UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

☐ |

|

Preliminary Proxy Statement |

|

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

☒ |

|

Definitive Proxy Statement |

|

|

|

☐ |

|

Definitive Additional Materials |

|

|

|

☐ |

|

Soliciting Material Pursuant to §240.14a-12 |

MSP Recovery, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

☒ |

|

No fee required |

|

|

|

☐ |

|

Fee paid previously with preliminary materials |

|

|

|

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Logo 2023 Proxy Statement Notice of Annual Stockholders Meeting

2701 South Le Jeune Road, Floor 10

Coral Gables, Florida 33134

September 22, 2023

Dear fellow LifeWallet stockholders:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of MSP Recovery, Inc. d/b/a LifeWallet (the “Company” or “LifeWallet”) to be held at 10:00 a.m. Eastern Time on Wednesday, November 1, 2023 by means of a live virtual-only on-line webcast.

The accompanying Notice of Annual Meeting and Proxy Statement describe the specific matters to be voted upon during the Annual Meeting. At the meeting, we also will report on our business and provide an opportunity for you to ask questions pertaining to our business.

Whether you own a few or many shares of LifeWallet, and whether or not you plan to attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting. Your vote is important, and we ask that you please cast your vote as soon as possible.

The Board of Directors recommends that you vote: FOR the re-election of all the Class I director nominees, and FOR the ratification of the appointment of Deloitte as the independent registered public accounting firm of the Company for the 2023 fiscal year. Please refer to the accompanying Proxy Statement for detailed information on each of the proposals and the Annual Meeting.

On behalf of the Board of Directors and the officers and employees of LifeWallet, I would like to take this opportunity to thank our stockholders for their continued support of LifeWallet.

|

|

|

|

|

Sincerely, |

|

|

|

|

John H. Ruiz |

|

Chief Executive Officer Chairman of the Board |

|

|

LifeWallet |

TABLE OF CONTENTS

1

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

for MSP Recovery, Inc. d/b/a LifeWallet

September 22, 2023

To the LifeWallet stockholders:

Notice is hereby given that the 2023 Annual Meeting of Stockholders of MSP Recovery, Inc. d/b/a LifeWallet (the “Company”) will be held at 10:00 a.m. Eastern Time on Wednesday, November 1, 2023 by means of a live, virtual-only on-line webcast for the following purposes, as more fully described in the accompanying Proxy Statement:

1.To re-elect the two Class I directors of the Company as Class I directors, each for a term of three years or until their successors are duly elected and qualified or until their earlier resignation or removal;

2.To ratify the appointment of Deloitte as the independent registered public accounting firm of the Company for the 2023 fiscal year; and

3.To transact any other business that is properly presented during the Annual Meeting or any adjournments or postponements of the Annual Meeting.

These proposals are more fully described in the Proxy Statement following this Notice.

The Board of Directors recommends that you vote: (i) FOR the re-election of Roger Meltzer and Beatriz M. Assapimonwait to serve as directors of the Company, and (ii) FOR ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

Along with the attached Proxy Statement, we are sending you copies of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

The Board of Directors has fixed the close of business on September 5, 2023 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting. A list of the stockholders of record as of the close of business on September 5, 2023 will be available for inspection by any of our stockholders for any purpose germane to the Annual Meeting during normal business hours at our principal executive offices, 2701 South Le Jeune Road, Floor 10, Coral Gables, Florida 33134 for a period of ten days prior to the Annual Meeting.

2

We cordially invite you to attend the Annual Meeting. Even if you do not plan to attend the Annual Meeting, we ask that you please cast your vote as soon as possible. As more fully described in the accompanying Proxy Statement, you may revoke your proxy and reclaim your right to vote at any time prior to its use.

|

|

|

By order of the Board of Directors, |

|

John H. Ruiz |

Chief Executive Officer Chairman of the Board |

LifeWallet |

YOUR VOTE IS IMPORTANT

Please vote via the Internet or telephone.

Internet: www.proxyvote.com/LIFW

Phone: 1-866-460-4822

If you request a proxy card, please mark, sign, and date the proxy card when received and

return it promptly in the self-addressed, stamped envelope we will provide.

3

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

NOVEMBER 1, 2023

This Proxy Statement contains information relating to the solicitation of proxies by the Board of Directors (the “Board”) of MSP Recovery, Inc. d/b/a LifeWallet (the “Company” or “LifeWallet”) for use at our 2023 Annual Meeting of Stockholders (“Annual Meeting”). Our Annual Meeting will be held at 10:00 a.m. Eastern Time on Wednesday, November 1, 2023 by means of a live virtual-only on-line webcast.

Only stockholders of record as of the close of business on September 5, 2023 (the “Record Date”) are entitled to receive notice of and vote during the Annual Meeting or any adjournments or postponements of the Annual Meeting. As of the Record Date, there were 332,445,943 shares of Class A common stock outstanding and 3,106,616,119 shares of Class V common stock (the “Common Stock”), issued and outstanding and entitled to vote during the Annual Meeting. In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are furnishing our proxy materials, including this proxy statement and our Form 10-K for the year ended December 31, 2022, to our stockholders via the Internet. On or about September 22, 2023, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) that contains instructions on how to access our proxy materials on the Internet and how to vote. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice of Internet Availability.

All references in this Proxy Statement to “we,” “us,” and “our” refer to MSP Recovery, Inc.

4

ABOUT LIFEWALLET

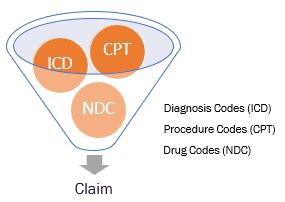

We are a leading data analytics company specializing in healthcare Claims recovery. Our Assignors are healthcare providers and payers (the “Assignors”) that have irrevocably assigned to us their recovery rights associated with certain healthcare Claims. We obtain Claims data from the Assignors and leverage our data analytics capabilities using our Claims recovery platform to identify payments that were improperly paid by our Assignors. We then seek the full recoverable amount from those parties who, under applicable law or contract, were responsible for payment (or reimbursement). Our Assignors fall into three general categories:

Medicare Advantage. Medicare Advantage organizations (“MAOs”) contract with CMS to administer Medicare benefits to Medicare beneficiaries pursuant to Medicare Advantage plans; and MAOs, in turn, contract with Medicare first-tier, downstream, and related entities to assist the MAOs in administering those Medicare benefits.

Medicaid. Health coverage provided to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities.

Commercial Insurance. Employer-sponsored or individual purchased health insurance coverage.

Our assets are generally comprised of recovery rights assigned by our Assignors relating to the improper payment of medical expenses. As opposed to service-based contracts, the entirety of these recovery rights have been irrevocably assigned to us, and because we own these rights, our recovery rights for Claims being pursued cannot be revoked.

Although our Assignors are primarily MAOs, Management Services Organizations (“MSO”) and Independent Practitioner Associations (“IPA”), we also can (and in certain cases do) provide our Claims recovery services to other entities such as:

• Health Maintenance Organizations

• Accountable Care Organizations

• Physicians

• Home Healthcare Facilities

• Self-Funded Plans

• States and Municipalities

• Skilled Nursing Facilities

• Hospitals/Health Systems

Our data recovery system operates across a Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) compliant IT platform incorporating the latest in business intelligence and data technology. Due to the sensitive nature of the data we receive from our Assignors, we ensure that our data systems comply with the security and privacy mandates under federal law. In April 2022, Marcum LLP (“Marcum”), a HITRUST authorized External Assessor Organization, completed an independent assessment of MSP Recovery’s system and service commitments, concluding that our system met the requirements to satisfy the applicable trust services criteria and HITRUST CSF criteria. This independent assessment verifies that we met the healthcare industry’s highest standards in protecting healthcare information and mitigating this risk, including compliance with HIPAA rules and regulations. On March 2, 2023, Marcum provided MSP Recovery a report demonstrating that our data recovery system’s commitments and system requirements meet or exceed the stringent SOC 2 Type II applicable trust services criteria. For our cloud computing services, we currently use the HITRUST certified Amazon Web Services (“AWS”).

5

The Company’s History

In April 2014, MSP Recovery’s predecessor, La Ley Recovery Systems, entered into its first assignment agreement. Later that year, MSP Recovery, LLC was founded to provide data driven solutions, and La Ley Recovery Systems filed its first lawsuit against a primary payer—Allstate Insurance Company. In late 2014, we entered into assignment agreements with our second and third Assignors. To date, we have over 160 Assignors. We have been assigned recovery rights associated with claims from all 50 states, as well as Puerto Rico.

Since 2014, we have had significant legal victories, including several significant federal appellate court wins. In these opinions, the courts agreed with us on a variety of key issues, holding that downstream entities, such as MSOs and IPAs have standing to sue primary plans under the Medicare Secondary Payer Act (“MSP Act”) and associated federal regulations (collectively, the “MSP Laws”); and that a settlement agreement with a Medicare beneficiary is evidence of constructive knowledge that the primary payer had reimbursement obligations.

Our Claims Recovery Model: Discover. Recover.

|

|

Discover. We believe our access to large volumes of data, sophisticated data analytics, and a leading technology platform provide a unique ability to discover potentially recoverable claims. Using Algorithms, we identify fraud, waste, and abuse in the Medicare, Medicaid, and commercial insurance segments. Our Algorithms have identified what we estimate to be significant value in potentially recoverable claims. Of the amount spent yearly by Medicare on medical expenses for its beneficiaries, we estimate that at least 10% are improper payments by private Medicare Advantage plans where a primary payer was responsible to make the payment. We seek recoveries of the billed amount from responsible primary payers, and in some instances, double damages and statutory interest pursuant to the MSP Laws. |

|

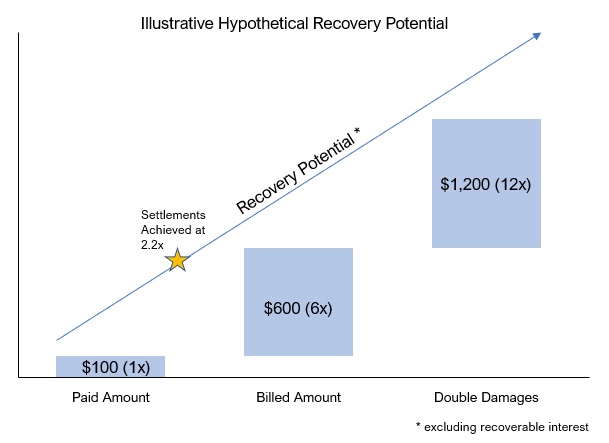

Recover. We receive our recovery rights through irrevocable assignments. We pursue recoveries using a variety of methods, including, but not limited to, demand letters, litigation, private lien resolution programs, and the submission of Claims to mass tort or antitrust settlement coordinators. We quantify and pursue recoveries based on the billed amount (or full commercial value) of service rendered, as opposed to discounted paid amounts based on Medicaid or Medicare rates. Under existing statute and case law, the private cause of action under the MSP Act permits the pursuit of an award of double damages when a primary plan fails to provide for primary payment or appropriate reimbursement. In addition, the Company is entitled to pursue interest pursuant to Section 1862(b)(2)(B)(ii) of the Social Security Act and 42 C.F.R. § 411.24(m), which provides express authority to assess interest on Medicare Secondary Payer debts. As a result, we believe we are positioned to generate substantial annual recovery revenue at high profit margins for our assigned Claims. The below graphic demonstrates the difference between the Paid Amount, the Billed Amount, and the potential for double damages.

The LifeWallet Ecosystem

In January 2022, the Company announced the launch of LifeWallet—a versatile, scalable, and expandable ecosystem, where tokenized data is stored in a secure, user friendly platform with multiple

6

applications. LifeWallet is expected to provide real-time analytics at the point of care, employing sophisticated data analytics to enable informed decision-making and improved patient outcomes. LifeWallet is being engineered to help to identify primary insurers, assisting providers in receiving reasonable and customary rates for accident-related treatment, shortening the company’s collection time frame, and increasing revenue visibility and predictability. The platform aims to avoid the improper documenting of medical claims that can lead to improper billing, thereby preventing fraud, waste, and abuse, and is also expected to provide an application programming interface that allows patients to gain immediate access to all of their medical records when seeking medical treatment. LifeWallet is in continuous development to provide innovative data solutions for a variety of industries, including, but not limited to, sports, education, legal, and healthcare, incorporating extensive privacy and security standards including HIPAA compliance.

For more information about LifeWallet, please refer to our website at www.LifeWallet.com.

7

ABOUT THE MEETING

What is the date, time, and place of the Annual Meeting?

LifeWallet’s 2023 Annual Stockholders’ Meeting will be held on Wednesday, November 1, 2023, beginning at 10:00 a.m. Eastern Time, by means of a live virtual-only on-line webcast.

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will act upon the matters outlined in the notice of meeting on the cover page of this proxy statement, consisting of:

1.To re-elect two Class I directors of the Company as Class I directors, each for a term of three years or until their successors are duly elected and qualified or until their earlier resignation or removal;

2.To ratify the appointment of Deloitte as the independent registered public accounting firm of the Company for the 2023 fiscal year; and

3.To transact any other business that is properly presented during the Annual Meeting or any adjournments or postponements of the Annual Meeting.

Who is entitled to vote at the meeting?

Only our stockholders of record at the close of business on September 5, 2023, the record date for the meeting, are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponement(s) or adjournment(s) of the meeting. As of the record date, there were 332,445,943 shares of Class A common stock outstanding and 3,106,616,119 shares of Class V common stock outstanding , all of which are entitled to be voted at the Annual Meeting.

A list of stockholders will be available at our headquarters at 2701 South Le Jeune Road, Floor 10, Coral Gables, Florida 33134 for a period of ten days prior to the Annual Meeting.

What are the voting rights of the holders of our Common Stock?

Holders of our Common Stock are entitled to one vote per share on each matter that is submitted to stockholders for approval.

How can I attend the Annual Meeting?

In order to attend the Annual Meeting, you must register in advance at https://www.proxydocs.com/LIFW. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions during the Annual Meeting. Please be sure to follow instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email. You will find more information on the matters for voting on the following pages.

8

If you are a stockholder of record, you may vote by using the Internet, by telephone, by mail, or during the Annual Meeting via the Internet. If you are a beneficial owner, please follow the voting instructions provided in the notice you receive from your broker, bank, or other nominee, and direct such organization to vote your shares in accordance with your instructions. A beneficial holder may also attend the Annual Meeting, but because a beneficial owner is not a stockholder of record, you may not vote during the Annual Meeting unless you obtain a “legal proxy” from the organization that holds your shares, giving you the right to vote the shares during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank, or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank, or other nominee as part of the registration process.

On the day of the Annual Meeting, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 10:00 a.m. Eastern Time.

What constitutes a quorum?

The presence at the meeting, in person, or by proxy, of the holders of Common Stock representing a majority of the combined voting power of our Common Stock on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, there were 332,445,943 shares of Class A common stock outstanding and 3,106,616,119 shares of Class V common stock outstanding, all of which are entitled to be voted at the annual meeting.

What vote is required to approve each item?

The vote required to elect our two Class I directors named in this proxy statement, each for a three-year term expiring at the 2026 Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes of the shares of Common Stock cast at the Annual Meeting. The vote required for the ratification of the selection of Deloitte as our auditor is the affirmative vote of a majority of the votes cast at the Annual Meeting.

The inspector of election for the Annual Meeting shall determine the number of shares of Common Stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall count and tabulate ballots and votes and determine the results thereof. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum.

A “broker non-vote” will occur when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that proposal and has not received instructions from the beneficial owner. Broker non-votes will not be counted as votes cast for the election of directors, and thus will not have any impact on the results of such elections. On other matters submitted for a vote, including the ratification of the selection of Deloitte as our auditor, broker non-votes will not be counted as votes cast, and abstentions will be treated as a vote “against.” If less than a majority of the combined voting power of the outstanding

9

shares of Common Stock is represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting from time to time without further notice.

What are the Board’s recommendations?

As more fully discussed under Summary of Matters to be Voted On, our Board of Directors recommends a vote FOR the re-election of the two Class I director nominees named in this proxy statement; and a vote FOR the ratification of the selection of Deloitte as auditor.

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth below) will be voted (1) FOR the re-election of our two Class I director nominees named in this proxy statement; and (2) FOR the ratification of the selection of Deloitte as auditor. In the event a stockholder specifies a different choice by means of the enclosed proxy, such shares will be voted in accordance with the specification made.

How do I vote?

You can vote in any of the following ways. Please check your proxy card or contact your broker for voting instructions.

If your shares are registered in your name (as a stockholder of record):

•To vote by Internet or telephone: Log on to the website or call the toll-free number set forth in the notice of meeting mailed to you and follow the instructions.

•To vote by mail: If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope.

•To vote during the meeting: Withdraw your earlier proxy and vote at the Annual Meeting via the Internet.

If your shares are held in “street name”:

You should give instructions to your broker on how to vote your shares. If you do not provide voting instructions to your broker, your broker has discretion to vote those shares on matters that are routine. However, a broker cannot vote shares on non-routine matters without your instructions. This is referred to as a “broker non-vote.” Under the rules of The Nasdaq Stock Market LLC (“Nasdaq”), the Director Election Proposal is non-routine and, as such, a broker does not have the discretion to vote on the Director Election Proposal if such broker has not received instructions from the beneficial owner of the shares represented. The Auditor Ratification Proposal is considered a routine proposal and may be voted in the absence of instructions.

Can I change my vote after I return my proxy card?

Yes. The giving of a proxy does not eliminate the right to vote in person should any stockholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise of that proxy, by voting in person at the Annual Meeting, by filing a written revocation or duly executed proxy bearing a later date with our Secretary at our headquarters.

10

Who pays for costs relating to the proxy materials and Annual Meeting?

The costs of preparing, assembling, and mailing this Proxy Statement, the Notice of Annual Meeting of Stockholders and the enclosed Annual Report and proxy card, along with the cost of posting the proxy materials on a website, are to be borne by us. In addition to the use of mail, our directors, officers, and employees may solicit proxies personally and by telephone, facsimile, and other electronic means. They will receive no compensation in addition to their regular salaries. We may request banks, brokers, and other custodians, nominees, and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing.

11

OWNERSHIP OF SECURITIES

The following table sets forth information known by us regarding the beneficial ownership of the Common Stock as of September 5, 2023, by:

•each person who is known by us to be the beneficial owner of more than 5% of the outstanding shares of Common Stock;

•each of our current Named Executive Officers and directors; and

•all of our current executive officers and directors as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days.

Unless otherwise noted, all information with respect to beneficial ownership has been furnished by the respective five percent or more stockholders, directors or named executive officers, as the case may be. The beneficial ownership percentages set forth in the table below are based on the Common Stock issued and outstanding as of September 5, 2023. Unless otherwise noted, all persons listed below can be reached at MSP Recovery, Inc., 2701 South Le Jeune Road, Floor 10, Coral Gables, Florida 33134.

|

|

|

|

|

Beneficial Stock Ownership Table |

|

Class A Common Stock (1) |

Class V Common Stock (2) |

Beneficial Owner Name |

Number of Shares |

% |

Number of Shares |

% |

Named Executive Officers & Directors |

|

|

|

|

John H. Ruiz (3)(4) |

2,085,176,055 |

94.11% |

2,084,157,566 |

67.09% |

Frank C. Quesada (5)(6) |

901,928,778 |

87.35% |

901,390,330 |

29.02% |

Ricardo Rivera (7) |

46,691 |

* |

- |

|

Alexandra Plasencia (8) |

35,825 |

* |

- |

|

Michael F. Arrigo |

6,355 |

* |

- |

|

Beatriz Assapimonwait |

- |

- |

- |

|

Roger Meltzer (9)(10)(11) |

1,190,000 |

0.90% |

- |

|

Thomas W. Hawkins (9)(12)(13) |

2,420,000 |

1.82% |

- |

|

Ophir Sternberg (14) |

601,617,492 |

82.71% |

- |

|

All directors and officers as a group (9 individuals) |

3,592,421,196 |

98.31% |

2,985,547,896 |

95.75% |

|

|

|

|

|

5% Stockholders |

|

|

|

|

Virage Recovery Master LP (15) |

96,552,851 |

42.47% |

|

|

Oliver SPV Holdings LLC (9)(16) |

59,540,075 |

31.38% |

|

|

Alex Ruiz (17) |

42,000,000 |

31.12% |

|

|

Paul Rapisarda |

21,911,856 |

14.37% |

|

|

JLS Equities LLC (18) |

11,912,499 |

8.36% |

|

|

Jessica Wasserstrom (9)(19) |

9,527,499 |

6.73% |

|

|

Leviathan Group LLC |

8,330,000 |

5.94% |

|

|

John H. Ruiz, II (20) |

7,420,004 |

5.37% |

7,420,004 |

* |

Virage Recovery Participation LP (21) |

17,095,368 |

11.56% |

17,095,368 |

* |

Series MRCS (22) |

413,478,000 |

75.97% |

413,478,000 |

13.11% |

Brickell Key Investments LP (23) |

66,666,666 |

47.01% |

|

|

Cano Health |

200,000,001 |

60.38% |

|

|

12

* Less than one percent (1%)

1.Includes shares of Class A common stock issuable pursuant to derivatives (including Up-C Units and warrants) exercisable within 60 days of September 5, 2023.

2.Includes shares of Class V common stock, which are non-economic voting shares of the Company.

3.Includes 172,489 shares of Class A common stock and 846,000 warrants directly held by Mr. Ruiz. In addition to securities directly held by Mr. Ruiz in his individual capacity, includes shares held by the following entities Jocral Family LLLP, Ruiz Group Holdings Limited, LLC and Series MRCS, a series of MDA, Series LLC, a Delaware series limited liability company (“Series MRCS”), including shares held by Series MRCS for the benefit of Jocral Holdings LLC. Reported figures do not include securities held by John Ruiz II, Mr. Ruiz’s son, in his capacity as a Member, or by Alex Ruiz, Mr. Ruiz’s son, of which Mr. Ruiz disclaims beneficial ownership.

4.Reported figures do not include any attributed ownership based on Mr. Ruiz’s investment in VRM, which have been transferred to affiliated trusts of Mr. Ruiz and of which Mr. Ruiz disclaims beneficial ownership. Messrs. Ruiz and Quesada together invested in VRM, which investment represented a 1.14% ownership interest in VRM. Mr. Ruiz is entitled to 70% of such investment, and Mr. Quesada is entitled to 30% of such investment. As a result, the indirect beneficial ownership attributable to such affiliated trusts would be 0.8% of VRM.

5.Includes 138,909 shares of Class A common stock and 399,539 warrants directly held by Mr. Quesada. In addition to securities directly held by Mr. Quesada in his individual capacity, includes shares held by Quesada Group Holdings LLC and Series MRCS.

6.Reported figures do not include any attributed ownership based on Mr. Quesada’s investment in VRM, which have been transferred to affiliated trusts of Mr. Quesada and of which Mr. Quesada disclaims beneficial ownership. Messrs. Ruiz and Quesada together invested in VRM, which investment represented a 1.14% ownership interest in VRM. Mr. Ruiz is entitled to 70% of such investment, and Mr. Quesada is entitled to 30% of such investment. As a result, the indirect beneficial ownership attributable to such affiliated trusts would be 0.3% of VRM.

7.Includes 46,691 shares of Class A common stock.

8.Consists of 35,825 shares of Class A common stock held by the spouse of Alexandra Plasencia.

9.The business address for each of these individuals is c/o, Lionheart Equities LLC, 4218 NE 2nd Avenue, Miami FL 33137.

10.Roger Meltzer has been a member of the Board since 2021.

11.Beneficial ownership includes 10,000 shares of Class A common stock and 1,180,000 shares of Class A common stock underlying New Warrants.

12.Thomas Hawkins has been a member of the Board since 2021. Beneficial ownership includes (i) 50,000 shares of Class A common stock and 2,360,000 shares of Class A common stock underlying New Warrants held in an individual capacity and (ii) 10,000 shares of Class A common stock and 1,180,000 shares of Class A common stock underlying New Warrants held by the Estate of Steven R. Berrard. Thomas Hawkins holds sole voting and investment control over the shares held by the Estate of Steven R. Berrard as the personal representative.

13.Beneficial ownership includes 50,000 shares of Class A common stock and 2,360,000 shares of Class A common stock underlying New Warrants.

14.Beneficial ownership includes 114,945,825 shares of Class A common stock issuable upon exchange of the Up-C Units.

15.Includes (i) 832,498 shares of Class A common stock and 87,320,000 shares of Class A common stock underlying New Warrants owned by Lionheart Investments, LLC; (ii) 1,000,000 shares of Class A common stock and 118,000,000 shares of Class A common stock underlying New Warrants owned by Star Mountain Equities, LLC; (iii) 2,435,060 shares of Class A common stock and 273,029,937 shares of Class A common stock underlying New Warrants owned by Sponsor; and (iv) 1,000,000 shares of Class A common stock and 118,000,000 shares of Class A common stock underlying New Warrants owned by the 2022 OS Irrevocable Trust. Mr. Sternberg holds sole voting and investment control over the shares held by each of Lionheart Investments, LLC, Star Mountain Equities, LLC, and Sponsor as the sole manager. Mr. Sternberg’s spouse holds sole voting and investment control over the shares owned by the 2022 OS Irrevocable Trust as its trustee and as a result, Mr. Sternberg may be deemed to have beneficial ownership of the shares owned by the 2022 OS Irrevocable Trust.

16.Beneficial ownership includes 58,990,077 shares of Class A common stock underlying New Warrants. Alan Rubenstein holds sole voting and investment control over the shares held by Oliver SPV Holdings, LLC as its manager. The address for Mr. Rubenstein and Oliver SPV Holdings, LLC is 822 Oliver St, Woodmere, NY 11598.

17.Alex Ruiz is the son of John H. Ruiz, the Company’s Chief Executive Officer.

13

18.Beneficial ownership includes 112,499 shares of Class A common stock and 11,800,000 shares of Class A common stock underlying New Warrants. Jacob Sod holds sole voting and investment control over the shares held by JLS Equities LLC as its manager. The address for Jacob Sod and JLS Equities LLC is 58 Larch Hill Rd, Lawrence, NY 11559.

19.Beneficial ownership includes 87,499 shares of Class A common stock and 9,440,000 shares of Class A common stock underlying New Warrants.

20.John H. Ruiz, II is the son of John H. Ruiz, the Company’s Chief Executive Officer. Beneficial ownership includes 7,420,004 shares of Class A common stock issuable upon exchange of the Up-C Units held in an individual capacity.

21.Beneficial ownership includes 5,065,769 shares of Class A common stock issuable upon exchange of the Up-C Units.

22.Includes 124,043,400 Up-C Units held by Series MRCS that are beneficially owned by Frank C. Quesada and 289,434,600 shares beneficially owned by John H. Ruiz (including through his affiliate, Jocral Holdings, LLC).

23.Includes 66,666,666 shares of Class A common stock issuable upon exercise of the CPIA Warrant pursuant to the Amendment and the Warrant Agreement with the Holder.

14

MATTERS TO COME BEFORE THE ANNUAL MEETING

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of seven directors divided into three classes: Class I, Class II and Class III. There are currently two Class I directors, two Class II directors, and three Class III directors, with one class being elected each year to serve a staggered three-year term.

•Class I directors shall serve for a term expiring at the 2023 Annual Meeting of Stockholders;

•Class II directors shall serve for a term expiring at the 2024 Annual Meeting of Stockholders; and

•Class III directors shall serve for a term expiring at the 2025 Annual Meeting of Stockholders.

At this Annual Meeting and each Annual Meeting thereafter, the successors to the class of directors whose terms expire at that meeting would be elected for a term of office to expire at the third succeeding Annual Meeting after their election, or until their successors have been duly elected and qualified.

Our Class I directors are Roger Meltzer and Beatriz M. Assapimonwait; our Class II directors are Michael F. Arrigo and Thomas Hawkins; and our Class III directors are John H. Ruiz, Frank C. Quesada, and Ophir Sternberg.

Our Board of Directors is recommending that Roger Meltzer and Beatriz M. Assapimonwait, our Class I directors, be re-elected to serve for a term until the 2026 Annual Meeting or until their successors are duly elected and qualified or until their earlier resignation or removal. If Roger Meltzer or Beatriz M. Assapimonwait become unavailable for any reason, including a situation which is not anticipated, substitute nominees may be proposed by the Board, and any shares represented by proxy will be voted for the substitute nominee, unless the Board reduces the number of directors.

The following table sets forth certain information concerning the nominees for Class I directors and each of the other members of the Board of Directors:

15

Directors and Executive Officers Summary

Below are the names of and certain information regarding our executive officers and directors:

|

|

|

Directors |

Age |

Position |

John H. Ruiz |

56 |

Class III Director |

Frank C. Quesada |

43 |

Class III Director |

Ophir Sternberg |

53 |

Class III Director |

Beatriz Maria Assapimonwait |

61 |

Class I Director |

Michael Arrigo |

65 |

Class II Director |

Thomas Hawkins |

62 |

Class II Director |

Roger Meltzer |

72 |

Class I Director |

|

|

|

Executive Officers |

|

Position |

John H. Ruiz |

56 |

Chief Executive Officer |

Frank C. Quesada |

43 |

Chief Legal Officer |

Ricardo Rivera |

52 |

Chief Operating Officer & Interim Chief Financial Officer |

Alexandra Plasencia |

38 |

General Counsel |

16

DIRECTORS

|

|

|

|

|

John H. Ruiz |

|

Founder, Chief Executive Officer & Chair of the Board |

|

Director since: 2022 |

|

Age: 56 |

|

Committees: Nominating & Corporate Governance |

Experience: John H. Ruiz is a founder of LifeWallet and has served as Chief Executive Officer since the Company’s inception (in 2014 as MSP Recovery). Mr. Ruiz was named one of Lawyers of Distinction’s “2023 Power Lawyers,” for his accomplishments in healthcare law. He was also named “2019’s DBR Florida Trailblazer,” for his work in integrating data analytics into the practice of law, and for its positive impact on healthcare recoveries across the mainland U.S. and Puerto Rico. Over the course of his 30-year legal career, Mr. Ruiz has gained national recognition in class action, mass tort litigation, MDL consolidated cases, medical malpractice, products liability, personal injury, real estate, and aviation disaster cases. Recently, Mr. Ruiz led the legal strategy in the landmark victory handed down by the U.S. Court of Appeals for the Eleventh Circuit, in MSP Recovery Claims Series v. Ace American (11th Cir.). In addition, he has certified more than 100 class actions and led MSP’s participation in Humana v. Western Heritage (11th Cir.), MSP Recovery v. Allstate (11th Cir.), and MSPA Claims 1, LLC v. Kingsway Amigo Ins. Co. (11th Cir.). Mr. Ruiz has been involved as counsel in cases that have totaled more than $20 billion in settlements. These class actions resulted in some of the largest awards in Florida against major insurance companies. In total, Mr. Ruiz has certified class actions against major car insurers in the State of Florida, resulting in the current and potential redistribution of billions of dollars in improperly paid claims spanning a period of more than 10 years. Starting as early as 1996, Mr. Ruiz filed class-action lawsuits on behalf of more than 30,000 Miami-Dade County residents against the Florida Department of Agriculture for trespassing onto the private properties of homeowners and chopping down their citrus trees without any compensation. The case was ultimately certified, and the Department of Agriculture directly compensated all members of the aggrieved class. In 2001, Mr. Ruiz represented consumers in a class action lawsuit against Firestone that resulted in dozens of fatalities and thousands of serious blowouts. Mr. Ruiz was also hired as local counsel by numerous out of state law firms that had pending cases in Florida courts. The cases in aggregate settled for more than $30 million. Mr. Ruiz also represented the families of crash victims in a wrongful death suit against Chalk’s International Ocean Airway. Mr. Ruiz was the first lawyer to file a limited fund class action. The case settled for a confidential agreed amount. Mr. Ruiz is licensed to practice before the Court of Appeals for the Fourth Circuit, the US Court of Appeals for the Second Circuit, the US Court of Appeals for the Third Circuit, and the Florida Supreme Court.

Skills & Expertise: Mr. Ruiz brings to the Board leadership, legal, strategic, operational, brand management, and data analytics expertise from his expansive legal career, business background, and use of technology in his law practice. He has experience formulating legal strategy and case development from his work leading La Ley con John H. Ruiz. Mr. Ruiz has vast leadership and business strategy experience having founded or led companies across a variety of sectors, including legal, media, aviation, and manufacturing companies. Mr. Ruiz designed and developed information systems that streamlined his law practice and algorithms that analyze terabytes of data to identify and pursue recoveries in a variety of lawsuits. Mr. Ruiz’s mastery of brand development is evidenced by his pioneering of panel format television and radio to reach audiences, and his recent development of LifeWallet Sports to raise brand awareness through college athlete spokespersons.

17

|

|

|

|

|

Frank C. Quesada |

|

Founder & Chief Legal Officer |

|

Director since: 2022 |

|

Age: 43 |

|

Committees: Nominating & Corporate Governance |

Experience: Frank C. Quesada is a founding member of LifeWallet and has served as Chief Legal Officer since its inception. Mr. Quesada is also a Partner at MSP Recovery Law Firm. With over 16 years of healthcare and complex commercial litigation experience, Mr. Quesada oversees LifeWallet’s in-house attorneys and several nationally recognized law firms that assist MSP Recovery Law Firm in their recovery efforts. Additionally, he develops LifeWallet’s legal strategies and spearheads execution. Notably, Mr. Quesada led the execution of federal appellate strategies in MSP Recovery cases resulting in landmark legal victories and new Medicare Secondary Payer Act precedent benefitting Medicare entities across the country. These legal victories include MSP Recovery v. Allstate (11th Cir.), MSPA Claims 1 v. Tenet (11th Cir.), MSPA Claims 1 v. Kingsway Amigo (11th Cir.), and MSP Recovery Claims Series v. Ace American (11th Cir.). Mr. Quesada currently serves on the Board of Directors of USA Water Polo, Inc.

Skills & Expertise: Mr. Quesada brings to the Board leadership, legal, strategic, operational, governmental, business development, and data analytics expertise. Mr. Quesada brings a depth of legal and strategic experience from years of complex commercial litigation. Having served in elected office, Mr. Quesada leverages years of experience navigating the political landscape, creating and influencing policy. This experience carries over to the business world, making Mr. Quesada an effective communicator and advocate on behalf of the Company with bankers and potential clients. Prior to the Company and MSP Recovery Law Firm, Mr. Quesada managed his own law firm, overseeing attorneys with a substantial case load in the hospitality industry.

18

|

|

|

|

|

Ophir Sternberg |

|

Board Member |

|

Director since: 2022 |

|

Age: 53 |

|

|

Experience: Ophir Sternberg is a Board Member of the Company, and was previously the Chairman, President and Chief Executive Officer of Lionheart Acquisition Corporation II, the SPAC through which MSPR became a publicly traded company. Mr. Sternberg is the Founder and Chief Executive Officer of Miami/Fort Lauderdale based Lionheart Capital, founded in 2010. Mr. Sternberg began his career assembling, acquiring, and developing properties in emerging neighborhoods in New York City, which established his reputation for identifying assets with unrealized potential and combining innovative partnerships with efficient financing structures to realize above average returns. Mr. Sternberg came to the United States in 1993 after completing three years of military service within an elite combat unit for the Israeli Defense Forces. In March 2020, Mr. Sternberg became Chairman of Nasdaq-listed OPES, and on June 30, 2020, announced the SPAC’s initial business combination with BurgerFi, a fast-casual “better burger” concept that consists of approximately 120 restaurants nationally and internationally. The OPES-BurgerFi business combination closed on December 16, 2020 and Mr. Sternberg is the Executive Chairman of the post-combination Nasdaq-listed company, BurgerFi International, Inc. (NASDAQ: BFI). On October 11, 2021, BurgerFi, led by Ophir Sternberg as Executive Chairman, announced the acquisition of Anthony’s Coal Fired Pizza & Wings, creating a multi-brand platform of premium casual restaurant concepts. With the acquisition of Anthony’s, BurgerFi now has 180 systemwide restaurant locations across the country through its two premium casual dining brands, with 61 Anthony’s locations and 119 BurgerFi locations. Mr. Sternberg is also the Chairman, President, and Chief Executive Officer of Lionheart III Corp, a SPAC that was originally formed for a $100 million raise, but on November 8, 2021, closed on its initial public offering at an upsized $125 million. Lionheart III Corp, under the ticker symbol LION, was welcomed into the Nasdaq family. On July 26, 2022, Lionheart III announced its business combination agreement with Security Matters Limited (“SMX”) (ASX:SMX), a publicly traded company on the Australian Securities Exchange, bringing the expected combined entity value to $360M. SMX creates a sustainable system within the current supply chain, designed for the 21st century economy. The SMX business combination closed on March 8, 2023.

Skills & Expertise: Mr. Sternberg brings to the Board leadership, strategic, operational, finance and business structuring, and capital markets experience. Mr. Sternberg is qualified to serve as a director due to his extensive experience in both the public and private company sectors. Having successfully launched a number of public companies, Mr. Sternberg is intimately familiar with the capital markets and large scale financing. Mr. Sternberg serves on the board of several public companies, and has led successful corporate growth strategies. Mr. Sternberg’s leadership qualities are demonstrated in his leadership positions over a variety of business sectors, including healthcare, hospitality, and technology.

19

|

|

|

|

|

Beatriz M. Assapimonwait |

|

Board Member |

|

Director since: 2022 |

|

Age: 61 |

|

Committees: Compensation |

Experience: Beatriz (Betty) Assapimonwait has over 40 years of experience in the managed health care industry. Ms. Assapimonwait was, up until August 2021, Regional President for the South Florida region at Humana Inc. (NYSE:HUM) ("Humana"), one of the largest private insurance health insurers in the U.S. with a focus on administering Medicare Advantage plans. In her role at Humana, Ms. Assapimonwait was responsible for developing market strategies and leading all market operations for all Medicare lines of business, including HMOs and PPOs for the South Florida region. Prior to her role at Humana, she served as CEO of Family Physicians of Winter Park, Inc., until its acquisition by Humana, where from December 2016 to July 2019, she led the strategic and operational efforts of a global risk MSO with 22 primary clinics in the Central Florida Region. Additionally, she served as the Vice President of Medicare Advantage Prescription Drug Plans at Aetna, Inc. from November 2014 to November 2016; Chief Operations Officer at Innovacare Health, from January 2014 to October 2014; Founder and President of Seven Stars Quality Healthcare, from July 2013 to December 2013; and Regional President for the North Florida region at Humana, from January 2009 to June 2013. Ms. Assapimonwait was appointed to serve on the board of directors of CareMax Inc. (Nasdaq:CMAX) in September 2021 and also serves as the Chair of the Strategy and Operations Committee since September 2021. She earned her Bachelor of Arts degree from Florida International University in 1983, and is certified in Healthcare Compliance by the Health Care Compliance Association and in HIPAA Compliance from Kennesaw State University. She has won several awards and commendations, including being a Stevie Award Finalist of the American Business Awards for Best Customer Service Organization in 2004 and appointed Preceptor and Clinical Adjunct Faculty for the Healthcare Administration Program in 1997 at the University of Houston-Clear Lake.

Skills & Expertise: Ms. Assapimonwait brings to the Board leadership, strategic, operational, and healthcare industry experience. A proven effective leader, Ms. Assapimonwait has served in director and officer positions for large-scale healthcare companies, leading strategy and operations initiatives. Ms. Assapimonwait has relevant experience in the pharmaceutical industry and with Medicare Advantage drug plans.

20

|

|

|

|

|

Michael F. Arrigo |

|

Board Member |

|

Director since: 2022 |

|

Age: 65 |

|

Committees: Audit, Compensation |

Experience: Michael F. Arrigo is a co-founder and the chief executive officer of No World Borders, Inc., a healthcare data, regulations, and economics firm with clients in the pharmaceutical, medical device, hospital, surgical center, physician group, diagnostic imaging, laboratory and genetic testing, health information technology, and health insurance markets. In his role at No World Borders, Inc., Mr. Arrigo advises MAOs who provide health insurance under Part C of the Medicare Act and serves as an expert witness regarding medical coding and medical billing, fraud damages, HIPAA privacy, and Electronic Health Record software. Prior to his current role, Mr. Arrigo served as Vice President at First American Financial (NYSE: FAF) from October 2002 to February 2007, overseeing eCommerce and regulatory compliance technology initiatives for top mortgage banks; Vice President of Fidelity National Financial (NYSE: FNF) from 2002 to 2003; chief executive officer of one of the first cloud-based billing software companies, Erogo, from 2000 to 2002; Vice President of Marketing for an email encryption and security software company until its acquisition by a company that merged into Axway Software SA (Euronext: AXW.PA) from 1999 to 2000; CEO of LeadersOnline, an online recruiting venture of Heidrick & Struggles from 1997 to 1999; management consultant to Hewlett Packard, Oracle, and Symantec from 1994 to 1997; Vice President of Marketing for a software company acquired by a company that merged into Cincom Systems from 1992 to 1994; Product Manager at Ashton-Tate from 1987 to 1992 responsible for database software products including Microsoft/Sybase SQL Server. Mr. Arrigo earned his Bachelor of Science in Business Administration from the University of Southern California in 1981. His post-graduate studies include biomedical ethics at Harvard Medical School, biomedical informatics at Stanford Medical School, blockchain and crypto-economics at the Massachusetts Institute of Technology, and training as a Certified Professional Medical Auditor (CPMA).

Skills & Expertise: Mr. Arrigo brings to the Board leadership, strategic, regulatory, information technology, finance, and Medicare Advantage industry experience. Mr. Arrigo has broad business experience. A data specialist, Mr. Arrigo is intimately familiar with data management and analysis and across the healthcare industry spectrum. He is admitted as an expert in court in healthcare privacy and cybersecurity (commonly known as HIPAA and the companion regulations such as the ARRA HITECH Act) and led the Sarbanes Oxley internal audit for a public Fortune 100 firm in compliance with the Public Company Accounting Oversight Board (PCAOB) Standards. He qualifies as a financial expert as defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”). Mr. Arrigo has also been admitted by courts as an expert in fair market value physician compensation and corporate governance. Having served in senior leadership positions at a variety of information technology and finance companies, Mr. Arrigo is a proven valuable advisor and strategist.

21

|

|

|

|

|

Thomas Hawkins |

|

Board Member |

|

Director since: 2022 |

|

Age: 62 |

|

Committees: Audit |

Experience: Since March 2023, Thomas Hawkins has served on the board of directors of SMX (Security Matters) Public Limited Company, a technology company that enables materials to carry a history that can be authenticated through organization, use, recycle, and multiple reuse cycles; he is also a member of the company's Risk and Audit Committee. Mr. Hawkins previously served as a Management Consultant for MEDNAX, Inc. from February 2014 to December 2017, after serving as General Counsel and Board Secretary from April 2003 to August 2012. Prior to that, Mr. Hawkins worked for New River Capital Partners as a Partner from January 2000 to March 2003; AutoNation, Inc. as Senior Vice President of Corporate Development from May 1996 to December 1999; Viacom, Inc. as Executive Vice President from September 1994 to May 1996; and Blockbuster Entertainment Corporation as Senior Vice President, General Counsel, and Secretary from October 1989 to September 1994. Mr. Hawkins currently serves on the board of directors of the Alumni Association of the University of Michigan, holding the position of Treasurer and thus leading the Finance Committee of the board. Mr. Hawkins also serves on the board of directors of Jumptuit Inc., a data analytics technology company. Mr. Hawkins received his Juris Doctor from Northwestern University in 1986 and his A.B. in Political Science from the University of Michigan in 1983.

Skills & Expertise: Mr. Hawkins brings to the Board leadership, finance, business, legal, and finance experience. Mr. Hawkins led companies across a variety of industries, including finance, entertainment, information technology, and retail sales. An experienced advisor, Mr. Hawkins is qualified to serve as a director due to his experience as a senior executive and chief legal officer at several public companies (including his experience acquiring companies and in finance) and with counseling and serving on boards of directors.

22

|

|

|

|

|

Roger Meltzer |

|

Board Member |

|

Director since: 2022 |

|

Age: 72 |

|

Committees: Audit |

Experience: Mr. Meltzer practiced law at DLA Piper LLP from 2007 and held various roles: Global Co-Chairman (2015 through 2020), and currently as Chairman Emeritus; Americas Co-Chairman (2013 through 2020); Member, Office of the Chair (2011 through 2020); Member, Global Board (2008 through 2020); Co-Chairman, U.S. Executive Committee (2013 through 2020); Member, U.S. Executive Committee (2007 through 2020); and Global Co-Chairman, Corporate Finance Practice (2007 through 2015). Prior to joining DLA Piper LLP, Mr. Meltzer practiced law at Cahill Gordon & Reindel LLP from 1977 to 2007 where he was a member of the Executive Committee from 1987 through 2007, Co-Administrative Partner and Hiring Partner from 1987 through 1999, and Partner from 1984 through 2007. Mr. Meltzer currently serves on the Advisory Board of Harvard Law School Center on the Legal Profession (May 2015—Present); and the Board of Trustees, New York University Law School (September 2011—Present); and previously served on the Corporate Advisory Board, John Hopkins, Carey Business School (January 2009—December 2012). He has previously served on the board of directors of: Lionheart II Corp (March 2021 to May 2022), Lionheart III Corp (March 2021 to August 2022), Haymaker Acquisition Corp. III (February 2021 to July 2022), certain subsidiaries of Nordic Aviation Capital (December 2021 to April 2022), The Legal Aid Society (November 2013 to January 2020), Hain Celestial Group, Inc. (December 2000 to February 2020), American Lawyer Media (January 2010 to July 2014) and The Coinmach Service Corporation (December 2009 to June 2013). Mr. Meltzer has also received several awards and honors and has been actively involved in philanthropic activity throughout his career. Mr. Meltzer received his Juris Doctor degree in law from New York University School of Law and an A.B. from Harvard College. In February 2021, Mr. Meltzer joined the board of directors of Haymaker Acquisition Corp. 4, a special purpose acquisition company focused on identifying and implementing value creation initiatives within the consumer and consumer-related products and services industries. In February 2021, Mr. Meltzer joined the board of directors of Ubicquia LLC, a smart solutions infrastructure company. In May 2022, Mr. Meltzer joined the board of directors of MSP Recovery, Inc. following its business combination with Lionheart Acquisition Corp. II. In June 2022, Mr. Meltzer joined the board of directors of Aearo Holding LLC and affiliated entities. In August 2022, Mr. Meltzer joined the board of directors of Empatan Public Limited Company (“SMX”) following its business combination with Lionheart III Corp, Security Matters Limited and Aryeh Merger Sub Inc. In January 2023, Mr. Meltzer joined the board of directors of AID Holdings II (“Enlivant”), a senior living facility provider and portfolio company of TPG Capital L.P. In February 2023, Mr. Meltzer joined the board of directors of Klein Hersh, an executive recruitment firm that spans the life sciences continuum and healthcare industry. In April 2023, Mr. Meltzer joined the board of directors of Cyxtera Technologies, Inc., a company specializing in colocation and interconnection services, with a footprint of more than 60 data centers in over 30 markets. In May

23

2023, Mr. Meltzer joined the board of directors of John C. Heath, Attorney at Law PC d/b/a/ Lexington Law, an industry leader specializing in credit repair services.

Skills & Expertise: Mr. Meltzer brings to the Board legal, finance, business, legal, and leadership experience. Mr. Meltzer is qualified to serve as a director due to his experience representing clients on high-profile, complex, and cross-border matters and his leadership qualities in managing a large international organization. During his tenure, DLA Piper was subject to a large-scale cybersecurity infiltration, and Mr. Meltzer was a leader of a small group of senior executives that managed the firm through that cyberattack.

24

|

|

|

|

|

Board Diversity Matrix (as of June 30, 2023) |

|

Male |

Female |

Non-Binary |

Did Not Disclose Gender |

Part I: Gender Identity |

|

|

|

|

Directors |

6 |

1 |

|

|

Part II: Demographic Background |

|

|

|

|

African American or Black |

|

|

|

|

Alaskan Native or American Indian |

|

|

|

|

Asian |

|

|

|

|

Hispanic, Latino or Latina |

3 |

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

White |

4 |

|

|

|

Two or More Races or Ethnicities |

|

|

|

|

LGBTQ+ |

1 |

|

|

Undisclosed |

|

|

|

|

Vote Required and Board Recommendation

The vote required to elect our two Class I directors named in this proxy statement, each for a three-year term expiring at the 2026 Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes of the shares of Common Stock cast at the Annual Meeting. The Board recommends that you vote “FOR” the re-election of each of the Class I director nominees named in this proxy statement.

25

MATTERS TO COME BEFORE THE ANNUAL MEETING

PROPOSAL 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Deloitte as LifeWallet’s independent registered public accounting firm to audit the consolidated financial statements of LifeWallet for the fiscal year ending December 31, 2023, which will include an audit of the effectiveness of LifeWallet’s internal control over financial reporting.

A representative of Deloitte is expected to be present at the meeting. The representative will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions.

Stockholder ratification of the selection of our independent registered public accounting firm is a matter of good corporate practice. In the event that this selection is not ratified by the affirmative vote of a majority of the shares cast during the meeting or by proxy of stockholders entitled to vote at the meeting, the appointment of the independent registered public accounting firm may be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of LifeWallet and our stockholders.

Principal Accounting Fees and Services

The following is a summary of the fees billed to us by Deloitte for professional services rendered for the fiscal year ending December 31, 2022.

|

|

|

Accounting Fees and Services |

Fee Category |

2021 |

2022 |

Audit Fees |

$557,795 |

$1,019,744 |

Audit-Related Fees |

— |

$895,821 |

Tax Fees |

— |

— |

All Other Fees |

— |

— |

Total Fees |

$557,795 |

$1,915,565 |

26

Audit Fees. The aggregate audit fees (inclusive of out-of-pocket expenses) billed by Deloitte were for professional services rendered for the audit of our annual financial statements and review of financial statements included in our Annual Report on Form 10-K filed with the SEC, and for services that are normally provided by the independent registered certified public accountants in connection with such filings, including amendments, or engagements for the fiscal year ended December 31.

Audit Related Fees. This category consists of assurance and related services by the independent registered public accounting firm that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” The services for the fees that would normally be disclosed under this category include consultation regarding our correspondence with the SEC and other accounting consulting.

Tax Fees. This category consists of professional services rendered by our independent registered public accounting firm for tax compliance, tax advice and tax planning. The services for the fees that would normally be disclosed under this category include tax return preparation and technical tax advice.

All Other Fees. This consists of fees billed for products and services other than those described above.

Pre-Approval of Audit and Non-Audit Services

The Audit Committee has established a policy to review and approve the engagement of our independent auditors to perform audit services and any permissible non-audit services.

Vote Required and Board Recommendation

The vote required for the ratification of the selection of Deloitte as our auditor is the affirmative vote of a majority of the votes cast at the Annual Meeting. The Board recommends that you vote “FOR” the ratification of the selection of Deloitte as our auditor.

27

28

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are all statements (and their underlying assumptions) included in this Proxy Statement that refer, directly or indirectly, to future events or outcomes and, as such, are inherently not factual, but rather reflect only our current projections for the future. Consequently, forward-looking statements usually include words such as “estimate,” “intend,” “plan,” “predict,” “seek,” “may,” “will,” “should,” “would,” “could,” “anticipate,” “expect,” “believe,” or similar words, in each case, intended to refer to future events or circumstances. Our future results may differ materially from our past results and from those projected in the forward-looking statements due to various uncertainties and risks, including, but not limited to, those included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on July 27, 2023. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof and are based upon information available to us at this time. These statements are not guarantees of future performance. We disclaim any obligation to update information in any forward-looking statement. Actual results could vary from our forward-looking statements due to the factors described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as well as other important factors.

29

CORPORATE GOVERNANCE

Corporate Governance Principles and Code of Ethics

Our Board is committed to sound corporate governance principles and practices. In order to clearly set forth our commitment to conduct our operations in accordance with our high standards of business ethics and applicable laws and regulations, our Board adopted Corporate Governance Guidelines applicable to our directors, executive officers and employees that complies with the rules and regulations of Nasdaq. A copy of our Corporate Governance Guidelines is available on our corporate website at https://investor.lifewallet.com, in the “Documents & Charters” section in the “Corporate Governance” tab. The information on our website shall not be deemed incorporated by reference in this Proxy Statement. You also may obtain without charge a printed copy of the Corporate Governance Guidelines by sending a written request to: LifeWallet General Counsel, 2701 South Le Jeune Road, Floor 10, Coral Gables, Florida 33134.

Board of Directors

The business and affairs of the Company are managed by or under the direction of the Board. The Board is currently composed of seven members.

The Board held eight meetings and acted by written consent on seven occasions during the year ended December 31, 2022. In 2022, each person serving as a director attended at least 75% of the total number of meetings of our Board and any Board committee on which he or she served.

Board Committees

Pursuant to our bylaws, our Board may establish one or more committees of the Board however designated, and delegate to any such committee the full power of the Board, to the fullest extent permitted by law.

The standing committees of our Board currently include an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each of the committees reports to the Board as such committee deems appropriate and as the Board may request. The composition, duties, and summary of responsibilities of these committees are as follows:

30

Audit Committee

Mr. Hawkins, Mr. Meltzer, and Mr. Arrigo serve on the Audit Committee. Mr. Hawkins qualifies as the Audit Committee financial expert as defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”), and serves as Chairperson of the Audit Committee. The Audit Committee operates under a written charter adopted by the Board of Directors. The charter contains a detailed description of the scope of the Audit Committee’s responsibilities and how they will be carried out. According to its charter, the Audit Committee shall consist of at least three members, each of whom shall be a non-employee director who has been determined by the Board to meet the independence requirements of Nasdaq, and also Rule 10A-3(b)(1) of the SEC, subject to the exemptions provided in Rule 10A-3(c). The Audit Committee’s charter is available on our website at https://investor.lifewallet.com, in the “Documents & Charters” section in the “Corporate Governance” tab. The information on our website shall not be deemed incorporated by reference in this proxy statement. The Audit Committee held two meetings during the year ended December 31, 2022.

The Audit Committee’s charter describes the primary functions of the Audit Committee, including, but not limited to, the following:

A.Oversight of the Independent Auditor

•retention of the independent auditor;

•assessment the independent auditor’s independence;

•evaluation of the qualifications and performance of the independent auditors;

31

•oversight of the work of the independent auditor;

•establish the terms of the audit engagement;

•consider rotation of the independent auditor; and

•consider for approval services proposed by the independent auditor for the Company.

B.Financial Statements and Other Financial Disclosures

•review and discuss with management and the independent auditor critical accounting policies and practices used by the Company and consider significant changes thereto;

•review and discuss with management and the independent auditor the audited and unaudited financial statements;

•submit an annual audit committee report for inclusion in the proxy statement or annual report; and

•review earnings releases with management and the independent auditor.

C.Controls and Procedures

•oversee management’s design and maintenance of the Company’s internal control over financial reporting, disclosure controls, and procedures;

•review and discuss with management and the independent auditor the certifications and related disclosures by the CEO and CFO in periodic reports; and

•maintain policies regarding the hiring of employees and former employees of the independent auditor.

D.Risk Management, Compliance, and Ethics

•review and discuss with management and the independent auditor significant risks or exposures, including cybersecurity, privacy standards, and the Company’s policies and processes with respect to risk assessment and risk management;

•review legal, regulatory, and compliance matters, the Company’s Code of Business Conduct and Ethics for changes deemed necessary, and requested waivers;

•establish “whistleblower” procedures; and

•review related person transactions and other significant conflicts of interest.

E.Self-Evaluation, Reporting, and Other

•conduct period self-evaluations of the Audit Committee performance;

32

•report regularly to the Board of Directors; and

•undertake such other responsibilities delegated to the Audit Committee from time to time.

Compensation Committee

Mr. Arrigo and Ms. Assapimonwait serve on the Compensation Committee. Mr. Arrigo serves as the Chairperson of the Compensation Committee. The Compensation Committee operates under a written charter adopted by the Board of Directors. The charter contains a detailed description of the scope of the Compensation Committee’s responsibilities and how they will be carried out. The Compensation Committee’s charter is available on our website at https://investor.lifewallet.com, in the “Documents & Charters” section in the “Corporate Governance” tab. The information on our website shall not be deemed incorporated by reference in this proxy statement. The Compensation Committee may delegate any of its responsibilities to one or more subcommittees as the Compensation Committee may from time to time deem appropriate. The Compensation Committee held two meetings during the year ended December 31, 2022.

The Compensation Committee’s duties, which are specified in our Compensation Committee’s charter, include, but are not limited to:

•establish and oversee compensation philosophy and programs;

•review and approve corporate goals and objectives relevant to officer compensation;

•evaluate the CEO and other executive officers’ performance against corporate goals and objectives;

•review and approve employment, compensation, benefit, and severance agreements;

•review management compensation programs and recommend modifications;

•approve special perquisites and other compensation and benefit arrangements;

•review, approve, recommend, and administer equity-based compensation plans;

•review and approve non-equity based compensation plans;

•after the Company ceases to be an “emerging growth company,” (i) review compensation to assess whether policies and practices could lead to excessive risk taking behavior, (ii) conduct a say-on-pay vote and recommend the frequency of say-on-pay votes, and (iii) produce a report on executive compensation if required, review and discuss with management the “Compensation Discussion and Analysis” required by the SEC;

•assess engagement agreements with, and the work of, compensation consultants;

•if the Company ceases to be a “controlled company” assess the independence of compensation consultants and other advisors to the committee;

33

•recommend to the Board for approval general principles for determining director compensation; periodically review executive officer stock ownership; and

•review and oversee stockholder proposals relating to compensation matters.

B.Self-Evaluation, Reporting, and Other

•conduct period self-evaluations of the Compensation Committee performance;

•report regularly to the Board of Directors; and

•undertake such other responsibilities delegated to the Compensation Committee from time to time.

The charter provides that the Compensation Committee is empowered to inquire into any matter that it considers appropriate to carry out its responsibilities, with access to all books, records, facilities and personnel of the Company, and, subject to the direction of the Board, the Committee is authorized and delegated the authority to act on behalf of the Board with respect to any matter it determines to be necessary or appropriate to the accomplishment of its purposes.

The Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser.

So long as the Company remains a “controlled company” under the rules applicable to companies listed on the Nasdaq Stock Market, each member of the Committee shall not be required to be an “independent” director in accordance with the applicable listing standards of Nasdaq, including for the purposes of serving on the Compensation Committee. If the Company ceases to be a “controlled company,” the Committee shall assess the independence of compensation consultants, legal, and other advisers to the Committee, taking into consideration the factors specified in the listing standards of Nasdaq prior to the retention of any advisers to the Committee, and annually or from time to time as the Committee deems appropriate.

The Committee shall recommend to the Board for approval general principles for determining the form and amount of director compensation, and, subject to such principles, shall evaluate annually the status of Board compensation in relation to comparable U.S. companies (in terms of size, business sector, etc.), reporting its findings and recommendations to the Board for approval.

Compensation Consultant

In December 2022, the Company engaged Pearl Meyer & Partners, LLC (“Pearl Meyer”), to conduct executive compensation consulting services starting in 2023. Pearl Meyer reports directly to the committee. While conducting assignments, Pearl Meyer interacts with the Compensation Committee, members of the Board of Directors, and senior management as needed. The Compensation Committee has the sole discretion to retain or obtain advice from, oversee, and terminate any compensation consultant, legal counsel, or other adviser to the Committee, and is directly responsible for the appointment, compensation, and oversight of any work of such adviser retained by the Committee. The

34

Company will provide appropriate funding (as determined by the Committee) for the payment of reasonable compensation to any such adviser.