UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF JULY 2019

METHANEX CORPORATION

(Registrant’s name)

SUITE 1800, 200 BURRARD STREET, VANCOUVER, BC V6C 3M1 CANADA

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

¨

Form 40-F

ý

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨

No

ý

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82

|

|

|

|

|

|

NEWS RELEASE

|

Methanex Corporation

1800 - 200 Burrard St.

Vancouver, BC Canada V6C 3M1

Investor Relations: (604) 661-2600

www.methanex.com

|

For immediate release

July 31, 2019

METHANEX REPORTS SECOND QUARTER 2019 RESULTS

VANCOUVER, BRITISH COLUMBIA - For the

second

quarter of

2019

, Methanex (TSX:MX) (NASDAQ:MEOH) reported net income attributable to Methanex shareholders of

$50 million

(

$0.51

per common share on a diluted basis) compared to net income of

$38 million

(

$0.50

per common share on a diluted basis) in the

first

quarter of

2019

. Adjusted EBITDA for the

second

quarter of

2019

was

$146 million

and Adjusted net income was

$26 million

(

$0.34

per common share). This compares with Adjusted EBITDA of

$194 million

and Adjusted net income of

$56 million

(

$0.73

per common share) for the

first

quarter of

2019

.

John Floren, President and CEO of Methanex, commented, "Our second quarter Adjusted EBITDA reflects lower sales of Methanex-produced methanol, slightly lower average realized prices and higher costs compared to the first quarter. Sales of Methanex-produced methanol were lower in the second quarter compared to the first quarter of 2019 due to the timing of inventory flows which impacted our mix of produced versus purchased product sales. Our average realized price was $326 per tonne compared to $331 per tonne in the first quarter. Our costs per tonne declined in the second quarter compared to the first quarter; however, a lower proportion of Methanex-produced methanol sales resulted in higher costs overall. In addition, we incurred higher logistics costs and higher selling and administrative expenses related to events during the quarter."

"We were very pleased to announce that we reached a final investment decision to construct a 1.8 million tonne facility in Geismar, Louisiana adjacent to our Geismar 1 and Geismar 2 facilities. We believe that Geismar 3 will create significant long-term value for shareholders. Compared to a standalone US Gulf greenfield plant, this project benefits from substantial capital and operating cost advantages, and we expect will deliver outstanding returns. We believe we are well positioned to complete this project. The Company has a strong balance sheet and a robust and flexible financing plan, a rigorous and well-defined execution plan, and an experienced team in place to execute the project."

"We returned $75 million of excess cash to shareholders through our regular dividend and share repurchases in the second quarter. To June 30, 2019, we have repurchased 1,069,893 common shares, of the 3,863,298 authorized, for approximately $53 million since the start of our normal course issuer bid on March 18, 2019."

“We have

$228 million

of cash on hand at the end of the

second

quarter, a revolving credit facility and a strong balance sheet. Our balanced approach to capital allocation remains unchanged. We

believe we are well positioned to meet our financial commitments, execute our growth projects in Louisiana and Chile, and deliver on our commitment to return excess cash to shareholders through dividends and share repurchases

," Floren said.

METHANEX CORPORATION 2019 SECOND QUARTER NEWS RELEASE PAGE 1

FURTHER INFORMATION

The information set forth in this news release su

mmari

zes Methanex's key financial and operational data for the

second

quarter of

2019

. It is not a complete source of information for readers and is not in any way a substitute for reading the

second

quarter

2019

Management’s Discussion and Analysis ("MD&A") dated

July 31, 2019

and the unaudited condensed consolidated interim financial statements for the period ended

June 30, 2019

, both of which are available from the Investor Relations section of our website at

www.methanex.com

. The MD&A and the unaudited condensed consolidated interim financial statements for the period ended

June 30, 2019

are also available on the Canadian Securities Administrators' SEDAR website at

www.sedar.com

and on the United States Securities and Exchange Commission's EDGAR website at

www.sec.gov

.

FINANCIAL AND OPERATIONAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

($ millions except per share amounts and where noted)

|

Jun 30

2019

|

|

Mar 31

2019

|

|

Jun 30

2018

|

|

|

Jun 30

2019

|

|

Jun 30

2018

|

|

|

Production (thousands of tonnes) (attributable to Methanex shareholders)

|

1,820

|

|

1,808

|

|

1,648

|

|

|

3,628

|

|

3,591

|

|

|

Sales volume (thousands of tonnes)

|

|

|

|

|

|

|

|

Methanex-produced methanol

|

1,669

|

|

1,921

|

|

1,729

|

|

|

3,590

|

|

3,613

|

|

|

Purchased methanol

|

716

|

|

473

|

|

709

|

|

|

1,189

|

|

1,322

|

|

|

Commission sales

|

216

|

|

329

|

|

329

|

|

|

545

|

|

650

|

|

|

Total sales volume

1

|

2,601

|

|

2,723

|

|

2,767

|

|

|

5,324

|

|

5,585

|

|

|

|

|

|

|

|

|

|

|

Methanex average non-discounted posted price ($ per tonne)

2

|

391

|

|

392

|

|

478

|

|

|

391

|

|

476

|

|

|

Average realized price ($ per tonne)

3

|

326

|

|

331

|

|

405

|

|

|

329

|

|

403

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

734

|

|

742

|

|

950

|

|

|

1,476

|

|

1,912

|

|

|

Adjusted revenue

|

777

|

|

799

|

|

972

|

|

|

1,576

|

|

1,959

|

|

|

Adjusted EBITDA

|

146

|

|

194

|

|

275

|

|

|

340

|

|

581

|

|

|

Cash flows from operating activities

|

117

|

|

213

|

|

290

|

|

|

330

|

|

534

|

|

|

Adjusted net income

|

26

|

|

56

|

|

143

|

|

|

82

|

|

314

|

|

|

Net income (attributable to Methanex shareholders)

|

50

|

|

38

|

|

111

|

|

|

89

|

|

280

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income per common share

|

0.34

|

|

0.73

|

|

1.75

|

|

|

1.07

|

|

3.79

|

|

|

Basic net income per common share

|

0.65

|

|

0.50

|

|

1.36

|

|

|

1.15

|

|

3.39

|

|

|

Diluted net income per common share

|

0.51

|

|

0.50

|

|

1.36

|

|

|

1.09

|

|

3.38

|

|

|

|

|

|

|

|

|

|

|

Common share information (millions of shares)

|

|

|

|

|

|

|

|

Weighted average number of common shares

|

77

|

|

77

|

|

82

|

|

|

77

|

|

83

|

|

|

Diluted weighted average number of common shares

|

77

|

|

77

|

|

82

|

|

|

77

|

|

83

|

|

|

Number of common shares outstanding, end of period

|

76

|

|

77

|

|

80

|

|

|

76

|

|

80

|

|

|

|

|

|

1

|

Methanex-produced methanol represents our equity share of volume produced at our facilities and excludes volume marketed on a commission basis related to the 36.9% of the Atlas facility and 50% of the Egypt facility that we do not own. Methanex-produced methanol includes any volume produced by Chile using natural gas supplied from Argentina under a tolling arrangement ("Tolling Volume"). No Tolling Volume has been produced in 2019. There were 48,000 MT of Tolling Volume in the second quarter of 2018 and 88,000 MT of Tolling Volume for the six months ended June 30, 2018.

|

|

|

|

|

2

|

Methanex average non-discounted posted price represents the average of our non-discounted posted prices in North America, Europe and Asia Pacific weighted by sales volume. Current and historical pricing information is available at

www.methanex.com

.

|

|

|

|

|

3

|

Average realized price is calculated as revenue, excluding commissions earned and the Egypt non-controlling interest share of revenue, but including an amount representing our share of Atlas revenue, divided by the total sales volume of Methanex-produced and purchased methanol, but excluding Tolling Volume.

|

METHANEX CORPORATION 2019 SECOND QUARTER NEWS RELEASE PAGE 2

A reconciliation from net income attributable to Methanex shareholders to Adjusted net income and the calculation of Adjusted net income per common share is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

($ millions except number of shares and per share amounts)

|

Jun 30

2019

|

|

Mar 31

2019

|

|

Jun 30

2018

|

|

|

Jun 30

2019

|

|

Jun 30

2018

|

|

|

Net income (attributable to Methanex shareholders)

|

$

|

50

|

|

$

|

38

|

|

$

|

111

|

|

|

$

|

89

|

|

$

|

280

|

|

|

Mark-to-market impact of share-based compensation, net of tax

|

(24

|

)

|

18

|

|

32

|

|

|

(7

|

)

|

34

|

|

|

Adjusted net income

|

$

|

26

|

|

$

|

56

|

|

$

|

143

|

|

|

$

|

82

|

|

$

|

314

|

|

|

Diluted weighted average shares outstanding (millions)

|

77

|

|

77

|

|

82

|

|

|

77

|

|

83

|

|

|

Adjusted net income per common share

|

$

|

0.34

|

|

$

|

0.73

|

|

$

|

1.75

|

|

|

$

|

1.07

|

|

$

|

3.79

|

|

|

|

|

|

▪

|

We recorded net income attributable to Methanex shareholders of $

50 million

during the

second

quarter of

2019

compared to net income of $

38 million

in the

first

quarter of

2019

.

The increase in earnings is primarily due to the change in the mark-to-market impact of share-based compensation, partially offset by a decrease in sales of Methanex-produced methanol during the second quarter, higher costs and a slight decrease in our average realized methanol price.

|

|

|

|

|

▪

|

We recorded Adjusted EBITDA of

$146 million

for the

second

quarter of

2019

compared with

$194 million

for the

first

quarter of

2019

. The decrease in Adjusted EBITDA for the second quarter of 2019 compared to the first quarter of 2019 is primarily due to the decrease in sales of Methanex-produced methanol, higher costs and a slight decrease in our average realized methanol price. Adjusted EBITDA for the first and second quarters of 2019 includes the adoption of IFRS 16 which increased Adjusted EBITDA for the first quarter of 2019 by $28 million and for the second quarter of 2019 by $27 million.

|

|

|

|

|

▪

|

Adjusted net income was

$26 million

for the

second

quarter of

2019

compared to Adjusted net income of

$56 million

for the

first

quarter of

2019

.

The decrease in Adjusted net income is primarily due to a decrease in sales of Methanex-produced methanol, higher costs and the slight decrease in average realized price to $326 per tonne for the second quarter of 2019 from $331 per tonne for the first quarter of 2019.

|

|

|

|

|

▪

|

We produced

1,820,000

tonnes in the

second

quarter of

2019

compared to

1,808,000

tonnes for the

first

quarter of

2019

.

|

|

|

|

|

▪

|

Total sales volume for the second quarter of 2019 was

2,601,000

tonnes compared with

2,723,000

tonnes for the

first

quarter of

2019

.

Sales of Methanex-produced methanol were

1,669,000

tonnes in the

second

quarter of

2019

compared with

1,921,000

tonnes

in the

first

quarter of

2019

.

In the second quarter of 2019, production exceeded sales of Methanex-produced methanol, resulting in a 151,000 tonne build of produced methanol inventory. This compares to the first quarter of 2019, where sales of Methanex-produced methanol exceeded production by 113,000 tonnes. An inventory build or draw is a result of the timing of produced and purchased methanol volume in and out of inventory.

|

|

|

|

|

▪

|

Total cash costs in the second quarter of 2019 were higher than in the first quarter of 2019 by $30 million decreasing Adjusted EBITDA. Total cash costs include the costs of both produced and purchased methanol, logistics costs and other costs not included in inventory. Our cash costs per tonne for both produced and purchased methanol were lower for the second quarter of 2019 compared to the first quarter of 2019, however the higher proportion of purchased methanol and lower proportion of Methanex-produced methanol sold resulted in higher cash costs and lower Adjusted EBITDA. Logistics costs and other costs were also higher.

|

|

|

|

|

▪

|

On March 18, 2019 we commenced a normal course issuer bid to purchase up to 3,863,298 common shares. To June 30, 2019, we have repurchased 1,069,893 common shares under the bid for $52.8 million.

|

|

|

|

|

▪

|

During the

second

quarter of

2019

we paid a

$0.36

per common share quarterly dividend to shareholders for a total of $

28

million.

|

|

|

|

|

▪

|

On July 19, 2019, we reached a final investment decision to construct a 1.8 million tonne facility in Geismar, Louisiana adjacent to our Geismar 1 and Geismar 2 facilities. Construction of the Geismar 3 facility will begin later this year and operations are targeted in the second half of 2022. The cost of the project is expected to be between $1.3 to $1.4 billion including costs of approximately $60 million incurred to date.

|

METHANEX CORPORATION 2019 SECOND QUARTER NEWS RELEASE PAGE 3

PRODUCTION HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2019

|

Q1 2019

|

|

Q2 2018

|

|

YTD Q2 2019

|

|

YTD Q2 2018

|

|

|

(thousands of tonnes)

|

Operating Capacity

1

|

|

Production

|

|

Production

|

|

Production

|

|

Production

|

|

Production

|

|

|

New Zealand

2

|

608

|

|

446

|

|

437

|

|

252

|

|

883

|

|

739

|

|

|

USA (Geismar)

|

500

|

|

530

|

|

405

|

|

518

|

|

935

|

|

1,031

|

|

|

Trinidad (Methanex interest)

3

|

500

|

|

384

|

|

429

|

|

442

|

|

813

|

|

901

|

|

|

Chile

4

|

430

|

|

290

|

|

241

|

|

128

|

|

531

|

|

294

|

|

|

Egypt (50% interest)

|

158

|

|

15

|

|

141

|

|

165

|

|

156

|

|

330

|

|

|

Canada (Medicine Hat)

|

150

|

|

155

|

|

155

|

|

143

|

|

310

|

|

296

|

|

|

|

2,346

|

|

1,820

|

|

1,808

|

|

1,648

|

|

3,628

|

|

3,591

|

|

|

|

|

|

1

|

Operating capacity includes only those facilities which are currently capable of operating, but excludes any portion of an asset that is underutilized due to a lack of natural gas feedstock over a prolonged period of time. The operating capacity of our production facilities may be higher than original nameplate capacity as, over time, these figures have been adjusted to reflect ongoing operating efficiencies at these facilities. Actual production for a facility in any given year may be higher or lower than operating capacity due to a number of factors, including natural gas composition or the age of the facility's catalyst.

|

|

|

|

|

2

|

The operating capacity of New Zealand is made up of the two Motunui facilities and the Waitara Valley facility

.

|

|

|

|

|

3

|

The operating capacity of Trinidad is made up of the Titan (100% interest) and Atlas (63.1% interest) facilities

.

|

|

|

|

|

4

|

The operating capacity of our Chile I and IV facilities is 1.7 million tonnes annually assuming access to natural gas feedstock.

For 2018, our operating capacity in Chile was 0.9 million tonnes. In the fourth quarter of 2018 we restarted our 0.8 million tonne Chile IV plant that had been idle since 2007.

|

Key production and operational highlights during the

second

quarter include:

|

|

|

|

▪

|

New Zealand produced

446,000

tonnes compared with

437,000

tonnes in the

first

quarter of

2019

.

Production continues to be lower than operating capacity as a result of natural gas suppliers completing planned and unplanned maintenance activities. We expect these upstream maintenance activities to continue in the third quarter.

|

|

|

|

|

▪

|

Geismar produced

530,000

tonnes during the

second

quarter of

2019

compared to

405,000

tonnes during the

first

quarter of

2019

. Production in Geismar for the

second

quarter of

2019

set a new quarterly site record following lower production in the

first

quarter of

2019

due to a scheduled turnaround of the Geismar 1 plant.

|

|

|

|

|

▪

|

Trinidad produced

384,000

tonnes (Methanex interest) compared with

429,000

tonnes in the

first

quarter of

2019

.

Production in Trinidad is lower in the second quarter of 2019 compared to the first quarter of 2019 primarily as a result of the turnaround completed in the Titan plant in April, and an unplanned production outage in May at the Atlas plant. For Trinidad, we continue to guide to approximately 85% operating rates.

|

|

|

|

|

▪

|

The Chile facilities produced

290,000

tonnes during the

second

quarter of

2019

compared to

241,000

tonnes during the

first

quarter of

2019

. We have continued to receive reliable gas supply from our partners in Chile and Argentina over the last few months and have resolved the technical issues we faced with the start-up of our Chile IV facility.

Late in the second quarter of 2019, we commenced the first phase of our refurbishment of our Chile I plant scheduled to match expected lower natural gas deliveries during the southern hemisphere winter months. Provided that we are able to secure sufficient longer-term natural gas, we will complete the second phase of the refurbishment over the coming years.

|

|

|

|

|

▪

|

The Egypt facility produced

30,000

tonnes (Methanex interest -

15,000

tonnes) in the

second

quarter of

2019

compared with 282,000 tonnes (Methanex interest - 141,000 tonnes) in the

first

quarter of

2019

.

During the quarter, the Egypt facility experienced an outage and the plant remained off-line for the remainder of the second quarter of 2019 for inspections and repair work. We expect to restart the plant in August 2019.

The losses related to the outage are expected to be partially covered by insurance, however no insurance recoveries have been recorded to date.

|

|

|

|

|

▪

|

Medicine Hat produced

155,000

tonnes during the

second

quarter of

2019

and the

first

quarter of

2019

.

|

METHANEX CORPORATION 2019 SECOND QUARTER NEWS RELEASE PAGE 4

CONFERENCE CALL

A conference call is scheduled for August 1, 2019 at 12:00 noon ET (9:00 am PT) to review these

second

quarter results. To access the call, dial the conferencing operator ten minutes prior to the start of the call at (416) 340-2216, or toll free at (800) 273-9672. A simultaneous audio-only webcast of the conference call can be accessed from our website at

www.methanex.com

and will also be available following the call. A playback version of the conference call will be available until August 15, 2019 at (905) 694-9451, or toll free at (800) 408-3053. The passcode for the playback version is 6411726#.

ABOUT METHANEX

Methanex is a Vancouver-based, publicly traded company and is the world’s largest producer and supplier of methanol to major international markets. Methanex shares are listed for trading on the Toronto Stock Exchange in Canada under the trading symbol "MX" and on the NASDAQ Global Market in the United States under the trading symbol "MEOH".

FORWARD-LOOKING INFORMATION WARNING

This

second

quarter

2019

press release contains forward-looking statements with respect to us and the chemical industry. By its nature, forward-looking information is subject to numerous risks and uncertainties, some of which are beyond the Company's control. Readers are cautioned that undue reliance should not be placed on forward-looking information as actual results may vary materially from the forward-looking information. Methanex does not undertake to update, correct or revise any forward-looking information as a result of any new information, future events or otherwise, except as may be required by applicable law. Refer to

Forward-Looking Information Warning

in the

second

quarter

2019

Management's Discussion and Analysis for more information which is available from the Investor Relations section of our website at

www.methanex.com

, the Canadian Securities Administrators' SEDAR website at

www.sedar.com

and on the United States Securities and Exchange Commission's EDGAR website at

www.sec.gov

.

NON-GAAP MEASURES

The Company has used the terms Adjusted EBITDA, Adjusted net income, Adjusted net income per common share, Adjusted revenue and operating income throughout this document. These items are non-GAAP measures that do not have any standardized meaning prescribed by GAAP. These measures represent the amounts that are attributable to Methanex Corporation shareholders and are calculated by excluding the mark-to-market impact of share-based compensation as a result of changes in our share price and the impact of certain items associated with specific identified events. Refer to

Additional Information - Supplemental Non-GAAP Measures

on page

15

of the Company's MD&A for the period ended

June 30, 2019

for reconciliations to the most comparable GAAP measures. Unless otherwise indicated, the financial information presented in this release is prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

-end-

For further information, contact:

Kim Campbell

Manager, Investor Relations

Methanex Corporation

604-661-2600

METHANEX CORPORATION 2019 SECOND QUARTER NEWS RELEASE PAGE 5

|

|

|

|

|

|

|

|

2

|

|

Share Information

Methanex Corporation’s common shares are listed for trading on the Toronto Stock Exchange under the symbol MX and on the Nasdaq Global Market under the symbol MEOH.

Transfer Agents & Registrars

AST Trust Company (Canada)

320 Bay Street

Toronto, Ontario Canada M5H 4A6

Toll free in North America: 1-800-387-0825

|

Investor Information

All financial reports, news releases and corporate information can be accessed on our website at

www.methanex.com

.

Contact Information

Methanex Investor Relations

1800 - 200 Burrard Street

Vancouver, BC Canada V6C 3M1

E-mail: invest@methanex.com

Methanex Toll-Free: 1-800-661-8851

|

|

Management's Discussion and Analysis for the

Three and Six Months Ended

June 30, 2019

|

|

At July 30, 2019 the Company had 76,196,080 common shares issued and outstanding and stock options exercisable for 1,232,798 additional common shares.

|

SECOND

QUARTER MANAGEMENT’S DISCUSSION AND ANALYSIS ("MD&A")

Except where otherwise noted, all currency amounts are stated in United States dollars.

FINANCIAL AND OPERATIONAL HIGHLIGHTS

|

|

|

|

▪

|

A reconciliation from net income attributable to Methanex shareholders to Adjusted net income and the calculation of Adjusted net income per common share is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

($ millions except number of shares and per share amounts)

|

Jun 30

2019

|

|

Mar 31

2019

|

|

Jun 30

2018

|

|

|

Jun 30

2019

|

|

Jun 30

2018

|

|

|

Net income (attributable to Methanex shareholders)

|

$

|

50

|

|

$

|

38

|

|

$

|

111

|

|

|

$

|

89

|

|

$

|

280

|

|

|

Mark-to-market impact of share-based compensation, net of tax

|

(24

|

)

|

18

|

|

32

|

|

|

(7

|

)

|

34

|

|

|

Adjusted net income

|

$

|

26

|

|

$

|

56

|

|

$

|

143

|

|

|

$

|

82

|

|

$

|

314

|

|

|

Diluted weighted average shares outstanding (millions)

|

77

|

|

77

|

|

82

|

|

|

77

|

|

83

|

|

|

Adjusted net income per common share

|

$

|

0.34

|

|

$

|

0.73

|

|

$

|

1.75

|

|

|

$

|

1.07

|

|

$

|

3.79

|

|

|

|

|

|

1

|

The Company has used the terms Adjusted EBITDA, Adjusted net income, Adjusted net income per common share, Adjusted revenue and operating income throughout this document. These items are non-GAAP measures that do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies.

Refer to

Additional Information - Supplemental Non-GAAP Measures

on page

15

of the MD&A for reconciliations to the most comparable GAAP measures.

|

|

|

|

|

▪

|

We recorded net income attributable to Methanex shareholders of $

50 million

during the

second

quarter of

2019

compared to net income of $

38 million

in the

first

quarter of 2019.

The increase in earnings is primarily due to the change in the mark-to-market impact of share-based compensation, partially offset by a decrease in sales of Methanex-produced methanol during the second quarter, higher costs and a slight decrease in our average realized methanol price.

|

|

|

|

|

▪

|

We recorded Adjusted EBITDA of

$146 million

for the

second

quarter of

2019

compared with

$194 million

for the

first

quarter of

2019

. The decrease in Adjusted EBITDA for the second quarter of 2019 compared to the first quarter of 2019 is primarily due to the decrease in sales of Methanex-produced methanol, higher costs and a slight decrease in our average realized methanol price. Adjusted EBITDA for the first and second quarters of 2019 includes the adoption of IFRS 16 which increased Adjusted EBITDA for the first quarter of 2019 by $28 million and for the second quarter of 2019 by $27 million.

|

|

|

|

|

▪

|

Adjusted net income was

$26 million

for the

second

quarter of

2019

compared to Adjusted net income of

$56 million

for the

first

quarter of

2019

.

The decrease in Adjusted net income is primarily due to a decrease in sales of Methanex-produced methanol, higher costs and the slight decrease in average realized price to $326 per tonne for the second quarter of 2019 from $331 per tonne for the first quarter of 2019.

|

|

|

|

|

▪

|

Production for the

second

quarter of

2019

increased to

1,820,000

tonnes compared with

1,808,000

tonnes for the

first

quarter of

2019

. Refer to the

Production Summary

section on page

4

of the MD&A.

|

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 1

MANAGEMENT’S DISCUSSION AND ANALYSIS

|

|

|

|

▪

|

Total sales volume for the second quarter of 2019 was

2,601,000

tonnes compared with

2,723,000

tonnes for the first quarter of 2019.

Sales of Methanex-produced methanol were

1,669,000

tonnes in the

second

quarter of

2019

compared with

1,921,000

tonnes

in the

first

quarter of

2019

.

In the second quarter of 2019, production exceeded sales of Methanex-produced methanol, resulting in a 151,000 tonne build of produced methanol inventory. This compares to the first quarter of 2019, where sales of Methanex-produced methanol exceeded production by 113,000 tonnes. An inventory build or draw is a result of the timing of produced and purchased methanol volume in and out of inventory.

|

|

|

|

|

▪

|

Total cash costs in the second quarter of 2019 were higher than in the first quarter of 2019 by $30 million decreasing Adjusted EBITDA. Total cash costs include the costs of both produced and purchased methanol, logistics costs and other costs not included in inventory. Our cash costs per tonne for both produced and purchased methanol were lower for the second quarter of 2019 compared to the first quarter of 2019, however the higher proportion of purchased methanol and lower proportion of Methanex-produced methanol sold resulted in higher cash costs and lower Adjusted EBITDA. Logistics costs and other costs were also higher.

|

|

|

|

|

▪

|

On March 18, 2019 we commenced a normal course issuer bid to purchase up to 3,863,298 common shares. To June 30, 2019, we have repurchased 1,069,893 common shares under the bid for $52.8 million.

|

|

|

|

|

▪

|

During the

second

quarter of

2019

we paid a

$0.36

per common share quarterly dividend to shareholders for a total of $

28

million.

|

|

|

|

|

▪

|

On July 19, 2019, we reached a final investment decision to construct a 1.8 million tonne facility in Geismar, Louisiana adjacent to our Geismar 1 and Geismar 2 facilities. Construction of the Geismar 3 facility will begin later this year and operations are targeted in the second half of 2022. The cost of the project is expected to be between $1.3 to $1.4 billion including costs of approximately $60 million incurred to date.

|

This

Second

Quarter

2019

Management’s Discussion and Analysis dated

July 31, 2019

for Methanex Corporation ("the Company") should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements for the period ended

June 30, 2019

as well as the

2018

Annual Consolidated Financial Statements and MD&A included in the Methanex

2018

Annual Report.

Unless otherwise indicated, the financial information presented in this

interim report

is prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

The Methanex

2018

Annual Report and additional information relating to Methanex is available on our website at

www.methanex.com

, the Canadian Securities Administrators' SEDAR website at

www.sedar.com

and on the United States Securities and Exchange Commission's EDGAR website at

www.sec.gov

.

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 2

MANAGEMENT’S DISCUSSION AND ANALYSIS

FINANCIAL AND OPERATIONAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

($ millions except per share amounts and where noted)

|

Jun 30

2019

|

|

Mar 31

2019

|

|

Jun 30

2018

|

|

|

Jun 30

2019

|

|

Jun 30

2018

|

|

|

Production (thousands of tonnes) (attributable to Methanex shareholders)

|

1,820

|

|

1,808

|

|

1,648

|

|

|

3,628

|

|

3,591

|

|

|

Sales volume (thousands of tonnes)

|

|

|

|

|

|

|

|

Methanex-produced methanol

|

1,669

|

|

1,921

|

|

1,729

|

|

|

3,590

|

|

3,613

|

|

|

Purchased methanol

|

716

|

|

473

|

|

709

|

|

|

1,189

|

|

1,322

|

|

|

Commission sales

|

216

|

|

329

|

|

329

|

|

|

545

|

|

650

|

|

|

Total sales volume

1

|

2,601

|

|

2,723

|

|

2,767

|

|

|

5,324

|

|

5,585

|

|

|

|

|

|

|

|

|

|

|

Methanex average non-discounted posted price ($ per tonne)

2

|

391

|

|

392

|

|

478

|

|

|

391

|

|

476

|

|

|

Average realized price ($ per tonne)

3

|

326

|

|

331

|

|

405

|

|

|

329

|

|

403

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

734

|

|

742

|

|

950

|

|

|

1,476

|

|

1,912

|

|

|

Adjusted revenue

|

777

|

|

799

|

|

972

|

|

|

1,576

|

|

1,959

|

|

|

Adjusted EBITDA

|

146

|

|

194

|

|

275

|

|

|

340

|

|

581

|

|

|

Cash flows from operating activities

|

117

|

|

213

|

|

290

|

|

|

330

|

|

534

|

|

|

Adjusted net income

|

26

|

|

56

|

|

143

|

|

|

82

|

|

314

|

|

|

Net income (attributable to Methanex shareholders)

|

50

|

|

38

|

|

111

|

|

|

89

|

|

280

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income per common share

|

0.34

|

|

0.73

|

|

1.75

|

|

|

1.07

|

|

3.79

|

|

|

Basic net income per common share

|

0.65

|

|

0.50

|

|

1.36

|

|

|

1.15

|

|

3.39

|

|

|

Diluted net income per common share

|

0.51

|

|

0.50

|

|

1.36

|

|

|

1.09

|

|

3.38

|

|

|

|

|

|

|

|

|

|

|

Common share information (millions of shares)

|

|

|

|

|

|

|

|

Weighted average number of common shares

|

77

|

|

77

|

|

82

|

|

|

77

|

|

83

|

|

|

Diluted weighted average number of common shares

|

77

|

|

77

|

|

82

|

|

|

77

|

|

83

|

|

|

Number of common shares outstanding, end of period

|

76

|

|

77

|

|

80

|

|

|

76

|

|

80

|

|

|

|

|

|

1

|

Methanex-produced methanol represents our equity share of volume produced at our facilities and excludes volume marketed on a commission basis related to the 36.9% of the Atlas facility and 50% of the Egypt facility that we do not own. Methanex-produced methanol includes any volume produced by Chile using natural gas supplied from Argentina under a tolling arrangement ("Tolling Volume"). No Tolling Volume has been produced in 2019. There were 48,000 MT of Tolling Volume in the second quarter of 2018 and 88,000 MT of Tolling Volume for the six months ended June 30, 2018.

|

|

|

|

|

2

|

Methanex average non-discounted posted price represents the average of our non-discounted posted prices in North America, Europe and Asia Pacific weighted by sales volume. Current and historical pricing information is available at

www.methanex.com

.

|

|

|

|

|

3

|

Average realized price is calculated as revenue, excluding commissions earned and the Egypt non-controlling interest share of revenue, but including an amount representing our share of Atlas revenue, divided by the total sales volume of Methanex-produced and purchased methanol, but excluding Tolling Volume.

|

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 3

MANAGEMENT’S DISCUSSION AND ANALYSIS

PRODUCTION SUMMARY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2019

|

Q1 2019

|

|

Q2 2018

|

|

|

YTD Q2 2019

|

|

YTD Q2 2018

|

|

|

(thousands of tonnes)

|

Operating Capacity

1

|

|

Production

|

|

Production

|

|

Production

|

|

|

Production

|

|

Production

|

|

|

New Zealand

2

|

608

|

|

446

|

|

437

|

|

252

|

|

|

883

|

|

739

|

|

|

USA (Geismar)

|

500

|

|

530

|

|

405

|

|

518

|

|

|

935

|

|

1,031

|

|

|

Trinidad (Methanex interest)

3

|

500

|

|

384

|

|

429

|

|

442

|

|

|

813

|

|

901

|

|

|

Chile

4

|

430

|

|

290

|

|

241

|

|

128

|

|

|

531

|

|

294

|

|

|

Egypt (50% interest)

|

158

|

|

15

|

|

141

|

|

165

|

|

|

156

|

|

330

|

|

|

Canada (Medicine Hat)

|

150

|

|

155

|

|

155

|

|

143

|

|

|

310

|

|

296

|

|

|

|

2,346

|

|

1,820

|

|

1,808

|

|

1,648

|

|

|

3,628

|

|

3,591

|

|

|

|

|

|

1

|

Operating capacity includes only those facilities which are currently capable of operating, but excludes any portion of an asset that is underutilized due to a lack of natural gas feedstock over a prolonged period of time. The operating capacity of our production facilities may be higher than original nameplate capacity as, over time, these figures have been adjusted to reflect ongoing operating efficiencies at these facilities. Actual production for a facility in any given year may be higher or lower than operating capacity due to a number of factors, including natural gas composition or the age of the facility's catalyst.

|

|

|

|

|

2

|

The operating capacity of New Zealand is made up of the two Motunui facilities and the Waitara Valley facility

(refer to the

New Zealand

section below).

|

|

|

|

|

3

|

The operating capacity of Trinidad is made up of the Titan (100% interest) and Atlas (63.1% interest) facilities

(refer to the

Trinidad

section below).

|

|

|

|

|

4

|

The operating capacity of our Chile I and IV facilities is 1.7 million tonnes annually assuming access to natural gas feedstock.

|

New Zealand

The New Zealand facilities produced

446,000

tonnes of methanol in the

second

quarter of

2019

compared with

437,000

tonnes in the

first

quarter of

2019

.

Production continues to be lower than operating capacity as a result of natural gas suppliers completing planned and unplanned maintenance activities. We expect these upstream maintenance activities to continue in the third quarter.

The New Zealand facilities are capable of producing up to

2.4 million

tonnes annually, depending on natural gas composition and availability.

United States

The Geismar facilities produced

530,000

tonnes during the

second

quarter of

2019

compared to

405,000

tonnes during the

first

quarter of

2019

. Production in Geismar for the

second

quarter of

2019

set a new quarterly site record following lower production in the

first

quarter of

2019

due to a scheduled turnaround of the Geismar 1 plant.

Trinidad

The Trinidad facilities produced

384,000

tonnes (Methanex interest) in the

second

quarter of

2019

compared with

429,000

tonnes (Methanex interest) in the

first

quarter of

2019

.

Production in Trinidad is lower in the second quarter of 2019 compared to the first quarter of 2019 primarily as a result of the turnaround completed in the Titan plant in April, and an unplanned production outage in May at the Atlas plant. For Trinidad, we continue to guide to approximately 85% operating rates.

Chile

The Chile facilities produced

290,000

tonnes during the

second

quarter of

2019

compared to

241,000

tonnes during the

first

quarter of

2019

. We have continued to receive reliable gas supply from our partners in Chile and Argentina over the last few months and have resolved the technical issues we faced with the start-up of our Chile IV facility. Increased production compared to the previous quarter is primarily due to higher natural gas availability.

Late in the second quarter of 2019, we commenced the first phase of our refurbishment of our Chile I plant scheduled to match expected lower natural gas deliveries during the southern hemisphere winter months. Provided that we are able to secure sufficient longer-term natural gas, we will complete the second phase of the refurbishment over the coming years.

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 4

MANAGEMENT’S DISCUSSION AND ANALYSIS

We expect that our current gas agreements will allow for a two-plant operation in Chile during the southern hemisphere summer months and up to a maximum of 75% of a two-plant operation annually over the near-term. The future of our Chile operations is primarily dependent on the level of natural gas exploration and development in southern Chile and our ability to secure a sustainable natural gas supply to our facilities on economic terms from Chile and Argentina.

Egypt

The Egypt facility produced

30,000

tonnes (Methanex interest -

15,000

tonnes) in the

second

quarter of

2019

compared with 282,000 tonnes (Methanex interest - 141,000 tonnes) in the

first

quarter of

2019

.

During the quarter, the Egypt facility experienced an outage and the plant remained off-line for the remainder of the second quarter of 2019 for inspections and repair work. We expect to restart the plant in August 2019.

The losses related to the outage are expected to be partially covered by insurance, however no insurance recoveries have been recorded to date.

Canada

The Medicine Hat facility produced

155,000

tonnes during the

second

quarter of

2019

and the

first

quarter of

2019

.

FINANCIAL RESULTS

For the

second

quarter of

2019

, we reported net income attributable to Methanex shareholders of

$50 million

(

$0.51

per common share on a diluted basis) compared with net income attributable to Methanex shareholders for the

first

quarter of

2019

of

$38 million

(

$0.50

per common share on a diluted basis) and net income attributable to Methanex shareholders for the

second

quarter of

2018

of

$111 million

(

$1.36

per common share on a diluted basis). For the six months ended June 30,

2019

compared to the same period for

2018

, we reported net income attributable to Methanex shareholders of

$89 million

(

$1.09

per common share on a diluted basis) and

$280 million

(

$3.38

per common share on a diluted basis).

For the

second

quarter of

2019

, we recorded Adjusted EBITDA of

$146 million

and Adjusted net income of

$26 million

(

$0.34

per common share). This compares with Adjusted EBITDA of

$194 million

and Adjusted net income of

$56 million

(

$0.73

per common share) for the

first

quarter of

2019

and Adjusted EBITDA of

$275 million

and Adjusted net income of

$143 million

(

$1.75

per common share) for the

second

quarter of

2018

. For the six month period ended June 30, 2019, we recorded Adjusted EBITDA of

$340 million

and Adjusted net income of

$82 million

(

$1.07

per common share) compared to Adjusted EBITDA of

$581 million

and Adjusted net income of

$314 million

(

$3.79

per common share) for the same period in 2018. In 2019, Adjusted EBITDA includes the impact from adoption of IFRS 16 which increased Adjusted EBITDA for the first quarter of 2019 by $28 million and second quarter of 2019 by $27 million or cumulatively $55 million for the six month period ended June 30, 2019. Refer to the

Adoption of New Accounting Standards

section on page

14

of the MD&A.

We calculate Adjusted EBITDA and Adjusted net income by including amounts related to our equity share of the Atlas facility (63.1% interest) and by excluding the non-controlling interests' share, the mark-to-market impact of share-based compensation as a result of changes in our share price and the impact of certain items associated with specific identified events. Refer to

Additional Information - Supplemental Non-GAAP Measures

on page

15

of the MD&A for a further discussion on how we calculate these measures. Our analysis of depreciation and amortization, finance costs, finance income and other expenses and income taxes is consistent with the presentation of our consolidated statements of income and excludes amounts related to Atlas.

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 5

MANAGEMENT’S DISCUSSION AND ANALYSIS

We review our financial results by analyzing changes in Adjusted EBITDA, mark-to-market impact of share-based compensation, depreciation and amortization, finance costs, finance income and other expenses and income taxes. A summary of our consolidated statements of income is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

($ millions)

|

Jun 30

2019

|

|

Mar 31

2019

|

|

Jun 30

2018

|

|

|

Jun 30

2019

|

|

Jun 30

2018

|

|

|

Consolidated statements of income:

|

|

|

|

|

|

|

|

Revenue

|

$

|

734

|

|

$

|

742

|

|

$

|

950

|

|

|

$

|

1,476

|

|

$

|

1,912

|

|

|

Cost of sales and operating expenses

|

(576

|

)

|

(590

|

)

|

(712

|

)

|

|

(1,166

|

)

|

(1,372

|

)

|

|

Mark-to-market impact of share-based compensation

|

(29

|

)

|

22

|

|

39

|

|

|

(7

|

)

|

41

|

|

|

Adjusted EBITDA (attributable to associate)

|

25

|

|

37

|

|

37

|

|

|

62

|

|

75

|

|

|

Amounts excluded from Adjusted EBITDA attributable to non-controlling interests

|

(8

|

)

|

(17

|

)

|

(39

|

)

|

|

(25

|

)

|

(75

|

)

|

|

Adjusted EBITDA (attributable to Methanex shareholders)

|

146

|

|

194

|

|

275

|

|

|

340

|

|

581

|

|

|

|

|

|

|

|

|

|

|

Mark-to-market impact of share-based compensation

|

29

|

|

(22

|

)

|

(39

|

)

|

|

7

|

|

(41

|

)

|

|

Depreciation and amortization

1

|

(86

|

)

|

(85

|

)

|

(63

|

)

|

|

(171

|

)

|

(122

|

)

|

|

Finance costs

1

|

(30

|

)

|

(28

|

)

|

(24

|

)

|

|

(58

|

)

|

(48

|

)

|

|

Finance income and other expenses

|

1

|

|

—

|

|

(2

|

)

|

|

1

|

|

1

|

|

|

Income tax expense

|

(6

|

)

|

(9

|

)

|

(33

|

)

|

|

(15

|

)

|

(78

|

)

|

|

Earnings of associate adjustment

2

|

(14

|

)

|

(19

|

)

|

(18

|

)

|

|

(33

|

)

|

(36

|

)

|

|

Non-controlling interests adjustment

2

|

10

|

|

7

|

|

15

|

|

|

18

|

|

23

|

|

|

Net income (attributable to Methanex shareholders)

|

$

|

50

|

|

$

|

38

|

|

$

|

111

|

|

|

$

|

89

|

|

$

|

280

|

|

|

Net income

|

$

|

49

|

|

$

|

46

|

|

$

|

135

|

|

|

$

|

96

|

|

$

|

333

|

|

|

|

|

|

1

|

Depreciation and amortization and finance costs for the periods ended June 30 and March 31, 2019 include the impact of the adoption of IFRS 16 "Leases". The comparative periods in 2018 have not been restated as the Company has adopted IFRS 16 using the modified retrospective approach.

|

|

|

|

|

2

|

These adjustments represent depreciation and amortization, finance costs, finance income and other expenses and income taxes associated with our 63.1% interest in the Atlas methanol facility and the non-controlling interests.

|

Adjusted EBITDA (attributable to Methanex shareholders)

Our operations consist of a single operating segment - the production and sale of methanol. We review the results of operations by analyzing changes in the components of Adjusted EBITDA. For a discussion of the definitions used in our Adjusted EBITDA analysis, refer to

How We Analyze Our Business

on page

19

of the MD&A. Changes in these components - average realized price, sales volume and total cash costs - similarly impact net income attributable to Methanex shareholders.

The changes in Adjusted EBITDA resulted from changes in the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ millions)

|

Q2 2019

compared with

Q1 2019

|

|

Q2 2019

compared with

Q2 2018

|

|

YTD Q2 2019

compared with

YTD Q2 2018

|

|

|

Average realized price

|

$

|

(16

|

)

|

$

|

(191

|

)

|

$

|

(360

|

)

|

|

Sales volume

|

(1

|

)

|

(7

|

)

|

(22

|

)

|

|

Total cash costs

|

(30

|

)

|

42

|

|

86

|

|

|

IFRS 16 leasing adoption impact

1

|

(1

|

)

|

27

|

|

55

|

|

|

Decrease

in Adjusted EBITDA

|

$

|

(48

|

)

|

$

|

(129

|

)

|

$

|

(241

|

)

|

1

Refer to the

Adoption of New Accounting Standards

section on page

14

of the MD&A for more information relating to the adoption of IFRS 16.

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 6

MANAGEMENT’S DISCUSSION AND ANALYSIS

Average realized price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

($ per tonne)

|

Jun 30

2019

|

|

Mar 31

2019

|

|

Jun 30

2018

|

|

|

Jun 30

2019

|

|

Jun 30

2018

|

|

|

Methanex average non-discounted posted price

|

391

|

|

392

|

|

478

|

|

|

391

|

|

476

|

|

|

Methanex average realized price

|

326

|

|

331

|

|

405

|

|

|

329

|

|

403

|

|

Methanex’s average realized price for the

second

quarter of

2019

decreased slightly to

$326

per tonne compared to

$331

per tonne in the

first

quarter of

2019

, decreasing Adjusted EBITDA by

$16 million

. For the three and six month period ended June 30, 2019, Methanex's average non-discounted posted price was

$391

per tonne compared to

$478

per tonne and

$476

per tonne for the same periods in 2018. Our average realized price for the three and six months ended June 30, 2019 decreased compared to the same periods in 2018 driven by lower average non-discounted posted prices (refer to

Supply/Demand Fundamentals

section on page

12

of the MD&A for more information).

Our average realized price for the

second

quarter of

2019

was

$326

per tonne compared to

$405

per tonne in the

second

quarter of

2018

, decreasing Adjusted EBITDA by

$191 million

. For the six months ended June 30, 2019, our average realized price was

$329

per tonne compared to

$403

per tonne for the same period in 2018, decreasing Adjusted EBITDA by

$360 million

.

Sales volume

Methanol sales volume excluding commission sales volume in the

second

quarter of

2019

was 9,000 tonnes lower than the

first

quarter of

2019

and 53,000 tonnes lower than the

second

quarter of

2018

. The decrease in the

second

quarter of

2019

compared to the

first

quarter of

2019

decreased Adjusted EBITDA by

$1 million

. The decrease in the second quarter of

2019

compared with the same period in

2018

decreased Adjusted EBITDA by

$7 million

. For the six months ended June 30, 2019 compared with the same period in 2018, methanol sales volume excluding commission sales volume was 156,000 tonnes lower and this resulted in lower Adjusted EBITDA by

$22 million

.

Total cash costs

The primary drivers of changes in our total cash costs are changes in the cost of Methanex-produced methanol and changes in the cost of methanol we purchase from others ("purchased methanol"). We supplement our production with methanol produced by others through methanol offtake contracts and purchases on the spot market to meet customer needs and to support our marketing efforts within the major global markets.

We apply the first-in, first-out method of accounting for inventories and it generally takes between 30 and 60 days to sell the methanol we produce or purchase. Accordingly, the changes in Adjusted EBITDA as a result of changes in Methanex-produced and purchased methanol costs primarily depend on changes in methanol pricing and the timing of inventory flows.

In a rising price environment, our margins at a given price are higher than in a stable price environment as a result of timing of methanol purchases and production versus sales. Generally, the opposite applies when methanol prices are decreasing.

The changes in Adjusted EBITDA due to changes in total cash costs were due to the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ millions)

|

Q2 2019

compared with

Q1 2019

|

|

Q2 2019

compared with

Q2 2018

|

|

YTD Q2 2019

compared with

YTD Q2 2018

|

|

|

Methanex-produced methanol costs

|

$

|

1

|

|

$

|

11

|

|

$

|

26

|

|

|

Proportion of Methanex-produced methanol sales

|

(33

|

)

|

(2

|

)

|

22

|

|

|

Purchased methanol costs

|

11

|

|

55

|

|

87

|

|

|

Logistics costs

|

(7

|

)

|

(10

|

)

|

(21

|

)

|

|

Other, net

|

(2

|

)

|

(12

|

)

|

(28

|

)

|

|

Increase/(decrease)

in Adjusted EBITDA due to changes in total cash costs

|

$

|

(30

|

)

|

$

|

42

|

|

$

|

86

|

|

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 7

MANAGEMENT’S DISCUSSION AND ANALYSIS

Methanex-produced methanol costs

Natural gas is the primary feedstock at our methanol facilities and is the most significant component of Methanex-produced methanol costs. We purchase natural gas for more than half of our production under agreements where the unique terms of each contract include a base price and a variable price component linked to the price of methanol to reduce our commodity price risk exposure. The variable price component of each gas contract is adjusted by a formula related to methanol prices above a certain level. For the

second

quarter of

2019

compared with the

first

quarter of

2019

and the

second

quarter of

2018

, Methanex-produced methanol costs were lower by

$1 million

and

$11 million

, respectively. For the six month period ended June 30, 2019 compared with the same period for 2018, Methanex-produced methanol costs were lower by

$26 million

. Changes in Methanex-produced methanol costs for all periods presented are primarily due to the impact of changes in realized methanol prices on the variable portion of our natural gas cost and changes in the mix of production sold from inventory.

Proportion of Methanex-produced methanol sales

The cost of purchased methanol is directly linked to the selling price for methanol at the time of purchase and the cost of purchased methanol is generally higher than the cost of Methanex-produced methanol. Accordingly, an increase in the proportion of Methanex-produced methanol sales results in a decrease in our overall cost structure for a given period. For the

second

quarter of

2019

compared with the

first

quarter of

2019

and the

second

quarter of

2018

, a lower proportion of Methanex-produced methanol sales decreased Adjusted EBITDA by

$33 million

and by

$2 million

, respectively. For the six month period ended June 30, 2019 compared with the same period for 2018, a higher proportion of Methanex-produced methanol sales increased Adjusted EBITDA by

$22 million

.

Purchased methanol costs

Changes in purchased methanol costs for all periods presented are primarily a result of changes in methanol pricing and the timing of purchases sold from inventory.

Logistics costs

Logistics costs vary from period to period depending on the levels of production from each of our production facilities and the resulting impact on our supply chain. Logistics costs in the

second

quarter of

2019

were

$7 million

higher than in the

first

quarter of

2019

, decreasing Adjusted EBITDA. Logistics costs for the three and six month periods ended

2019

compared with the same periods in

2018

were

$10 million

and

$21 million

higher, respectively. The increase in logistics costs decreased Adjusted EBITDA. Logistics costs for all periods presented were higher due to changes in the mix of Methanex-produced methanol sales volume resulting in longer supply chains and higher costs per delivered tonne. Specifically, for the second quarter of 2019 compared to the first quarter of 2019 and compared to the second quarter of 2018, the Egypt plant outage has led to longer supply chains and higher costs for delivery to our customers in the Mediterranean while the ITC terminal fire in Houston and high water levels on the Mississippi river have led to higher in-region logistics costs in North America.

Other, net

Other, net relates to unabsorbed fixed costs, selling, general and administrative expenses and other operational items. For the

second

quarter of

2019

compared with the

first

quarter of

2019

, other costs were higher by

$2 million

, primarily due to higher selling, general and administrative expenses related to events during the quarter.

For the

second

quarter of

2019

compared with the second quarter of 2018, other costs were higher by

$12 million

, primarily due to higher selling, general and administrative expenses related to events during the quarter, including cloud-based computing system implementation costs required to be expensed under IFRS , and higher unabsorbed fixed costs at our manufacturing sites during scheduled turnarounds and plant outages incurred during the quarter. For the six month period ended June 30, 2019 compared with the same period in 2018, other costs were higher by

$28 million

primarily due to higher selling, general and administrative expenses including cloud-based computing system implementation costs required to be expensed under IFRS, and higher unabsorbed fixed costs of $11 million at our manufacturing sites during scheduled turnarounds and plant outages incurred including the current Egypt plant outage in 2019.

METHANEX CORPORATION 2019 SECOND QUARTER PAGE 8

MANAGEMENT’S DISCUSSION AND ANALYSIS

IFRS 16 leasing adjustment

The adoption of IFRS 16 in 2019 has increased Adjusted EBITDA for the three and six month periods ended June 30, 2019 compared to the same periods in 2018 by $27 million and $55 million, respectively. The three and six month periods ended June 30, 2018 do not reflect IFRS 16. The lower lease costs included in the calculation of Adjusted EBITDA due to the adoption of IFRS 16 in 2019 is approximately offset by higher depreciation and amortization by $24 million and finance costs by $5 million recognized in the three month period ended June 30, 2019, and higher depreciation and amortization by $48 million and finance costs by $10 million recognized in the six month period ended June 30, 2019 . Refer to the

Adoption of New Accounting Standards

section on page

14

of the MD&A.

Mark-to-Market Impact of Share-based Compensation

We grant share-based awards as an element of compensation. Share-based awards granted include stock options, share appreciation rights, tandem share appreciation rights, deferred share units, restricted share units and performance share units. For all share-based awards, share-based compensation is recognized over the related vesting period for the proportion of the service that has been rendered at each reporting date. Share-based compensation includes an amount related to the grant-date value and a mark-to-market impact as a result of subsequent changes in the fair value of the share-based awards primarily driven by the Company’s share price. The grant-date value amount is included in Adjusted EBITDA and Adjusted net income. The mark-to-market impact of share-based compensation as a result of changes in our share price is excluded from Adjusted EBITDA and Adjusted net income and analyzed separately.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

($ millions except share price)

|

Jun 30

2019

|

|

Mar 31

2019

|

|

Jun 30

2018

|

|

|

Jun 30

2019

|

|

Jun 30

2018

|

|

|

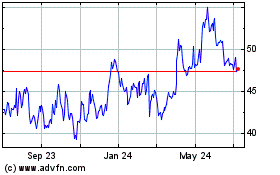

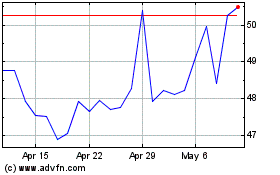

Methanex Corporation share price

1

|

$

|

45.46

|

|

$

|

56.86

|

|

$

|

70.70

|

|

|

$

|

45.46

|

|

$

|

70.70

|

|

|

Grant-date fair value expense included in Adjusted EBITDA and Adjusted net income

|

5

|

|

6

|

|

4

|

|

|

11

|

|

8

|

|

|

Mark-to-market impact due to change in share price

2

|

(29

|

)

|

22

|

|

39

|

|

|

(7

|

)

|

41

|

|

|

Total share-based compensation expense (recovery), before tax

|

$

|

(24

|

)

|

$

|

28

|

|

$

|

43

|

|

|

$

|

4

|

|

$

|

49

|

|

1

US dollar share price of Methanex Corporation as quoted on the NASDAQ Global Market on the last trading day of the respective period.

|

|

|

|

2

|