Although many new ETFs have followed a ‘back-to-basics’ approach

lately—focusing on segments like dividends, IPOs, or bonds—there

are still a few ETF providers that are bringing fresh ideas to

market. This includes the latest such launch under the

‘Exchange-Traded Concepts’ umbrella, with the

ROBO-STOX

Global Robotics and Automation Index ETF (ROBO).

This brand new fund looks to zero in on the quickly growing—and

increasingly ubiquitous—segment of robotics and automation by

tracking the ROBO-STOX Global Robotics and Automation Index. This

benchmark looks to invest in companies that have some aspect of

their business that is derived from robotics-related and/or

automation-related products or services, as determined by the index

committee.

According to the fund prospectus, the index breaks this down into

four general categories: industrial robots, service robots for

government or corporate use, service robots for personal use, and

ancillary businesses related to robotics and automation (see all

the technology ETFs here).

Some examples of the types of products that fall into this

robotics/automation theme include the following: unmanned vehicles,

software that enables virtualized product design and

implementation, three-dimensional printers, navigation systems, and

medical robots or robotic instruments.

ROBO ETF in Focus

Investors should note that the product charges a somewhat steep 95

basis points a year in fees for this product, putting it at the top

of the cost list for unleveraged funds. However, it clearly does

provide a unique type of exposure, so there is definitely some

merit to this high cost.

The product also has an interesting mix of ‘bellwether’ and

‘non-bellwether’ stocks. Bellwether companies are indicative of the

performance of the segment, while non-bellwether firms have some

aspect of their business in robotics, but don’t rely entirely on

the space for their revenues.

ROBO looks to put 40% of its portfolio in the bellwethers, and 60%

into the non-bellwethers, though each individual ‘bellwether’ stock

will make up about 2.2% of the index, compared to just over 1% for

the non-bellwether firms (read Alternative ETF Weighting

Methodologies 101).

In total, the ETF will hold about 77 stocks in its basket, putting

heavy weights into the U.S. (36.4%), Japan (24.7%), and then German

and Taiwanese (6.5% each) companies. For sector exposure, some of

the top segments include industrials (50%), technology (31.6%), and

health care (9.5%).

Holdings have a definite skew towards mid and small cap stocks in

this segment, as large caps make up just 20% of the total. This

means that most of the names in the product are probably unknown to

many investors, though some of the most famous initial holdings

include components like

3D Systems (DDD) and

iRobot (IRBT) (for bellwethers), and then

Deere (DE) and Siemens AG for non-bellwethers.

How does it fit in a portfolio?

This ETF could be an ideal choice for those seeking a play on a

high growth industry that has both proven itself, and has plenty of

room left to run. The trend towards greater levels of automation is

clear, so this could be a top choice if this continues (see all the

top ranked ETFs here).

However, the product is definitely more of a tactical play, and

with its high cost, is unlikely to be a good pick for fee-focused

investors. There are also a lot of names—in the ‘non-bellwether’

section—that might dull the return for the overall space, or could

even not be that representative of the overall trends in the

industry, though this is clearly the best option currently on the

market.

Competition and Bottom Line

There aren’t any real competitors to ROBO, as the product is quite

unique. There are, however, a couple of niche ETFs currently on the

market that may attract a similar type of investor (though none

follow the robotics segment in particular).

These include the

Global X Social Media Index ETF

(SOCL) and the

First Trust ISE Cloud Computing

Index Fund (SKYY). Both of these funds have done very well

in terms of performance in 2013, and have accumulated a decent

level of assets to boot (also see 5 Clean Energy ETFs Leading the

Sector’s Surge).

Plus, they have a targeted niche focus in a high growth industry,

so investors may consider these instead of ROBO. This is

particularly the case from an expense ratio perspective, as both

funds cost at least 30 basis points less than the new Robotics

ETF.

Given this, ROBO might have some difficulty in building up assets,

at least initially. Though if the fund can deliver some

outperformance, and if the robotics industry remains strong,

investors could definitely embrace this novel ETF for a slice of

their portfolios.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

3D SYSTEMS CORP (DDD): Free Stock Analysis Report

IROBOT CORP (IRBT): Free Stock Analysis Report

FT-CLOUD COMPUT (SKYY): ETF Research Reports

GLBL-X SOCL MDA (SOCL): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

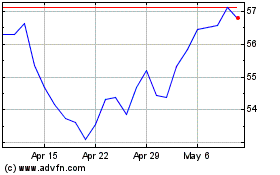

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Apr 2024 to May 2024

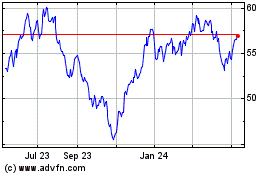

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From May 2023 to May 2024