Groupe Casino : Casino Board of Directors decides on the proposal of GPA to launch an OPA on Éxito

July 24 2019 - 7:04PM

Groupe Casino : Casino Board of Directors decides on the

proposal of GPA to launch an OPA on Éxito

Paris, on July 25th, 2019

On July 24th 2019, in the context of the project

that would lead to the simplification of Casino Group's structure

in Latin America, the Board of Directors of Casino approved the

decision:

- to tender Casino's entire stake (55.3%) in Éxito to GPA's

tender offer; and

- to offer to purchase from Éxito, immediately following

completion of GPA's tender offer, Éxito's equity interest in GPA

through the French company Segisor (which itself holds 99.9% of the

voting rights and 37.3% of the economic rights of GPA), based on a

price per GPA share of 109 BRL.

This price represents a 24% premium over GPA

last 3-month Volume Weighed Average Price before June 27th 2019,

the date on which the possibility of the GPA's tender offer was

publicly announced.

On that same day, Casino also takes note of GPA

Board of Directors' decision to launch, through a wholly-owned

subsidiary, an all-cash tender offer to acquire up to 100% of Éxito

at a price per share of 18,000 COP.

This price represents a 26% premium over Éxito

last 3-month Volume Weighed Average Price before June 27th

2019.

The filing by GPA of its tender offer with the

Financial Superintendence of Colombia would be made after Éxito

will have approved, as the case may be, and pursuant to applicable

law, the documentation allowing Casino to exercise exclusive

control over Segisor and to acquire Éxito’s stake in Segisor

immediately following the completion of the tender offer.

This simplification project also includes the

migration of GPA shares to the Novo Mercado B3 listing segment,

with the conversion of preferred shares (PN) into ordinary shares

(ON) at an exchange ratio of 1:1, allowing to end the existence of

two classes of shares and giving GPA access to an extended base of

international investors.

Following completion of GPA's tender offer and

Casino's acquisition of Éxito's equity interest in Segisor, Casino

would hold 41.4% of GPA, which would itself become the controlling

shareholder of Éxito and its subsidiaries in Uruguay and

Argentina.

Casino's acquisition offer made to Éxito is to

be examined by the audit committee of Éxito.

These transactions remain subject to corporate

approvals of competent governance bodies.

ANALYST AND INVESTOR

CONTACTSRégine Gaggioli – +33 (0)1 53 65

64 17 rgaggioli@groupe-casino.fror

+33 (0)1 53 65 24 17

IR_Casino@groupe-casino.fr

PRESS

CONTACTSCasino Group – Direction

of CommunicationStéphanie ABADIE -

sabadie@groupe-casino.fr - +33 (0)6 26 27 37 05

or

+33(0)1 53 65 24 78 -

directiondelacommunication@groupe-casino.fr

Agence IMAGE 7Karine

ALLOUIS - +33(0)1 53 70 74 84 -

kallouis@image7.frGrégoire LUCAS - gregoire.lucas@image7.fr

Disclaimer

This press release was prepared solely for

information purposes, and should not be construed as a solicitation

or an offer to buy or sell securities or related financial

instruments. Likewise, it does not provide and should not be

treated as providing investment advice. It has no connection with

the specific investment objectives, financial situation or needs of

any receiver. No representation or warranty, either express or

implied, is provided in relation to the accuracy, completeness or

reliability of the information contained herein. It should not be

regarded by recipients as a substitute for the exercise of their

own judgement. All the opinions expressed herein are subject to

change without notice.

- 2019 25 07 - PR - Casino Board of Directors decides on the

proposal of GPA to launch an OPA on Éxito

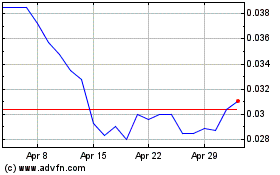

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Apr 2023 to Apr 2024