Current Report Filing (8-k)

November 06 2019 - 4:11PM

Edgar (US Regulatory)

NASDAQ NASDAQ true NASDAQ false 0001754301 0001754301 2019-11-05 2019-11-05 0001754301 us-gaap:CommonClassAMember 2019-11-05 2019-11-05 0001754301 us-gaap:CommonClassBMember 2019-11-05 2019-11-05 0001754301 us-gaap:ParticipatingPreferredStockSubjectToMandatoryRedemptionMember 2019-11-05 2019-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT

(DATE OF EARLIEST EVENT REPORTED)

November 5, 2019

Fox Corporation

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

|

|

|

|

|

|

Delaware

|

|

001-38776

|

|

83-1825597

|

|

(STATE OR OTHER JURISDICTION

OF INCORPORATION)

|

|

(COMMISSION

FILE NO.)

|

|

(IRS EMPLOYER

IDENTIFICATION NO.)

|

1211 Avenue of the Americas, New York, New York 10036

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES, INCLUDING ZIP CODE)

(212) 852-7000

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbols

|

|

Name of Each Exchange

on Which Registered

|

|

Class A Common Stock, par value $0.01 per share

|

|

FOXA

|

|

The Nasdaq Global Select Market

|

|

Class B Common Stock, par value $0.01 per share

|

|

FOX

|

|

The Nasdaq Global Select Market

|

|

Rights to Purchase Series A Junior Participating Preferred Stock

|

|

N/A

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On November 6, 2019, Fox Corporation (the “Company”) entered into a stockholders agreement (the “Stockholders Agreement”) by and between the Company and the Murdoch Family Trust (the “MFT”). Pursuant to the Stockholders Agreement, the MFT and the Company have agreed not to take actions that would result in the MFT and Murdoch family members together owning more than 44% of the outstanding voting power of the shares of the Company’s Class B common stock, par value $0.01 per share (“Class B Shares”), or would increase the MFT’s voting power by more than 1.75% in any rolling twelve-month period. The MFT would forfeit votes to the extent necessary to ensure that the MFT and the Murdoch family collectively do not exceed 44% of the outstanding voting power of the Class B Shares, except where a Murdoch family member votes their own shares differently from the MFT on any matter.

The Stockholders Agreement will terminate upon the MFT’s distribution of all or substantially all of its Class B Shares. The Company will reimburse the MFT for certain fees and expenses (including any governmental filing fees) in connection with the Stockholders Agreement.

The Stockholders Agreement was approved by the independent members of the Company’s Board of Directors (the “Board”), with the assistance of independent legal and financial advisors.

The foregoing description of the Stockholders Agreement is qualified in its entirety by reference to the full text of the Stockholders Agreement, which is attached hereto as Exhibit 10.1, and incorporated herein by reference.

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On November 6, 2019, the Company released its financial results for the quarter ended September 30, 2019. A copy of the Company’s press release is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Stock Repurchase Program

On November 6, 2019, the Company issued a press release announcing that the Board approved a $2 billion stock repurchase program for the Company’s Class A common stock, par value $0.01 per share (“Class A Shares”) and Class B Shares. The manner, timing, number and share price of the repurchases will be determined by the Company at its discretion and will depend upon such factors as the market price of the stock, general market conditions, applicable securities laws, alternative investment opportunities and other factors. The stock repurchase program has no time limit and may be modified, suspended or discontinued at any time. The Company also announced that it had entered into an accelerated stock repurchase transaction to repurchase $350 million of Class A Shares.

A copy of the Company’s press release announcing the stock repurchase program, the accelerated stock repurchase transaction and the entry into the Stockholders Agreement is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Television Stations Acquisitions and Dispositions

On November 5, 2019, the Company issued a press release announcing the entry into an agreement with Nexstar Media Group (“Nexstar”) pursuant to which the Company has agreed to acquire three television stations from Nexstar for approximately $350 million and sell two stations to Nexstar for approximately $45 million, subject to regulatory approvals and the satisfaction or waiver of customary closing conditions.

A copy of the Company’s press release announcing the entry into the agreement with Nexstar is filed as Exhibit 99.3 hereto and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

Description

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Stockholders Agreement, dated as of November 6, 2019, by and between Fox Corporation and the Murdoch Family Trust (the “Stockholders Agreement”).

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press release issued by Fox Corporation, dated November 6, 2019, announcing Fox Corporation’s financial results for the quarter ended September 30, 2019.

|

|

|

|

|

|

|

|

|

99.2

|

|

|

Press release issued by Fox Corporation, dated November 6, 2019, announcing stock repurchase program and the Stockholders Agreement.

|

|

|

|

|

|

|

|

|

99.3

|

|

|

Press release issued by Fox Corporation, dated November 5, 2019, announcing agreement between Fox Corporation and Nexstar Media Group.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

FOX CORPORATION

|

|

|

|

|

|

By:

|

|

/s/ Viet D. Dinh

|

|

|

|

Name: Viet D. Dinh

|

|

|

|

Title: Chief Legal and Policy Officer

|

November 6, 2019

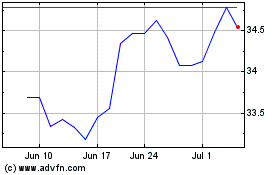

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

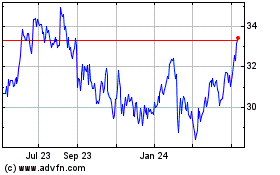

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2023 to Apr 2024