false

0001173489

0001173489

2023-08-09

2023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 9, 2023

CEVA, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

000-49842

(Commission File Number)

|

77-0556376

(I.R.S. Employer Identification No.)

|

| |

|

| |

|

|

15245 Shady Grove Road, Suite 400, Rockville, MD

(Address of Principal Executive Offices)

|

20850

(Zip Code)

|

(240)-308-8328

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.001 per share

|

CEVA

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Security Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On August 9, 2023, CEVA, Inc. (the “Company”) announced its financial results for the quarter ended June 30, 2023. A copy of the press release, dated August 9, 2023, is attached and filed herewith as Exhibit 99.1. On the same day, the Company will hold a conference call to discuss its financial results for the second quarter of 2023. A copy of the script of the conference call is attached hereto as Exhibit 99.2. This information, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference to such filing.

In addition to the disclosure of financial results for the quarter and year ended June 30, 2023 and 2022 in accordance with generally accepted accounting principles in the United States (“GAAP”), the press release and script also included non-GAAP gross margin, operating income, net income and diluted earnings per share (EPS) figures for the referenced periods.

Non-GAAP gross margin for (1) the second quarter of 2023 excluded: (a) equity-based compensation expenses and (b) amortization of acquired intangibles and (2) the second quarter of 2022 excluded (i) equity-based compensation expenses and (ii) amortization of acquired intangibles.

Non-GAAP operating loss for the second quarter of 2023 excluded (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles associated with the acquisition of the Intrinsix, VisiSonics and Hillcrest Labs businesses and investments in NB-IoT technologies, and (c) costs associated with the Intrinsix and VisiSonics business acquisitions. Non-GAAP operating income for the second quarter of 2022 excluded (i) equity-based compensation expenses, (ii) the impact of the amortization of acquired intangibles associated with the acquisition of the Intrinsix and Hillcrest Labs businesses and investments in NB-IoT and Immervision technologies, and (iii) costs associated with the Intrinsix acquisition.

Non-GAAP net loss and diluted loss per share for the second quarter of 2023 excluded (a) equity-based compensation expenses, (b) the impact of the amortization of acquired intangibles associated with the acquisition of the Intrinsix, VisiSonics and Hillcrest Labs businesses and investments in NB-IoT technologies, (c) costs associated with the Intrinsix and VisiSonics business acquisitions and (d) income associated with the reevaluation of an investment in another company. Non-GAAP net income and diluted earnings per share for the second quarter of 2022 excluded (i) equity-based compensation expenses, (ii) the impact of the amortization of acquired intangibles associated with the acquisition of the Intrinsix and Hillcrest Labs businesses and investments in NB-IoT and Immervision technologies, (iii) costs associated with the Intrinsix acquisition and (iv) loss, net of taxes, associated with the reevaluation of an investment in another company.

The Company believes that the reconciliation of financial measures in the press release and script is useful to investors in analyzing the results for the quarters ended June 30, 2023 and 2022 because the exclusion of the applicable expenses may provide a more meaningful analysis of the Company’s core operating results and comparison of quarterly results. Further, the Company believes it is useful for investors to understand how the expenses associated with the application of FASB ASC No. 718 are reflected on its statements of income. The reconciliation of financial measures should be reviewed in addition to and in conjunction with results presented in accordance with GAAP, and are intended to provide additional insight into the Company’s operations that, when viewed with its GAAP results and the accompanying reconciliation, offer a more complete understanding of factors and trends affecting the Company’s business. The reconciliation of financial measures should not be viewed as a substitute for the Company’s reported GAAP results.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

99.1

|

|

| |

|

|

99.2

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CEVA, INC.

|

| |

|

|

Date: August 9, 2023

|

By:

|

/s/Yaniv Arieli

|

| |

|

Yaniv Arieli

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

CEVA, Inc. Announces Second Quarter 2023 Financial Results

ROCKVILLE, MD., August 9, 2023 – CEVA, Inc. (NASDAQ: CEVA), the leading licensor of wireless connectivity and smart sensing technologies and custom SoC solutions, today announced its financial results for the second quarter ended June 30, 2023.

Total revenue for the second quarter of 2023 was $26.2 million, a 21% decrease compared to $33.2 million reported for the second quarter of 2022. Second quarter 2023 licensing, non-recurring engineering (NRE) and related revenue was $16.8 million, a decrease of 24% when compared to $22.1 million reported for the same quarter a year ago. Royalty revenue for the second quarter of 2023 was $9.4 million, a decrease of 15% when compared to $11.1 million reported for the second quarter of 2022, but up 17% sequentially.

Amir Panush, Chief Executive Officer of CEVA, remarked: “Our second quarter results reflect a challenging and dynamic environment, where our licensing business was impacted by a slowdown in funding of semiconductor startups that limited our ability to conclude certain anticipated customer licensing agreements. Nevertheless, we had a number of noteworthy licensing achievements in the quarter, including three customers for Wi-Fi & Bluetooth combos and four new agreements with customers targeting automotive applications. We are also encouraged by the sequential recovery in our royalty business, with strong shipments of smartphones for emerging markets and inventory restocking across PCs, 5G RAN and the broad IoT markets which we serve. We believe we are well positioned to capitalize on the insatiable demand to connect everything and deploy generative AI everywhere with our unrivalled portfolio of wireless connectivity and sensing AI technologies.”

During the quarter, seventeen IP license and NRE agreements were concluded, targeting a wide variety of end markets and applications, including Wi-Fi 6 and Bluetooth 5 for combo connectivity chips targeting consumer, smart home and industrial IoT, 5G Redcap and cellular IoT wireless communications for industrial, UWB for digital car keys and in-cabin radar in automotive, AI for automotive ADAS and sensor fusion for digital pens. Five agreements were with first-time customers.

GAAP gross margin for both the second quarters of 2023 and 2022 was 79%. GAAP operating loss for the second quarter of 2023 was $6.3 million, as compared to a GAAP operating loss of $0.3 million for the same period in 2022. GAAP net loss for the second quarter of 2023 was $5.8 million, as compared to a GAAP net loss of $1.1 million reported for the same period in 2022. GAAP diluted losses per share for the second quarter of 2023 was $0.25, as compared to a GAAP diluted losses per share of $0.05 for the same period in 2022.

Non-GAAP gross margin for both the second quarters of 2023 and 2022 was 82%. Non-GAAP operating loss for the second quarter of 2023 was $1.1 million, as compared to Non-GAAP operating profit of $4.6 million reported for the second quarter of 2022. Non-GAAP net loss and diluted losses per share for the second quarter of 2023 were $0.5 million and $0.02, respectively, compared with Non-GAAP net income and diluted income per share of $4.3 million and $0.18, respectively, reported for the second quarter of 2022.

Non-GAAP gross margin for the second quarter of 2023 excluded: (a) equity-based compensation expenses of $0.4 million and (b) amortization of acquired intangibles of $0.4 million. Non-GAAP gross margin for the second quarter of 2022 excluded: (a) equity-based compensation expenses of $0.3 million and (b) amortization of acquired intangibles of $0.5 million.

Non-GAAP operating loss for the second quarter of 2023 excluded: (a) equity-based compensation expenses of $4.2 million, (b) the impact of the amortization of acquired intangibles of $0.7 million associated with the acquisition of the Intrinsix, VisiSonics and Hillcrest Labs businesses as well as investments in NB-IoT technologies, and (c) $0.3 million of costs associated with the Intrinsix and VisiSonics business acquisitions. Non-GAAP operating income for the second quarter of 2022 excluded: (a) equity-based compensation expenses of $3.3 million, (b) the impact of the amortization of acquired intangibles of $1.3 million associated with the acquisition of the Intrinsix and Hillcrest Labs business and investments in NB-IoT and Immervision technologies and (c) $0.3 million of costs associated with the Intrinsix acquisition.

Non-GAAP net loss and diluted loss per share for the second quarter of 2023 excluded: (a) equity-based compensation expenses of $4.2 million, (b) the impact of the amortization of acquired intangibles of $0.7 million associated with the acquisition of the Intrinsix, VisiSonics and Hillcrest Labs businesses as well as investments in NB-IoT technologies, (c) $0.3 million of costs associated with the Intrinsix and VisiSonics business acquisitions and (d) $0.1 million associated with the reevaluation of an investment in another company. Non-GAAP net income and diluted earnings per share for the second quarter of 2022 excluded: (a) equity-based compensation expenses of $3.3 million, (b) the impact of the amortization of acquired intangibles of $1.3 million associated with the acquisition of the Intrinsix and Hillcrest Labs businesses and investments in NB-IoT and Immervision technologies, (c) $0.3 million of costs associated with the Intrinsix acquisition and (d) $0.5 million loss, net of taxes, associated with the reevaluation of an investment in another company.

Yaniv Arieli, Chief Financial Officer of CEVA, stated: “As we navigate the current macroeconomic conditions, we have implemented cost-saving initiatives to reduce expense levels for the remainder of the year. We believe these initiatives will enable us to remain lean and dynamic, which combined with our strong balance sheet will allow us to act decisively to support our future growth strategy.”

CEVA Conference Call

On August 9, 2023, CEVA management will conduct a conference call at 8:30 a.m. Eastern Time to discuss the operating performance for the quarter.

The conference call will be available via the following dial in numbers:

| |

●

|

U.S. Participants: Dial 1-844-435-0316 (Access Code: CEVA)

|

| |

●

|

International Participants: Dial +1-412-317-6365 (Access Code: CEVA)

|

The conference call will also be available live via webcast at the following link: https://app.webinar.net/ZBNxQXMOR09. Please go to the web site at least fifteen minutes prior to the call to register, download and install any necessary audio software.

For those who cannot access the live broadcast, a replay will be available by dialing +1-877-344-7529 or +1-412-317-0088 (conference replay code: 5117586) from one hour after the end of the call until 9:00 a.m. (Eastern Time) on August 16, 2023. The replay will also be available at CEVA's web site www.ceva-dsp.com.

Forward Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of CEVA to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include statements regarding CEVA’s ability to capitalize on demand with its portfolio of technologies, the impact of CEVA’s cost-savings initiatives, and CEVA’s growth prospects and potential. The risks, uncertainties and assumptions that could cause differing CEVA results include: the effect of intense industry competition; the ability of CEVA’s technologies and products incorporating CEVA’s technologies to achieve market acceptance; CEVA’s ability to meet changing needs of end-users and evolving market demands; the cyclical nature of and general economic conditions in the semiconductor industry; CEVA’s ability to diversify its royalty streams and license revenues; CEVA’s ability to continue to generate significant revenues from the handset baseband market and to penetrate new markets; and general market conditions and other risks relating to CEVA’s business, including, but not limited to, those that are described from time to time in our SEC filings. CEVA assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

###

About CEVA, Inc.

CEVA is the leading licensor of wireless connectivity and smart sensing technologies and custom SoC solutions for a smarter, safer, connected world. We provide Digital Signal Processors, AI engines, wireless platforms, cryptography cores and complementary embedded software for sensor fusion, image enhancement, computer vision, spatial audio, voice input and artificial intelligence. These technologies are offered in combination with our Intrinsix IP integration services, helping our customers address their most complex and time-critical integrated circuit design projects. Leveraging our technologies and chip design skills, many of the world’s leading semiconductors, system companies and OEMs create power-efficient, intelligent, secure and connected devices for a range of end markets, including mobile, consumer, automotive, robotics, industrial, aerospace & defense and IoT.

Our DSP-based solutions include platforms for 5G baseband processing in mobile, IoT and infrastructure, advanced imaging and computer vision for any camera-enabled device, audio/voice/speech and ultra-low-power always-on/sensing applications for multiple IoT markets. For motion sensing solutions, our Hillcrest Labs sensor processing technologies provide a broad range of sensor fusion software and inertial measurement unit (“IMU”) solutions for markets including hearables, wearables, AR/VR, PC, robotics, remote controls and IoT. For wireless IoT, our platforms for Bluetooth connectivity (low energy and dual mode), Wi-Fi 4/5/6 (802.11n/ac/ax), Ultra-wideband (UWB), NB-IoT and GNSS are the most broadly licensed connectivity platforms in the industry.

CEVA is a sustainable and environmentally conscious company, adhering to our Code of Business Conduct and Ethics. As such, we emphasize and focus on environmental preservation, recycling, the welfare of our employees and privacy – which we promote on a corporate level. At CEVA, we are committed to social responsibility, values of preservation and consciousness towards these purposes.

Visit us at www.ceva-dsp.com and follow us on Twitter, YouTube, Facebook,, LinkedIn and Instagram.

Source: CEVA, Inc.

For More Information Contact:

|

Yaniv Arieli

CEVA, Inc.

CFO

+1.650.417.7941

yaniv.arieli@ceva-dsp.com

|

Richard Kingston

CEVA, Inc.

VP Market Intelligence, Investor & Public Relations

+1.650.417.7976

richard.kingston@ceva-dsp.com

|

CEVA, INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF LOSS – U.S. GAAP

U.S. dollars in thousands, except per share data

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

Jun 30,

|

|

|

Jun 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensing, NRE and related revenues

|

|

$ |

16,801 |

|

|

$ |

22,123 |

|

|

$ |

37,522 |

|

|

$ |

44,516 |

|

|

Royalties

|

|

|

9,371 |

|

|

|

11,072 |

|

|

|

17,385 |

|

|

|

23,070 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

26,172 |

|

|

|

33,195 |

|

|

|

54,907 |

|

|

|

67,586 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

5,572 |

|

|

|

6,825 |

|

|

|

10,887 |

|

|

|

13,229 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

20,600 |

|

|

|

26,370 |

|

|

|

44,020 |

|

|

|

54,357 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, net

|

|

|

19,594 |

|

|

|

19,538 |

|

|

|

40,385 |

|

|

|

39,748 |

|

|

Sales and marketing

|

|

|

2,795 |

|

|

|

2,723 |

|

|

|

5,840 |

|

|

|

5,646 |

|

|

General and administrative

|

|

|

4,169 |

|

|

|

3,635 |

|

|

|

8,217 |

|

|

|

7,271 |

|

|

Amortization of intangible assets

|

|

|

316 |

|

|

|

750 |

|

|

|

645 |

|

|

|

1,500 |

|

|

Total operating expenses

|

|

|

26,874 |

|

|

|

26,646 |

|

|

|

55,087 |

|

|

|

54,165 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

(6,274 |

) |

|

|

(276 |

) |

|

|

(11,067 |

) |

|

|

192 |

|

|

Financial income, net

|

|

|

1,121 |

|

|

|

413 |

|

|

|

2,576 |

|

|

|

695 |

|

|

Reevaluation of marketable equity securities

|

|

|

(119 |

) |

|

|

(685 |

) |

|

|

(236 |

) |

|

|

(1,816 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before taxes on income

|

|

|

(5,272 |

) |

|

|

(548 |

) |

|

|

(8,727 |

) |

|

|

(929 |

) |

|

Income tax expense

|

|

|

546 |

|

|

|

575 |

|

|

|

1,963 |

|

|

|

1,890 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(5,818 |

) |

|

$ |

(1,123 |

) |

|

$ |

(10,690 |

) |

|

$ |

(2,819 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$ |

(0.25 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.12 |

) |

|

Weighted-average shares used to compute net loss per share (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

23,476 |

|

|

|

23,174 |

|

|

|

23,405 |

|

|

|

23,139 |

|

Unaudited Reconciliation of GAAP to Non-GAAP Financial Measures

U.S. Dollars in thousands, except per share amounts

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

Jun 30,

|

|

|

Jun 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

GAAP net loss

|

|

$ |

(5,818 |

) |

|

$ |

(1,123 |

) |

|

$ |

(10,690 |

) |

|

$ |

(2,819 |

) |

|

Equity-based compensation expense included in cost of revenues

|

|

|

390 |

|

|

|

344 |

|

|

|

794 |

|

|

|

683 |

|

|

Equity-based compensation expense included in research and development expenses

|

|

|

2,420 |

|

|

|

2,006 |

|

|

|

4,593 |

|

|

|

4,001 |

|

|

Equity-based compensation expense included in sales and marketing expenses

|

|

|

468 |

|

|

|

340 |

|

|

|

861 |

|

|

|

673 |

|

|

Equity-based compensation expense included in general and administrative expenses

|

|

|

927 |

|

|

|

613 |

|

|

|

1,816 |

|

|

|

1,335 |

|

|

Amortization of intangible assets related to acquisition of Intrinsix, VisiSonics business in 2023 and Hillcrest Labs business, and investments in NB-IoT and Immervision technologies

|

|

|

702 |

|

|

|

1,282 |

|

|

|

1,379 |

|

|

|

2,564 |

|

|

Costs associated with the Intrinsix and VisioSonics business acquisition

|

|

|

312 |

|

|

|

325 |

|

|

|

638 |

|

|

|

651 |

|

|

Loss associated with the remeasurement of marketable equity securities, net of taxes.

|

|

|

119 |

|

|

|

527 |

|

|

|

236 |

|

|

|

1,398 |

|

|

NRE revenues associated with the purchase price allocation (PPA) related to Intrinsix acquisition

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

42 |

|

|

Non-GAAP net income (loss)

|

|

$ |

(480 |

) |

|

$ |

4,314 |

|

|

$ |

(373 |

) |

|

$ |

8,528 |

|

|

GAAP weighted-average number of Common Stock used in computation of diluted net loss and loss per share (in thousands)

|

|

|

23,476 |

|

|

|

23,174 |

|

|

|

23,405 |

|

|

|

23,139 |

|

|

Weighted-average number of shares related to outstanding stock-based awards (in thousands)

|

|

|

— |

|

|

|

820 |

|

|

|

— |

|

|

|

795 |

|

|

Weighted-average number of Common Stock used in computation of diluted earnings per share, excluding the above (in thousands)

|

|

|

23,476 |

|

|

|

23,994 |

|

|

|

23,405 |

|

|

|

23,934 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted loss per share

|

|

$ |

(0.25 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.12 |

) |

|

Equity-based compensation expense

|

|

$ |

0.18 |

|

|

$ |

0.14 |

|

|

$ |

0.34 |

|

|

$ |

0.28 |

|

|

Amortization of intangible assets related to acquisition of Intrinsix, VisiSonics business in 2023 and Hillcrest Labs business, and investments in NB-IoT and Immervision technologies

|

|

$ |

0.03 |

|

|

$ |

0.06 |

|

|

$ |

0.06 |

|

|

$ |

0.11 |

|

|

Costs associated with the Intrinsix and VisioSonics business acquisitions

|

|

$ |

0.01 |

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

$ |

0.03 |

|

|

Loss associated with the remeasurement of marketable equity securities, net of taxes.

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.06 |

|

|

Non-GAAP diluted earnings (loss) per share

|

|

$ |

(0.02 |

) |

|

$ |

0.18 |

|

|

$ |

(0.02 |

) |

|

$ |

0.36 |

|

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

Jun 30,

|

|

|

Jun 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

GAAP Operating Income (loss)

|

|

$ |

(6,274 |

) |

|

$ |

(276 |

) |

|

$ |

(11,067 |

) |

|

$ |

192 |

|

|

Equity-based compensation expense included in cost of revenues

|

|

|

390 |

|

|

|

344 |

|

|

|

794 |

|

|

|

683 |

|

|

Equity-based compensation expense included in research and development expenses

|

|

|

2,420 |

|

|

|

2,006 |

|

|

|

4,593 |

|

|

|

4,001 |

|

|

Equity-based compensation expense included in sales and marketing expenses

|

|

|

468 |

|

|

|

340 |

|

|

|

861 |

|

|

|

673 |

|

|

Equity-based compensation expense included in general and administrative expenses

|

|

|

927 |

|

|

|

613 |

|

|

|

1,816 |

|

|

|

1,335 |

|

|

Amortization of intangible assets related to acquisition of Intrinsix, VisiSonics business in 2023 and Hillcrest Labs business, and investments in NB-IoT and Immervision technologies

|

|

|

702 |

|

|

|

1,282 |

|

|

|

1,379 |

|

|

|

2,564 |

|

|

Costs associated with the Intrinsix and VisiSonics business acquisitions

|

|

|

312 |

|

|

|

325 |

|

|

|

638 |

|

|

|

651 |

|

|

NRE revenues associated with the purchase price allocation (PPA) related to Intrinsix acquisition

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

42 |

|

|

Total non-GAAP Operating Income (Loss)

|

|

$ |

(1,055 |

) |

|

$ |

4,634 |

|

|

$ |

(986 |

) |

|

$ |

10,141 |

|

| |

|

Three months ended

|

|

|

Six months ended

|

|

| |

|

Jun 30,

|

|

|

Jun 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

|

Unaudited

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Gross Profit

|

|

$ |

20,600 |

|

|

$ |

26,370 |

|

|

$ |

44,020 |

|

|

$ |

54,357 |

|

|

GAAP Gross Margin

|

|

|

79 |

% |

|

|

79 |

% |

|

|

80 |

% |

|

|

80 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional NRE revenues associated with the purchase price allocation (PPA) related to Intrinsix acquisition

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

42 |

|

|

Equity-based compensation expense included in cost of revenues

|

|

|

390 |

|

|

|

344 |

|

|

|

794 |

|

|

|

683 |

|

|

Amortization of intangible assets related to acquisition of Intrinsix, acquisition of VisiSonics business in 2023, and investments in NB-IoT and Immervision technologies

|

|

|

386 |

|

|

|

532 |

|

|

|

734 |

|

|

|

1,064 |

|

|

Total Non-GAAP Gross profit

|

|

|

21,376 |

|

|

|

27,246 |

|

|

|

45,548 |

|

|

|

56,146 |

|

|

Non-GAAP Gross Margin

|

|

|

82 |

% |

|

|

82 |

% |

|

|

83 |

% |

|

|

83 |

% |

CEVA, INC. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. Dollars in thousands)

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022 (*) |

|

| |

|

Unaudited

|

|

|

Unaudited

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

27,511 |

|

|

$ |

21,285 |

|

|

Marketable securities and short-term bank deposits

|

|

|

108,136 |

|

|

|

118,194 |

|

|

Trade receivables, net

|

|

|

13,502 |

|

|

|

12,297 |

|

|

Unbilled receivables

|

|

|

18,370 |

|

|

|

18,953 |

|

|

Prepaid expenses and other current assets

|

|

|

7,753 |

|

|

|

6,896 |

|

|

Total current assets

|

|

|

175,272 |

|

|

|

177,625 |

|

|

Long-term assets:

|

|

|

|

|

|

|

|

|

|

Bank deposits

|

|

|

— |

|

|

|

8,205 |

|

|

Severance pay fund

|

|

|

7,916 |

|

|

|

8,475 |

|

|

Deferred tax assets, net

|

|

|

8,936 |

|

|

|

8,599 |

|

|

Property and equipment, net

|

|

|

6,868 |

|

|

|

7,099 |

|

|

Operating lease right-of-use assets

|

|

|

9,836 |

|

|

|

10,283 |

|

|

Investment in marketable equity securities

|

|

|

172 |

|

|

|

408 |

|

|

Goodwill

|

|

|

76,771 |

|

|

|

74,777 |

|

|

Intangible assets, net

|

|

|

6,907 |

|

|

|

6,680 |

|

|

Other long-term assets

|

|

|

7,595 |

|

|

|

6,291 |

|

|

Total assets

|

|

$ |

300,273 |

|

|

$ |

308,442 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Trade payables

|

|

$ |

1,104 |

|

|

$ |

1,995 |

|

|

Deferred revenues

|

|

|

3,788 |

|

|

|

3,168 |

|

|

Accrued expenses and other payables

|

|

|

18,340 |

|

|

|

25,133 |

|

|

Operating lease liabilities

|

|

|

2,895 |

|

|

|

2,982 |

|

|

Total current liabilities

|

|

|

26,127 |

|

|

|

33,278 |

|

|

Long-term liabilities:

|

|

|

|

|

|

|

|

|

|

Accrued severance pay

|

|

|

8,702 |

|

|

|

9,064 |

|

|

Operating lease liabilities

|

|

|

6,239 |

|

|

|

6,703 |

|

|

Other accrued liabilities

|

|

|

621 |

|

|

|

526 |

|

|

Total liabilities

|

|

|

41,689 |

|

|

|

49,571 |

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

24 |

|

|

|

23 |

|

|

Additional paid in-capital

|

|

|

244,250 |

|

|

|

242,841 |

|

|

Treasury stock

|

|

|

(1,462 |

) |

|

|

(9,904 |

) |

|

Accumulated other comprehensive loss

|

|

|

(5,583 |

) |

|

|

(6,249 |

) |

|

Retained earnings

|

|

|

21,355 |

|

|

|

32,160 |

|

|

Total stockholders’ equity

|

|

|

258,584 |

|

|

|

258,871 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

300,273 |

|

|

$ |

308,442 |

|

(*) Derived from audited financial statements.

Exhibit 99.2

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

CEVA, INC.

Second Quarter 2023 Financial Results Conference Call

Prepared Remarks of Amir Panush, Chief Executive Officer and

Yaniv Arieli, Chief Financial Officer

August 9, 2023

8:30 A.M. Eastern

Richard

Good morning everyone and welcome to CEVA’s second quarter 2023 earnings conference call. Joining me today on the call are Amir Panush, Chief Executive Officer, and Yaniv Arieli, Chief Financial Officer of CEVA.

Forward Looking Statements and Non-GAAP Financial Measures

Before handing over to Amir, I would like to remind everyone that today’s discussion contains forward-looking statements that involve risks and uncertainties, as well as assumptions that if they materialize or prove incorrect, could cause the results of CEVA to differ materially from those expressed or implied by such forward-looking statements and assumptions. Forward-looking statements include statements regarding market trends and dynamics, including anticipated recovery in semiconductor startup funding and opportunities for Wi-Fi and Generative AI, our market position, strategy and growth drivers, demand for and benefits of our technologies, and expectations and financial guidance regarding future performance, including expected recovery in revenues and guidance for the third quarter of and full year 2023. For information on the factors that could cause a difference in our results, please refer to our filings with the Securities and Exchange Commission. These include the effect of intense industry competition; the ability of CEVA’s technologies and products incorporating CEVA’s technologies to achieve market acceptance; CEVA’s ability to meet changing needs of end-users and evolving market demands; the cyclical nature of and general economic conditions in the semiconductor industry; CEVA’s ability to diversify its royalty streams and license revenues; CEVA’s ability to continue to generate significant revenues from the handset baseband market and to penetrate new markets. CEVA assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

In addition, we will be discussing certain non-GAAP financial measures which we believe provide a more meaningful analysis of our core operating results and comparison of quarterly results. A reconciliation of non-GAAP financial measures is included in the earnings release we issued this morning and in the SEC filings section of our investors relations website at investors.ceva-dsp.com.

With that said, I’d like to turn the call over to Amir who will review our business performance for the quarter and provide some insight into our ongoing business. Amir?

Amir

Thank you, Richard. Welcome everyone and thank you for joining us today.

Our second quarter results reflect a dynamic environment, brought about by challenging macroeconomic conditions that has led to a slower than expected recovery in some regions. On the other hand, we also saw a resumption in chip demand following a few quarters of inventory correction. Our licensing business experienced a slowdown in the quarter, which I will explain momentarily. On royalties, we saw our royalty revenues recover to grow 17% sequentially, and we anticipate this recovery can continue in the coming quarters.

In licensing, our revenue came in below our expectations. The primary reason for this relates to semiconductor startups, a customer base that is an important contributor to any IP licensing business. Semiconductor startups rely on venture capital funding to underpin their businesses. Funding from VCs for semi startups slowed down towards the end of 2022, and global VC funding for the first quarter of 2023 fell 53% year-over-year. Consequentially, some of the deals with startups we anticipated closing in the quarter did not come through as planned, and the resulting shortfall in licensing revenues was unexpected. However, we are already seeing funding of startups in the semiconductor ecosystem picking up again and anticipate licensing to these companies will recover in the coming quarters. We also saw mixed results in our design services activities in the quarter, where the overall defense industry is moving slower than expected to conclude new investments, and funding there takes more time. As a result, some projects in our sales pipeline are taking longer to get funded.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

Looking at the licensing business concluded in the quarter in more detail, we signed 17 new licensing and NRE agreements, with noteworthy interest in our wireless communications offerings, encompassing 5G, cellular IoT, Wi-Fi, Bluetooth and UWB. All of these technologies continue to be in demand with deals signed in each of these areas. We signed 3 Wi-Fi 6 deals for combo chips, where we also license our Bluetooth technology. One of these deals was with a strategic customer, a leading supplier of connectivity chips into IoT devices spanning consumer, industrial and the smart home. This latest deal with this customer is a multi-use agreement, as they look to expand their Wi-Fi 6 business on the back of their highly successful Wi-Fi 4 business, where they have shipped more than 300 million CEVA-powered Wi-Fi chips to date. As we have discussed previously, the average royalty per unit we get for Wi-Fi 6 is higher than the previous generations of Wi-Fi. Having an established customer and leader in this space migrate to Wi-Fi 6 presents another potentially strong contributor to our Wi-Fi royalty streams in the coming years.

Other deals of note in the quarter include four new agreements for automotive – two for our UWB technology for digital keys and in-cabin radar applications and two for our AI compiler technology that creates fully-optimized runtime software for our SensPro processors and NeuPro-M NPUs. Our product offerings are very well aligned with the automotive industry’s push towards electrification and ever more powerful safety systems. We have many touch points already in the car, including our vision/AI processors for ADAS, sensor fusion DSPs for drive train and battery management systems, and UWB, Bluetooth, Wi-Fi, 5G and V2X for safety, infotainment, communications and connectivity. Our inherently low-power solutions are an excellent fit for automotive, and while it can take quite a number of years before our automotive design wins show up in production vehicles, we are very excited about design wins we have secured to date and the potential royalty streams that we can generate from this highly lucrative market.

Finally, we signed two new agreements in the cellular IoT space, one for our NB-IoT technology and another for targeting 5G RedCap.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

Now to royalties. After a weak first quarter, we saw a good recovery in the second quarter, driven by smartphones targeting emerging markets and restocking for consumer and industrial IoT products following the inventory correction. Royalties for the quarter reached $9.4 million up 17% sequentially. We saw CEVA-powered chip volumes increase sequentially across the broad spectrum of markets we address, and a notable recovery in smartphones, PCs and 5G base stations in particular. On the last earnings call, we explained there was a significant inventory correction taking place, particularly in the smartphone and consumer IoT spaces, where we have meaningful exposure. Following conversations with our customers and other companies in the supply chain, we believe that this inventory has been worked through for the most part and our royalties reflect a resumption in demand to refill the channels. We reiterate our belief that the first quarter was the bottom for our royalty business and we anticipate continued recovery for our royalty business through the remainder of the year.

Now, I would like to switch to discuss a new strategic market TAM expansion opportunity that we’re addressing with our products targeting AI, from the cloud to the edge. Earlier this week we announced our latest Neural Processors targeting Generative AI applications. Generative AI is creating a lot of headlines recently, dominating the AI narrative thanks to ChatGPT and other Generative Pre-trained Transformers or GPT models. In general, AI is divided into training, including deep learning and machine learning, and inference, including computer vision, co-piloting, photonics (fast optical networking) and more. CEVA has addressed inference applications with our SensPro and NeuPro product line for a number of years and has been successful in helping our customers deploy AI across multiple end markets and devices including industrial, automotive and consumer.

Generative AI takes the AI experience to the next level. Transformer-based models have led to significant breakthroughs in several forms of generative AI. They are key in both increasingly powerful text-to-image models, such as DALL-E or stable diffusion, and language and instruction-following models, such as ChatGPT or Stanford’s Alpaca.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

Today, such networks are typically executed on GPU-based compute infrastructure in the cloud, because of their massive model sizes and high memory and bandwidth requirements. However, as transformer-based networks mature and become increasingly popular, there is an opportunity spanning all the way from the cloud to the edge to increase the performance and efficiency of executing Generative AI. For example, there are new Generative AI models which are domain and enterprise specific that use smaller proprietary datasets with fewer parameters and expert systems. These Generative AI models don’t require GPU-based compute to execute, and thanks to our extensive experience in developing processors that support AI in low power devices, we have enhanced our NeuPro-M NPU family to support these transformer-based Large Language Models (LLM) and Generative AI models to allow natural language processing and generative capabilities locally (aka co-piloting), with incredible efficiency. This directly improves the latency and overall personalized experience of using Generative AI, protects the privacy of the user data, addressing a key concern of cloud-based AI today, and significantly reduces the cost per-query. I believe that our ability to support transformer architectures with exceptionally low power consumption and highly efficiently positions us very well to exploit this new wave of AI across the full spectrum of end markets from consumer IoT to industrial, automotive and networking. Our NeuPro-M is already available for licensing to customers, and we’re very excited about the potential here to grow our AI footprint with this enhanced product family.

In summary, despite the revenue shortfall in licensing this quarter, we believe our portfolio of wireless communications and sensing AI technologies is unrivalled and leads the industry in terms of performance, power efficiency and quality. Our NeuPro-M family further expands our strength in AI to address the growing trend of deploying the incredible potential of Generative AI to any device and application. With our technology leadership position and top tier customer base, and desire to grow and expand, we remain very optimistic about the long-term trends in our business and our ability to drive long-term shareholder value.

Now I will turn the call over to Yaniv for the financials.

Yaniv

Thank you, Amir, and good day to all. I’ll now start by reviewing the results of our operations for the second quarter of 2023.

- Revenue for the second quarter was $26.2 million, as compared to $33.2 million for the same quarter last year. The revenue breakdown is as follows:

- Licensing, NRE and related revenue - reflecting 64% of total revenues - was $16.8 million, as compared to $22.1 million for the second quarter of 2022. The licensing business can be volatile in the IP industry, and in recent periods has been influenced both by secular macroeconomic trends as well as short-term conditions, such as shifts in funding of our startup customers.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

- Royalty revenue - reflecting 36% of total revenues - was $9.4 million, as compared to $11.1 million for the same quarter last year, illustrative of the overall soft demand in our end markets from this time last year. Encouragingly, on a sequential basis, royalty revenue grew 17%, as we experienced a significant improvement in the smartphone, 5G base station and PC markets from the first quarter.

- Quarterly gross margins came in lower on GAAP and non-GAAP basis as compared to our guidance, due a lower revenue base and higher subcontracting related expenses in cost of revenues. Gross margin was 79% on GAAP basis and 82% on non-GAAP basis compared to our 82% and 85% guidance on GAAP and non-GAAP, respectively. Non-GAAP quarterly gross margin excluded approximately: (a) equity-based compensation expenses of $0.4 million and (b) amortization of acquired intangibles $0.4 million.

- Total GAAP operating expenses for the second quarter was lower than low-end of our guidance at $26.9 million due to immediate actions taken by management, associated with lower overall employee related benefit accruals, as well as better FX environment with a stronger USD compared to other currencies and lower overall marketing related activities.

- Total non-GAAP operating expenses for the second quarter, excluding equity-based compensation expenses, amortization of intangibles, and holdback expenses, were $22.4 million, also below the lower-end of our guidance, due to the same reasons I just explained.

- GAAP operating loss for the second quarter was $6.3 million, up from GAAP operating loss of $0.3 million in the same quarter a year ago. GAAP quarterly operating loss included: (a) equity-based compensation expenses of $4.2 million, (b) the impact of the amortization of acquired intangibles of $0.7 million associated with the acquisition of the Intrinsix, VisiSonics and Hillcrest Labs businesses, as well as investments in NB-IoT technologies and (c) $0.3 million of costs associated with the Intrinsix and VisiSonics business acquisitions.

Non-GAAP operating loss was $1.0 million, compared with operating income of $4.6 million for the same period a year ago.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

- GAAP and non-GAAP tax expense of $0.5 million was recorded, mainly associated with withholding tax deducted by our customers that could not be utilized and were expensed.

- GAAP net loss was $5.8 million and diluted loss per share was 25 cents for the second quarter of 2023, as compared to a loss of $1.1 million and diluted loss per share of 5 cents for the second quarter of 2022.

With respect to other related data

Shipped units by CEVA licensees during the second quarter of 2023 were 370 million units, up 25% sequentially compared to the first quarter of 2023 reported shipments of 297 million units, and down from 433 million a year ago, primarily for the reasons Amir discussed earlier.

- Of the 370 million units reported, 79 million units, or 21%, were for handset baseband chips, up from 27 million units in the first quarter.

- Our base station and IoT product shipments were 291 million units, up 8% sequentially from 270 million units in the first quarter of 2023 and down 17% year-over-year from 349 million units.

- Bluetooth shipments were 210 million units in the quarter, as compared to 190 million units in the first quarter of 2023, as we saw the beginning of restocking following the inventory correction.

- Wi-Fi shipments were 29 million units, as compared to 21 million units in the first quarter of 2023.

- Cellular IoT shipments were 21 million units as compared to 29 million units in the first quarter.

- Other shipments under our base station & IoT umbrella totaled 31 million units in the quarter. This includes our computer vision, AI, audio, sensor fusion, 5G RAN and DSPs for non-cellular communications.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

- As Amir stated, we saw a significant recovery in handset baseband chips for smartphones in the quarter, driven by channel restocking in emerging markets following the inventory correction in the first quarter.

As for the balance sheet items

- At the end of the quarter our cash and cash equivalent balances, marketable securities and bank deposits were approximately $136 million.

- Our DSO for the second quarter of 2023 was 47 days, better than first’s quarter 55 days.

- During the second quarter, we used $4.8 million cash from operating activities, on-going depreciation and amortization was $1.4 million, and purchase of fixed assets was $1.1 million.

- At the end of the second quarter, our headcount was 497 people, of whom 410 were engineers. This is the same count as we had at the end of the first quarter.

Now, turning to our outlook

Our licensing, NRE and related revenues business is fueled by a strong portfolio of wireless connectivity and sensing AI technologies and provides critical building blocks for many in the semiconductor industry. With that said, and with current market conditions, we are taking a cautious approach and forecasting a lower base revenue level than achieved last year.

In royalties, the correction and improved environment in handset baseband royalties can continue into the second half of the year. Our base station and IoT customers also look more positively in the upcoming two quarters, so we anticipate sequentially higher royalties for the third and fourth quarters. In parallel, will continue to monitor market trends.

Earlier this year, on our Q4-22 earnings conference call, Amir outlined this scenario and the potential for the licensing business to be impacted by project expense adjustment and realignments within the semiconductor industry. At the time, we also stated that we may further our cost control measures if required. In light of our recent financial results, re-focus on products and technology investments, and to some extent also tied to the current macro environment, we have acted on this and taken a few immediate measures to reduce overall headcount and expenses, and forecast overall lower expenses in both the third and fourth quarters. We’ll continue to monitor our expenses closely and strategically invest our resources.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

Specifically for the third quarter of 2023

Gross margin is expected to be higher than second quarter, approximately 82% on GAAP basis, and higher sequentially on non-GAAP basis at 85%, excluding an aggregate of $0.4 million of equity-based compensation expenses and $0.4 million amortization of acquired intangibles.

- OPEX for the third quarter of 2023 is expected to be slightly higher compared to the second quarter of 2023, due to R&D effort allocation from cost of goods and in the range of $26.7 million to $27.7 million, including an expected $4.7 million of equity-based compensation expenses, and $0.8 million for amortization of acquired intangibles. Non-GAAP OPEX is also expected to be slightly higher than the second quarter due to the reasons I explained and in the range of $22.2 million – $23.2 million. I want to emphasize that overall expenses for CEVA in the third quarter is forecasted to be lower that the lower second quarter expense level that we recorded due to the cost measures I mentioned.

- Net interest income is expected to be approximately $1.0 million.

- Taxes for the third quarter are expected to be shy of $1.0 million derived mainly from withholding taxes of new deals signed and reported royalties for the quarter.

- Share count for the third quarter of 2023 is expected to be 24.7 million shares.

CEVA, Inc. Q2 2023 Financial Results Conference Call - Prepared Remarks:: August 9, 2023

Operator: You can now open the Q&A session

Wrap Up: Richard

Thank you for joining us today and for your continued interest in CEVA. As a reminder, the prepared remarks for this conference call are filed as an exhibit to the Current Report on Form 8-K and accessible through the investor section of our website at https://investors.ceva-dsp.com.

With regards to upcoming events, we will be participating in the following conferences:

| |

●

|

Oppenheimer 26th Annual Technology, Internet & Communications Conference, taking place today, virtually

|

| |

●

|

Rosenblatt's 3rd Annual Technology Summit: The Age of AI, taking place August 22-August 24, virtually

|

| |

●

|

Jefferies Semiconductor, IT Hardware & Communications Technology Summit, August 29-30, in Chicago

|

| |

●

|

Jefferies Israel Tech Trek, September 11-13 in Israel

|

Further information on these events and all events we will be participating in can be found on the investors section of our website.

Thank you and goodbye

v3.23.2

Document And Entity Information

|

Aug. 09, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CEVA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 09, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-49842

|

| Entity, Tax Identification Number |

77-0556376

|

| Entity, Address, Address Line One |

15245 Shady Grove Road, Suite 400

|

| Entity, Address, City or Town |

Rockville

|

| Entity, Address, State or Province |

MD

|

| Entity, Address, Postal Zip Code |

20850

|

| City Area Code |

240

|

| Local Phone Number |

308-8328

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CEVA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001173489

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

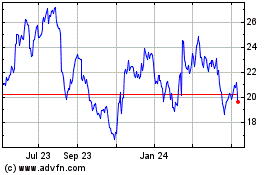

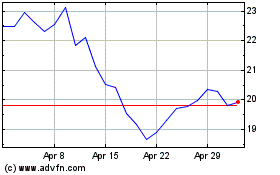

CEVA (NASDAQ:CEVA)

Historical Stock Chart

From Apr 2024 to May 2024

CEVA (NASDAQ:CEVA)

Historical Stock Chart

From May 2023 to May 2024