UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

September 10, 2015

Banner Corporation

(Exact name of registrant as specified in its

charter)

| Washington |

0-26584 |

91-1691604 |

| (State or other jurisdiction |

(Commission File |

(I.R.S. Employer |

| of incorporation) |

Number) |

Identification No.) |

10 S. First Avenue

Walla Walla, Washington 99362

(Address of principal executive offices and

zip code)

(509) 527-3636

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR240.13e-4(c))

Item 8.01 Other Events

On September 10, 2015,

Banner Corporation (“Banner”) issued a press release announcing that, in connection with the Agreement and Plan of

Merger, dated as of November 5, 2014, by and among Banner Corporation, SKBHC Holdings LLC and Starbuck Bancshares, Inc., related

to Banner’s proposed acquisition of AmericanWest Bank, Banner has obtained approvals from the Federal Reserve Board, the

Washington Department of Financial Institutions and the Federal Deposit Insurance Corporation, and that the transaction is expected

to close early in the fourth quarter of 2015, subject to customary closing conditions, and will not require any further approvals

on the part of the shareholders of either company. A copy of the press release issued by Banner is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

| |

99.1 |

Press release of Banner Corporation, dated September 10, 2015. |

| |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

BANNER CORPORATION |

| |

|

| Date: September 10, 2015 |

By: /s/ Lloyd W. Baker |

| |

Lloyd W. Baker

Executive Vice President and

Chief Financial Officer |

Kelly McPhee

VP, Director of Communications & Public Relations

(509) 991-0575 |

|

Contact: Mark J. grescovich,

President

& CEO

Lloyd

W. Baker, CFO

(509)

527-3636

News

Release

|

Banner Corporation Receives Regulatory

Approval for AmericanWest Bank Merger with Banner Bank

WALLA WALLA, Wash. and SPOKANE,

Wash. – September 10, 2015 - Banner Corporation (“Banner”), the holding company for Banner Bank, previously announced

that it had entered into a definitive agreement pursuant to which AmericanWest’s holding company will merge with and into

Banner and AmericanWest Bank will merge with and into Banner Bank. In connection with the proposed transaction, Banner has received

the written approval of the Federal Reserve Board. Banner has also received approval from the Federal Deposit Insurance Corporation

and the Washington Department of Financial Institutions.

The transaction is expected to close early in the fourth quarter

of 2015, subject to customary closing conditions, and does not require any further approvals on the part of the shareholders of

either company. At the time of the close, the combined company will have approximately $9.7 billion in assets and approximately

190 branches across five western states.

About Banner Corporation

Banner Corporation is a $5.2 billion bank

holding company operating two commercial banks in Washington, Oregon and Idaho. Banner serves the Pacific Northwest region through

a network of 104 branches with a full range of deposit services and business, commercial real estate, construction, residential,

agricultural and consumer loans. Visit Banner Bank on the Web at www.bannerbank.com.

About AmericanWest Bank

Based in Spokane, Washington, AmericanWest Bank, with approximately $4.6 billion in assets, is a business-focused

community bank offering commercial and business banking, mortgage lending, treasury management products and a full line of

consumer products and services. The bank currently operates 94 branches in California, Washington, Idaho, Oregon and Utah.

Find out more about AmericanWest Bank at www.awbank.net.

Forward Looking Statements

When used in this press release

and in other documents filed with or furnished to the Securities and Exchange Commission (the "SEC"), in press releases

or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the

words or phrases "believe," "will," "will likely result," “may,” “shall,”

"are expected to," "will continue," "is anticipated," "estimate," "project,"

"plans," “forecast,” “initiative,” “objective,” “goal,” “outlook,”

“priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,”

or the negative of any of those words or phrases or similar expressions are intended to identify "forward-looking statements"

within the meaning of applicable federal securities laws, including the Private Securities Litigation Reform Act of 1995. You are

cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date such statements are made.

These statements may relate to future financial performance, strategic plans or objectives, revenues or earnings projections, or

other financial information. By their nature, these statements are subject to numerous uncertainties that could cause actual results

to differ materially from those anticipated in the statements. Statements about the expected timing, completion and effects of

the proposed transactions and all other statements in this release other than historical facts constitute forward-looking statements.

Important factors that

could cause actual results to differ materially from the results anticipated or projected include, but are not limited to,

the following: (1) expected revenues, cost savings, synergies and other benefits from the proposed merger of Banner Bank and

AmericanWest Bank (“AmericanWest”) might not be realized within the expected time frames or at all and costs or

difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater

than expected; (2) the credit risks of lending activities, including changes in the level and direction of loan delinquencies

and write-offs and changes in estimates of the adequacy of the allowance for loan losses, which could necessitate additional

provisions for loan losses, resulting both from loans originated and loans acquired from other financial institutions; (3)

results of examinations by regulatory authorities, including the possibility that any such regulatory authority may, among

other things, require increases in the allowance for loan losses or writing down of assets; (4) competitive pressures among

depository institutions; (5) interest rate movements and their impact on customer behavior and net interest margin; (6) the

impact of repricing and competitors' pricing initiatives on loan and deposit products; (7) fluctuations in real estate

values; (8) the ability to adapt successfully to technological changes to meet customers' needs and developments in the

market place; (9) the ability to access cost-effective funding; (10) changes in financial markets; (11) changes in economic

conditions in general and in Washington, Idaho, Oregon and California in particular; (12) the costs, effects and outcomes of

litigation; (13) new legislation or regulatory changes, including but not limited to the Dodd-Frank Act and regulations

adopted thereunder, changes in capital requirements pursuant to the Dodd-Frank Act and the implementation of the Basel III

capital standards, other governmental initiatives affecting the financial services industry and changes in federal and/or

state tax laws or interpretations thereof by taxing authorities; (14) changes in accounting principles, policies or

guidelines; (15) future acquisitions by Banner or AmericanWest of other depository institutions or lines of business; (16)

and future goodwill impairment due to changes in Banner's business, changes in market conditions, or other factors.

Banner does not undertake

any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the

forward-looking statement is made except where expressly required by law.

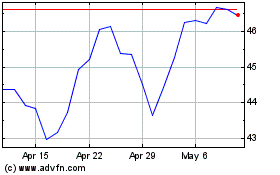

Banner (NASDAQ:BANR)

Historical Stock Chart

From Jun 2024 to Jul 2024

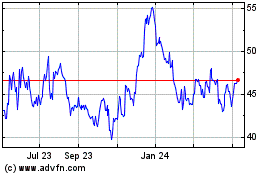

Banner (NASDAQ:BANR)

Historical Stock Chart

From Jul 2023 to Jul 2024