0001362190

false

0001362190

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 10, 2023

AUDIOEYE, INC.

(Exact name of registrant as specified in charter)

| Delaware |

001-38640 |

20-2939845 |

| State of Other Jurisdiction of Incorporation |

Commission File Number |

IRS Employer Identification No. |

5210 E. Williams Circle, Suite 750

Tucson, Arizona 85711

(Address of principal executive offices / Zip Code)

(866) 331-5324

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act. |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.00001 per share |

|

AEYE |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 10, 2023, AudioEye,

Inc. (the “Company”) issued a press release reporting its financial results for the fiscal quarter ended June 30, 2023. A

copy of the Company’s press release is furnished herewith as Exhibit 99.1.

The information set forth

in this Item 2.02 and in Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such

section nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act,

regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such

filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| August 10, 2023 |

AudioEye, Inc. |

| |

(Registrant) |

| |

|

|

| |

By |

/s/ James Spolar |

| |

Name: |

James Spolar |

| |

Title: |

General Counsel and Secretary |

Exhibit 99.1

AudioEye Reports

Record Second Quarter 2023 Results

Thirtieth Consecutive

Period of Record Revenue

TUCSON, Ariz. — August 10,

2023 — AudioEye, Inc. (NASDAQ: AEYE) (“AudioEye” or the “Company”), the industry-leading enterprise

SaaS accessibility company, reported financial results for the second quarter ended June 30, 2023.

“The second quarter’s achievements

have set the stage for the acceleration of ARR in the second half and into next year. We announced several new enterprise products, completed

the integration of the Bureau of Internet Accessibility (“BOIA”), and have assembled a world-class revenue organization while

remaining highly efficient,” said AudioEye CEO David Moradi. “We are excited about recent developments from the Department

of Justice that will help ensure people with disabilities have equal access to web content and mobile apps. We believe that momentum

is building to resolve digital accessibility at scale.”

Second Quarter 2023 Financial Results

| ● | Total revenue increased 4% to

a record $7.84M from $7.6M in the same prior year period. |

| ● | Gross profit increased to $6.05M

(77% of total revenue) from $5.7M (76% of total revenue) in the same prior year period. The

increase in gross profit was due to continued revenue growth and decreases in the cost of

revenue from improved automation in product offerings. |

| ● | Total operating expenses decreased

3% to $8.1M from $8.3M in the same prior year period. The decrease in operating expenses

was due primarily to increased efficiency in sales and marketing and lower non-recurring

G&A expenses, partially offset by continued investment in R&D. |

| ● | Net loss available to common stockholders improved 24% to $2.0M, or $(0.17) per share, from a net loss of $2.6M, or $(0.23) per share,

in the same prior year period. The improvement in net loss was primarily due to increases in revenue and gross profit and increased efficiencies

in sales and marketing and G&A. |

| ● | Non-GAAP net loss in Q2 2023 was $0.2M, or $(0.02) per share, and remained consistent with the non-GAAP net loss in the same prior

year period. For Q2 2023, the non-GAAP net loss and EPS performance reflect adjustments primarily for stock-based compensation expense

and depreciation and amortization. |

| ● | Annual Recurring Revenue (“ARR”) as of June 30, 2023, increased sequentially to $29.7M from $29.6M as of March 31, 2023,

despite contract re-negotiations that negatively impacted ARR. |

| ● | As of June 30, 2023, the Company had $4.3M in cash, compared to $5.5M as of March 31, 2023. The decrease in cash was primarily driven

by continued investment in R&D including software capitalization costs, tax payments from employee share-based grants, and non-recurring

items. |

Other Updates

| ● | Last week, the Department of Justice issued a proposed rule on website accessibility under Title II of the Americans with Disabilities

Act (“ADA”) that would help ensure people with disabilities have equal access to essential public programs and services. The

proposed rule will drive more awareness and compliance, and we are well-positioned as we already work with over 900 government organizations

and school districts. |

| ● | In July, AudioEye announced new enterprise-grade digital accessibility offerings, including the Accessibility Maturity Management

(“AMM”) program and the Accessibility Health Advisor (“AHA”). These programs and tools use our team of certified

experts to assess a company's current level of accessibility and help define the investments required to make measurable, sustainable

progress in accessibility. Our AMM Program identifies the people, culture, process, and system changes an organization needs to make accessibility

a first-class concern and tracks progress toward those goals. When new regulations change accessibility guidelines, the AHA notifies the

company of any changes required to comply. With the further development of AI automation, we believe this first-of-its-kind program and

corresponding tools will be powerful drivers in increasing accessibility at scale. |

| ● | In July, AudioEye announced that Gabby Giffords, former United States Congresswoman for Arizona's 8th congressional district,

joined the Company's Advisory Board. Gabby Giffords is a retired U.S. politician who resigned from Congress in 2012 after sustaining a

severe brain injury during an assassination attempt. Today, she helps raise awareness about aphasia, the language impairment caused by

injuries from her shooting. Gabby's influence in the disability community and her passion for change will help AudioEye continue to make

great strides in building solutions that close the digital accessibility gap. |

| ● | Customer count increased 37% to approximately 104,000 customers as of June 30, 2023, compared to about 76,000 as of June 30, 2022.

The expansion of platforms was the most material driver of the customer count increase in the quarter. |

| ● | In July, we completed the successful integration of BOIA, which was acquired in March of 2022. The integration will help enable retention

and upsells as well as result in cost savings in the near term. BOIA’s non-recurring audit revenue will now primarily generate ARR

under our subscription model. The impact of the integration of BOIA will reduce third quarter revenue by approximately $200,000 as we

transition one-time audits into recurring revenue. |

Financial Outlook

The Company expects to generate revenue of

between $7.8 million and $7.9 million in the third quarter of 2023. The impact of the integration of BOIA

will reduce third quarter revenue by approximately $200,000 as the Company transitions one-time audits into recurring revenue. Management

forecasts that ARR will increase by approximately $1 million sequentially, representing the fastest growth rate in several quarters. The

Company also expects to generate a non-GAAP profit of approximately $100,000 in the third quarter and expects cash flow to inflect positively

by the fourth quarter of this year, depending on items such as working capital.

Conference Call Information

AudioEye management will hold a conference call today, August 10, 2023

at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) to discuss these results, followed by a question-and-answer

period.

Date: Thursday, August

10, 2023

Time: 4:30 p.m. Eastern

Time (1:30 p.m. Pacific Time)

U.S. dial-in number:

800-830-9649

International number:

213-992-4624

Webcast:

Q223 Webcast Link

Please call the conference

telephone number 5-10 minutes prior to the start time. If you have any difficulty connecting with the conference call, please contact

Gateway Group at 949-574-3860.

The conference

call will also be webcast live and available for replay via the investor relations section

of the Company’s website. The audio recording will remain available via the investor relations

section of the Company’s website for 90 days.

A telephonic replay of the

conference call will also be available after 7:30 p.m. Eastern Time on the same day through August 24, 2023 via the following numbers:

Toll-free replay number:

844-512-2921

International replay number:

412-317-6671

Replay passcode: 152982

About AudioEye

AudioEye

exists to ensure the digital future we build is inclusive. By combining the latest AI automation technology with guidance from certified

experts and direct input from the disability community, AudioEye helps ensure businesses of all sizes — including over 104,000

customers like Samsung, Calvin Klein, and Samsonite — are accessible. Holding 23 US patents, AudioEye helps companies

solve every aspect of digital accessibility with flexible approaches that best meet their needs — from finding and removing

barriers to navigating legal compliance, to ongoing training, monitoring and upkeep. Join

AudioEye on its mission to eradicate barriers to digital access.

Forward-Looking Statements

Any statements in

this press about AudioEye’s expectations, beliefs, plans, objectives, prospects, financial condition, assumptions or future events

or performance are not historical facts and are “forward-looking statements” as that term is defined under the federal securities

laws. Forward-looking statements are often, but not always, made through the use of words or phrases such as “believe”, “anticipate”,

“should”, “confident”, “intend”, “plan”, “will”, “expects”, “estimates”,

“projects”, “positioned”, “strategy”, “outlook” and similar words. You should read the

statements that contain these types of words carefully. Such forward-looking statements contained herein include, but are not limited

to, statements regarding future cash flows of the Company, anticipated contributions from new sales channels, expectations regarding

the integration of BOIA and its products, long-term growth prospects, opportunities in the digital accessibility industry, our revenue

and ARR guidance, and our expectation of investments in marketing and sales. These statements are subject to a number of risks, uncertainties

and other factors that could cause actual results to differ materially from what is expressed or implied in such forward-looking statements,

including the variability of AudioEye’s revenue and financial performance; risks associated with our new platform, sales channels

and offerings; product development and technological changes; the acceptance of AudioEye’s products in the marketplace; the effectiveness

of our integration efforts; competition; inherent uncertainties and costs associated with litigation; and general economic conditions.

These and other risks are described more fully in AudioEye’s filings with the Securities and Exchange Commission. There may be

events in the future that AudioEye is not able to predict accurately or over which AudioEye has no control. Forward-looking statements

reflect management’s view as of the date of this press release, and AudioEye urges you not to place undue reliance on these forward-looking

statements. AudioEye does not undertake any obligation to update such forward-looking statements to reflect events or uncertainties after

the date hereof. Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages

may not precisely reflect the absolute figures.

About Key Operating Metrics

We consider annual recurring revenue (“ARR”) as a key

operating metric and a key indicator of our overall business. We also use ARR as one of the primary methods for planning and forecasting

overall expectations and for evaluating, on at least a quarterly and annual basis, actual results against such expectations.

We manage customers through two primary channels, Enterprise and

Partner and Marketplace. Enterprise channel consists of our larger customers and organizations, including those with non-platform custom

websites, who generally engage directly with AudioEye sales personnel for custom pricing and solutions. This channel also includes federal,

state and local government agencies. The Partner and Marketplace channel consists of our CMS partners, platform & agency partners,

authorized resellers and our marketplace. This channel serves small and medium sized businesses who are on a partner or reseller’s

web-hosting platform or who purchase an AudioEye solution from our marketplace.

We define ARR as the sum of (i) for our Enterprise channel, the

total of the annual recurring fee under each active contract at the date of determination, plus (ii) for our Partner and Marketplace channel,

the monthly fee for all active customers at the date of determination, in each case, assuming no changes to the subscription, multiplied

by 12. This determination includes both annual and monthly contracts for recurring products. Some of our contracts are cancelable, which

may impact future ARR. ARR excludes revenue from our PDF remediation services business, one-time Website and Mobile App report services

business and other miscellaneous non-recurring services.

Use of Non-GAAP Financial Measures

From time to time, we review adjusted financial measures that assist

us in comparing our operating performance consistently over time, as such measures remove the impact of certain items, as applicable,

such as our capital structure (primarily interest charges), items outside the control of the management team (taxes), and expenses that

do not relate to our core operations, including significant transaction and litigation-related expenses and other costs that are expected

to be non-recurring. In order to provide investors with greater insight and allow for a more comprehensive understanding of the information

used in our financial and operational decision-making, the Company has supplemented the financial statements presented on a GAAP basis

in this press release with the following non-GAAP financial measures: Non-GAAP earnings (loss) and Non-GAAP earnings (loss) per diluted

share.

These non-GAAP financial measures have limitations as analytical

tools and should not be considered in isolation or as a substitute for analysis of Company results as reported under GAAP. The Company

compensates for such limitations by relying primarily on our GAAP results and using non-GAAP financial measures only as supplemental data.

We also provide a reconciliation of non-GAAP to GAAP measures used. Investors are encouraged to carefully review this reconciliation.

In addition, because these non-GAAP measures are not measures of financial performance under GAAP and are susceptible to varying calculations,

these measures, as defined by us, may differ from and may not be comparable to similarly titled measures used by other companies.

Non-GAAP Earnings (Loss) and Non-GAAP Earnings (Loss) per Diluted

Share

We define: (i) Non-GAAP earnings (loss) as net income (loss), plus

(less) interest expense (income), plus depreciation and amortization expense, plus stock-based compensation expense, plus non-cash valuation

adjustment to contingent consideration, plus certain litigation expense, plus certain acquisition expense, and plus loss on disposal or

impairment of long-lived assets; and (ii) Non-GAAP earnings (loss) per diluted share as net income (loss) per diluted common share, plus

(less) interest expense (income), plus depreciation and amortization expense, plus stock-based compensation expense, plus non-cash valuation

adjustment to contingent consideration, plus certain litigation expense, plus certain acquisition expense, and plus loss on disposal or

impairment of long-lived assets, each on a per share basis. Non-GAAP earnings per diluted share would include incremental shares in the

share count that are considered anti-dilutive in a GAAP net loss position. However, no incremental shares apply when there is a Non-GAAP

loss per diluted share, as is the case for the periods presented in this press release.

Non-GAAP earnings (loss) and Non-GAAP earnings (loss) per

diluted share are used to facilitate a comparison of our operating performance on a consistent basis from period to period and

provide for a more complete understanding of factors and trends affecting our business than GAAP measures alone. All of the items

adjusted in the Non-GAAP earnings (loss) to net loss and the related per share calculations are either recurring non-cash items,

or items that management does not consider in assessing our on-going operating performance. In the case of the non-cash items,

such as stock-based compensation expense and valuation adjustments to assets and liabilities, management believes that investors may

find it useful to assess our comparative operating performance because the measures without such items are expected to be less

susceptible to variances in actual performance resulting from expenses that do not relate to our core operations and are more

reflective of other factors that affect operating performance. In the case of items that do not relate to our core operations,

management believes that investors may find it useful to assess our operating performance if the measures are presented without

these items because their financial impact does not reflect ongoing operating performance.

Non-GAAP earnings (loss) is not a measure of liquidity under GAAP,

or otherwise, and is not an alternative to cash flow from continuing operating activities, despite the advantages regarding the use and

analysis of these measures as mentioned above. Non-GAAP earnings (loss) and Non-GAAP earnings (loss) per diluted share, as disclosed in

this press release, have limitations as analytical tools, and you should not consider these measures in isolation or as a substitute for

analysis of our results as reported under GAAP; nor are these measures intended to be measures of liquidity or free cash flow for our

discretionary use.

To properly and prudently evaluate our business, we encourage readers

to review the GAAP financial statements included elsewhere in this press release, and not rely on any single financial measure to evaluate

our business. The following table sets forth reconciliations of Non-GAAP loss to net loss, the most directly comparable GAAP-based measure,

as well as Non-GAAP loss per diluted share to net loss per diluted share, the most directly comparable GAAP-based measure. We strongly

urge readers to review these reconciliations, along with the financial statements included elsewhere in this press release.

Investor

Contact:

Tom

Colton or Luke Johnson

Gateway

Investor Relations

AEYE@gateway-grp.com

949-574-3860

AUDIOEYE, INC.

STATEMENTS OF OPERATIONS

(unaudited)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| (in thousands, except per share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue | |

$ | 7,836 | | |

$ | 7,569 | | |

$ | 15,608 | | |

$ | 14,475 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 1,787 | | |

| 1,841 | | |

| 3,489 | | |

| 3,551 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 6,049 | | |

| 5,728 | | |

| 12,119 | | |

| 10,924 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling and marketing | |

| 3,253 | | |

| 3,425 | | |

| 6,496 | | |

| 7,151 | |

| Research and development | |

| 2,033 | | |

| 1,406 | | |

| 3,779 | | |

| 2,935 | |

| General and administrative | |

| 2,791 | | |

| 3,505 | | |

| 5,926 | | |

| 7,061 | |

| Total operating expenses | |

| 8,077 | | |

| 8,336 | | |

| 16,201 | | |

| 17,147 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (2,028 | ) | |

| (2,608 | ) | |

| (4,082 | ) | |

| (6,223 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income (expense), net | |

| 55 | | |

| (2 | ) | |

| 98 | | |

| (3 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (1,973 | ) | |

| (2,610 | ) | |

| (3,984 | ) | |

| (6,226 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share-basic and diluted | |

$ | (0.17 | ) | |

$ | (0.23 | ) | |

$ | (0.34 | ) | |

$ | (0.54 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding-basic and diluted | |

| 11,738 | | |

| 11,489 | | |

| 11,688 | | |

| 11,467 | |

AUDIOEYE, INC.

BALANCE SHEETS

(unaudited)

| | |

June 30, | | |

December 31, | |

| (in thousands, except per share data) | |

2023 | | |

2022 | |

| ASSETS | |

| |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 4,317 | | |

$ | 6,904 | |

| Accounts receivable, net | |

| 4,680 | | |

| 5,418 | |

| Prepaid expenses and other current assets | |

| 531 | | |

| 644 | |

| Total current assets | |

| 9,528 | | |

| 12,966 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 216 | | |

| 161 | |

| Right of use assets | |

| 770 | | |

| 1,154 | |

| Intangible assets, net | |

| 5,982 | | |

| 6,041 | |

| Goodwill | |

| 4,001 | | |

| 4,001 | |

| Other | |

| 102 | | |

| 105 | |

| Total assets | |

$ | 20,599 | | |

$ | 24,428 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 2,480 | | |

$ | 2,452 | |

| Finance lease liabilities | |

| 23 | | |

| 38 | |

| Operating lease liabilities | |

| 415 | | |

| 468 | |

| Deferred revenue | |

| 6,610 | | |

| 7,125 | |

| Contingent consideration | |

| 2,171 | | |

| 979 | |

| Total current liabilities | |

| 11,699 | | |

| 11,062 | |

| | |

| | | |

| | |

| Long term liabilities: | |

| | | |

| | |

| Finance lease liabilities | |

| — | | |

| 7 | |

| Operating lease liabilities | |

| 527 | | |

| 745 | |

| Deferred revenue | |

| 29 | | |

| 73 | |

| Contingent consideration, long term | |

| — | | |

| 1,952 | |

| Total liabilities | |

| 12,255 | | |

| 13,839 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.00001 par value, 10,000 shares authorized | |

| | | |

| | |

| Common stock, $0.00001 par value, 50,000 shares authorized, 11,797 and 11,551 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

| 1 | | |

| 1 | |

| Additional paid-in capital | |

| 94,809 | | |

| 93,070 | |

| Accumulated deficit | |

| (86,466 | ) | |

| (82,482 | ) |

| Total stockholders’ equity | |

| 8,344 | | |

| 10,589 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 20,599 | | |

$ | 24,428 | |

AUDIOEYE, INC.

RECONCILIATIONS OF GAAP to NON-GAAP FINANCIAL

MEASURES

(unaudited)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| (in thousands, except per share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Non-GAAP Earnings (Loss) Reconciliation | |

| | | |

| | | |

| | | |

| | |

| Net loss (GAAP) | |

$ | (1,973 | ) | |

$ | (2,610 | ) | |

$ | (3,984 | ) | |

$ | (6,226 | ) |

| Non-cash valuation adjustment to contingent consideration | |

| 159 | | |

| 158 | | |

| 214 | | |

| 158 | |

| Interest (income) expense, net | |

| (55 | ) | |

| 2 | | |

| (98 | ) | |

| 3 | |

| Stock-based compensation expense | |

| 1,031 | | |

| 1,041 | | |

| 2,149 | | |

| 2,186 | |

| Acquisition expense (1) | |

| — | | |

| 42 | | |

| — | | |

| 240 | |

| Litigation expense (2) | |

| 39 | | |

| 499 | | |

| 194 | | |

| 1,361 | |

| Depreciation and amortization | |

| 577 | | |

| 622 | | |

| 1,103 | | |

| 1,009 | |

| Loss on disposal or impairment of long-lived assets | |

| — | | |

| 7 | | |

| 147 | | |

| 7 | |

| Non-GAAP loss | |

$ | (222 | ) | |

$ | (239 | ) | |

$ | (275 | ) | |

$ | (1,262 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP Earnings (Loss) per Diluted Share Reconciliation | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share (GAAP) — diluted | |

$ | (0.17 | ) | |

$ | (0.23 | ) | |

$ | (0.34 | ) | |

$ | (0.54 | ) |

| Non-cash valuation adjustment to contingent consideration | |

| 0.01 | | |

| 0.01 | | |

| 0.02 | | |

| 0.01 | |

| Interest (income) expense, net | |

| — | | |

| — | | |

| (0.01 | ) | |

| — | |

| Stock-based compensation expense | |

| 0.09 | | |

| 0.09 | | |

| 0.18 | | |

| 0.19 | |

| Acquisition expense (1) | |

| — | | |

| — | | |

| — | | |

| 0.02 | |

| Litigation expense (2) | |

| — | | |

| 0.04 | | |

| 0.02 | | |

| 0.12 | |

| Depreciation and amortization | |

| 0.05 | | |

| 0.05 | | |

| 0.09 | | |

| 0.09 | |

| Loss on disposal or impairment of long-lived assets | |

| — | | |

| — | | |

| 0.01 | | |

| — | |

| Non-GAAP loss per diluted share (3) | |

$ | (0.02 | ) | |

$ | (0.02 | ) | |

$ | (0.02 | ) | |

$ | (0.11 | ) |

| Diluted weighted average shares (4) | |

| 11,738 | | |

| 11,489 | | |

| 11,688 | | |

| 11,467 | |

| |

(1) |

Represents legal and accounting fees associated with the BOIA acquisition. |

| |

(2) |

Represents legal expenses related primarily to non-recurring litigation pursued by the Company. |

| |

(3) |

Non-GAAP earnings per adjusted diluted share for our common stock is computed using the treasury stock method. |

| |

(4) |

The number of diluted weighted average shares used for this calculation is the same as the weighted average common shares outstanding share count when the Company reports a GAAP and non-GAAP net loss. |

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-38640

|

| Entity Registrant Name |

AUDIOEYE, INC.

|

| Entity Central Index Key |

0001362190

|

| Entity Tax Identification Number |

20-2939845

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

5210 E. Williams Circle

|

| Entity Address, Address Line Two |

Suite 750

|

| Entity Address, City or Town |

Tucson

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85711

|

| City Area Code |

866

|

| Local Phone Number |

331-5324

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001 per share

|

| Trading Symbol |

AEYE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

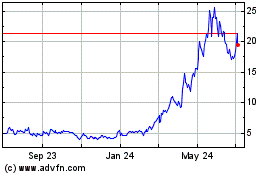

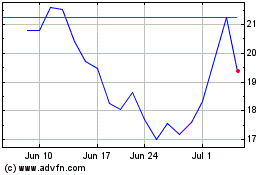

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From Mar 2024 to Apr 2024

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From Apr 2023 to Apr 2024