |

|

|

1,051 |

|

|

Accounts payable |

|

(1,890 |

) |

|

|

(1,406 |

) |

|

Accrued expenses and other current liabilities |

|

(9,653 |

) |

|

|

(9,313 |

) |

|

Deferred revenue |

|

30,327 |

|

|

|

13,772 |

|

|

Operating lease liabilities |

|

(2,070 |

) |

|

|

(2,035 |

) |

|

Net cash provided by operating activities |

|

10,719 |

|

|

|

43,267 |

|

| Cash flows from investing

activities |

|

|

|

|

Acquisition of assets |

|

— |

|

|

|

(356 |

) |

|

Purchases of property and equipment |

|

(9,303 |

) |

|

|

(2,464 |

) |

|

Net cash used in investing activities |

|

(9,303 |

) |

|

|

(2,820 |

) |

| Cash flows from financing

activities |

|

|

|

|

Proceeds from borrowings on revolving credit facility |

|

20,000 |

|

|

|

— |

|

|

Payments on revolving credit facility |

|

(20,000 |

) |

|

|

(30,000 |

) |

|

Payments of debt issuance costs |

|

(367 |

) |

|

|

— |

|

|

Exercise of stock options |

|

1,856 |

|

|

|

2,204 |

|

|

Stock issuance under the employee stock purchase plan |

|

2,424 |

|

|

|

2,698 |

|

|

Principal payments on financing obligations |

|

(303 |

) |

|

|

(564 |

) |

|

Net cash provided by (used in) financing

activities |

|

3,610 |

|

|

|

(25,662 |

) |

|

Effect of foreign currency exchange rate changes on cash, cash

equivalents, and restricted cash |

|

(1,895 |

) |

|

|

1,166 |

|

|

Net increase in cash, cash equivalents, and restricted

cash |

|

3,131 |

|

|

|

15,951 |

|

|

Cash, cash equivalents, and restricted cash, beginning of

period |

|

88,399 |

|

|

|

87,418 |

|

|

Cash, cash equivalents, and restricted cash, end of

period |

$ |

91,530 |

|

|

$ |

103,369 |

|

| |

|

|

|

|

Reconciliation of cash, cash equivalents, and restricted

cash, end of period: |

|

|

|

|

Cash and cash equivalents |

$ |

86,148 |

|

|

$ |

98,003 |

|

|

Restricted cash included in prepaid expenses and other current

assets |

|

— |

|

|

|

5,162 |

|

|

Restricted cash included in other long-term assets |

|

5,382 |

|

|

|

204 |

|

|

Total cash, cash equivalents, and restricted cash, end of

period |

$ |

91,530 |

|

|

$ |

103,369 |

|

Non-GAAP Financial MeasuresIn nCino’s public

disclosures, nCino has provided non-GAAP measures, which are

measurements of financial performance that have not been prepared

in accordance with generally accepted accounting principles in the

United States, or GAAP. In addition to its GAAP measures, nCino

uses these non-GAAP financial measures internally for budgeting and

resource allocation purposes and in analyzing our financial

results. For the reasons set forth below, nCino believes that

excluding the following items provides information that is helpful

in understanding our operating results, evaluating our future

prospects, comparing our financial results across accounting

periods, and comparing our financial results to our peers, many of

which provide similar non-GAAP financial measures.

- Amortization of Purchased Intangibles. nCino incurs

amortization expense for purchased intangible assets in connection

with certain mergers and acquisitions. Because these costs have

already been incurred, cannot be recovered, are non-cash, and are

affected by the inherent subjective nature of purchase price

allocations, nCino excludes these expenses for our internal

management reporting processes. nCino’s management also finds it

useful to exclude these charges when assessing the appropriate

level of various operating expenses and resource allocations when

budgeting, planning and forecasting future periods. Although nCino

excludes amortization expense for purchased intangibles from these

non-GAAP measures, management believes it is important for

investors to understand that such intangible assets were recorded

as part of purchase accounting and contribute to revenue

generation.

- Stock-Based Compensation Expenses. nCino excludes stock-based

compensation expenses primarily because they are non-cash expenses

that nCino excludes from our internal management reporting

processes. nCino’s management also finds it useful to exclude these

expenses when they assess the appropriate level of various

operating expenses and resource allocations when budgeting,

planning and forecasting future periods. Moreover, because of

varying available valuation methodologies, subjective assumptions

and the variety of award types that companies can use, nCino

believes excluding stock-based compensation expenses allows

investors to make meaningful comparisons between our recurring core

business operating results and those of other companies.

- Acquisition-Related Expenses. nCino excludes expenses related

to acquisitions as they limit comparability of operating results

with prior periods. We believe these costs are non-recurring in

nature and outside the ordinary course of business.

- Litigation Expenses. nCino excludes fees and expenses related

to litigation expenses incurred from legal matters outside the

ordinary course of our business as we believe their exclusion from

non-GAAP operating expenses will facilitate a more meaningful

explanation of operating results and comparisons with prior period

results.

- Restructuring Costs. nCino excludes costs incurred related to

bespoke restructuring plans and other one-time costs that are

fundamentally different in strategic nature and frequency from

ongoing initiatives. We believe excluding these costs facilitates a

more consistent comparison of operating performance over time.

- Income Tax Effect on Non-GAAP Adjustments. The income tax

effects are related to the imputed tax impact on the difference

between GAAP and non-GAAP costs and expenses.

- Adjustment to Redeemable Non-Controlling Interest. nCino

adjusts the value of redeemable non-controlling interest of its

joint venture nCino K.K. in accordance with the operating agreement

for that entity. nCino believes investors benefit from an

understanding of the company’s operating results absent the effect

of this adjustment, and for comparability, has reconciled this

adjustment for previously reported non-GAAP results.

There are limitations to using non-GAAP financial measures

because non-GAAP financial measures are not prepared in accordance

with GAAP and may be different from non-GAAP financial measures

provided by other companies. The non-GAAP financial measures are

limited in value because they exclude certain items that may have a

material impact upon our reported financial results. In addition,

they are subject to inherent limitations as they reflect the

exercise of judgments by nCino’s management about which items are

adjusted to calculate its non-GAAP financial measures. nCino

compensates for these limitations by analyzing current and future

results on a GAAP basis as well as a non-GAAP basis and also by

providing GAAP measures in its public disclosures. Non-GAAP

financial measures should not be considered in isolation from, or

as a substitute for, financial information prepared in accordance

with GAAP. nCino encourages investors and others to review our

financial information in its entirety, not to rely on any single

financial measure to evaluate our business, and to view our

non-GAAP financial measures in conjunction with the most directly

comparable GAAP financial measures. A reconciliation of GAAP to the

non-GAAP financial measures has been provided in the tables

below.

nCino,

Inc.RECONCILIATION OF GAAP TO NON-GAAP

MEASURES(In thousands, except share and per share

data)(Unaudited)

| |

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

| GAAP total

revenues |

$ |

99,627 |

|

|

$ |

117,236 |

|

|

$ |

193,838 |

|

|

$ |

230,908 |

|

| |

|

|

|

|

|

|

|

| GAAP cost of

subscription revenues |

$ |

26,145 |

|

|

$ |

29,719 |

|

|

$ |

51,655 |

|

|

$ |

58,876 |

|

|

Amortization expense - developed technology |

|

(4,256 |

) |

|

|

(4,190 |

) |

|

|

(8,518 |

) |

|

|

(8,441 |

) |

|

Stock-based compensation |

|

(352 |

) |

|

|

(485 |

) |

|

|

(728 |

) |

|

|

(799 |

) |

|

Restructuring charges |

|

— |

|

|

|

(21 |

) |

|

|

— |

|

|

|

(39 |

) |

| Non-GAAP cost of

subscription revenues |

$ |

21,537 |

|

|

$ |

25,023 |

|

|

$ |

42,409 |

|

|

$ |

49,597 |

|

| |

|

|

|

|

|

|

|

| GAAP cost of

professional services and other revenues |

$ |

15,076 |

|

|

$ |

18,328 |

|

|

$ |

29,868 |

|

|

$ |

35,359 |

|

|

Amortization expense - other |

|

— |

|

|

|

(83 |

) |

|

|

— |

|

|

|

(165 |

) |

|

Stock-based compensation |

|

(1,915 |

) |

|

|

(2,460 |

) |

|

|

(3,786 |

) |

|

|

(4,089 |

) |

|

Restructuring charges |

|

— |

|

|

|

(46 |

) |

|

|

— |

|

|

|

(92 |

) |

| Non-GAAP cost of

professional services and other revenues |

$ |

13,161 |

|

|

$ |

15,739 |

|

|

$ |

26,082 |

|

|

$ |

31,013 |

|

| |

|

|

|

|

|

|

|

| GAAP gross

profit |

$ |

58,406 |

|

|

$ |

69,189 |

|

|

$ |

112,315 |

|

|

$ |

136,673 |

|

|

Amortization expense - developed technology |

|

4,256 |

|

|

|

4,190 |

|

|

|

8,518 |

|

|

|

8,441 |

|

|

Amortization expense - other |

|

— |

|

|

|

83 |

|

|

|

— |

|

|

|

165 |

|

|

Stock-based compensation |

|

2,267 |

|

|

|

2,945 |

|

|

|

4,514 |

|

|

|

4,888 |

|

|

Restructuring charges |

|

— |

|

|

|

67 |

|

|

|

— |

|

|

|

131 |

|

| Non-GAAP gross

profit |

$ |

64,929 |

|

|

$ |

76,474 |

|

|

$ |

125,347 |

|

|

$ |

150,298 |

|

| |

|

|

|

|

|

|

|

| The following

table sets forth reconciling items as a percentage of total revenue

for the periods presented.1 |

| GAAP gross margin

% |

|

59 |

% |

|

|

59 |

% |

|

|

58 |

% |

|

|

59 |

% |

|

Amortization expense - developed technology |

|

4 |

|

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

|

Amortization expense - other |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation |

|

2 |

|

|

|

3 |

|

|

|

2 |

|

|

|

2 |

|

|

Restructuring charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP gross margin

% |

|

65 |

% |

|

|

65 |

% |

|

|

65 |

% |

|

|

65 |

% |

| |

|

|

|

|

|

|

|

| GAAP sales &

marketing expense |

$ |

32,512 |

|

|

$ |

32,164 |

|

|

$ |

61,851 |

|

|

$ |

62,105 |

|

|

Amortization expense - customer relationships |

|

(2,168 |

) |

|

|

(2,167 |

) |

|

|

(4,335 |

) |

|

|

(4,335 |

) |

|

Amortization expense - trade name |

|

(604 |

) |

|

|

(604 |

) |

|

|

(1,208 |

) |

|

|

(1,208 |

) |

|

Stock-based compensation |

|

(3,447 |

) |

|

|

(3,830 |

) |

|

|

(6,818 |

) |

|

|

(7,041 |

) |

|

Restructuring charges |

|

— |

|

|

|

(38 |

) |

|

|

— |

|

|

|

(76 |

) |

| Non-GAAP sales &

marketing expense |

$ |

26,293 |

|

|

$ |

25,525 |

|

|

$ |

49,490 |

|

|

$ |

49,445 |

|

| |

|

|

|

|

|

|

|

| GAAP research &

development expense |

$ |

29,701 |

|

|

$ |

29,889 |

|

|

$ |

58,816 |

|

|

$ |

58,084 |

|

|

Stock-based compensation |

|

(2,613 |

) |

|

|

(4,279 |

) |

|

|

(5,445 |

) |

|

|

(7,279 |

) |

|

Restructuring charges |

|

— |

|

|

|

(131 |

) |

|

|

— |

|

|

|

(265 |

) |

| Non-GAAP research

& development expense |

$ |

27,088 |

|

|

$ |

25,479 |

|

|

$ |

53,371 |

|

|

$ |

50,540 |

|

| |

|

|

|

|

|

|

|

| GAAP general &

administrative expense |

$ |

21,199 |

|

|

$ |

21,930 |

|

|

$ |

43,885 |

|

|

$ |

39,905 |

|

|

Stock-based compensation |

|

(4,344 |

) |

|

|

(4,227 |

) |

|

|

(9,194 |

) |

|

|

(6,938 |

) |

|

Acquisition-related expenses |

|

(387 |

) |

|

|

(212 |

) |

|

|

(1,884 |

) |

|

|

(423 |

) |

|

Litigation expenses |

|

(2,136 |

) |

|

|

(3,204 |

) |

|

|

(3,868 |

) |

|

|

(4,349 |

) |

|

Restructuring charges |

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

(5 |

) |

| Non-GAAP general &

administrative expense |

$ |

14,332 |

|

|

$ |

14,285 |

|

|

$ |

28,939 |

|

|

$ |

28,190 |

|

| |

|

|

|

|

|

|

|

| GAAP loss from

operations |

$ |

(25,006 |

) |

|

$ |

(14,794 |

) |

|

$ |

(52,237 |

) |

|

$ |

(23,421 |

) |

|

Amortization of intangible assets |

|

7,028 |

|

|

|

7,044 |

|

|

|

14,061 |

|

|

|

14,149 |

|

|

Stock-based compensation |

|

12,671 |

|

|

|

15,281 |

|

|

|

25,971 |

|

|

|

26,146 |

|

|

Acquisition-related expenses |

|

387 |

|

|

|

212 |

|

|

|

1,884 |

|

|

|

423 |

|

|

Litigation expenses |

|

2,136 |

|

|

|

3,204 |

|

|

|

3,868 |

|

|

|

4,349 |

|

|

Restructuring charges |

|

— |

|

|

|

238 |

|

|

|

— |

|

|

|

477 |

|

| Non-GAAP operating

income (loss) |

$ |

(2,784 |

) |

|

$ |

11,185 |

|

|

$ |

(6,453 |

) |

|

$ |

22,123 |

|

| |

|

|

|

|

|

|

|

| The following

table sets forth reconciling items as a percentage of total revenue

for the periods presented.1 |

| GAAP operating margin

% |

(25)% |

|

(13)% |

|

(27)% |

|

(10)% |

|

Amortization of intangible assets |

|

7 |

|

|

|

6 |

|

|

|

7 |

|

|

|

6 |

|

|

Stock-based compensation |

|

13 |

|

|

|

13 |

|

|

|

13 |

|

|

|

11 |

|

|

Acquisition-related expenses |

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

Litigation expenses |

|

2 |

|

|

|

3 |

|

|

|

2 |

|

|

|

2 |

|

|

Restructuring charges |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-GAAP operating

margin % |

(3)% |

|

|

10 |

% |

|

(3)% |

|

|

10 |

% |

| |

|

|

|

|

|

|

|

| GAAP net loss

attributable to nCino |

$ |

(27,245 |

) |

|

$ |

(15,884 |

) |

|

$ |

(57,933 |

) |

|

$ |

(27,127 |

) |

|

Amortization of intangible assets |

|

7,028 |

|

|

|

7,044 |

|

|

|

14,061 |

|

|

|

14,149 |

|

|

Stock-based compensation |

|

12,671 |

|

|

|

15,281 |

|

|

|

25,971 |

|

|

|

26,146 |

|

|

Acquisition-related expenses |

|

387 |

|

|

|

212 |

|

|

|

1,884 |

|

|

|

423 |

|

|

Litigation expenses |

|

2,136 |

|

|

|

3,204 |

|

|

|

3,868 |

|

|

|

4,349 |

|

|

Restructuring charges |

|

— |

|

|

|

238 |

|

|

|

— |

|

|

|

477 |

|

|

Income tax effect on non-GAAP adjustments |

|

(3 |

) |

|

|

(225 |

) |

|

|

(6 |

) |

|

|

(379 |

) |

|

Adjustment attributable to redeemable non-controlling interest |

|

128 |

|

|

|

73 |

|

|

|

1,157 |

|

|

|

(48 |

) |

| Non-GAAP net income

(loss) attributable to nCino |

$ |

(4,898 |

) |

|

$ |

9,943 |

|

|

$ |

(10,998 |

) |

|

$ |

17,990 |

|

| |

|

|

|

|

|

|

|

| Basic and diluted GAAP

net loss attributable to nCino, Inc. per share |

$ |

(0.25 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.24 |

) |

| Weighted-average

shares used to compute basic and diluted GAAP net loss attributable

to nCino, Inc. per share |

|

110,391,865 |

|

|

|

112,396,716 |

|

|

|

110,198,509 |

|

|

|

112,262,527 |

|

| Basic non-GAAP net

income (loss) attributable to nCino, Inc. per share |

$ |

(0.04 |

) |

|

$ |

0.09 |

|

|

$ |

(0.10 |

) |

|

$ |

0.16 |

|

| Weighted-average

shares used to compute basic non-GAAP net income (loss)

attributable to nCino, Inc. per share |

|

110,391,865 |

|

|

|

112,396,716 |

|

|

|

110,198,509 |

|

|

|

112,262,527 |

|

| Diluted non-GAAP net

income (loss) attributable to nCino, Inc. per share |

$ |

(0.04 |

) |

|

$ |

0.09 |

|

|

$ |

(0.10 |

) |

|

$ |

0.16 |

|

| Weighted-average

shares used to compute diluted non-GAAP net income (loss)

attributable to nCino, Inc. per share |

|

110,391,865 |

|

|

|

114,549,192 |

|

|

|

110,198,509 |

|

|

|

114,336,289 |

|

| |

|

|

|

|

|

|

|

| Free cash

flow |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

9,471 |

|

|

$ |

11,964 |

|

|

$ |

10,719 |

|

|

$ |

43,267 |

|

|

Purchases of property and equipment |

|

(4,609 |

) |

|

|

(859 |

) |

|

|

(9,303 |

) |

|

|

(2,464 |

) |

| Free cash

flow |

$ |

4,862 |

|

|

$ |

11,105 |

|

|

$ |

1,416 |

|

|

$ |

40,803 |

|

|

Principal payments on financing obligations2 |

|

(153 |

) |

|

|

(320 |

) |

|

|

(303 |

) |

|

|

(564 |

) |

| Free cash flow less

principal payments on financing obligations |

$ |

4,709 |

|

|

$ |

10,785 |

|

|

$ |

1,113 |

|

|

$ |

40,239 |

|

1Columns may not foot due to rounding.2These amounts represent

the non-interest component of payments towards financing

obligations for facilities.

CONTACTS

INVESTOR CONTACTHarrison MastersnCino+1

910.734.7743Harrison.masters@ncino.com

MEDIA CONTACTNatalia

MoosenCinoNatalia.moose@ncino.com

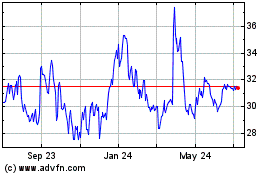

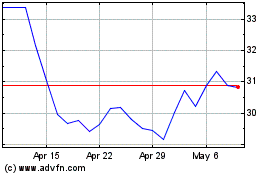

nCino (NASDAQ:NCNO)

Historical Stock Chart

From Apr 2024 to May 2024

nCino (NASDAQ:NCNO)

Historical Stock Chart

From May 2023 to May 2024