Canadian Dollar Advances Amid Higher Oil Prices

September 22 2023 - 6:19AM

RTTF2

The Canadian dollar climbed against its most major counterparts

in the New York session on Friday on rising oil prices, as Russia's

ban on fuel exports outweighed worries about slower demand due to

tighter monetary policies in the United States and Europe.

Crude for November delivery rose $1.59 to 91.22 per barrel.

Oil prices steadied after a volatile week as Russia announced

Thursday a temporary ban on diesel and gasoline exports.

The action reversed a recent downside movement in crude markets

following hawkish comments on interest rates from the Federal

Reserve and other central banks.

It is feared that higher interest rates and a weak global

economy could dent fuel demand.

Both WTI and Brent contracts rose more than 10 percent in the

previous three weeks, buoyed by a confluence of supply cuts from

major producers and reports from OPEC and the U.S. Energy

Information Administration predicting that surging demand and

recent price gains could stick through the remainder of the

year.

The loonie climbed to 1.3423 against the greenback, setting a

2-day high. Next key resistance for the currency may be located

around the 1.32 level.

The loonie strengthened to a 3-day high of 110.41 against the

yen and a multi-month high of 1.4285 against the euro, from its

early lows of 109.37 and 1.4374, respectively. The currency is seen

facing resistance around 113.5 against the yen and 1.40 against the

euro.

In contrast, loonie fell against the aussie, reaching 0.8690. If

it falls further, it is likely to test support around the 0.90

level.

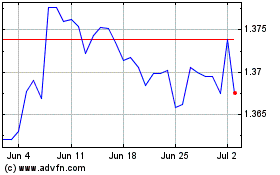

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From May 2024 to Jun 2024

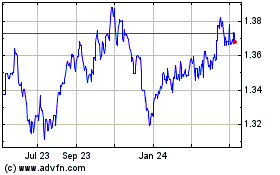

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jun 2023 to Jun 2024