RoboGroup Announces Third-Quarter 2004 Financial Results Sharp

Decrease in Net Loss ROSH HA'AYIN, Israel, November 9

/PRNewswire-FirstCall/ -- RoboGroup T.E.K. Ltd. (NASDAQ:ROBO) today

reported third-quarter and first nine months of 2004 financial

results. The company's third-quarter net loss dropped to NIS 0.6

million (US$0.1 million) from a net loss of NIS 2.1 million (US$0.5

million) in the third quarter of 2003. Rafael Aravot, chief

executive officer of RoboGroup, commented: "These third quarter

results reflect significant cost cuts and strict controls as we

continue implementing our cost-cutting plan in an effort to align

expenses and revenues and to improve our financial position. This

plan's implementation resulted in a sharp decline in our net loss."

Revenues for the third quarter totaled NIS 14 million (US$3.1

million) compared with NIS 18 million (US$4 million) for the

comparable quarter in 2003. Gross profit for the third quarter

reached NIS 6.6 million (US$1.5 million) compared with NIS 8.4

million (US$1.9 million) for the comparable quarter in 2003.

Backlog as of September 30, 2004 stood at NIS 12.8 million (US$2.9

million) compared with NIS 4.6 million (US$1.0 million) as of

September 30, 2003. The net loss for the nine month period

decreased significantly to NIS 6.4 million (US$1.4 million) from

NIS 11.7 million (US$2.6 million) in the comparable period in 2003.

Revenues for the nine month period reached NIS 41.7 million (US$9.3

million) compared to NIS 44.9 million (US$10 million) for the

comparable period in 2003. Gross profit for the nine-month period

reached NIS18.6 (US$4.2 million) compared with NIS 20.3 million

(US$4.5 million) for the comparable period in 2003. During the

quarter YET continued its investment in the development of sales

and marketing channels in Europe and the USA. YET's fully owned

subsidiary, YET US Inc., continued its efforts to distribute YET's

products in the US market and has entered into agreements with

multiple distributors for distribution across the United States. In

addition, YET US received an order from an American client for the

purchase of YET products valued at US$350 thousand over a two-year

period. The operations with OMRON YASKAWA Motion Control B.V, YET's

European partner, continued to produce sales of YET products in

Europe. YET's revenues this quarter totaled US$1.25 million,

compared with US$0.7 million for the comparable quarter in 2003. In

July 2004, YET's Board of Directors decided on a dividend

distribution of US$800 thousand to its two shareholders. RoboGroup

received approximately US$400 thousand from the dividend

distribution. A complete Directors' Report for the third quarter of

2004 is available on the Company's Website at

http://www.robo-group.com/ or as a PDF file upon request. Please

contact Ayelet Shiloni at Integrated IR, toll-free +1-866-447-8633.

RoboGroup engages in three business sectors. The first sector is

devoted to RoboGroup's training products and e-learning systems.

RoboGroup is a world leader in engineering and manufacturing

technology training systems. The Company is market driven, deriving

its growth from technological leadership, strong partnerships and

management expertise. The second is Yaskawa Eshed Technology (YET),

a joint venture with Japan's Yaskawa Electric Corp., which provides

industrial motion controls, particularly those based on its

patented algorithms. The third is MemCall, a company with a limited

operation, which develops new technology designed to shorten the

length of time required to locate and retrieve information in

computer and communications networks. For more information, visit

http://www.robo-group.com/. To the extent that this press release

discusses expectations about market conditions or about market

acceptance and future sales of the Company's products, or otherwise

makes statements about the future, such statements are

forward-looking and are subject to a number of risks and

uncertainties that could cause results to differ materially from

the statements made. These factors include the rapidly changing

technology and evolving standards in the industries in which the

Company and its subsidiaries operate, risks associated with the

acceptance of new products by individual customers and by the

market place and other factors discussed in the business

description and management discussion and analysis sections of the

Company's Annual Report on Form 20-F. RoboGroup T.E.K. Ltd. Balance

Sheets December, September 30 31 2004 2004 2003 2003 US$ (K) NIS

(K) NIS (K) NIS (K) Unaudited Unaudited Unaudited Audited Adjusted

amount for the Convenience translation Reported Israeli CPI as of

to US amounts dollars (*) December 2003 ASSETS Current assets Cash

and cash equivalents 1,574 7,054 17,698 14,878 Trade receivables

3,033 13,596 13,280 13,217 Other receivables and debit balances 658

2,946 3,268 2,292 Inventories 2,845 12,751 14,353 13,603 8,110

36,347 48,599 43,990 Long-term investments Investments in investee

and other companies 3 15 108 15 Funds in respect of employee rights

upon retirement, net 73 329 - 81 76 344 108 96 Fixed assets 8,215

36,821 39,042 38,233 Deferred taxes 94 420 764 1,097 Other assets

60 270 551 428 16,555 74,202 89,064 83,844 (*) Discontinuance of

the adjustment for the effects of inflation according to the

Israeli CPI as of December 2003 RoboGroup T.E.K. Ltd. Balance

Sheets December, September 30 31 2004 2004 2003 2003 US$ (K) NIS

(K) NIS (K) NIS (K) Unaudited Unaudited Unaudited Audited Adjusted

amount for the Convenience Israeli CPI as of translation Reported

December 2003 to US amounts dollars (*) LIABILITIES Current

liabilities Credit from banks 3,516 15,757 16,625 15,941 Trade

payables 1,234 5,533 5,645 5,394 Other payables and credit balances

2,407 10,790 11,482 14,345 7,157 32,080 33,752 35,680 Long-term

liabilities Loans from banks 3,958 17,740 18,002 17,516 Liability

for termination of employee/employer relationship, net 46 207 429

200 4,004 17,947 18,431 17,716 Shareholders' equity Share capital

2,544 11,400 11,399 11,399 Capital reserves and premium on shares

9,853 44,159 44,150 44,021 Accumulated deficit (6,779) (30,381)

(17,665) (23,969) Treasury stock (224) (1,003) (1,003) (1,003)

5,394 24,175 36,881 30,448 16,555 74,202 89,064 83,844 (*)

Discontinuance of the adjustment for the effects of inflation

according to the Israeli CPI as of December RoboGroup T.E.K. Ltd.

Statements of Operations For the three Year For the nine months

ended months ended ended December, September 30 September 30 31

2004 2004 2003 2004 2003 2003 US$ (K) NIS (K) NIS (K) NIS (K) NIS

(K) NIS (K) Unaudited Unaudited Unaudited Unaudited Unaudited

Audited Adjusted amount for the Adjusted amount Israeli for the

Convenience CPI as of translation Reported Reported Israeli CPI as

of to US amounts December amounts dollars (*) 2003 (*) December

2003 Revenues 9,300 41,682 44,942 14,001 17,992 56,116 Cost of

revenues 5,141 23,044 24,628 7,412 9,557 32,598 Gross profit 4,159

18,638 20,314 6,589 8,435 23,518 Operating expenses Research and

development expenses, net 1,330 5,963 9,324 1,676 2,633 12,651

Marketing and selling expenses 2,271 10,175 9,742 3,108 3,119

12,622 Administrative and general expenses 1,639 7,348 11,278 2,328

3,982 14,569 5,240 23,486 30,344 7,112 9,734 39,842 Operating loss

(1,081) (4,848) (10,030) (523) (1,299) (16,324) Financial expenses,

net (298) (1,334) (3,176) (259) (1,192) (3,783) Other income, net

150 671 1,533 173 409 2,032 Loss before taxes on income (1,229)

(5,511) (11,653) (609) (2,082) (18,075) Income tax expenses

(income) 201 901 36 - - (82) Net loss (1,430) (6,412) (11,689)

(609) (2,082) (17,993) Loss per share ("LPS") (0.13) (0.6) (1.09)

(0.06) (0.19) (1.67) Weighted average number of shares used in

computation of LPS (in thousands) 10,746 10,746 10,744 10,746

10,744 10,744 (*) Discontinuance of the adjustment for the effects

of inflation according to the Israeli CPI as of December 2003

Company contact: Michal Afuta RoboGroup +972-3-900-4112 Agency

contact: Ayelet Shiloni Integrated IR +1-866-447-8633 DATASOURCE:

RoboGroup t.e.k. Ltd CONTACT: Company contact: Michal Afuta,

RoboGroup, , +972-3-900-4112. Agency contact: Ayelet Shiloni,

Integrated IR, , +1-866-447-8633

Copyright

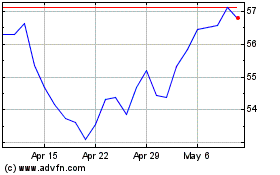

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Jun 2024 to Jul 2024

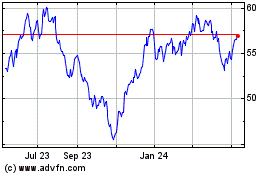

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Jul 2023 to Jul 2024