Statement of Changes in Beneficial Ownership (4)

August 24 2020 - 6:34PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Sero Capital LLC |

2. Issuer Name and Ticker or Trading Symbol

AUDIOEYE INC

[

AEYE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

See Remarks |

|

(Last)

(First)

(Middle)

119 WASHINGTON AVE., SUITE 403 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/20/2020 |

|

(Street)

MIAMI BEACH, FL 33139

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 8/20/2020 | | A(1) | | 55000 | A | (1) | 250586 (2) | D (3) | |

| Common Stock | 8/20/2020 | | A(4) | | 50000 | A | (4) | 300586 (2) | D (3) | |

| Common Stock | 8/20/2020 | | A(5) | | 50000 | A | (5) | 350586 (2) | D (3) | |

| Common Stock | | | | | | | | 2731265 | I | Through Sero Capital LLC (6) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Reflects the grant of performance share awards ("PSAs") under the AudioEye, Inc. 2019 Equity Incentive Plan, as amended from time to time (the "Plan"), which PSAs will vest upon the earlier of (i) the Volume Weight Average Price ("VWAP") of AudioEye, Inc.'s (the "Issuer") common stock being in excess of $25 on The Nasdaq Stock Market LLC ("NASDAQ") over 20 Consecutive Trading Days prior to August 20, 2025 while David Moradi is serving as Interim Chief Executive Officer or Chief Strategic Officer of the Issuer or (ii) the termination of David Moradi's employment with the Issuer by the Issuer without cause prior to August 20, 2025, and will be settled promptly after the vesting date. |

| (2) | In addition to the shares reported herein, this reflects 40,417 previously granted restricted stock units ("RSUs") under the Plan, of which (i) 11,280 RSUs will vest on December 6, 2020, subject to David Moradi's continuing service with the Issuer through such date, and will be settled on the earlier of (A) December 6, 2026 and (B) immediately prior to a "change in control event" within the meaning of Treasury Regulation Section 1.409A-3(i)(5), (ii) 17,857 RSUs will vest on November 8, 2020, subject to David Moradi's continuing service with the Issuer through such date, and will be settled promptly after the vesting date but no later than March 15, 2021, and (iii) 11,280 RSUs will vest on May 20, 2021, subject to David Moradi's continuing service with the Issuer through such date, and will be settled on the earlier of (X) May 20, 2027 and (Y) immediately prior to a "change in control event" within the meaning of Treasury Regulation Section 1.409A-3(i)(5). |

| (3) | Securities of the Issuer held directly by David Moradi. |

| (4) | Reflects the grant of PSAs under the Plan, which PSAs will vest upon the earlier of (i) the VWAP of the Issuer's common stock being in excess of $50 on NASDAQ over 20 Consecutive Trading Days prior to August 20, 2025 while David Moradi is serving as Interim Chief Executive Officer or Chief Strategic Officer of the Issuer or (ii) the termination of David Moradi's employment with the Issuer by the Issuer without cause prior to August 20, 2025, and will be settled promptly after the vesting date. |

| (5) | Reflects the grant of PSAs under the Plan, which PSAs will vest upon the earlier of (i) the VWAP of the Issuer's common stock being in excess of $100 on NASDAQ over 20 Consecutive Trading Days prior to August 20, 2025 while David Moradi is serving as Interim Chief Executive Officer or Chief Strategic Officer of the Issuer or (ii) the termination of David Moradi's employment with the Issuer by the Issuer without cause prior to August 20, 2025, and will be settled promptly after the vesting date. |

| (6) | Securities of the Issuer held directly by Sero Capital LLC ("Sero Capital"). David Moradi is the Managing Partner of Sero Capital and may be deemed to direct all voting and investment decisions made by Sero Capital. |

Remarks:

David Moradi serves as Interim Chief Executive Officer and Chief Strategy Officer of the Issuer. In addition to the PSAs reported above, David Moradi was also granted 105,000 PSAs, which are not included on this Form 4, on August 20, 2020, under the Plan that will vest upon the Issuer meeting certain revenue targets. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Sero Capital LLC

119 WASHINGTON AVE., SUITE 403

MIAMI BEACH, FL 33139 | X | X | See Remarks |

|

Moradi David

119 WASHINGTON AVE., SUITE 403

MIAMI BEACH, FL 33139 | X | X | See Remarks |

|

Signatures

|

| SERO CAPITAL LLC, Name: /s/ David Moradi, Title: Managing Partner | | 8/24/2020 |

| **Signature of Reporting Person | Date |

| /s/ David Moradi | | 8/24/2020 |

| **Signature of Reporting Person | Date |

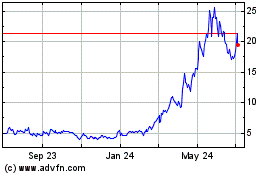

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From Mar 2024 to Apr 2024

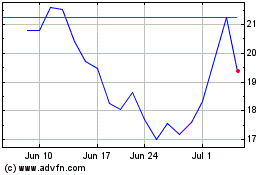

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From Apr 2023 to Apr 2024