Paychex Takes Over Icon Time - Analyst Blog

January 12 2012 - 4:45AM

Zacks

New York-based outsourcing service

provider Paychex Inc. (PAYX) recently announced

the takeover of online and PC-based time and attendance solutions

provider, Icon Time Systems Inc. Financial details of the

transaction were not divulged. Post the acquisition, Icon Time will

operate as a wholly-owned subsidiary of Paychex and all its

employees will be retained.

Founded in 1989, Icon Time serves

small businesses with its PC-based and web-enabled time and

attendance products. Icon’s experience and innovation in the time

and attendance market is expected to help Paychex enrich its

Payroll services products, specifically the PST 1000 time

clock.

In February last year, Paychex

partnered with Icon Time for the launch of the Paychex PST 1000

time clock, which immediately curtails the time spent to calculate

timesheets and compile employee information. Alongside, the time

clock also enhances payroll productivity and accuracy. According to

company officials, the product has remained a great revenue earner

till date.

Paychex has always been

enthusiastic about strengthening Payroll activities. In May 2011,

the company took over recordkeeping and administrative solutions

provider, ePlan Services. ePlan Services’ Web-based platform

complements Paychex’ existing recordkeeping business. PLANSPONSOR

magazine had acknowledged Paychex as the leading recordkeeper in

the U.S. With ePlan Services’ under its wing, Paychex will be able

to serve financial advisers with clarity into fee structures, while

the market transitions to full disclosure models to keep pace with

consumer and legislative demand.

Apart from this, Paychex also

solidified its Payroll Services segment with the acquisition of the

online payroll solutions provider, SurePayroll Inc. in December

2010. Paychex had to shell out $115.0 million in cash for this

deal.

Though the company’s initiative for

boosting the Payroll Services segment is encouraging, the effort is

not showing up in its results. The segment is not performing well

mainly due to the lack of new business wins.

Small businesses are significant

revenue sources for Paychex. But the SMB (small and medium

business) sector is being hit hard by lackluster demand due to high

unemployment and inflation rates. Paychex is highly dependent on

the performance of the SMB sector and this is the reason the

company may not see much revenue growth in the near term.

Despite the concern in the SMB

sector, Paychex delivered modest second quarter results by

marginally beating the Zacks Consensus Estimate on the bottom line.

Moreover, we are encouraged by Paychex’ endeavour to introduce a

software-as-a-service (SaaS) application that is tailor-made for

Apple Inc.’s (AAPL) iPad. With this, the ace

payroll, human resource and benefits outsourcing solutions provider

will be able to compete against its rivals, Automated Data

Processing Inc. (ADP) and Intuit Inc.

(INTU), whose SaaS-based mobile solutions have already gained

decent market share.

Paychex has a Zacks #3 Rank,

implying a short-term Hold recommendation.

APPLE INC (AAPL): Free Stock Analysis Report

AUTOMATIC DATA (ADP): Free Stock Analysis Report

INTUIT INC (INTU): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

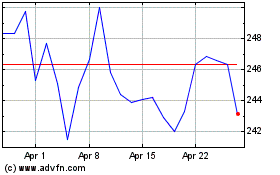

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jun 2024 to Jul 2024

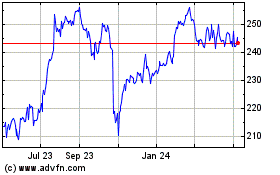

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jul 2023 to Jul 2024