Item 1.01 Entry into a Material Definitive Agreement.

Amended and Restated Board Representation and Standstill Agreement

On August 2, 2019, Sanchez Midstream Partners LP (the “Partnership”) and Sanchez Midstream Partners GP LLC, the general partner of the Partnership (the “General Partner” and together with the Partnership, the “Partnership Parties”), entered into an Amended and Restated Board Representation and Standstill Agreement (the “Board Representation and Standstill Agreement”) with Stonepeak Catarina Holdings LLC (“Stonepeak”). Pursuant to the Board Representation and Standstill Agreement, the Partnership and the General Partner have agreed to permit Stonepeak to designate up to two persons to serve as directors on the Board of Directors of the General Partner (the “Board”), and the Partnership and the General Partner are required take all actions necessary or advisable to effect such designations. The right to designate one director will immediately terminate on such date as Stonepeak no longer owns at least 25% of the outstanding Class C Preferred Units of the Partnership (the “Class C Preferred Units”) issued to Stonepeak in exchange for all issued and outstanding Class B Preferred Units of the Partnership (the “Class B Preferred Units”), and the right to designate the second director will immediately terminate on such date in which Stonepeak does not hold any of the issued and outstanding Class C Preferred Units. Stonepeak also has the right to appoint three independent members to the Board if all of the Class C Preferred Units have not been redeemed by December 31, 2021, with such right continuing until all Class C Preferred Units have been redeemed.

The Board Representation and Standstill Agreement provides that until the earlier of the occurrence of a material breach of the Third Amended and Restated Agreement of Limited Partnership of the Partnership (the “Partnership Agreement”) by the Partnership or General Partner and the date on which all Class C Preferred Units have been redeemed, Stonepeak will not, among other things: (i) acquire any additional equity or debt securities of the Partnership; (ii) engage in any hostile or takeover activities with respect to the Partnership or the General Partner, (iii) enter into any transaction the effect of which would be to “short” any securities of the Partnership; (iv) call (or participate in a group calling) a meeting of the limited partners of the Partnership for the purpose of removing the General Partner; (v) solicit any proxies or votes for or in support of (a) the removal of the General Partner or (b) the election of any successor general partner of the Partnership, in each case without the Partnership’s consent; (vi) advise or influence any person with respect to voting in connection with the removal of the General Partner or election of a successor general partner of the Partnership; or (vii) control or influence the management, Board or policies of the Partnership, except through the designated directors to the Board.

In addition, the Board Representation and Standstill Agreement provides that until the date on which all Class C Preferred Units have been redeemed, the prior written consent of Stonepeak will be required for the Partnership Parties or the Board, as applicable, among other things, to: (i) approve capital expenditures that exceed $5.0 million, in the aggregate, in a single year and any capital expenditure not in the ordinary course of business; (ii) approve any agreement or amendment to an agreement with any member of the Partnership Group (as defined in the Partnership Agreement), on the one hand, and the General Partner or Sanchez Energy Corporation (or its successor-in-interest to its business or assets) or any of their respective affiliates, on the other hand, that results in lower gathering rates currently in effect; (iii) approve total compensation of any officer (or any independent contractor performing officer functions) or director of the General Partner in amounts greater than ten percent (10%), in the aggregate, of the salaries approved in 2019 and the bonus approved for performance in 2018; (iv) approve any increases to the total compensation of any non-independent director of the General Partner or any member of the Partnership Group greater than the salary approved in 2019 and the bonus approved for performance in 2018; (v) approve any increase to the general and administrative expenses, other than certain expenses described in the Board Representation and Standstill Agreement, of the General Partner and the Partnership Group (taken as a whole) in amounts greater than ten percent (10%) in the aggregate of such expenses approved by the Board in January 2019; and (vi) any of member of the Partnership Group having an amount of cash or cash equivalents in excess of $10 million, in the aggregate, at any time other than to pay dividends or distributions within the following 90 calendar days.

Lastly, the Board Representation and Standstill Agreement provides that the General Partner may not materially diminish the duties of the chief executive officer of the General Partner without the consent of the directors appointed by Stonepeak. In addition, if at any time after August 2, 2022, the Partnership has a leverage ratio greater than 5.50 to 1.00, as calculated in the Board Representation and Standstill Agreement, Stonepeak will have the ability to appoint a new chief executive officer of the General Partner until such time as such leverage ratio is less than or equal to 3.00 to 1.00. Such appointment right will terminate on the date on which Stonepeak and its affiliates no longer hold any of the outstanding Class C Preferred Units.

2

The foregoing description of the Board Representation and Standstill Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Board Representation and Standstill Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Amended and Restated Registration Rights Agreement

On August 2, 2019, the Partnership entered into an Amended and Restated Registration Rights Agreement (the “Registration Rights Agreement”) with Stonepeak relating to the registered resale of common units representing limited partner interests in the Partnership (“Common Units”) issuable upon exercise of the warrant exercisable for Junior Securities (the “Warrant”). Pursuant to the Registration Rights Agreement, the Partnership has agreed, subject to certain exceptions, to prepare and file a registration statement (the “Registration Statement”) under the Securities Act of 1933, as amended the (“Securities Act”) upon request of the holders of Class C Preferred Units and to cause the Registration Statement to be declared effective no later than 210 days after such request is made.

In certain circumstances, the holders of Class C Preferred Units will have piggyback registration rights as described in the Registration Rights Agreement. If the Partnership issues any Junior Securities, other than Common Units, then the Partnership will enter into a separate registration rights agreement for any Junior Securities that are issuable to Stonepeak upon exercise of the Warrant.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to such document, which is filed as Exhibit 4.1 hereto and incorporated herein by reference.

Warrant

On August 2, 2019, the Partnership issued the Warrant to Stonepeak. The information regarding the Warrant set forth in Item 3.02 hereof is incorporated by reference into this Item 1.01.

Item 3.02 Unregistered Sales of Equity Securities.

On August 2, 2019, Stonepeak exchanged all of the issued and outstanding Class B Preferred Units for newly issued Class C Preferred Units and the Warrant in a privately negotiated transaction (the “Private Placement”). The Warrant may be exercised at any time and from time to time during the period beginning on August 2, 2019 and ending on the later of the seventh anniversary of such date and the date thirty days after the date on which all of the Class C Preferred Units have been redeemed for a number of Junior Securities equal to 10% of each applicable class of Junior Securities then outstanding as of the exercise date. No purchase price will be payable in connection with the exercise of the Warrant.

The issuance of the Class C Preferred Units and the Warrant was made in reliance upon an exemption from the registration requirements of the Securities Act pursuant to Section 4(a)(2) thereof.

The information regarding the Class C Preferred Units set forth in Item 5.03 hereof is incorporated by reference into this Item 3.02.

The description of the Warrant is qualified in its entirety by reference to the full text of the Warrant, which is filed as Exhibit 10.2 hereto and is incorporated into this Item 3.02 by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements

of Certain Officers.

On August 2, 2019, the General Partner entered into Executive Services Agreements with each of: (1) Gerald F. Willinger, Chief Executive Officer, and (2) Charles C. Ward, Chief Financial Officer and Secretary (each, an “Executive Agreement” and, collectively, the “Executive Agreements”). The Executive Agreements were approved by the Board on August 2

, 2019.

3

Each respective Executive Agreement provides (i) that the applicable executive will continue to serve in his current executive officer position with the General Partner and provide services to the Partnership Parties during the applicable term, (ii) for an annual base salary (Mr. Willinger: $600,000 and Mr. Ward: $375,000) and (iii) for eligibility to receive an annual cash bonus based on a qualitative assessment of financial and individual performance achievements.

Under each Executive Agreement, in the event of the applicable executive’s termination as an officer of the General Partner due to (a) such executive’s death or “disability,” (b) the General Partner terminating such executive without “cause,” or (c) such executive terminating for “good reason” (as such terms are defined in the Executive Agreements), such executive (or such executive’s designated beneficiaries, as applicable) will be entitled to receive payment of: (i) any unpaid annual bonus for the year prior to the year of termination and (ii) a pro-rated annual bonus for the year of termination.

In addition, such executive will also be entitled to receive the following severance payments or benefits in the event of: (1) the General Partner terminating such executive without “cause” (2) such executive terminating for “good reason” or (3)(A) the General Partner terminating such executive without “cause”, (B) such executive’s death or “disability,” or (C) such executive terminating for any reason, in the case of (A)-(C), during a period beginning 60 days prior to and ending two years following a “Change in Control” (as defined in the Executive Agreements) such executive will be entitled to receive (w) a lump-sum cash payment equal to two times such executive’s then-current annual base salary plus two times the largest annual bonus paid (or due to be paid) to such executive for the year in which the termination occurs or any year in the three calendar year period immediately preceding the date of termination, (x) payment of the COBRA premiums for such executive and such executive’s eligible dependents during the COBRA continuation period, (y) to the extent not yet paid to such executive, a lump-sum cash payment equal to all outstanding amounts owed to such executive for services performed for or on behalf of the Partnership Parties, the amount of such executive’s annual bonus for the last full year during which such executive performed services for the Partnership Parties, and the amount of such executive’s annual bonus for the current year, based on such executive’s annual bonus for such last full year (pro-rated to the date of termination), and (z) immediate vesting in full, as of the date of such Change in Control, of any units awarded to such executive under the Partnership’s Long-Term Incentive Plan.

Item 5.03

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Third Amended and Restated Agreement of Limited Partnership

On August 2, 2019, in connection with the Private Placement, the General Partner entered into the Partnership Agreement to set forth the terms of the Class C Preferred Units.

Distributions

Under the terms of the Partnership Agreement, commencing with the quarter ending on June 30, 2019, the Class C Preferred Units will receive a quarterly distribution of, at the election of the Board, (i) with respect to any distribution made with respect to the quarter ended June 30, 2019, 10.0% per annum if paid in full in cash or 12.0% per annum if paid in paid-in-kind units; (ii) with respect to any distribution made with respect to any quarter beginning with and after the quarter ending September 30, 2019, through and including the quarter ending December 31, 2021, 12.5% per annum, regardless of whether paid in cash, paid-in-kind units or a combination thereof; and (iii) with respect to any distribution made with respect to any quarter beginning on or after January 1, 2022, 14.0% per annum, regardless of whether paid in cash, paid-in-kind units or a combination thereof.

Distributions are to be paid on or about the last day of each of February, May, August and November after the end of each quarter.

4

Voting

The Class C Preferred Units will have the same voting rights as the holders of the Common Units and shall vote together as a single class with the Common Units.

Redemption

The Partnership has the right to redeem the Class C Preferred Units as follows:

·

from August 2, 2019 through December 31, 2019, the Partnership can redeem 66.67% of the outstanding Class C Preferred Units for cash at the greater of the current market price of the Common Units and 120% of the liquidation preference of the Class C Preferred Units plus any accumulated and unpaid distributions;

·

from January 1, 2020 through December 31, 2020, the Partnership can redeem 100% of the outstanding Class C Preferred Units for cash at the greater of the current market price of the Common Units and 110% of the liquidation preference of the Class C Preferred Units plus any accumulated and unpaid distributions; and

·

from January 2021 and thereafter, the Partnership can redeem 100% of the outstanding Class C Preferred Units for cash at the greater of the current market price and 100% of the liquidation preference of the Class C Preferred Units plus any accumulated and unpaid distributions.

Subject to the foregoing limitations, if all Class C Preferred Units are not redeemed by December 31, 2021, then the Partnership is restricted from making cash distributions on any other units until the Class C Preferred Units are redeemed in full as a result of a monthly sweep of adjusted available cash.

The foregoing description of the Partnership Agreement does not purport to be complete and is qualified in its entirety by

reference

to such document, which is filed as Exhibit 3.1 hereto and incorporated herein by reference.

Amendment No. 3 to Limited Liability Company Agreement

On August 2, 2019, in connection with the Private Placement described in Item 3.02 above, SP Holdings, LLC, as the sole member of the General Partner entered into Amendment No. 3 to Limited Liability Company Agreement of the General Partner (the “LLC Agreement Amendment”) to make certain changes to reflect the rights of the holders of the Class C Preferred Units.

The foregoing description of the LLC Agreement Amendment does not purport to be complete and is qualified in its entirety by reference to such document, which is filed as Exhibit 3.2 hereto and incorporated by reference.

Item 8.01 Other Events.

On August 2, 2019, in connection with the execution of the Board Representation and Standstill Agreement described in Item 1.01 above, the Partnership Parties entered into a letter agreement with Stonepeak Catarina Holdings LLC (the “letter agreement”). Pursuant to the letter agreement, the Partnership Parties have agreed that, in the event the number of directors comprising the Board increases to more than nine directors, for each additional director added, the Partnership Parties shall take all actions necessary or advisable to cause an additional director to be added to the Board, to be designated by Stonepeak in its sole discretion, subject only to the qualification restrictions in the Board Representation and Standstill Agreement.

The foregoing description of the letter agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the letter agreement, a copy of which is filed as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 9.01 Financial

Statements and Exhibits

(d)

Exhibits

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Third Amended and Restated Agreement of Limited Partnership of Sanchez Midstream Partners LP, dated August 2, 2019.

|

|

3.2

|

|

Amendment No. 3 to Limited Liability Company Agreement of Sanchez Midstream Partners GP LLC, dated August 2, 2019.

|

|

4.1

|

|

Amended and Restated Registration Rights Agreement, dated August 2, 2019, by and among Sanchez Midstream Partners LP and Stonepeak Catarina Holdings LLC.

|

|

10.1

|

|

Amended and Restated Board Representation and Standstill Agreement, dated August 2, 2019, by and among Sanchez Midstream Partners LP, Sanchez Midstream Partners GP LLC and Stonepeak Catarina Holdings LLC.

|

|

10.2

|

|

Warrant Exercisable for Junior Securities, dated August 2, 2019, by and between Sanchez Midstream Partners LP and Stonepeak Catarina Holdings LLC.

|

|

99.1

|

|

Letter Agreement, dated August 2, 2019, by and among Sanchez Midstream Partners LP, Sanchez Midstream Partners GP LLC and Stonepeak Catarina Holdings LLC.

|

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SANCHEZ MIDSTREAM PARTNERS LP

|

|

|

By:

|

Sanchez Midstream Partners GP LLC,

|

|

|

|

its general partner

|

|

|

|

|

|

Date: August 2, 2019

|

By:

|

/s/ Charles C. Ward

|

|

|

|

Charles C. Ward

|

|

|

|

Chief Financial Officer

|

6

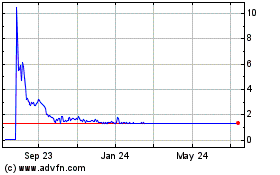

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Jul 2023 to Jul 2024