Cintas Retains 'Neutral' - Analyst Blog

June 29 2011 - 7:15AM

Zacks

Cintas Corporation

(CTAS), providing specialized services to businesses of all types

throughout North America retains a 'Neutral' rating. The company

designs, manufactures, implements corporate identity uniform

programs, and provides entrance mats, restroom supplies,

promotional products and first aid and safety products for

approximately 800,000 businesses. Cintas operates under two

operating segments, Rental Uniforms and Ancillary Products and

Other Services.

Cintas in its last reported quarter

delivered an EPS of 41 cents surpassing the Zacks Consensus

Estimate of 36 cents and 32 cents reported during the prior-year

quarter. Cintas’ total revenue increased 8.8% to $937.8 million in

the reported quarter, outperforming the Zacks Consensus Estimate of

$909 million and $861.8 million in the year-earlier quarter. The

improvement in revenue can be attributed to continued momentum in

sales productivity and customer retention.

Cintas pursues an aggressive share

repurchase policy. Although the company did not purchase any shares

during the last quarter, it repurchased $203.2 million worth of

shares in the first six months of the fiscal year. The company is

still authorized to purchase $500 million shares under its new

share repurchase program.

Encouraged by its third quarter

performance, Cintas upgraded its guidance for fiscal 2011. The

company now expects full year revenues in the range of $3.75

billion–$3.77 billion, up from the previous range of $3.55

billion–$3.75 billion. However, there is no change in the EPS

guidance of $1.60–$1.63, as management expects an increase in

gasoline and diesel cost to negatively impact its fourth quarter

results.

Besides, Cintas recently announced

a strategic alliance with Diversey Inc. – a leading global provider

of commercial cleaning, sanitation and hygiene solutions – to

further strengthen its position in the services industry. The

alliance has developed a service called Signet, which combines the

industry-leading green chemicals with the excellent service of

Cintas to provide customers fully integrated management of their

cleaning and hygiene needs.

Cintas has formulated a long-term

strategy in order to maximize revenue growth for all the products

and services it offers by penetrating the existing customer base as

well as entering unexplored markets. For proper implementation of

the strategy, the company has evolved a highly talented team of

professionals that visits customers on a regular basis. This

creates a personal relationship with consumers and enables the

company to introduce new products and services.

However, Cintas’ revenue largely

depends upon the service industry, including hotels, airlines,

restaurants, etc. Any drop in the employment rate has the potential

to adversely impact the company’s profitability. Besides, Cintas

faces competition from national, regional and small local players

that are targeting its markets.

These players at times target the

markets at the expense of margins, thereby negatively affecting

Cintas’ results. Moreover, Cintas draws 70% of revenue from its

core uniform rental segment, which is in the saturation stage.

The company is constantly making

efforts to innovate and focus on its other businesses, including

direct uniform sales, first aid safety, fire protection and

document management. However, in doing so, the additional resources

and time involved in developing these growing segments may threaten

Cintas' profitability. Thus, the reasons above explain the Neutral

recommendation of Cintas.

Cincinnati, Ohio-based Cintas

Corporation designs, manufactures and implements corporate identity

uniform programs, and provides entrance mats, restroom supplies,

promotional products, and first aid and safety products for

approximately 800,000 businesses. Cintas competes with

G&K Services Inc. (GKSR), UniFirst

Corp. (UNF) and privately held Alsco Inc. and ARAMARK

Corporation. Cintas currently retains a Zacks #3 Rank (short-term

Hold rating).

CINTAS CORP (CTAS): Free Stock Analysis Report

G&K SVCS A (GKSR): Free Stock Analysis Report

UNIFIRST CORP (UNF): Free Stock Analysis Report

Zacks Investment Research

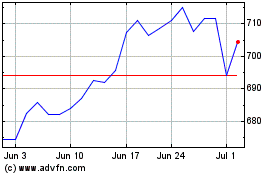

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

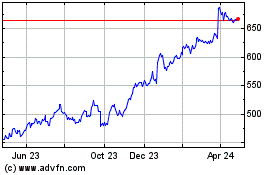

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024