2nd UPDATE: ADP 4Q Profit Rises 16% On New-Business Sales Growth

July 28 2011 - 2:38PM

Dow Jones News

Automatic Data Processing Inc.'s (ADP) fiscal fourth-quarter

profit improved 16% due to solid new-business sales growth and

higher payroll revenue, while the number of employees on U.S.

clients' payrolls increased.

The payroll-processing and human-resources-outsourcing company

has seen its revenue grow in recent quarters, helped by strong

new-business sales growth in its employer-services and professional

employer organization services segments. The company said it is

seeing strength from employers in the Central U.S.--including

Chicago, Texas and Oklahoma, as well as Northern California.

In an interview with Dow Jones Newswires, Chief Financial

Officer Chris Reidy said the company's investments in its sales and

service staff and product innovation helped lift retention and new

bookings. The company began making those investments in the fourth

quarter of fiscal 2010, and has now achieved an all-time high

retention of 91%.

Reidy added the company's focus on product innovation has helped

drive results, including mobile applications and deal and

management systems. For example, ADP earlier this month began

offering small-business owners a mobile application that would

allow them to input payroll and run reports on their

smartphone.

For the quarter ended June 30, ADP reported a profit of $241.8

million, or 48 cents a share, compared with $207.9 million, or 42

cents a share, a year earlier. Revenue rose 14% to $2.51

billion.

Analysts surveyed by Thomson Reuters had expected a profit of 49

cents a share on revenue of $2.44 billion.

Gross margin declined to 39.4% from 41.5%.

Revenue at the company's employer-services segment, the largest

top-line contributor by far, climbed 9%. New-business sales for

Employer Services and PEO Services 8%.

In the U.S., revenue from the traditional payroll and payroll

tax filing business grew by 4%. The number of employees on ADP's

clients' payrolls in the U.S. increased 2.6%, as measured on a

same-store-sales basis.

The company now sees earnings rising 8% to 10% and revenue

growth of 7% to 9%. In a conference call with analysts, Chairman

and Chief Executive Gary Butler said the company sees stronger

top-line growth for dealer services, due to a larger sales force

and new products. He did warn the new year would see pressure from

the continued low-interest rate environment.

Shares were down 0.6% to $52.07 in recent trading. The stock is

up 13% this year.

-By John Kell, Dow Jones Newswires; 212-416-2480; john.kell@dowjones.com

--Mia Lamar contributed to this report.

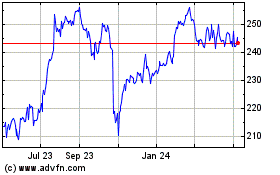

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jun 2024 to Jul 2024

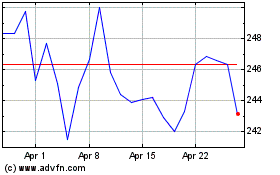

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jul 2023 to Jul 2024