CalAmp Corp. (Nasdaq: CAMP), a leading provider of wireless

products, services and solutions, today reported results for its

fiscal 2009 second quarter ended August 31, 2008. Key elements

include: Consolidated second quarter revenues of $23.3 million;

wireless datacom revenues of $20.1 million. GAAP loss from

continuing operations of $1.5 million, or $0.06 loss per basic and

diluted share, within expectations; Adjusted Basis (non-GAAP) loss

from continuing operations of $0.5 million or $0.02 loss per basic

and diluted share, also within expectations. Consolidated gross

margin percentage of 32.0%; wireless datacom gross margin

percentage of 37.5%. Unit volumes of Direct Broadcast Satellite

(DBS) product shipments to historically largest customer beginning

to ramp up. Rick Gold, CalAmp�s President and Chief Executive

Officer, commented, �Similar to last quarter, our operating results

were driven by the continued strong performance of our wireless

datacom business, which generated revenues of $20.1 million and

accounted for 86% of our consolidated revenue. I am particularly

pleased with the contributions from our mobile resource

management�or MRM�product lines that continue to gain customer

acceptance in applications targeted for high value asset tracking

and fleet management.� Mr. Gold continued, �Satellite product sales

were modest for most of the second quarter. However, I was

encouraged to see unit volumes to our historically largest DBS

customer begin ramping up significantly at the end of the quarter

and we expect this will continue throughout the second half of

fiscal 2009. We are committed to rebuilding our competitive

position in the DBS market and I believe our recent efforts will

help us achieve this goal and return CalAmp to profitability.�

Fiscal 2009 Second Quarter Results Total revenue for the fiscal

2009 second quarter was $23.3 million compared to $32.7 million for

the second quarter of fiscal 2008. The reduction in revenues was

due primarily to significantly lower sales of the Company�s

satellite products. Gross profit for the fiscal 2009 second quarter

was $7.5 million, or 32.0% of revenues compared to gross profit of

$6.3 million, or 19.3% of revenue for the same period last year.

The improvement in gross profit and gross margin percentage in the

latest quarter was due primarily to higher MRM revenues and gross

margin, and a charge included in last year�s second quarter of $1.5

million for estimated expenses to correct a product performance

issue with a key DBS customer. Results of operations for the fiscal

2009 second quarter as determined in accordance with U.S. Generally

Accepted Accounting Principles (�GAAP�) was a loss from continuing

operations of $1.5 million, or $0.06 loss per basic and diluted

share. This compares to a loss from continuing operations of $3.3

million, or $0.14 loss per basic and diluted share, in the second

quarter of last year. The lower loss in the latest quarter was

attributable to higher gross profit as discussed above. The

Adjusted Basis (non-GAAP) loss from continuing operations for the

fiscal 2009 second quarter was $0.5 million, or $0.02 loss per

basic and diluted share compared to an Adjusted Basis loss from

continuing operations of $2.0 million or $0.08 loss per basic and

diluted share for the same period last year. Adjusted Basis income

(loss) from continuing operations excludes the impact of

amortization of intangible assets, stock-based compensation expense

and in-process research and development, each net of tax. A

reconciliation of the GAAP basis income (loss) from continuing

operations to Adjusted Basis income (loss) from continuing

operations is provided in the table at the end of this press

release. Liquidity At August 31, 2008, the Company had total cash

of $4.7 million, with $26.0 million in total outstanding bank debt

and a $5 million note payable to a key DBS customer. Net cash used

by operating activities was $1.1 million for the three months ended

August 31, 2008, primarily for working capital. For the six month

period ended August 31, 2008, net cash generated by operating

activities was approximately $700,000. During the latest quarter,

bank term loan principal was paid down by $1.0 million. The bank

term loan has a maturity date of June 30, 2009, and consequently

the entire term loan balance of $26 million is classified as a

current liability in the August 31, 2008 balance sheet. The Company

has requested an extension of the maturity date, and is currently

in discussions with the banks on this matter. Business Outlook

Commenting on the Company�s business outlook, Mr. Gold said, �Our

third quarter outlook remains cautious due in part to continued

uncertainty surrounding the U.S. economy, which may impact purchase

decisions by key customers. That said, we expect sales of our

satellite products to increase materially compared to the second

quarter as unit volumes shipped to our historically largest DBS

customer continue to ramp higher. Based on our current forecast, we

believe fiscal 2009 third quarter consolidated revenues will be in

the range of $26 to $30 million, with a GAAP basis net loss in the

range of $0.03 to $0.07 per diluted share. The Adjusted Basis

(non-GAAP) results of operations for the third quarter, which

exclude amortization of intangible assets and stock-based

compensation expense net of tax, are expected to be in the range of

a $0.03 loss to $0.01 income per diluted share.� Conference Call

and Webcast A conference call and simultaneous webcast to discuss

fiscal 2009 second quarter financial results and business outlook

will be held today at 4:30 p.m. Eastern / 1:30 p.m. Pacific. The

live webcast of the call is available on CalAmp�s web site at

www.calamp.com. Participants are encouraged to visit the web site

at least 15 minutes prior to the start of the call to register,

download and install any necessary audio software. CalAmp�s

President and CEO Rick Gold and CFO Rick Vitelle will host the

conference call. After the live webcast, a replay will remain

available until the next quarterly conference call in the Investor

Relations section of CalAmp�s web site. About CalAmp Corp. CalAmp

provides wireless communications solutions that enable

anytime/anywhere access to critical data and content. The Company

serves customers in the public safety, industrial monitoring and

controls, mobile resource management, and direct broadcast

satellite markets. The Company�s products are marketed under the

CalAmp, Dataradio, SmartLink, Aercept, LandCell and Omega trade

names. For more information, please visit www.calamp.com.

Forward-Looking Statements Statements in this press release that

are not historical in nature are forward-looking statements, that

involve known and unknown risks and uncertainties. Words such as

�may,� �will,� �expect,� �intend,� �plan,� �believe,� �seek,�

�could,� �estimate,� �judgment,� �targeting,� �should,�

�anticipate,� �goal� and variations of these words and similar

expressions, are intended to identify forward-looking statements.

Actual results could differ materially from those implied by such

forward-looking statements due to a variety of factors, including

general and industry economic conditions, product demand, increased

competition, competitive pricing and continued pricing declines in

the DBS market, the timing of customer approvals of new product

designs, operating costs, the Company�s ability to efficiently and

cost-effectively integrate its acquired businesses, the risk that

the ultimate cost of resolving a product performance issue with one

of the Company�s key DBS customers may exceed the amount of

reserves established for that purpose, the length and extent of the

U.S. market downturn stemming from the recent tightening of credit

markets that may impact the Company�s business and that of its

customers and which may constrain the Company�s ability to

refinance its bank term loan, and other risks or uncertainties that

are described in the Company�s fiscal 2008 Annual Report on Form

10-K as filed with the Securities and Exchange Commission on May

15, 2008. Although the Company believes the expectations reflected

in such forward-looking statements are based upon reasonable

assumptions, it can give no assurance that its expectations will be

attained. The Company undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. CAL AMP CORP. CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited, in thousands except per share

amounts) � � Three Months Ended � Six Months Ended August 31,

August 31, 2008 � 2007 2008 � 2007 � Revenues $ 23,308 $ 32,668 $

51,209 $ 79,061 � Cost of revenues � 15,840 � � 26,353 � � 34,312 �

� 78,132 � � Gross profit � 7,468 � � 6,315 � � 16,897 � � 929 � �

Operating expenses: Research and development 3,131 3,795 6,331

8,114 Selling 1,647 2,373 3,919 4,642 General and administrative

3,266 3,457 6,362 6,659 Intangible asset amortization 1,240 1,558

2,572 3,302 In-process research and development � - � � - � � - � �

310 � � 9,284 � � 11,183 � � 19,184 � � 23,027 � � Operating loss

(1,816 ) (4,868 ) (2,287 ) (22,098 ) � Non-operating expense, net �

(334 ) � (507 ) � (750 ) � (1,090 ) � Loss from continuing

operations before income taxes (2,150 ) (5,375 ) (3,037 ) (23,188 )

� Income tax benefit � 652 � � 2,117 � � 1,042 � � 8,985 � � Loss

from continuing operations (1,498 ) (3,258 ) (1,995 ) (14,203 ) �

Loss from discontinued operations, net of tax - � (1,115 ) - �

(1,532 ) � � Net loss $ (1,498 ) $ (4,373 ) $ (1,995 ) $ (15,735 )

� � Basic and diluted loss per share: Loss from continuing

operations $ (0.06 ) $ (0.14 ) $ (0.08 ) $ (0.60 ) Loss from

discontinued operations � - � � (0.05 ) � - � � (0.07 ) � Total

basic and diluted loss per share $ (0.06 ) $ (0.19 ) $ (0.08 ) $

(0.67 ) � � Shares used in per share calculations: Basic 24,737

23,623 24,720 23,612 Diluted 24,737 23,623 24,720 23,612 CAL AMP

CORP. BUSINESS SEGMENT INFORMATION (Unaudited, in thousands) � �

Three Months Ended � Six Months Ended August 31, August 31, 2008 �

2007 2008 � 2007 Revenue Satellite $ 3,176 $ 9,851 $ 10,817 $

32,882 Wireless DataCom � 20,132 � � 22,817 � � 40,392 � � 46,179 �

� Total revenue $ 23,308 � $ 32,668 � $ 51,209 � $ 79,061 � � Gross

profit (loss) Satellite $ (81 ) $ (1,835 ) $ 652 $ (15,751 )

Wireless DataCom � 7,549 � � 8,150 � � 16,245 � � 16,680 � � Total

gross profit $ 7,468 � $ 6,315 � $ 16,897 � $ 929 � � Operating

income (loss) Satellite $ (1,324 ) $ (3,064 ) (a) $ (1,656 ) $

(18,295 ) (a) Wireless DataCom 916 (b) (500 ) (c) 1,973 (b) (1,146

) (c) Corporate expenses � (1,408 ) � (1,304 ) � (2,604 ) � (2,657

) � Total operating loss $ (1,816 ) $ (4,868 ) $ (2,287 ) $ (22,098

) � (a) Includes charges for estimated product warranty and related

costs in the three and six-month periods ended August 31, 2007 of

$1.5 million and $17.8 million, respectively. � (b) Includes

intangible asset amortization expense in the three and six-month

periods ended August 31, 2008 of $1.2 million and $2.6 million,

respectively. � (c) Includes intangible asset amortization expense

in the three and six-month periods ended August 31, 2007 of $1.6

million and $3.3 million, respectively. CAL AMP CORP. CONSOLIDATED

BALANCE SHEETS (Unaudited - In thousands) � � August 31, � February

28, 2008 2008 Assets Current assets: Cash and cash equivalents $

4,697 $ 6,588 Accounts receivable, net 16,612 20,043 Inventories

23,977 25,097 Deferred income tax assets 4,698 5,306 Prepaid

expenses and other current assets � 10,213 � � 9,733 � � Total

current assets 60,197 66,767 � Equipment and improvements, net

4,398 5,070 � Deferred income tax assets, less current portion

16,289 14,802 � Goodwill 28,224 28,520 � Other intangible assets,

net 21,852 24,424 � Other assets � 3,491 � � 3,458 � � $ 134,451 �

$ 143,041 � Liabilities and Stockholders' Equity Current

liabilities: Current portion of long-term debt $ 31,030 $ 5,343

Accounts payable 9,708 10,875 Accrued payroll and employee benefits

3,535 4,218 Accrued warranty costs 4,867 3,818 Other accrued

liabilities 10,198 11,800 Deferred revenue � 3,085 � � 4,005 � �

Total current liabilities � 62,423 � � 40,059 � � Long-term debt,

less current portion - 27,187 � Other non-current liabilities 1,090

2,375 � Stockholders' equity: Common stock 252 250 Additional

paid-in capital 144,252 144,318 Accumulated deficit (73,144 )

(71,149 ) Accumulated other comprehensive income (loss) � (422 ) �

1 � � Total stockholders' equity � 70,938 � � 73,420 � � $ 134,451

� $ 143,041 � � CAL AMP CORP. � � CONSOLIDATED CASH FLOW STATEMENTS

(Unaudited - In thousands) � Six Months Ended August 31, 2008 2007

Cash flows from operating activities: Net loss $ (1,995 ) $ (15,735

) Depreciation and amortization 3,770 5,201 Stock-based

compensation expense 361 1,027 Write-off of in-process research and

development costs - 310 Excess tax benefit from stock-based

compensation - (55 ) Deferred tax assets, net (1,046 ) (14,388 )

Loss on sale of discontinued operations, net of tax - 935 Gain on

sale of investment - (331 ) Changes in operating working capital

(376 ) 20,934 Other � - � � (2 ) � Net cash provided (used) by

operating activities � 714 � � (2,104 ) � Cash flows from investing

activities: Capital expenditures (561 ) (920 ) Earn-out payments on

TechnoCom acquisition (872 ) - Proceeds from sale of discontinued

operations 420 4,000 Proceeds from sale of property and equipment -

4 Proceeds from sale of investment - 1,045 Acquisition of Aercept -

(19,315 ) Acquisition of SmartLink, net of refunds from escrow fund

296 (7,944 ) Cash restricted for repayment of debt � - � � (3,309 )

� Net cash used in investing activities � (717 ) � (26,439 ) � Cash

flows from financing activities: Debt repayments (1,500 ) (1,476 )

Proceeds from stock option exercises - 157 Excess tax benefit from

stock-based compensation � - � � 55 � � Net cash used in financing

activities � (1,500 ) � (1,264 ) � Effect of exchange rate changes

on cash � (388 ) � 640 � � Net change in cash and cash equivalents

(1,891 ) (29,167 ) � Cash and cash equivalents at beginning of

period � 6,588 � � 37,537 � � Cash and cash equivalents at end of

period $ 4,697 � $ 8,370 � CAL AMP CORP. NON-GAAP EARNINGS

RECONCILIATION (Unaudited, in thousands except per share amounts) �

Non-GAAP Earnings Reconciliation "GAAP" refers to financial

information presented in accordance with Generally Accepted

Accounting Principles in the United States. This press release

includes historical non-GAAP financial measures, as defined in

Regulation G promulgated by the Securities and Exchange Commission.

CalAmp believes that its presentation of historical non-GAAP

financial measures provides useful supplementary information to

investors. The presentation of historical non-GAAP financial

measures is not meant to be considered in isolation from or as a

substitute for results prepared in accordance with accounting

principles generally accepted in the United States. � In this press

release, CalAmp reports the non-GAAP financial measures of Adjusted

Basis Loss from Continuing Operations and Adjusted Basis Loss from

Continuing Operations Per Diluted Share. CalAmp uses these non-GAAP

financial measures to enhance the investor's overall understanding

of the financial performance and future prospects of CalAmp's core

business activities. Specifically, CalAmp believes that a report of

Adjusted Basis (non-GAAP) Loss from Continuing Operations and

Adjusted Basis Loss from Continuing Operations Per Diluted Share

provides consistency in its financial reporting and facilitates the

comparison of results of core business operations between its

current and past periods. � The reconciliation of the GAAP Basis

Loss from Continuing Operations to Adjusted Basis (non-GAAP) Loss

from Continuing Operations is as follows: � Three Months Ended �

Six Months Ended August 31, August 31, 2008 � 2007 2008 � 2007 �

GAAP Basis Loss from Continuing Operations $ (1,498 ) $ (3,258 ) $

(1,995 ) $ (14,203 ) � Adjustments to reconcile to Adjusted Basis

Loss from Continuing Operations: Amortization of intangible assets,

net of tax 815 955 1,690 2,024 Stock-based compensation expense,

net of tax 231 315 237 597 In-process R&D, net of tax - - - 190

� � � � � � � � � Adjusted Basis Loss from Continuing Operations $

(452 ) $ (1,988 ) $ (68 ) $ (11,392 ) � Adjusted Basis Loss from

Continuing Operations per Diluted Share $ (0.02 ) $ (0.08 ) $ - $

(0.48 ) � Weighted average common shares outstanding on diluted

basis 24,737 23,623 24,720 23,612 � The reconciling items above are

tax effected using the year-to-date effective tax rate. The

computation of the year-to-date effective income tax rate is as

follows: � Six Months Ended August 31, 2008 2007 Pretax loss from

continuing operations, as reported $ (3,037 ) $ (23,188 ) � Income

tax benefit, as reported 1,042 � 8,985 � � Effective income tax

rate 34.3 % 38.7 %

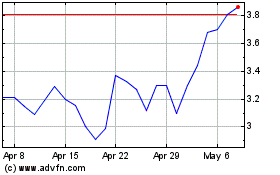

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

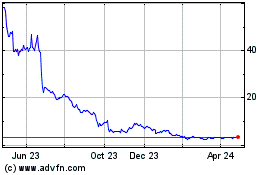

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jul 2023 to Jul 2024