Ameristar Casinos, Inc. (NASDAQ: ASCA)

- Third Quarter Consolidated Net Revenues Hold

Steady Year Over Year at $299.6 Million

- Strong Consolidated Adjusted EBITDA of $81.2

Million and Adjusted EBITDA Margin of 27.1% Despite Low Table Games

Hold at Several Properties

- Ameristar Black Hawk Adjusted EBITDA Grew 38.3% ($3.8 Million) Year Over Year,

Benefiting from the New Hotel and Other Amenities

- Continued Strengthening of Balance Sheet with

$59 Million in Third Quarter Debt Repayments for a Total of $123

Million in Year-to-Date Repayments

Ameristar Casinos, Inc. (NASDAQ: ASCA) today announced financial

results for the third quarter of 2010.

"The third quarter produced a solid and steady financial

performance," said Gordon Kanofsky, Ameristar's Chief Executive

Officer. "Our key financial metrics, including net revenues,

Adjusted EBITDA and Adjusted EBITDA margin, generally reflected

signs of stabilization in this difficult economic environment.

Overall, we had smaller quarterly year-over-year variances and

relatively consistent sequential results. These steadied results

were also evident at our East Chicago and St. Charles properties,

both of which have encountered new challenges in their respective

markets. A bridge closure near our East Chicago property has

adversely impacted the year-over-year comparisons since November

2009. However, we believe East Chicago's 2010 third quarter results

were positive under the circumstances and indicative of our

expectations for normalized operations going forward. Also, our St.

Charles property appears to have stabilized in all key financial

metrics, as well as admissions and market share, since the opening

of a new competitor in March 2010.

"Ameristar Black Hawk had strong third quarter year-over-year

net revenue growth of 50.5%. This significantly contributed to

producing the first quarter since 2008 in which consolidated net

revenues did not decline year over year," added Kanofsky. "In

addition to Ameristar Black Hawk, several of our properties in

stable competitive environments produced solid financial results

this quarter in all key financial metrics. Our Vicksburg, Council

Bluffs and Kansas City properties improved or were down only

slightly in Adjusted EBITDA compared to the prior-year third

quarter."

Third Quarter 2010 Results The following

factors impacted the comparison between the third quarters of 2010

and 2009:

- East Chicago bridge closure. The closure of the Cline Avenue

bridge has made access less convenient for many of the property's

guests. The closure resulted in decreases of $4.6 million (7.7%)

and $2.5 million (24.3%) in the property's net revenues and

Adjusted EBITDA, respectively, as compared to the prior-year third

quarter. This is a substantial improvement from the second quarter

of 2010, in which the property had year-over-year declines of $17.5

million (25.6%) in net revenues and $9.2 million (62.6%) in

Adjusted EBITDA.

- Black Hawk hotel. Our hotel that opened in late September 2009

contributed to Ameristar Black Hawk's $13.3 million and $3.8

million increases in year-over-year net revenues and Adjusted

EBITDA, respectively. "We continue to be pleased with Ameristar

Black Hawk's financial performance, especially considering we

reached the anniversary of the regulatory improvements at the

beginning of the third quarter," said Kanofsky. "To offer some

long-term perspective on Ameristar Black Hawk's growth, the

property produced approximately $7 million in Adjusted EBITDA

during 2005, which was the first full calendar year following our

acquisition of the property. Adjusted EBITDA for the 12 months

ended September 30, 2010 totaled $53.0 million on our total

investment in the property of approximately $415 million. The

significant growth can be attributed to our hotel, the regulatory

changes and our 2006 rebranding, which more than offset the adverse

impact of the statewide smoking ban that went into effect in

2008."

- Ameristar St. Charles. During the third quarter of 2010, our

St. Charles property's net revenues and Adjusted EBITDA declined

$6.6 million (9.1%) and $4.4 million (17.7%), respectively, from

the prior-year third quarter. The decreases were mostly due to the

entry of a new competitor in the St. Louis gaming market in March

2010. The adverse impact from the new competitor stabilized during

the second and third quarters of 2010. The third quarter declines

were relatively consistent with the second quarter's year-over-year

declines of 11.6% in net revenues and 14.2% in Adjusted

EBITDA.

Consolidated net revenues for the third quarter improved year

over year by $0.1 million, to $299.6 million. For the quarter ended

September 30, 2010, promotional allowances increased $10.6 million

(15.6%) over the prior-year third quarter. The rise in promotional

allowances was mostly due to increased promotional spending related

to the new hotel in Black Hawk and our efforts to draw business

following the bridge closure near our East Chicago property. We

generated operating income of $48.7 million in the third quarter of

2010, compared to $50.7 million in the same period in 2009.

Consolidated Adjusted EBITDA decreased 3.8%, from $84.4 million in

the third quarter of 2009 to $81.2 million in 2010. Consolidated

Adjusted EBITDA margin decreased 1.1 percentage points, from 28.2%

in the third quarter of 2009 to 27.1% in the third quarter of

2010.

The declines in operating income, Adjusted EBITDA and the

related margin are primarily attributable to lower table games hold

percentages at our Vicksburg and Missouri properties. We believe

that table hold variances accounted for approximately $2.8 million

of the decline in Adjusted EBITDA and a drop of 0.9 percentage

point in Adjusted EBITDA margin compared to the prior-year third

quarter. Also contributing to the declines were the changed

competitive environments at St. Charles and East Chicago, offset to

a significant degree by the improved performance at Black Hawk.

For the quarter ended September 30, 2010, the Company reported

net income of $11.9 million, or $0.20 per diluted share, compared

to net income of $14.5 million, or $0.25 per diluted share, for the

quarter ended September 30, 2009. Adjusted EPS was $0.21 for the

quarter ended September 30, 2010, compared to $0.27 for the 2009

third quarter. The decrease in Adjusted EPS from the prior-year

third quarter was primarily attributable to higher income tax

expense and increased depreciation expense from the Black Hawk

hotel, as partially offset by lower borrowing costs.

Additional Financial Information

Debt. At September 30, 2010, our

outstanding debt was $1.57 billion. Net repayments in the third

quarter of 2010 totaled $59.2 million, including a $58.0 million

repayment of a portion of the principal balance outstanding under

the revolving credit facility. After taking into consideration the

$120.0 million in net repayments under the revolving credit

facility made during the first nine months of 2010, the Company has

$107.0 million due on November 10, 2010, with approximately $168

million available for borrowing under the extended portion of the

revolving credit facility. The Company intends to repay all 2010

debt maturities with cash from operations and availability under

the extended portion of the revolving credit facility. At September

30, 2010, our total leverage and senior leverage ratios (each as

defined in the senior credit facility) were required to be no more

than 6.00:1 and 5.50:1, respectively. As of that date, our total

leverage and senior leverage ratios were each 4.81:1.

Interest Expense. For the third quarter of

2010, net interest expense was $28.1 million, compared to $30.1

million in the prior-year third quarter. The decrease is due mostly

to the July 2010 termination of the Company's two interest rate

swap agreements, with a partial offset from lower capitalized

interest. Capitalized interest decreased from $4.2 million for the

third quarter of 2009 to $0.2 million in the 2010 third quarter,

due to the completion of the Black Hawk hotel.

Capital Expenditures. For the third

quarters of 2010 and 2009, capital expenditures were $14.1 million

and $33.3 million, respectively.

Dividends. During the third quarter of

2010, our Board of Directors declared a cash dividend of $0.105 per

share, which we paid on September 27, 2010.

Outlook "We believe the signs of

stabilization that were evident at most of our properties in the

third quarter will continue into the 2010 fourth quarter," said

Kanofsky. "Year-over-year quarterly variances are expected to

narrow at our Black Hawk and East Chicago properties. The positive

impact from the Black Hawk hotel will be fully included in the

final quarters of 2010 and 2009. During the fourth quarter, we will

also lap the November 2009 East Chicago bridge closure and its

adverse impact on that property's financial results. As always, we

will continue to focus on producing net revenue and EBITDA growth.

We are optimistic the combination of solid net revenues and

consistently strong margins should continue to produce efficient

revenue flow-through."

For the full year 2010, the Company currently expects:

- depreciation to range from $108.2 million to $109.2

million.

- interest expense, net of capitalized interest, to be between

$122.5 million and $123.5 million, including non-cash interest

expense of approximately $11 million.

- the combined state and federal income tax rate to be in the

range of 43.5% to 44.5%.

- capital spending of $65 million to $70 million.

- capitalized interest of $0.6 million to $0.7 million.

- non-cash stock-based compensation expense of $13.8 million to

$14.3 million.

Conference Call Information We will hold a

conference call to discuss our third quarter results on Wednesday,

November 3, 2010 at noon EDT. The call may be accessed live by

dialing toll-free (888) 694-4728 domestically, or (973) 582-2745,

and referencing conference ID number 13620413. Conference call

participants are requested to dial in at least five minutes early

to ensure a prompt start. Interested parties wishing to listen to

the conference call and view corresponding informative slides on

the Internet may do so live at our website -- www.ameristar.com --

by clicking on "About Us/Investor Relations" and selecting the

"Webcasts and Events" link. A copy of the slides will be available

in the corresponding "Earnings Releases" section one-half hour

before the conference call. In addition, the call will be recorded

and can be replayed from 3 p.m. EDT, November 3, 2010 until 11:59

p.m. EST, November 17, 2010. To listen to the replay, call

toll-free (800) 642-1687 domestically, or (706) 645-9291, and

reference the conference ID number above.

Forward-Looking Information This release

contains certain forward-looking information that generally can be

identified by the context of the statement or the use of

forward-looking terminology, such as "believes," "estimates,"

"anticipates," "intends," "expects," "plans," "is confident that,"

"should" or words of similar meaning, with reference to Ameristar

or our management. Similarly, statements that describe our future

plans, objectives, strategies, financial results or position,

operational expectations or goals are forward-looking statements.

It is possible that our expectations may not be met due to various

factors, many of which are beyond our control, and we therefore

cannot give any assurance that such expectations will prove to be

correct. For a discussion of relevant factors, risks and

uncertainties that could materially affect our future results,

attention is directed to "Item 1A. Risk Factors" and "Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Annual Report on Form 10-K for the

year ended December 31, 2009, and "Item 1A. Risk Factors" and "Item

2. Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Quarterly Report on Form 10-Q for the

quarter ended June 30, 2010.

On a monthly basis, gaming regulatory authorities in certain

states in which we operate publish gross gaming revenue and/or

certain other financial information for the gaming facilities that

operate within their respective jurisdictions. Because various

factors in addition to our gross gaming revenue (including

operating costs, promotional allowances and corporate and other

expenses) influence our operating income, Adjusted EBITDA and

diluted earnings per share, such reported information, as it

relates to Ameristar, may not accurately reflect the results of our

operations for such periods or for future periods.

About Ameristar Ameristar Casinos, Inc. is

a leading Las Vegas-based gaming and entertainment company known

for its premier properties characterized by state-of-the-art casino

floors and superior dining, lodging and entertainment offerings.

Ameristar's focus on the total entertainment experience and the

highest quality guest service has earned it leading positions in

the markets in which it operates. Founded in 1954 in Jackpot, Nev.,

Ameristar has been a public company since November 1993. The

Company has a portfolio of eight casinos in seven markets:

Ameristar Casino Resort Spa St. Charles (greater St. Louis);

Ameristar Casino Hotel East Chicago (Chicagoland area); Ameristar

Casino Hotel Kansas City; Ameristar Casino Hotel Council Bluffs

(Omaha, Neb., and southwestern Iowa); Ameristar Casino Hotel

Vicksburg (Jackson, Miss., and Monroe, La.); Ameristar Casino

Resort Spa Black Hawk (Denver metropolitan area); and Cactus Petes

Resort Casino and The Horseshu Hotel and Casino in Jackpot, Nev.

(Idaho and the Pacific Northwest).

Visit Ameristar Casinos' website at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

Please refer to the tables near the end of this release for the

reconciliation of the non-GAAP financial measures Adjusted EBITDA

and Adjusted EPS reported throughout this release. Additionally,

more information on these non-GAAP financial measures can be found

under the caption "Use of Non-GAAP Financial Measures" at the end

of this release.

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in Thousands, Except Per Share Data)

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

2010 2009 2010 2009

---------- ---------- ---------- ----------

REVENUES:

Casino $ 314,314 $ 311,143 $ 941,973 $ 949,547

Food and beverage 35,444 31,198 101,379 103,970

Rooms 20,602 16,598 60,234 47,084

Other 7,499 8,197 23,681 25,012

---------- ---------- ---------- ---------

377,859 367,136 1,127,267 1,125,613

Less: promotional allowances (78,292) (67,706) (232,077) (201,444)

---------- ---------- ---------- ---------

Net revenues 299,567 299,430 895,190 924,169

OPERATING EXPENSES:

Casino 137,595 135,418 407,237 421,898

Food and beverage 15,727 16,186 47,803 49,270

Rooms 4,650 2,162 13,782 6,496

Other 3,131 3,593 9,681 11,340

Selling, general and

administrative 62,692 64,995 183,262 180,579

Depreciation and

amortization 27,016 26,106 81,821 78,807

Impairment of goodwill - - 21,438 -

Impairment of other

intangible assets 191 - 34,791 -

Impairment of fixed assets - 12 4 107

Net (gain) loss on

disposition of assets (148) 264 (95) 99

---------- ---------- ---------- ---------

Total operating expenses 250,854 248,736 799,724 748,596

Income from operations 48,713 50,694 95,466 175,573

OTHER INCOME (EXPENSE):

Interest income 114 122 338 390

Interest expense, net of

capitalized interest (28,065) (30,100) (96,564) (72,617)

Loss on early retirement of

debt - (155) - (5,365)

Other 956 1,091 655 1,675

---------- ---------- ---------- ---------

INCOME (LOSS) BEFORE INCOME

TAX PROVISION 21,718 21,652 (105) 99,656

Income tax provision 9,794 7,190 2,185 41,013

---------- ---------- ---------- ---------

NET INCOME (LOSS) $ 11,924 $ 14,462 $ (2,290) $ 58,643

========== ========== ========== =========

EARNINGS (LOSS) PER SHARE:

Basic $ 0.20 $ 0.25 $ (0.04) $ 1.02

========== ========== ========== =========

Diluted $ 0.20 $ 0.25 $ (0.04) $ 1.01

========== ========== ========== =========

CASH DIVIDENDS DECLARED PER

SHARE $ 0.11 $ 0.21 $ 0.32 $ 0.32

========== ========== ========== =========

WEIGHTED-AVERAGE SHARES

OUTSTANDING:

Basic 58,188 57,648 58,003 57,491

========== ========== ========== =========

Diluted 59,421 58,647 58,003 58,233

========== ========== ========== =========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA

(Dollars in Thousands)

(Unaudited)

September 30, 2010 December 31, 2009

---------------------- ----------------------

Balance sheet data

Cash and cash

equivalents $ 87,269 $ 96,493

Total assets $ 2,101,091 $ 2,214,628

Total debt, net of

discount of $10,615 and

$12,779 $ 1,555,902 $ 1,677,128

Stockholders' equity $ 342,901 $ 335,993

Three Months Ended Nine Months Ended

September 30, September 30,

2010 2009 2010 2009

---------- ---------- ---------- ----------

Consolidated cash flow

information

Net cash provided by

operating activities $ 69,776 $ 86,040 $ 177,077 $ 212,244

Net cash used in

investing activities $ (13,917) $ (40,165) $ (45,108) $ (136,569)

Net cash used in

financing activities $ (66,496) $ (7,781) $ (141,193) $ (17,277)

Net revenues

Ameristar St. Charles $ 65,479 $ 72,065 $ 200,579 $ 222,548

Ameristar East Chicago 55,379 59,967 162,358 196,088

Ameristar Kansas City 56,928 57,528 166,973 176,354

Ameristar Council Bluffs 38,759 38,451 116,141 120,689

Ameristar Vicksburg 27,335 27,918 87,489 92,063

Ameristar Black Hawk 39,499 26,246 113,963 67,292

Jackpot Properties 16,188 17,255 47,687 49,135

---------- ---------- ---------- ----------

Consolidated net

revenues $ 299,567 $ 299,430 $ 895,190 $ 924,169

========== ========== ========== ==========

Operating income (loss)

Ameristar St. Charles $ 13,544 $ 17,952 $ 44,998 $ 56,390

Ameristar East Chicago 3,686 6,330 (46,240) 29,912

Ameristar Kansas City 15,579 15,006 44,279 47,613

Ameristar Council Bluffs 12,320 12,232 36,144 36,439

Ameristar Vicksburg 7,440 6,099 26,457 25,373

Ameristar Black Hawk 8,634 4,567 25,462 10,438

Jackpot Properties 3,851 4,171 10,288 11,472

Corporate and other (16,341) (15,663) (45,922) (42,064)

---------- ---------- ---------- ----------

Consolidated operating

income $ 48,713 $ 50,694 $ 95,466 $ 175,573

========== ========== ========== ==========

Adjusted EBITDA

Ameristar St. Charles $ 20,333 $ 24,704 $ 64,995 $ 77,113

Ameristar East Chicago 7,814 10,316 21,876 41,255

Ameristar Kansas City 19,310 19,228 55,497 59,933

Ameristar Council Bluffs 14,971 15,254 44,343 45,224

Ameristar Vicksburg 11,063 10,329 37,923 38,132

Ameristar Black Hawk 13,586 9,823 40,469 22,921

Jackpot Properties 5,240 5,813 14,646 16,292

Corporate and other (11,100) (11,025) (33,786) (31,754)

---------- ---------- ---------- ----------

Consolidated Adjusted

EBITDA $ 81,217 $ 84,442 $ 245,963 $ 269,116

========== ========== ========== ==========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA - CONTINUED

(Dollars in Thousands)

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

2010 2009 2010 2009

---------- ---------- ---------- ----------

Operating income (loss) margins

(1)

Ameristar St. Charles 20.7% 24.9% 22.4% 25.3%

Ameristar East Chicago 6.7% 10.6% -28.5% 15.3%

Ameristar Kansas City 27.4% 26.1% 26.5% 27.0%

Ameristar Council Bluffs 31.8% 31.8% 31.1% 30.2%

Ameristar Vicksburg 27.2% 21.8% 30.2% 27.6%

Ameristar Black Hawk 21.9% 17.4% 22.3% 15.5%

Jackpot Properties 23.8% 24.2% 21.6% 23.3%

Consolidated operating income

margin 16.3% 16.9% 10.7% 19.0%

Adjusted EBITDA margins (2)

Ameristar St. Charles 31.1% 34.3% 32.4% 34.7%

Ameristar East Chicago 14.1% 17.2% 13.5% 21.0%

Ameristar Kansas City 33.9% 33.4% 33.2% 34.0%

Ameristar Council Bluffs 38.6% 39.7% 38.2% 37.5%

Ameristar Vicksburg 40.5% 37.0% 43.3% 41.4%

Ameristar Black Hawk 34.4% 37.4% 35.5% 34.1%

Jackpot Properties 32.4% 33.7% 30.7% 33.2%

Consolidated Adjusted EBITDA

margin 27.1% 28.2% 27.5% 29.1%

(1) Operating income (loss) margin is operating income (loss) as

a percentage of net revenues.

(2) Adjusted EBITDA margin is Adjusted EBITDA as a percentage of

net revenues.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA

(Dollars in Thousands) (Unaudited)

The following tables set forth reconciliations of operating

income (loss), a GAAP financial measure, to Adjusted EBITDA, a

non-GAAP financial measure.

Three Months Ended September 30, 2010

-------------------------------------

Impairment

Loss

and Deferred

Depreci- (Gain) Compen- Non-

ation Loss on Stock- sation Operational

Operating and Disposi- Based Plan Profess-

Income Amorti- tion of Compen- Expense ional Adjusted

(Loss) zation Assets sation (1) Fees EBITDA

-------- -------- ------- -------- ------- -------- --------

Ameristar St.

Charles $ 13,544 $ 6,520 $ 76 $ 193 $ - $ - $ 20,333

Ameristar East

Chicago 3,686 4,046 3 79 - - 7,814

Ameristar

Kansas City 15,579 3,577 (4) 158 - - 19,310

Ameristar

Council Bluffs 12,320 2,525 - 126 - - 14,971

Ameristar

Vicksburg 7,440 3,480 - 143 - - 11,063

Ameristar Black

Hawk 8,634 4,838 (32) 146 - - 13,586

Jackpot

Properties 3,851 1,263 - 126 - - 5,240

Corporate and

other (16,341) 767 - 2,346 1,081 1,047 (11,100)

-------- -------- ------- -------- ------- -------- --------

Consol-

idated $ 48,713 $ 27,016 $ 43 $ 3,317 $ 1,081 $ 1,047 $ 81,217

======== ======== ======= ======== ======= ======== ========

Three Months Ended September 30, 2009

-------------------------------------

Impairment

Loss and

Loss Deferred

Depreci- on Compen-

ation Disposi- Stock- sation

Operating and tion Based Plan Pre-

Income Amorti- of Compen- Expense Opening Adjusted

(Loss) zation Assets sation (1) Costs EBITDA

-------- -------- ------- -------- ------- -------- --------

Ameristar St.

Charles $ 17,952 $ 6,487 $ - $ 265 $ - $ - $ 24,704

Ameristar East

Chicago 6,330 3,890 12 84 - - 10,316

Ameristar

Kansas City 15,006 3,909 81 232 - - 19,228

Ameristar

Council Bluffs 12,232 2,703 143 176 - - 15,254

Ameristar

Vicksburg 6,099 3,953 40 237 - - 10,329

Ameristar Black

Hawk 4,567 2,889 - 142 - 2,225 9,823

Jackpot

Properties 4,171 1,475 - 167 - - 5,813

Corporate and

other (15,663) 800 - 2,800 1,038 - (11,025)

-------- -------- ------- -------- ------- -------- --------

Consol-

idated $ 50,694 $ 26,106 $ 276 $ 4,103 $ 1,038 $ 2,225 $ 84,442

======== ======== ======= ======== ======= ======== ========

(1) Deferred compensation plan expense represents the change in

the Company's non-cash liability based on plan participant

investment results. This expense is included in selling, general

and administrative expenses in the accompanying condensed

consolidated statements of operations.

RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA - CONTINUED

(Dollars in Thousands) (Unaudited)

Nine Months Ended September 30, 2010

------------------------------------

Impairment

Loss

and Deferred

(Gain) Compens- Non-

Deprecia- Loss on Stock- ation Operational

Operating tion and Disposi- Based Plan Profess-

Income Amortiz- tion of Compen- Expense ional Adjusted

(Loss) ation Assets sation (1) Fees EBITDA

-------- -------- ------- ------- ------- -------- --------

Ameri-

star

St.

Char-

les $ 44,998 $ 19,386 $ 90 $ 521 $ - $ - $ 64,995

Ameri-

star

East

Chic-

ago (46,240) 11,847 56,032 237 - - 21,876

Ameri-

star

Kansas

City 44,279 10,844 (48) 422 - - 55,497

Ameri-

star

Council

Bluffs 36,144 7,850 - 349 - - 44,343

Ameri-

star

Vicks-

burg 26,457 11,023 14 429 - - 37,923

Ameri-

star

Black

Hawk 25,462 14,652 (32) 387 - - 40,469

Jackpot

Prop-

erties 10,288 3,925 78 355 - - 14,646

Corporate

and

other (45,922) 2,294 4 7,896 895 1,047 (33,786)

-------- -------- ------- ------- ------- -------- --------

Con-

soli-

dat-

ed $ 95,466 $ 81,821 $56,138 $10,596 $ 895 $ 1,047 $245,963

======== ======== ======= ======= ======= ======== ========

Nine Months Ended September 30, 2009

------------------------------------

Impairment

Loss and

(Gain)

Loss Deferred

Deprecia- on Compen- One-Time

tion Disposi- Stock- sation Property

Operating and tion Based Plan Pre- Tax

Income Amortiz- of Compen- Expense Opening Adjust- Adjusted

(Loss) ation Assets sation (1) Costs ment EBITDA

-------- -------- ------- ------- ------- -------- -------- --------

Ameri-

star

St.

Char-

les $ 56,390 $ 20,102 $ 41 $ 580 $ - $ - $ - $ 77,113

Ameri-

star

East

Chic-

ago 29,912 11,076 81 186 - - - 41,255

Ameri-

star

Kansas

City 47,613 11,772 32 516 - - - 59,933

Ameri-

star

Council

Bluffs 36,439 8,403 (3) 385 - - - 45,224

Ameri-

star

Vicks-

burg 25,373 12,212 56 491 - - - 38,132

Ameri-

star

Black

Hawk 10,438 8,434 - 351 - 2,422 1,276 22,921

Jackpot

Prop-

erties 11,472 4,449 (1) 372 - - - 16,292

Corp-

orate

and

other (42,064) 2,359 - 6,408 1,543 - - (31,754)

-------- -------- ------- ------- ------- -------- -------- --------

Con-

soli-

dat-

ed $175,573 $ 78,807 $ 206 $ 9,289 $ 1,543 $ 2,422 $ 1,276 $269,116

======== ======== ======= ======= ======= ======== ======== ========

(1) Deferred compensation plan expense represents the change in

the Company's non-cash liability based on plan participant

investment results. This expense is included in selling, general

and administrative expenses in the accompanying condensed

consolidated statements of operations.

RECONCILIATION OF NET INCOME (LOSS) TO ADJUSTED EBITDA

(Dollars in Thousands) (Unaudited)

The following table sets forth a reconciliation of consolidated

net income (loss), a GAAP financial measure, to consolidated

Adjusted EBITDA, a non-GAAP financial measure.

Three Months Ended Nine Months Ended

September 30, September 30,

2010 2009 2010 2009

-------- -------- -------- --------

Net income (loss) $ 11,924 $ 14,462 $ (2,290) $ 58,643

Income tax provision 9,794 7,190 2,185 41,013

Interest expense, net of

capitalized interest 28,065 30,100 96,564 72,617

Interest income (114) (122) (338) (390)

Other (956) (1,091) (655) (1,675)

Net (gain) loss on disposition

of assets (148) 264 (95) 99

Impairment of goodwill - - 21,438 -

Impairment of other intangible

assets 191 - 34,791 -

Impairment of fixed assets - 12 4 107

Depreciation and amortization 27,016 26,106 81,821 78,807

Stock-based compensation 3,317 4,103 10,596 9,289

Deferred compensation plan

expense 1,081 1,038 895 1,543

Non-operational professional

fees 1,047 - 1,047 -

Loss on early retirement of debt - 155 - 5,365

Black Hawk hotel pre-opening

costs - 2,225 - 2,422

One-time non-cash adjustment to

Black Hawk property taxes - - - 1,276

-------- -------- -------- --------

Adjusted EBITDA $ 81,217 $ 84,442 $245,963 $269,116

======== ======== ======== ========

RECONCILIATION OF DILUTED EPS TO ADJUSTED DILUTED EPS

(Unaudited)

The following table sets forth a reconciliation of diluted

earnings (loss) per share (EPS), a GAAP financial measure, to

adjusted diluted earnings per share (Adjusted EPS), a non-GAAP

financial measure.

Three Months Ended Nine Months Ended

September 30, September 30,

2010 2009 2010 2009

---------- ---------- --------- ----------

Diluted earnings (loss) per

share (EPS) $ 0.20 $ 0.25 $ (0.04) $ 1.01

Non-operational professional

fees 0.01 - 0.01 -

Impairment loss on East Chicago

intangible assets - - 0.56 -

Black Hawk hotel pre-opening

expenses - 0.02 - 0.03

Loss on early retirement of debt - - - 0.06

One-time non-cash adjustment to

Black Hawk property taxes - - - 0.01

---------- ---------- --------- ----------

Adjusted diluted earnings per

share (Adjusted EPS) $ 0.21 $ 0.27 $ 0.53 $ 1.11

========== ========== ========= ==========

Use of Non-GAAP Financial Measures

Securities and Exchange Commission Regulation G, "Conditions for

Use of Non-GAAP Financial Measures," prescribes the conditions for

use of non-GAAP financial information in public disclosures. We

believe our presentation of the non-GAAP financial measures

Adjusted EBITDA and Adjusted EPS are important supplemental

measures of operating performance to investors. The following

discussion defines these terms and explains why we believe they are

useful measures of our performance.

Adjusted EBITDA is a commonly used measure of performance in the

gaming industry that we believe, when considered with measures

calculated in accordance with United States generally accepted

accounting principles, or GAAP, gives investors a more complete

understanding of operating results before the impact of investing

and financing transactions, income taxes and certain non-cash and

non-recurring items and facilitates comparisons between us and our

competitors.

Adjusted EBITDA is a significant factor in management's internal

evaluation of total Company and individual property performance and

in the evaluation of incentive compensation for employees.

Therefore, we believe Adjusted EBITDA is useful to investors

because it allows greater transparency related to a significant

measure used by management in its financial and operational

decision-making and because it permits investors similarly to

perform more meaningful analyses of past, present and future

operating results and evaluations of the results of core ongoing

operations. Furthermore, we believe investors would, in the absence

of the Company's disclosure of Adjusted EBITDA, attempt to use

equivalent or similar measures in assessment of our operating

performance and the valuation of our Company. We have reported

Adjusted EBITDA to our investors in the past and believe its

inclusion at this time will provide consistency in our financial

reporting.

Adjusted EBITDA, as used in this press release, is earnings

before interest, taxes, depreciation, amortization, other

non-operating income and expenses, stock-based compensation,

deferred compensation plan expense, non-operational professional

fees, impairment charges related to intangible assets, pre-opening

costs and a one-time Black Hawk property tax adjustment. In future

periods, the calculation of Adjusted EBITDA may be different than

in this release. The foregoing tables reconcile Adjusted EBITDA to

operating income (loss) and net income (loss), based upon GAAP.

Adjusted EPS, as used in this press release, is diluted earnings

(loss) per share, excluding the after-tax per-share impacts of

non-operational professional fees, impairment charges related to

intangible assets, pre-opening expenses, the one-time Black Hawk

property tax adjustment and the loss on early debt retirement.

Management adjusts EPS, when deemed appropriate, for the evaluation

of operating performance because we believe that the exclusion of

certain items is necessary to provide the most accurate measure of

our core operating results and as a means to compare

period-to-period results. We have chosen to provide this

information to investors to enable them to perform more meaningful

analysis of past, present and future operating results and as a

means to evaluate the results of our core ongoing operations.

Adjusted EPS is a significant factor in the internal evaluation of

total Company performance. Management believes this measure is used

by investors in their assessment of our operating performance and

the valuation of our Company. In future periods, the adjustments we

make to EPS in order to calculate Adjusted EPS may be different

than or in addition to those made in this release. The foregoing

table reconciles EPS to Adjusted EPS.

Limitations on the Use of Non-GAAP Measures

The use of Adjusted EBITDA and Adjusted EPS has certain

limitations. Our presentation of Adjusted EBITDA and Adjusted EPS

may be different from the presentations used by other companies and

therefore comparability among companies may be limited.

Depreciation expense for various long-term assets, interest

expense, income taxes and other items have been and will be

incurred and are not reflected in the presentation of Adjusted

EBITDA. Each of these items should also be considered in the

overall evaluation of our results. Additionally, Adjusted EBITDA

does not consider capital expenditures and other investing

activities and should not be considered as a measure of our

liquidity. We compensate for these limitations by providing the

relevant disclosure of our depreciation, interest and income tax

expense, capital expenditures and other items both in our

reconciliations to the GAAP financial measures and in our

consolidated financial statements, all of which should be

considered when evaluating our performance.

Adjusted EBITDA and Adjusted EPS should be used in addition to

and in conjunction with results presented in accordance with GAAP.

Adjusted EBITDA and Adjusted EPS should not be considered as an

alternative to net income, operating income or any other operating

performance measure prescribed by GAAP, nor should these measures

be relied upon to the exclusion of GAAP financial measures.

Adjusted EBITDA and Adjusted EPS reflect additional ways of viewing

our operations that we believe, when viewed with our GAAP results

and the reconciliations to the corresponding GAAP financial

measures, provide a more complete understanding of factors and

trends affecting our business than could be obtained absent this

disclosure. Management strongly encourages investors to review our

financial information in its entirety and not to rely on a single

financial measure.

Add to Digg Bookmark with del.icio.us Add to Newsvine

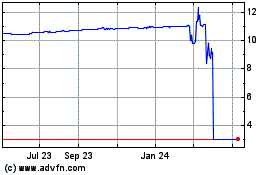

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2024 to Jul 2024

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jul 2023 to Jul 2024