MORNING UPDATE: Man Securities Issues Alerts for JNPR, SUPG, VXGN, CECO, and MXT

March 15 2004 - 9:54AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for JNPR, SUPG, VXGN,

CECO, and MXT CHICAGO, March 15 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EST with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for JNPR, SUPG, VXGN, CECO, and MXT,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "This correction is healthy; it'll scare some

money out of this market, which is good." -- Harry Clark,

president, Clark Capital Management Group New PriceWatch Alerts for

JNPR, SUPG, VXGN, CECO, and MXT... PRICEWATCH ALERTS - HIGH RETURN

COVERED CALL OPTIONS -- Juniper Networks Inc. (NASDAQ:JNPR) Last

Price 25.81 - APR 25.00 CALL OPTION@ $2.30 -> 6.3 % Return

assigned* -- SuperGen Inc. (NASDAQ:SUPG) Last Price 9.84 - APR 7.50

CALL OPTION@ $2.80 -> 6.5 % Return assigned* -- VaxGen, Inc.

(NASDAQ:VXGN) Last Price 11.15 - APR 10.00 CALL OPTION@ $1.55 ->

4.2 % Return assigned* -- Career Education Corp. (NASDAQ:CECO) Last

Price 46.47 - APR 45.00 CALL OPTION@ $3.90 -> 5.7 % Return

assigned* -- Metris Companies Inc. (NYSE:MXT) Last Price 5.57 -APR

5.00 CALL OPTION@ $0.80 -> 4.8 % Return assigned* * To learn

more about how to use these alerts and for our FREE report, "The 18

Warning Signs That Tell You When To Dump A Stock", go to:

http://www.investorsobserver.com/mu18 (Note: You may needto copy

the link above into your browser then press the [ENTER] key) ** For

the FREE report, "The Secrets of Smart Election Year Investing -

Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEelection NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW Overseas markets continue

to trade in the grip of fear of continued acts of terrorism, as

just three of the 15 markets that we track are currently positive.

The cumulative average return on the group stands at a minus 0.755

percent. While I am not qualified to discuss the topic, it would

appear the Spanish populace bowed to the most recent act of

terrorism, shifting their position on this weekend's presidential

election. A surprise shift in sentiment elected Opposition

Socialist leader Jose Luis Rodriguez Zapatero as the country's new

Prime Minister. Also bowing to the dark hand of terrorism, the

Spain IBEX 35 is dragging our overseas collective lower, trading

off some 3.24 percent. U.S. futures trade is not offering up any

moral support either. Before the market open today, the March

Empire State Manufacturing Index is scheduled for release. Like

many reports of late, it too is expected to slow a bit from record

high levels to 38.1 from the prior month's (record) 42.05 reading.

At 9:15 a.m., the release of the February Industrial Production

index is expected to show a slowing to a plus 0.4 percent versus

January's robust plus 0.8 percent. The companion report, February

Capacity Utilization, is seen inching higher to 76.4 percent from

the prior month's 76.2 percent of use. Be prepared for the

investing week ahead with Bernie Schaeffer's FREE Monday Morning

Outlook. For moredetails and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES The stock markets in both America and Europe

rebounded well after being shaken by the tragic Madrid bombings.

But essentially, the U.S. rally was solidly underway before the

news suggesting the bombing might be Al-Qaeda cut it short. The

result was a free-fall that drove the Dow and NASDAQ to extremely

oversold levels. Brit Ryle, noted market analyst at the Money Flow

Matrix Trader, writes, "Dailymomentum on the NASDAQ increased

Thursday, but never got to extreme territory. Daily stochastics are

turning up. The volatility indices (VIX and VXN) have also spiked

over the past few days. The put/call ratio, which was running above

.9, finally hit a bullish crescendo at 1.20 Thursday. I think the

NASDAQ has some upside coming, but it will likely be quick and

could mark the highs for the next few months. My charts point to a

high probability of the index rallying through 2,000 over the next

3-4 days. The 10-day moving average is at 2,025, while the 35-day

and 50-day averages are zeroing in on 2,050. 2,050 is a probable

target for next week, and there's an outside shot at 2,070 or even

2,100. In short, making money with calls should be the way to go

through Wednesday, at least." The editorial team has prepared a

special FREE REPORT for you - "America's 1,300 Fastest-Growing

Companies." You can access it immediately by following this link:

http://www.investorsobserver.com/agora1 TODAY'S ECONOMIC CALENDAR

8:30 a.m.: March Empire State Manufacturing Index (last 42.05).

9:15 a.m.: February Industrial Production (seen at plus 0.4

percent, last plus 0.8 percent). 9:15 a.m.: February Capacity

Utilization (seen at 76.4 percent, last 76.2 percent). 1:00 p.m.:

March National Association of Home Builders (NAHB) Housing Index

(last 65). Man Financial Inc is one of the world's major futures

and options brokers and has been recognized as a leading option

order execution firm for individuals and institutions. Member

CBOE/NASD/SIPC (CRD#6731). For more information and a free CD with

educational tools to help you invest smarter, see

http://www.investorsobserver.com/mancd This Morning Update was

prepared with data and information provided by:

InvestorsObserver.com -- Better Strategies for Making Money ->

For Investors With a Sense of Humor. Only $1 for your first month

plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research -- Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus -- The

Best Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp . Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

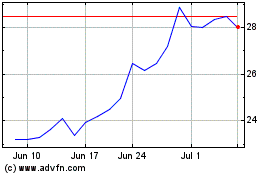

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2024 to Jul 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jul 2023 to Jul 2024