Earnings Scorecard: AMAT - Analyst Blog

November 23 2011 - 11:25AM

Zacks

Following the fourth quarter earnings announcement on November

16, more than half the analysts covering Applied

Materials (AMAT) have made downward revisions to their

estimates. The reason for the negative revisions may be traced to

the weak results and outlook, particularly for the Display and

Energy and Environmental Systems (EES) segments that is expected to

continue well into 2012.

Last Quarter Synopsis

Applied’spro forma earnings were in line with the Zacks

Consensus Estimate as lower revenue and margins were partially

offset by strong opex management and a lower-than-expected tax

rate.

Revenue growth was weak across the Display and EES (solar)

segments, with the Silicon Systems Group (SSG) performing in line

with expectations. However, Applied’s penetration in Asiadeepened

significantly, helping the Applied Global Services (AGS) segment to

exceed expectations.

Orders in the quarter were down 33.0% sequentially due to order

declines in display (-91% sequentially) and EES (-3% sequentially).

The lower demand for TVs and mobile devices in the display segment

and excess capacity in the EES segment were the main reasons for

the decline. Gross margins also declined sequentially to 39.6%

aslower volumes impacted cost absorption.

Agreement of Analysts

Estimate revisions for the upcoming quarter indicate declining

sentiments, with 15 out of 17 analysts making downward revisions in

the last 30 days. Also, for fiscal 2012, 15 out of 20 analysts made

downward revisions, with only 1 analyst moving upward in the last

30 days.

Analysts, by and large, continue to expect additional semi

equipment order weakness in 2012. They believe that significant

pressure in both Display (due to slow large TV sales growth) and

EES (due to overcapacity and subsidy cutbacks) will weigh on

Applied’s core fundamentals.

The analysts believe that both these segments will likely remain

under pressure over the next several quarters with the timing of a

recovery being uncertain, given the overcapacity issues and macro

headwinds.

Very few analysts believe that the display business will improve

in the upcoming quarter, banking on investments in LCD/OLED that

they expect will enable recovery.

Applied now projects first quarter revenue to be down 5-15%

sequentially, with SSG (including Varian) to be up 5-20%

sequentially, AGSto be down 10-20% (the combined effect of lower

200mm sales, lower utilization rates and the absence of thin film

revenue), and Display and EES to be down 40-60%.

Impact on Estimates

As the majority of analysts have lowered their estimates over

the past 30 days, the Zacks Consensus Estimate has fallen 6 cents

for the upcoming quarter to 12cents and 16 cents for fiscal 2012 to

84 cents. In the past 90 days, the Zacks Consensus Estimate fell 19

cents for the upcoming quarter and 49 cents for fiscal 2012 to 84

cents.

The significant decline of 48 cents in the Zacks Consensus

Estimate for 2012 clearly indicates the uncertainties in the

semiconductor business and echoes the general pessimism for both

display and solar in 2012.

Conclusion

Though we believe there is potential in the solar energy market

over the long term, we remain cautious on the company's efforts

since management has already missed several targets to bring its

solar division to profitability. Additionally, limited visibility

and lower overall semiconductor equipment spending levels are the

reasons our Sell rating on the stock.

However, we remain positive about Applied’s strong position in

the semiconductor market, the solar business in China, the huge

portfolio and strategic relationships, which will however be less

effective in the current market scenario.

Applied, which competes with other large equipment makers, such

as KLA-Tencor Corporation (KLAC), Lam

Research Corporation (LRCX) and Novellus

Systems (NVLS),holds a Zacks #5 Rank that translates into

a short-term Sell rating.

APPLD MATLS INC (AMAT): Free Stock Analysis Report

KLA-TENCOR CORP (KLAC): Free Stock Analysis Report

LAM RESEARCH (LRCX): Free Stock Analysis Report

NOVELLUS SYS (NVLS): Free Stock Analysis Report

Zacks Investment Research

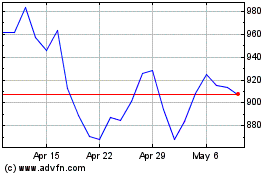

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

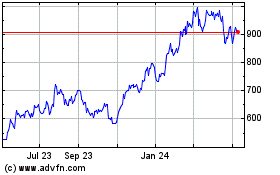

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Jul 2023 to Jul 2024