McGrath RentCorp (NASDAQ: MGRC) (the “Company”), a diversified

business-to-business rental company, today announced total revenues

for the quarter ended June 30, 2022 of $177.0 million, an increase

of 21%, compared to the second quarter of 2021. The Company

reported net income of $26.1 million, or $1.07 per diluted share,

for the second quarter of 2022, compared to net income of $20.6

million, or $0.84 per diluted share, for the second quarter of

2021.

SECOND QUARTER 2022 YEAR-OVER-YEAR COMPANY

HIGHLIGHTS:

- Rental revenues increased 17% to $110.6 million.

- Total revenues increased 21% to $177.0 million.

- Adjusted EBITDA1 increased 13% to $66.3 million.

- Dividend rate increased 5% to $0.455 per share for the

second quarter of 2022. On an annualized basis, this dividend

represents a 2.2% yield on the July 27, 2022 close price of $81.18

per share.

Joe Hanna, President and CEO of McGrath RentCorp, made the

following comments regarding these results and future

expectations:

“We were very pleased with our second quarter results. Our 21%

growth in total company revenues was a result of strong performance

in both rental operations and sales revenues. Demand was healthy

across each of our rental segments. Mobile Modular rental revenues

grew 22%, with approximately half of the growth attributable to our

Design Space and Titan Storage Container acquisitions. Excluding

the acquisitions, the modular segment rental revenues grew by 11%.

Rental revenue growth was also strong at TRS-RenTelco and Adler

Tanks, which grew 7% and 18%, respectively.

Mobile Modular saw broad-based strength across our commercial,

education and portable storage customer bases. We responded to this

strong rental demand with increased capital spending to organically

grow our fleet to capture growth opportunities, while also

improving overall fleet utilization and increasing pricing.

Operating expenses were elevated as we continued to spend robustly

to prepare modular equipment for rent as we enter what is typically

our busiest time of year for new project shipments. Our initiatives

to also grow modular sales showed progress as sales revenues

increased by 68% compared to a year ago.

At TRS-RenTelco and Adler Tanks the positive trends we

experienced earlier this year continued in the second quarter.

TRS-RenTelco saw growth in both communications and general-purpose

rentals. Adler Tanks continued to experience broad-based demand

improvement across its regions and vertical markets.

We have delivered strong performance in the first half of the

year, and we have entered the second half with good momentum across

the business. As a result, we have increased our financial outlook

for the full year.”

DIVISION HIGHLIGHTS:

All comparisons presented below are for the quarter ended June

30, 2022 to the quarter ended June 30, 2021 unless otherwise

indicated.

MOBILE MODULAR

For the second quarter of 2022, the Company’s Mobile Modular

division reported income from operations of $23.9 million, an

increase of $5.8 million, or 32%, with Adjusted EBITDA increasing

$6.3 million, or 21%, to $35.8 million. Rental revenues increased

22% to $64.9 million, depreciation expense increased 10% to $7.7

million and other direct costs increased 51% to $24.1 million,

which resulted in an increase in gross profit on rental revenues of

9% to $33.1 million. The rental revenue increase reflects the 2021

Design Space and Titan Storage Containers customers that

contributed approximately one half of the increase. Rental related

services revenues increased 31% to $21.2 million, primarily

attributable to higher delivery and pick up activities, and higher

site related and other services performed during the lease with

associated gross profit increasing 39% to $6.1 million. Sales

revenues increased 68% to $24.8 million, from both higher used and

new equipment sales. Gross margin on sales was 41% compared to 39%

in 2021, resulting in a 75% increase in gross profit on sales

revenues to $10.1 million. Selling and administrative expenses

increased 14% to $25.8 million, primarily due to increased employee

salaries and benefit costs totaling $1.5 million reflecting the

addition of Design Space employees, and $1.3 million higher

allocated corporate expenses.

TRS-RENTELCO

For the second quarter of 2022, the Company’s TRS-RenTelco

division reported income from operations of $9.5 million, an

increase of $1.0 million, or 12%, with Adjusted EBITDA increasing

$1.1 million, or 5%, to $22.1 million. Rental revenues increased 7%

to $29.7 million, depreciation expense increased 3% to $12.3

million and other direct costs increased 15% to $5.4 million, which

resulted in a 6% increase in gross profit on rental revenues to

$11.9 million. The rental revenue increase was the result of higher

average equipment on rent and higher average monthly rental rates

compared to the prior year. Sales revenues increased 35% to $6.4

million and gross profit on sales revenues increased 23% to $3.6

million. Selling and administrative expenses increased 9% to $6.6

million, primarily due to higher employees’ salaries and benefit

costs.

ADLER TANKS

For the second quarter of 2022, the Company’s Adler Tanks

division reported income from operations of $3.9 million, an

increase of $2.2 million, with Adjusted EBITDA increasing $1.9

million, or 28%, to $8.6 million. Rental revenues increased $2.5

million, or 18%, to $16.0 million, depreciation expense decreased

4% to $4.0 million and other direct costs increased 24% to $3.3

million, which resulted in an increased gross profit on rental

revenues of 30%, to $8.7 million. The rental revenue increase was

broad based across regions and vertical markets served. Rental

related services revenues increased 17% to $6.8 million, with gross

profit on rental related services increasing 63%, to $1.7 million.

Selling and administrative expenses increased 12% to $7.0 million

primarily due to higher employees’ salaries and benefit costs.

FINANCIAL OUTLOOK:

Based upon the Company’s year-to-date results and current

outlook for the remainder of the year, the Company is raising its

financial outlook. For the full-year 2022, the Company expects:

Previous

Current

Total revenue:

$675 million to $705 million

$695 million to $720 million

Adjusted EBITDA1, 2:

$260 million to $275 million

$266 million to $276 million

Gross rental equipment capital

expenditures:

$117 million to $127 million

$145 million to $155 million

- Adjusted EBITDA is defined as net income before interest

expense, provision for income taxes, depreciation, amortization,

non-cash impairment costs and share-based compensation. A

reconciliation of actual net income to Adjusted EBITDA and Adjusted

EBITDA to net cash provided by operating activities can be found at

the end of this release.

- Information reconciling forward-looking Adjusted EBITDA to the

comparable GAAP financial measures is unavailable to the Company

without unreasonable effort because certain items required for such

reconciliations are outside of the Company’s control and/or cannot

be reasonably predicted, such as the provision for income taxes.

Therefore, no reconciliation to the most comparable GAAP measures

is provided. The Company provides Adjusted EBITDA guidance because

it believes that Adjusted EBITDA, when viewed with the Company’s

results under GAAP, provides useful information for the reasons

noted in the reconciliation of actual Adjusted EBITDA to the most

directly comparable GAAP measures at the end of this release.

ABOUT MCGRATH RENTCORP:

Founded in 1979, McGrath RentCorp (Nasdaq: MGRC) is a

diversified business-to-business rental company providing modular

buildings, electronic test equipment, portable storage and tank

containment solutions across the United States and other select

North American regions. The Company’s rental operations consist of

four divisions: Mobile Modular rents and sells modular buildings to

fulfill customers’ temporary and permanent classroom and office

space needs; TRS-RenTelco rents and sells electronic test

equipment; Adler Tank Rentals rents and sells containment solutions

for hazardous and nonhazardous liquids and solids; and Mobile

Modular Portable Storage provides portable storage rental

solutions. For more information on McGrath RentCorp and its

operating units, please visit our websites:

Corporate – www.mgrc.com Modular Buildings –

www.mobilemodular.com Electronic Test Equipment –

www.trsrentelco.com Tanks and Boxes – www.adlertankrentals.com

Portable Storage – www.mobilemodularcontainers.com School

Facilities Manufacturing – www.enviroplex.com

You should read this press release in conjunction with the

financial statements and notes thereto included in the Company’s

latest Forms 10-K, 10-Q and other SEC filings. You can visit the

Company’s web site at www.mgrc.com to access information on McGrath

RentCorp, including the latest Forms 10-K, 10-Q and other SEC

filings.

CONFERENCE CALL NOTE:

As previously announced in its press release of June 30, 2022,

McGrath RentCorp will host a conference call at 5:00 p.m. Eastern

Time (2:00 p.m. Pacific Time) on July 28, 2022 to discuss the

second quarter 2022 results. To participate in the teleconference,

dial 1-800-445-7795 (in the U.S.), or 1-203-518-9848 (outside the

U.S.), or to listen only, access the simultaneous webcast at the

investor relations section of the Company’s website at

https://investors.mgrc.com/. A replay will be available for 7 days

following the call by dialing 1-800-839-6975 (in the U.S.), or

1-402-220-6061 (outside the U.S.). In addition, a live audio

webcast and replay of the call may be found in the investor

relations section of the Company’s website at

https://investors.mgrc.com/events-and-presentations.

FORWARD-LOOKING STATEMENTS:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical facts,

regarding McGrath RentCorp’s expectations, strategies, prospects or

targets are forward looking statements. These forward-looking

statements also can be identified by the use of forward-looking

terminology such as “anticipates,” “believes,” “continues,”

“could,” “estimates,” “expects,” “intends,” “may,” “plan,”

“predict,” “project,” or “will,” or the negative of these terms or

other comparable terminology. In particular, Mr. Hanna’s statements

about spending robustly to prepare modular equipment for rent and

the expectation of demand in the following quarter due to

seasonality, as well as the statements regarding the full year 2022

in the “Financial Outlook” section, are forward-looking.

These forward-looking statements are not guarantees of future

performance and involve significant risks and uncertainties that

could cause our actual results to differ materially from those

projected including: the duration of the COVID-19 pandemic and its

economic impact, the extent and length of the restrictions

associated with COVID-19 pandemic, the health of the education and

commercial markets in our modular building division; the activity

levels in the general purpose and communications test equipment

markets at TRS-RenTelco; the utilization levels and rental rates of

our Adler Tanks liquid and solid containment tank and box rental

assets; continued execution of our performance improvement

initiatives; our ability to successfully increase prices to offset

cost increases; and our ability to effectively manage our rental

assets, as well as the factors disclosed under “Risk Factors” in

the Company’s Form 10-K and other SEC filings.

Forward-looking statements are made only as of the date hereof.

Except as otherwise required by law, we assume no obligation to

update any of the forward-looking statements contained in this

press release.

MCGRATH RENTCORP

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(UNAUDITED)

Three Months Ended June

30,

Six Months Ended June

30,

(in thousands, except per share

amounts)

2022

2021

2022

2021

Revenues

Rental

$

110,624

$

94,581

$

214,865

$

180,668

Rental related services

28,819

22,688

53,136

42,357

Rental operations

139,443

117,269

268,001

223,025

Sales

36,471

28,256

52,347

42,867

Other

1,117

910

2,056

1,738

Total revenues

177,031

146,435

322,404

267,630

Costs and

Expenses

Direct costs of rental operations:

Depreciation of rental equipment

24,064

23,159

47,938

44,414

Rental related services

20,853

17,276

38,996

31,880

Other

32,825

23,278

60,648

42,985

Total direct costs of rental

operations

77,742

63,713

147,582

119,279

Costs of sales

21,452

16,855

30,496

25,403

Total costs of revenues

99,194

80,568

178,078

144,682

Gross profit

77,837

65,867

144,326

122,948

Selling and administrative expenses

40,788

36,261

79,915

69,398

Income from operations

37,049

29,606

64,411

53,550

Other expense:

Interest expense

(3,001

)

(2,257

)

(5,821

)

(4,040

)

Foreign currency exchange loss

(181

)

(2

)

(168

)

(57

)

Income before provision for income

taxes

33,867

27,347

58,422

49,453

Provision for income taxes

7,730

6,739

13,492

11,447

Net income

$

26,137

$

20,608

$

44,930

$

38,006

Earnings per share:

Basic

$

1.07

$

0.85

$

1.85

$

1.57

Diluted

$

1.07

$

0.84

$

1.83

$

1.55

Shares used in per share calculation:

Basic

24,360

24,229

24,323

24,191

Diluted

24,509

24,494

24,522

24,505

Cash dividends declared per share

$

0.455

$

0.435

$

0.910

$

0.870

MCGRATH RENTCORP

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

June 30,

December 31,

(in thousands)

2022

2021

Assets

Cash

$

874

$

1,491

Accounts receivable, net of allowance for

credit losses of $2,125 in 2022

and 2021

167,329

159,499

Rental equipment, at cost:

Relocatable modular buildings

1,075,898

1,040,094

Electronic test equipment

389,383

361,391

Liquid and solid containment tanks and

boxes

309,010

309,908

1,774,291

1,711,393

Less: accumulated depreciation

(676,766

)

(646,169

)

Rental equipment, net

1,097,525

1,065,224

Property, plant and equipment, net

137,465

135,325

Prepaid expenses and other assets

65,800

54,945

Intangible assets, net

44,086

47,049

Goodwill

132,305

132,393

Total assets

$

1,645,384

$

1,595,926

Liabilities and Shareholders'

Equity

Liabilities:

Notes payable

$

441,460

$

426,451

Accounts payable and accrued

liabilities

137,729

136,313

Deferred income

77,551

58,716

Deferred income taxes, net

236,610

242,425

Total liabilities

893,350

863,905

Shareholders’ equity:

Common stock, no par value - Authorized

40,000 shares

Issued and outstanding - 24,378 shares as

of June 30, 2022 and 24,260 shares as of December 31, 2021

105,894

108,610

Retained earnings

646,130

623,465

Accumulated other comprehensive income

(loss)

10

(54

)

Total shareholders’ equity

752,034

732,021

Total liabilities and shareholders’

equity

$

1,645,384

$

1,595,926

MCGRATH RENTCORP

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

Six Months Ended June

30,

(in thousands)

2022

2021

Cash Flows from Operating

Activities:

Net income

$

44,930

$

38,006

Adjustments to reconcile net income to net

cash provided by

operating activities:

Depreciation and amortization

55,355

50,559

Deferred income taxes

(5,815

)

7,268

Provision for doubtful accounts

49

138

Share-based compensation

3,412

3,597

Gain on sale of used rental equipment

(16,093

)

(11,870

)

Foreign currency exchange loss

168

57

Amortization of debt issuance costs

9

6

Change in:

Accounts receivable

(7,879

)

(5,494

)

Prepaid expenses and other assets

(10,855

)

(9,385

)

Accounts payable and accrued

liabilities

(73

)

17,642

Deferred income

18,835

7,458

Net cash provided by operating

activities

82,043

97,982

Cash Flows from Investing

Activities:

Purchases of rental equipment

(94,820

)

(58,902

)

Purchases of property, plant and

equipment

(6,594

)

(2,272

)

Cash paid for acquisition of

businesses

—

(284,341

)

Proceeds from sales of used rental

equipment

31,830

24,674

Net cash used in investing activities

(69,584

)

(320,841

)

Cash Flows from Financing

Activities:

Net borrowings under bank lines of

credit

15,000

189,983

Borrowings under note purchase

agreement

—

60,000

Taxes paid related to net share settlement

of stock awards

(6,128

)

(4,828

)

Payment of dividends

(22,083

)

(21,089

)

Net cash (used in) provided by financing

activities

(13,211

)

224,066

Effect of foreign currency exchange rate

changes on cash

135

(33

)

Net (decrease) increase in cash

(617

)

1,174

Cash balance, beginning of period

1,491

1,238

Cash balance, end of period

$

874

$

2,412

Supplemental Disclosure of Cash Flow

Information:

Interest paid, during the period

$

5,821

$

3,987

Net income taxes paid, during the

period

$

17,078

$

6,990

Dividends accrued during the period, not

yet paid

$

11,009

$

9,918

Rental equipment acquisitions, not yet

paid

$

6,906

$

8,502

MCGRATH RENTCORP

BUSINESS SEGMENT DATA

(unaudited)

Three months ended June 30,

2022

(dollar amounts in thousands)

Mobile Modular

TRS- RenTelco

Adler Tanks

Enviroplex

Consolidated

Revenues

Rental

$

64,949

$

29,718

$

15,957

$

—

$

110,624

Rental related services

21,233

813

6,773

—

28,819

Rental operations

86,182

30,531

22,730

—

139,443

Sales

24,816

6,404

601

4,650

36,471

Other

379

406

332

—

1,117

Total revenues

111,377

37,341

23,663

4,650

177,031

Costs and Expenses

Direct costs of rental operations:

Depreciation

7,749

12,333

3,982

—

24,064

Rental related services

15,116

664

5,073

—

20,853

Other

24,073

5,443

3,309

—

32,825

Total direct costs of rental

operations

46,938

18,440

12,364

—

77,742

Costs of sales

14,760

2,765

418

3,509

21,452

Total costs of revenues

61,698

21,205

12,782

3,509

99,194

Gross Profit

Rental

33,127

11,942

8,666

—

53,735

Rental related services

6,117

149

1,700

—

7,966

Rental operations

39,244

12,091

10,366

—

61,701

Sales

10,056

3,639

183

1,141

15,019

Other

379

406

332

—

1,117

Total gross profit

49,679

16,136

10,881

1,141

77,837

Selling and administrative expenses

25,755

6,614

6,979

1,440

40,788

Income (loss) from operations

$

23,924

$

9,522

$

3,902

$

(299

)

37,049

Interest expense

(3,001

)

Foreign currency exchange loss

(181

)

Provision for income taxes

(7,730

)

Net income

$

26,137

Other Information

Adjusted EBITDA 1

$

35,773

$

22,128

$

8,620

$

(230

)

$

66,291

Average rental equipment 2

$

1,019,927

$

382,068

$

307,402

Average monthly total yield 3

2.12

%

2.59

%

1.73

%

Average utilization 4

78.1

%

64.5

%

51.6

%

Average monthly rental rate 5

2.72

%

4.02

%

3.35

%

- Adjusted EBITDA is defined as net income before interest

expense, provision for income taxes, depreciation, amortization,

non-cash impairment costs and share-based compensation.

- Average rental equipment represents the cost of rental

equipment, excluding accessory equipment. For Mobile Modular and

Adler Tanks, Average rental equipment also excludes new equipment

inventory.

- Average monthly total yield is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

for the period.

- Average utilization is calculated by dividing the average month

end costs of rental equipment on rent by the average month end

total costs of rental equipment.

- Average monthly rental rate is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

on rent for the period.

MCGRATH RENTCORP

BUSINESS SEGMENT DATA

(unaudited)

Three months ended June 30,

2021

(dollar amounts in thousands)

Mobile Modular

TRS-RenTelco

Adler Tanks

Enviroplex

Consolidated

Revenues

Rental

$

53,238

$

27,860

$

13,483

$

—

$

94,581

Rental related services

16,207

710

5,771

—

22,688

Rental operations

69,445

28,570

19,254

—

117,269

Sales

14,784

4,757

593

8,122

28,256

Other

343

456

111

—

910

Total revenues

84,572

33,783

19,958

8,122

146,435

Costs and Expenses

Direct costs of rental operations:

Depreciation

7,074

11,916

4,169

—

23,159

Rental related services

11,804

745

4,727

—

17,276

Other

15,901

4,718

2,659

—

23,278

Total direct costs of rental

operations

34,779

17,379

11,555

—

63,713

Costs of sales

9,034

1,792

427

5,602

16,855

Total costs of revenues

43,813

19,171

11,982

5,602

80,568

Gross Profit

Rental

30,264

11,225

6,655

—

48,144

Rental related services

4,401

(33

)

1,044

—

5,412

Rental operations

34,665

11,192

7,699

—

53,556

Sales

5,751

2,964

166

2,520

11,401

Other

343

456

111

—

910

Total gross profit

40,759

14,612

7,976

2,520

65,867

Selling and administrative expenses

22,602

6,073

6,253

1,333

36,261

Income from operations

$

18,157

$

8,539

$

1,723

$

1,187

29,606

Interest expense

(2,257

)

Foreign currency exchange loss

(2

)

Provision for income taxes

(6,739

)

Net income

$

20,608

Other Information

Adjusted EBITDA 1

$

29,518

$

21,019

$

6,736

$

1,250

$

58,523

Average rental equipment 2

$

906,653

$

349,480

$

313,108

Average monthly total yield 3

1.96

%

2.66

%

1.44

%

Average utilization 4

75.5

%

67.7

%

44.0

%

Average monthly rental rate 5

2.59

%

3.93

%

3.27

%

- Adjusted EBITDA is defined as net income before interest

expense, provision for income taxes, depreciation, amortization,

non-cash impairment costs and share-based compensation.

- Average rental equipment represents the cost of rental

equipment, excluding accessory equipment. For Mobile Modular and

Adler Tanks, Average rental equipment also excludes new equipment

inventory.

- Average monthly total yield is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

for the period.

- Average utilization is calculated by dividing the average month

end costs of rental equipment on rent by the average month end

total costs of rental equipment.

- Average monthly rental rate is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

on rent for the period.

MCGRATH RENTCORP

BUSINESS SEGMENT DATA

(unaudited)

Six months ended June 30, 2022

(dollar amounts in thousands)

Mobile Modular

TRS-RenTelco

Adler Tanks

Enviroplex

Consolidated

Revenues

Rental

$

126,487

$

58,230

$

30,148

$

—

$

214,865

Rental related services

39,594

1,484

12,058

—

53,136

Rental operations

166,081

59,714

42,206

—

268,001

Sales

35,191

10,331

1,258

5,567

52,347

Other

750

787

519

—

2,056

Total revenues

202,022

70,832

43,983

5,567

322,404

Costs and Expenses

Direct costs of rental operations:

Depreciation

15,582

24,362

7,994

—

47,938

Rental related services

28,296

1,244

9,456

—

38,996

Other

44,235

10,135

6,278

—

60,648

Total direct costs of rental

operations

88,113

35,741

23,728

—

147,582

Costs of sales

21,089

4,265

920

4,222

30,496

Total costs of revenues

109,202

40,006

24,648

4,222

178,078

Gross Profit

Rental

66,670

23,733

15,876

—

106,279

Rental related services

11,298

240

2,602

—

14,140

Rental operations

77,968

23,973

18,478

—

120,419

Sales

14,102

6,066

338

1,345

21,851

Other

750

787

519

—

2,056

Total gross profit

92,820

30,826

19,335

1,345

144,326

Selling and administrative expenses

50,447

13,204

13,501

2,763

79,915

Income (loss) from operations

$

42,373

$

17,622

$

5,834

$

(1,418

)

64,411

Interest expense

(5,821

)

Foreign currency exchange loss

(168

)

Provision for income taxes

(13,492

)

Net income

$

44,930

Other Information

Adjusted EBITDA 1

$

66,178

$

42,781

$

15,327

$

(1,276

)

$

123,010

Average rental equipment 2

$

1,013,361

$

374,364

$

307,985

Average monthly total yield 3

2.08

%

2.59

%

1.63

%

Average utilization 4

77.6

%

64.6

%

49.9

%

Average monthly rental rate 5

2.68

%

4.02

%

3.27

%

- Adjusted EBITDA is defined as net income before interest

expense, provision for income taxes, depreciation, amortization,

non-cash impairment costs and share-based compensation.

- Average rental equipment represents the cost of rental

equipment, excluding accessory equipment. For Mobile Modular and

Adler Tanks, Average rental equipment also excludes new equipment

inventory.

- Average monthly total yield is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

for the period.

- Average utilization is calculated by dividing the average month

end costs of rental equipment on rent by the average month end

total costs of rental equipment.

- Average monthly rental rate is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

on rent for the period.

MCGRATH RENTCORP

BUSINESS SEGMENT DATA

(unaudited)

Six months ended June 30, 2021

(dollar amounts in thousands)

Mobile Modular

TRS- RenTelco

Adler Tanks

Enviroplex

Consolidated

Revenues

Rental

$

99,895

$

55,136

$

25,637

$

—

$

180,668

Rental related services

30,258

1,450

10,649

—

42,357

Rental operations

130,153

56,586

36,286

—

223,025

Sales

22,404

9,906

1,201

9,356

42,867

Other

663

894

181

—

1,738

Total revenues

153,220

67,386

37,668

9,356

267,630

Costs and Expenses

Direct costs of rental operations:

Depreciation

12,893

23,278

8,243

—

44,414

Rental related services

21,876

1,398

8,606

—

31,880

Other

28,776

9,252

4,957

—

42,985

Total direct costs of rental

operations

63,545

33,928

21,806

—

119,279

Costs of sales

13,982

4,093

843

6,485

25,403

Total costs of revenues

77,527

38,021

22,649

6,485

144,682

Gross Profit

Rental

58,227

22,605

12,437

—

93,269

Rental related services

8,380

54

2,043

—

10,477

Rental operations

66,607

22,659

14,480

—

103,746

Sales

8,423

5,812

358

2,871

17,464

Other

663

894

181

—

1,738

Total gross profit

75,693

29,365

15,019

2,871

122,948

Selling and administrative expenses

41,839

12,371

12,520

2,668

69,398

Income from operations

$

33,854

$

16,994

$

2,499

$

203

53,550

Interest expense

(4,040

)

Foreign currency exchange loss

(57

)

Provision for income taxes

(11,447

)

Net income

$

38,006

Other Information

Adjusted EBITDA 1

$

53,473

$

41,411

$

12,436

$

329

$

107,649

Average rental equipment 2

$

876,529

$

342,526

$

313,498

Average monthly total yield 3

1.90

%

2.68

%

1.36

%

Average utilization 4

75.7

%

67.7

%

42.1

%

Average monthly rental rate 5

2.44

%

3.96

%

3.24

%

- Adjusted EBITDA is defined as net income before interest

expense, provision for income taxes, depreciation, amortization,

non-cash impairment costs and share-based compensation.

- Average rental equipment represents the cost of rental

equipment, excluding accessory equipment. For Mobile Modular and

Adler Tanks, Average rental equipment also excludes new equipment

inventory.

- Average monthly total yield is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

for the period.

- Average utilization is calculated by dividing the average month

end costs of rental equipment on rent by the average month end

total costs of rental equipment.

- Average monthly rental rate is calculated by dividing the

averages of monthly rental revenues by the cost of rental equipment

on rent for the period.

Reconciliation of Adjusted EBITDA to the most directly

comparable GAAP measures

To supplement the Company’s financial data presented on a basis

consistent with accounting principles generally accepted in the

United States of America (“GAAP”), the Company presents “Adjusted

EBITDA”, which is defined by the Company as net income before

interest expense, provision for income taxes, depreciation,

amortization and share-based compensation. The Company presents

Adjusted EBITDA as a financial measure as management believes it

provides useful information to investors regarding the Company’s

liquidity and financial condition and because management, as well

as the Company’s lenders, use this measure in evaluating the

performance of the Company.

Management uses Adjusted EBITDA as a supplement to GAAP measures

to further evaluate the Company’s period-to-period operating

performance, compliance with financial covenants in the Company’s

revolving lines of credit and senior notes and the Company’s

ability to meet future capital expenditure and working capital

requirements. Management believes the exclusion of non-cash

charges, including share-based compensation, is useful in measuring

the Company’s cash available for operations and performance of the

Company. Because management finds Adjusted EBITDA useful, the

Company believes its investors will also find Adjusted EBITDA

useful in evaluating the Company’s performance.

Adjusted EBITDA should not be considered in isolation or as a

substitute for net income, cash flows, or other consolidated income

or cash flow data prepared in accordance with GAAP or as a measure

of the Company’s profitability or liquidity. Adjusted EBITDA is not

in accordance with or an alternative for GAAP, and may be different

from non-GAAP measures used by other companies. Unlike EBITDA,

which may be used by other companies or investors, Adjusted EBITDA

does not include share-based compensation charges. The Company

believes that Adjusted EBITDA is of limited use in that it does not

reflect all of the amounts associated with the Company’s results of

operations as determined in accordance with GAAP and does not

accurately reflect real cash flow. In addition, other companies may

not use Adjusted EBITDA or may use other non-GAAP measures,

limiting the usefulness of Adjusted EBITDA for purposes of

comparison. The Company’s presentation of Adjusted EBITDA should

not be construed as an inference that the Company will not incur

expenses that are the same as or similar to the adjustments in this

presentation. Therefore, Adjusted EBITDA should only be used to

evaluate the Company’s results of operations in conjunction with

the corresponding GAAP measures. The Company compensates for the

limitations of Adjusted EBITDA by relying upon GAAP results to gain

a complete picture of the Company’s performance. Because Adjusted

EBITDA is a non-GAAP financial measure as defined by the SEC, the

Company includes in the tables below reconciliations of Adjusted

EBITDA to the most directly comparable financial measures

calculated and presented in accordance with GAAP.

Reconciliation of Net Income to Adjusted EBITDA

(dollar amounts in thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

Twelve Months Ended

June 30,

2022

2021

2022

2021

2022

2021

Net income

$

26,137

$

20,608

$

44,930

$

38,006

$

96,629

$

97,282

Provision for income taxes

7,730

6,739

13,492

11,447

34,096

26,976

Interest expense

3,001

2,257

5,821

4,040

12,236

7,991

Depreciation and amortization

27,771

27,099

55,355

50,559

111,491

97,539

EBITDA

64,639

56,703

119,598

104,052

254,452

229,788

Share-based compensation

1,652

1,820

3,412

3,597

7,481

5,922

Adjusted EBITDA 1

$

66,291

$

58,523

$

123,010

$

107,649

$

261,933

$

235,710

Adjusted EBITDA margin 2

37

%

40

%

38

%

40

%

39

%

41

%

Reconciliation of Adjusted EBITDA to Net Cash Provided by

Operating Activities

(dollar amounts in thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

Twelve Months Ended

June 30,

2022

2021

2022

2021

2022

2021

Adjusted EBITDA 1

$

66,291

$

58,523

$

123,010

$

107,649

$

261,933

$

235,710

Interest paid

(3,684

)

(2,362

)

(5,821

)

(3,987

)

(12,160

)

(8,006

)

Income taxes paid, net of refunds

received

(16,658

)

(6,618

)

(17,078

)

(6,990

)

(19,175

)

(39,740

)

Gain on sale of used rental equipment

(10,729

)

(7,076

)

(16,093

)

(11,870

)

(29,664

)

(21,597

)

Foreign currency exchange loss (gain)

181

2

168

57

321

(340

)

Amortization of debt issuance costs

5

3

9

6

18

12

Change in certain assets and

liabilities:

Accounts receivable, net

(15,765

)

(6,464

)

(7,830

)

(5,356

)

(26,420

)

(2,732

)

Prepaid expenses and other assets

(15,068

)

(9,291

)

(10,855

)

(9,385

)

(8,286

)

(3,937

)

Accounts payable and other liabilities

12,115

30,785

(2,302

)

20,400

(7,221

)

28,940

Deferred income

13,612

2,871

18,835

7,458

20,459

(7,346

)

Net cash provided by operating

activities

$

30,300

$

60,373

$

82,043

$

97,982

$

179,805

$

180,964

- Adjusted EBITDA is defined as net income before interest

expense, provision for income taxes, depreciation, amortization and

share-based compensation.

- Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided

by total revenues for the period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220727006128/en/

Keith E. Pratt EVP & Chief Financial Officer

925-606-9200

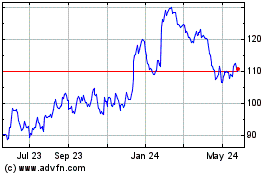

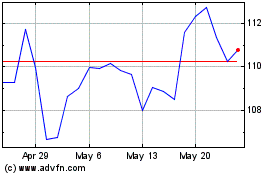

McGrath RentCorp (NASDAQ:MGRC)

Historical Stock Chart

From May 2024 to Jun 2024

McGrath RentCorp (NASDAQ:MGRC)

Historical Stock Chart

From Jun 2023 to Jun 2024