If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

About This Prospectus

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”). As permitted by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read the registration statement and the other reports we file with the SEC at the SEC’s website as described under the heading “Where You Can Find More Information” in this prospectus.

This prospectus and the documents incorporated by reference in this prospectus include important information about us and the securities being offered. You should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information that is in addition to, or different from, the information that is contained, or incorporated by reference, in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

The information appearing in this prospectus is accurate only as of the date on the front of the document and any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Where You Can Find More Information.”

This prospectus and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus are the property of their respective owners.

Unless the context indicates otherwise in this prospectus, the terms “NovaBay,” the “Company,” the “Registrant,” “we,” “our” or “us” in this prospectus refer to NovaBay Pharmaceuticals, Inc.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, including the financial data and related notes, risks of investing in our securities discussed under the heading “Risk Factors” and other information incorporated by reference in this prospectus. Each of the risk factors could adversely affect our business, operating results and financial conditions, as well as adversely affect the value of an investment in our securities.

Our Company

NovaBay Pharmaceuticals, Inc. (the “Company”) is a medical device company predominantly focused on eye care. We are currently focused primarily on commercializing Avenova®, an FDA cleared product sold in the United States for cleansing and removing foreign material including microorganisms and debris from skin around the eye, including the eyelid.

Avenova is formulated with our proprietary, stable and pure form of hypochlorous acid. Avenova has proven in laboratory testing to have broad antimicrobial properties as a preservative in solution as it removes foreign material including microorganisms and debris from the skin around the eye without burning or stinging. Avenova is free from the bleach impurities found in nearly all other hypochlorous products and is safe for long term use.

In the first quarter of 2019, many national insurance payors stopped reimbursing Avenova. Despite consistent demand for Avenova, we were challenged by the costs of maintaining an expanded commercial organization with our new lower net selling price. In the second quarter, we made a strategic shift by significantly reducing our number of field sales representatives by about three-quarters and redeploying our remaining representatives in territories that account for about 95% of our retail pharmacy sales. This shift allowed us to effectively utilize our streamlined commercial resources to reach higher-prescribing physicians while significantly reducing our operating expenses.

Going forward, our core business strategy will center around increasing sales of Avenova in all distribution channels: (1) Avenova Direct, our direct-to-consumer model, allowing customers to forego time-consuming doctor visits and trips to the pharmacy; (2) Retail Pharmacies, selling to consumers through local pharmacies across all 50 states; (3) our Partner Pharmacy Program; providing a consistent patient experience at contracted pricing; and (4) our Buy-and-Sell channel, allowing patients to buy Avenova during their office visits to their preferred eye care specialist.

Beyond Avenova, we have developed additional products containing our proprietary, stable and pure form of hypochlorous acid, including NeutroPhase® for the wound care market and CelleRx® for the dermatology market. For NeutroPhase, we have established a U.S. distribution partner and an international distribution partner in China. For CelleRx, we plan to begin selling directly to consumers before the end of the year in a low-cost online distribution channel. Avenova, NeutroPhase, and CelleRx are medical devices cleared by the FDA under the Food and Drug Administration Act Section 510(k).

Additional Information

For additional information related to our business and operations, please refer to the reports incorporated herein by reference, including our most recent Annual Report on Form 10-K, as amended, and Quarterly Reports on Form 10-Q, as described under the caption “Incorporation of Certain Information by Reference.”

Company Information

The Company was incorporated under the laws of the State of California on January 19, 2000, as NovaCal Pharmaceuticals, Inc. It had no operations until July 1, 2002, on which date it acquired all of the operating assets of NovaCal Pharmaceuticals, LLC, a California limited liability company. In February 2007, it changed its name from NovaCal Pharmaceuticals, Inc. to NovaBay Pharmaceuticals, Inc. In June 2010, the Company changed the state in which it was incorporated and is now incorporated under the laws of the State of Delaware.

Our corporate address is 2000 Powell Street, Suite 1150, Emeryville, California 94608, and our telephone number is (510) 899-8800. Our website address is www.novabay.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of this prospectus. Our website address is included in this document as an inactive textual reference only.

The August Financing Transactions

The Foreign Offering to the Foreign Selling Securityholders

On August 8, 2019, the Company entered into the Foreign Purchase Agreement with the Foreign Selling Securityholders for the sale of (i) 2,700,000 shares of the Company’s Series A Non-Voting Convertible Preferred Stock (the “Preferred Stock”) which subsequently automatically converted into 2,700,000 shares of Common Stock, at a ratio of 1:1, upon the approval by the Company’s stockholders at the Company’s special stockholders meeting on October 9, 2019 and (ii) the Foreign Warrants exercisable for 2,700,000 shares of Common Stock with each warrant exercisable upon the approval by the Company’s stockholders at the Company’s special stockholders meeting on October 9, 2019, for an aggregate purchase price of $2.7 million (the “Foreign Offering”).

The Foreign Selling Securityholders are: Hai Dong Pang (who purchased Preferred Stock that converted into 800,000 shares of Common Stock and Foreign Warrants exercisable for 800,000 shares of Common Stock), Xiao Rui Liu (who purchased Preferred Stock that converted into 400,000 shares of Common Stock and Foreign Warrants exercisable for 400,000 shares of Common Stock) and Ping Huang (who purchased Foreign Stock that converted into 1,500,000 shares of Common Stock and Foreign Warrants exercisable for 1,500,000 shares of Common Stock). China Kington Asset Management Co. Ltd. served as placement agent for the Foreign Offering in exchange for a commission equal to six percent (6%) of the gross proceeds received by the Company upon the closing of the Foreign Offering.

The Domestic Offering to the Domestic Selling Securityholders

On August 8, 2019, the Company also entered into the Domestic Purchase Agreement with the Domestic Selling Securityholders for the sale of (i) an aggregate of 4,198,566 shares of the Company’s Common Stock in a registered direct offering and (ii) the unregistered Domestic Warrants exercisable for 4,198,566 shares of Common Stock (the “Domestic Offering”). The Foreign Selling Securityholders did not participate in the Domestic Offering.

The Domestic Selling Securityholders are: Armistice Capital Master Fund Ltd. (which purchased Domestic Warrants exercisable for 2,100,000 shares of Common Stock), Empery Asset Master, LTD (which purchased Domestic Warrants exercisable for 623,824 shares of Common Stock), Empery Tax Efficient, LP (which purchased Domestic Warrants exercisable for 181,255 shares of Common Stock) and Empery Tax Efficient II, LP (which purchased Domestic Warrants exercisable for 1,293,487 shares of Common Stock).

Ladenburg Thalmann & Co. Inc. served as placement agent in the Domestic Offering for (i) a cash fee equal to 6% of the gross proceeds generated from the Domestic Offering, (ii) issuance of the Ladenburg Warrants to purchase up to 167,942 shares of Common Stock, which represent 4% of the shares of Common Stock sold in the Domestic Offering, with an exercise price of $1.25, and (iii) reimbursement of the placement agent’s expenses in an amount not to exceed $60,000, each pursuant to the terms of that certain Placement Agency Agreement between the Company and Ladenburg, dated August 8, 2019 (the “Ladenburg Agreement”).

For more information about the Foreign Offering and Domestic Offering, please refer to our Current Reports on Form 8-K filed with the SEC on August 9, 2019 and August 13, 2019, which are incorporated herein by reference.

The Offering

This prospectus relates to the resale by the Selling Securityholders listed in this prospectus of up to 9,766,508 shares of our Common Stock, of which 7,066,508 are Warrant Shares issuable upon the exercise of the Warrants. Our Common Stock is currently listed on the NYSE American under the symbol “NBY.” All of the Shares and Warrant Shares, if exercised and sold, will be sold by the Selling Securityholders. Such Selling Securityholders may sell their shares of our Common Stock from time to time at market prices prevailing at the time of sale, at prices related to the prevailing market price, or at negotiated prices. We will not receive any of the proceeds from the sale of the Shares or Warrant Shares by the Selling Securityholders. However, in the case of the Warrants, upon a cash exercise of the Warrants, we will receive, for each share of Common Stock exercised, the exercise price of $1.15 for the Foreign Warrants and Domestic Warrants and $1.25 for the Ladenburg Warrants. If any of the Warrants are exercised in a cashless exercise, we will not receive any proceeds from the exercise of such Warrants.

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described below and under the heading “Risk Factors” contained in our most recent Annual Report on Form 10-K, as amended, and in our most recent Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety, together with other information in this prospectus and the documents incorporated by reference.

The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

We discuss in greater detail many of these risks under the heading “Risk Factors” contained in our most recent Annual Report on Form 10-K and in our most recent Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus together with the documents we have filed with the SEC that are incorporated by reference completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the Shares or the Warrant Shares by the Selling Securityholders pursuant to this prospectus. The Warrant Shares are issuable upon exercise of the Warrants to purchase our Common Stock. Upon any exercise of the Warrants for cash, the Selling Securityholders would pay us the exercise price of the Warrants. The cash exercise price of the Warrants is $1.15 for the Foreign Warrants and Domestic Warrants and $1.25 for the Ladenburg Warrants, respectively, per share of our Common Stock. Under certain conditions set forth in the Warrants, the Warrants are exercisable on a cashless basis. If the Warrants are exercised on a cashless basis, we would not receive any cash payment from the Selling Securityholders upon any exercise of the Warrants.

MARKET OF OUR COMMON STOCK

Market Information

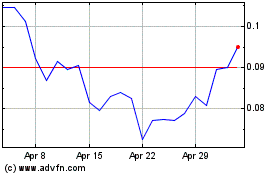

Our Common Stock is listed on the NYSE American, under the symbol “NBY.”

Holders

As of October 14, 2019, there were approximately 150 holders of record of our Common Stock. This figure does not reflect persons or entities that hold their stock in nominee or “street” name through various brokerage firms.

Dividend Policy

We have not paid cash dividends on our Common Stock since our inception. We currently expect to retain earnings primarily for use in the operation and expansion of our business; therefore, we do not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, restrictions under any existing indebtedness and other factors the Board of Directors deems relevant.

PRINCIPAL STOCKHOLDERS

The following table indicates information as of October 14, 2019, regarding the ownership of our Common Stock by:

|

|

●

|

each person who is known by us to own more than 5.0% of our shares of Common Stock;

|

|

|

●

|

each of our senior executive officers who are named executive officers under SEC proxy rules;

|

|

|

●

|

each of our directors; and

|

|

|

●

|

all of our directors and executive officers as a group.

|

The percentage of shares beneficially owned is based on 27,901,850 shares of Common Stock outstanding as of October 14, 2019. Except as indicated in the footnotes to this table, and as affected by applicable community property laws, all persons listed have sole voting and investment power for all shares shown as beneficially owned by them and no shares are pledged.

|

Name and Address of Beneficial Owner(1)

|

|

Number of Shares Beneficially Owned

|

|

Percent of Class

|

|

|

|

|

|

|

|

Beneficial Owners Holding More Than 5.0% (other than Executive Officers and Directors)

|

|

|

|

|

|

Mr. Jian Ping Fu(2)

|

|

5,302,350

|

|

19.0%

|

|

11 Williams Road

|

|

|

|

|

|

Mt. Eliza, Melbourne VIC 3930

|

|

|

|

|

|

Australia

|

|

|

|

|

|

|

|

|

|

|

|

China Pioneer Pharma Holdings Limited(3)

|

|

5,188,421

|

|

18.6%

|

|

190 Elgin Avenue, George Town,

|

|

|

|

|

|

Grand Cayman, Cayman Islands KY1-9005

|

|

|

|

|

|

|

|

|

|

|

|

Empery Asset Management, LP(4)

|

|

2,098,566

|

|

7.5%

|

|

1 Rockefeller Plaza, Suite 1205

|

|

|

|

|

|

New York, New York 10020

|

|

|

|

|

|

|

|

|

|

|

|

Armistice Capital Master Fund Ltd.(5)

|

|

1,747,944

|

|

6.3%

|

|

20 Genesis Close

|

|

|

|

|

|

P.O. Box 314

|

|

|

|

|

|

Grand Cayman, Cayman Islands KY1-1104

|

|

|

|

|

|

|

|

|

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

Justin M. Hall, Esq.(6)

|

|

163,765

|

|

*

|

|

Jason Raleigh(7)

|

|

9,413

|

|

*

|

|

Paul E. Freiman, Ph.D.(8)

|

|

96,675

|

|

*

|

|

Xinzhou (Paul) Li(3), (9)

|

|

36,915

|

|

*

|

|

Gail Maderis, M.B.A.(10)

|

|

95,880

|

|

*

|

|

Xiaopei (Ray) Wang

|

|

—

|

|

*

|

|

Mijia (Bob) Wu, M.B.A.(11)

|

|

46,911

|

|

*

|

|

Yenyou (Jeff) Zheng

|

|

—

|

|

*

|

|

|

|

|

|

|

|

All directors and executive officers as a group (8 persons)

|

|

449,559

|

|

1.6%

|

*Less than one percent (1%).

|

(1)

|

The address for each director and officer of NovaBay listed is c/o NovaBay Pharmaceuticals, Inc., 2000 Powell Street, Suite 1150, Emeryville, CA 94608. Number of shares beneficially owned and percent of class is calculated in accordance with SEC rules. A beneficial owner is deemed to beneficially own shares the beneficial owner has the right to acquire within 60 days of October 14, 2019. For purposes of calculating the percent of class held by a single beneficial owner, the shares that such beneficial owner has the right to acquire within 60 days of October 14, 2019 are also deemed to be outstanding; however, such shares are not deemed to be outstanding for purposes of calculating the percentage ownership of any other beneficial owner.

|

|

(2)

|

Mr. Fu holds sole voting power and sole investment power over all 5,302,350 shares.

|

|

(3)

|

Director Xinzhou (Paul) Li is Chairman and Executive Director of China Pioneer Pharma and Director of Pioneer Hong Kong. Mr. Li disclaims beneficial ownership of the shares of the Company Common Stock held by China Pioneer Pharma. China Pioneer Pharma and Pioneer Hong Kong (by virtue of its indirect ownership by China Pioneer Pharma), share voting power and share investment power over the 5,188,421 shares. Pioneer Hong Kong is a wholly-owned subsidiary of China Pioneer Pharma. The address for China Pioneer Pharma is: Flat 2605, 26/F Trendy Centre, 682 Castle Peak Road, Lai Chi Kok, Kowloon, Hong Kong.

|

|

(4)

|

Based upon information contained in the Schedule 13G filed by Empery Asset Management, LP (“Empery”) with the SEC on August 15, 2019, Empery beneficially owned 2,098,566 shares of Common Stock as of August 15, 2019, with sole voting power over 0 shares, shared voting power over 2,098,566 shares, sole dispositive power over 0 shares and shared dispositive power over 2,098,566 shares. Empery shares such voting and dispositive power with Empery Tax Efficient II, LP (as to 1,293,847 of the shares), Ryan M. Lane (as to all 2,098,566 of the shares) and Martin D. Hoe (as to all 2,098,566 of the shares), each with the same address as Empery. Empery also beneficially owns warrants exercisable for 2,098,566 shares of Common Stock which are not reflected in the above table as pursuant to the terms of such warrants Empery is prohibited from exercising such warrants while it beneficially owns more than 4.99% of the Company’s outstanding shares of Common Stock.

|

|

(5)

|

Based upon information contained in the Schedule 13G filed by Armistice Capital Master Fund Ltd. (“Armistice”) with the SEC on August 19, 2019, Armistice beneficially owned 1,747,944 shares of Common Stock as of August 19, 2019, with sole voting power over 0 shares, shared voting power over 1,747,944 shares, sole dispositive power over 0 shares and shared dispositive power over 1,747,944 shares. Armistice shares such voting and dispositive power with Armistice Capital, LLC and Steven Boyd, both with the following address: 510 Madison Avenue, 7th Floor, New York, New York 10022. Armistice also beneficially owns warrants exercisable for 2,100,000 shares of Common Stock which are not reflected in the above table as pursuant to the terms of such warrants Armistice is prohibited from exercising such warrants while it beneficially owns more than 4.99% of the Company’s outstanding shares of Common Stock.

|

|

(6)

|

Includes (i) 3,405 shares of Common Stock held directly by Mr. Hall, and (ii) 160,360 shares issuable upon exercise of outstanding options which are exercisable as of October 14, 2019 or within 60 days after such date.

|

|

(7)

|

Includes 9,413 shares issuable upon exercise of outstanding options which are exercisable as of October 14, 2019 or within 60 days after such date.

|

|

(8)

|

Includes (i) 2,311 shares held by the Paul Freiman and Anna Mazzuchi Freiman Trust, of which Mr. Freiman and his spouse are trustees (with sole voting power over 625 shares, shared voting power over 1,061 shares, sole investment power over no shares and shared investment power over 1,686 shares), and (ii) 94,364 shares issuable upon exercise of outstanding options which are exercisable as of October 14, 2019, or within 60 days after such date.

|

|

(9)

|

Reflects 36,915 shares issuable upon exercise of outstanding options which are exercisable as of October 14, 2019, or within 60 days after such date.

|

|

(10)

|

Reflects 95,880 shares issuable upon exercise of outstanding options which are exercisable as of October 14, 2019, or within 60 days after such date. The right to exercise these stock options is held by the Gail J. Maderis Revocable Trust dated April 7, 2013.

|

|

(11)

|

Reflects 46,911 shares issuable upon exercise of outstanding options which are exercisable as of October 14, 2019, or within 60 days after such date. As Non-Executive Director of China Pioneer Pharma, Mr. Wu disclaims beneficial ownership of the shares of the Company Common Stock held by China Pioneer Pharma and Pioneer Hong Kong. See Note (3) above for shares of the Company owned by China Pioneer Pharma and Pioneer Hong Kong.

|

DESCRIPTION OF SECURITIES

Our authorized capital stock consists of 50,000,000 shares of Common Stock and 5,000,000 shares of preferred stock, $0.01 par value per share. A description of material terms and provisions of our amended and restated certificate of incorporation, including the certificate of designations for the Preferred Stock, and bylaws affecting the rights of holders of our capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to our amended and restated certificate of incorporation, including the certificate of designations for the Preferred Stock, and the bylaws. As of October 14, 2019, there were 27,901,850 shares of Common Stock outstanding, and no shares of our preferred stock outstanding.

On December 18, 2015, we effected a 1-for-25 reverse stock split and 25 shares of our outstanding Common Stock decreased to one share of Common Stock. Similarly, the number of shares of Common Stock issuable upon the exercise of outstanding stock options or warrants, or upon the vesting of outstanding restricted stock units, decreased on a 1-for-25 basis and the exercise price of each outstanding option and warrant increased proportionately.

Common stock

Dividend rights. Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our Common Stock are entitled to receive dividends out of funds legally available if our Board of Directors (the “Board”), in its discretion, determines to issue dividends and then only at the times and in the amounts that our Board may determine.

Voting rights. Each holder of Common Stock is entitled to one vote for each share of Common Stock held on all matters submitted to a vote of stockholders. Our amended and restated certificate of incorporation does not provide for the right of stockholders to cumulate votes for the election of directors. Our amended and restated certificate of incorporation establishes a classified Board, divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

No preemptive or similar rights. Our Common Stock is not entitled to preemptive rights and is not subject to conversion, redemption or sinking fund provisions. The rights, preferences and privileges of the holders of our Common Stock are subject to, and may be adversely affected by, the rights of the holders of any series of our preferred stock that we may designate and issue in the future.

Right to receive liquidation distributions. Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to holders of our Common Stock are distributable ratably among the holders of our Common Stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights and payment of liquidation preferences, if any, on any outstanding shares of our preferred stock.

The rights of the holders of our Common Stock are subject to, and may be adversely affected by, the rights of holders of shares of any preferred stock that we may designate and issue in the future.

Preferred stock

Under the terms of our certificate of incorporation, as amended, our Board is authorized to issue up to 5,000,000 shares of preferred stock in one or more series without stockholder approval. We currently have no shares of preferred stock outstanding.

Our Board is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions. Our Board can also increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our Board may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of the Common Stock. The issuance of preferred stock, while providing flexibility in connection with financings, possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring, discouraging or preventing a change in control of our Company, may adversely affect the market price of our Common Stock and the voting and other rights of the holders of Common Stock, and may reduce the likelihood that common stockholders will receive dividend payments and payments upon liquidation.

Series A Convertible Preferred Stock

The Company previously issued 2,700,000 shares of Preferred Stock, all of which was automatically converted into 2,700,000 shares of the Company’s Common Stock after stockholder approval of the conversion was obtained at the special stockholders meeting on October 9, 2019. The Preferred Stock is summarized below. The following description is subject to, and qualified in its entirety by, the certificate of designations for the Preferred Stock, which was filed as an exhibit to a Current Report on Form 8-K filed on August 13, 2019, which is incorporated herein by reference. You should review a copy of the certificate of designations for a complete description of the powers, preferences, rights, qualifications, limitations and restrictions applicable to the Preferred Stock.

Rank

The Preferred Stock ranked:

|

|

●

|

on par with our Common Stock;

|

|

|

●

|

senior to any class or series of our capital stock hereafter created specifically ranking by its terms junior to the Preferred Stock; and

|

|

|

●

|

junior to any class or series of our capital stock hereafter created specifically ranking by its terms senior to the Preferred Stock,

|

in each case, as to dividends or distributions of assets upon our liquidation, dissolution or winding up whether voluntarily or involuntarily.

Conversion

Prior to stockholder approval, the Preferred Stock was non-convertible. However, each share of Preferred Stock was convertible into one share of our Common Stock immediately upon stockholder approval of such conversion. As such, the Preferred Stock was convertible into an aggregate of 2,700,000 shares of our Common Stock. The Preferred Stock did not contain any price-based anti-dilution protection. We agreed to hold a Special Meeting of Stockholders no later than sixty (60) days after the closing of the Foreign Offering to receive stockholder approval of the conversion of the Preferred Stock, which was held on October 9, 2019. The Preferred Stock automatically converted into Common Stock after stockholder approval of the conversion was obtained at the special stockholders meeting.

Liquidation Preference

In the event of our liquidation, dissolution or winding up, holders of Preferred Stock were entitled to receive the same amount as a holder of Common Stock.

Voting Rights

Shares of Preferred Stock generally had no voting rights, except as required by law and except that the consent of the majority of holders of the outstanding Preferred Stock were required to: (i) alter or change adversely the powers, preferences or rights given to the Preferred Stock or alter or amend the certificate of designation of the Preferred Stock, (ii) amend the Company’s certificate of incorporation or bylaws in any way that adversely affects the rights of the holders of Preferred Stock and (iii) increase the number of authorized shares of Preferred Stock.

Dividends

Holders of Preferred Stock were entitled to receive, and we were required to pay, dividends on shares of the Preferred Stock equal (on an as if converted to Common Stock basis) to and in the same form as dividends actually paid on shares of the Common Stock when, as and if such dividends are paid on shares of the Common Stock. The Preferred Stock was not entitled to any other dividends.

Redemption

We were not obligated to redeem or repurchase any shares of Preferred Stock. Shares of Preferred Stock were not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous fund provisions.

Listing

There was no established public trading market for the Preferred Stock, and the Preferred Stock was never listed on any national securities exchange or trading system.

Fundamental Transactions

If, at any time that shares of Preferred Stock were outstanding, we effected a merger or other change of control transaction, as described in the certificate of designations and referred to as a fundamental transaction, then a holder would have the right to receive, upon any subsequent conversion of a share of Preferred Stock (in lieu of conversion shares) for each issuable conversion share, the same kind and amount of securities, cash or property as such holder would have been entitled to receive upon the occurrence of such fundamental transaction if such holder had been, immediately prior to such fundamental transaction, the holder of Common Stock.

Registration Rights

The Company agreed to certain registration rights pursuant to which the Company would file a resale registration statement with the SEC for the Common Stock underlying the Preferred Stock within 90 days of closing the Foreign Offering. The Company is performing such obligation and registering the Common Stock underlying the Preferred Stock pursuant to the filing of this registration statement on Form S-1.

Outstanding warrants

As of October 14, 2019, we had warrants outstanding to purchase an aggregate of 8,588,461 shares of Common Stock with a weighted-average exercise price of $1.09 per share.

Anti-takeover effects of provisions of our certificate of incorporation and bylaws and Delaware law

Amended and restated certificate of incorporation and bylaws. Our amended and restated certificate of incorporation provides that our Board is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Because holders of our Common Stock do not have cumulative voting rights in the election of directors, stockholders holding a majority of the shares of Common Stock outstanding are able to elect all of our directors. Our Board is able to elect a director to fill a vacancy created by the expansion of the Board or due to the resignation or departure of an existing board member. Our amended and restated certificate of incorporation and bylaws also provide that all stockholder actions must be effected at a duly called meeting of stockholders and not by written consent, and that only the Board pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders. In addition, our bylaws include a requirement for the advance notice of nominations for election to the Board or for proposing matters that can be acted upon at a stockholders’ meeting. Our amended and restated certificate of incorporation provides for the ability of the Board to issue, without stockholder approval, up to 5,000,000 shares of preferred stock with terms set by the Board, which rights could be senior to those of our Common Stock. Our amended and restated certificate of incorporation and bylaws also provide that approval of at least 66-2/3% of the shares entitled to vote at an election of directors will be required to adopt, amend or repeal our bylaws, or repeal the provisions of our amended and restated certificate of incorporation regarding the election of directors and the inability of stockholders to take action by written consent in lieu of a meeting.

The foregoing provisions make it difficult for holders of our Common Stock to replace our Board. In addition, the authorization of undesignated preferred stock makes it possible for our Board to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of our Company.

Section 203 of the Delaware General Corporation Law

We are subject to the provisions of Section 203 of the Delaware General Corporation Law regulating corporate takeovers. This section prevents some Delaware corporations from engaging, under some circumstances, in a business combination, which includes a merger or sale of at least 10% of the corporation’s assets with any interested stockholder, meaning a stockholder who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of the corporation’s outstanding voting stock, unless:

|

|

●

|

the transaction is approved by the Board prior to the time that the interested stockholder became an interested stockholder;

|

|

|

●

|

upon consummation of the transaction which resulted in the stockholder’s becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

|

|

●

|

at or subsequent to such time that the stockholder became an interested stockholder, the business combination is approved by the Board and authorized at an annual or special meeting of stockholders by at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We do not plan to “opt out” of these provisions. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire us.

SELLING SECURITYHOLDERS

On August 8, 2019, the Company entered into the Foreign Purchase Agreement with the Foreign Selling Securityholders for the sale of an aggregate of 2,700,000 shares of the Preferred Stock which have subsequently converted into 2,700,000 shares of Common Stock and the Foreign Warrants exercisable for 2,700,00 shares of Common Stock.

On August 8, 2019, the Company also entered into the Domestic Purchase Agreement with the Domestic Selling Securityholders for the sale of an aggregate 4,198,566 shares of Common Stock in a registered direct offering and unregistered Domestic Warrants exercisable for 4,198,566 shares of Common Stock. Additionally, as compensation for serving as placement agent in the Domestic Offering, Ladenburg was issued the Ladenburg Warrants exercisable for 167,942 shares of Common Stock in accordance with the Ladenburg Agreement.

We are registering the resale of the Shares and the Warrant Shares issued to permit each of the Selling Securityholders identified below, or their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, to resell or otherwise dispose of the shares in the manner contemplated under “Plan of Distribution” in this prospectus (as may be supplemented and amended). This prospectus covers the sale or other disposition by the Selling Securityholders of up to the total number of shares of Common Stock issued or issuable to the Selling Securityholders pursuant to the Foreign Purchase Agreement, Domestic Purchase Agreement and Ladenburg Agreement, as applicable. Throughout this prospectus, when we refer to the shares of our Common Stock being registered on behalf of the Selling Securityholders, we are referring to the shares issued or issuable to the Selling Securityholders pursuant to the Foreign Purchase Agreement, Domestic Purchase Agreement and Ladenburg Agreement, as applicable, and when we refer to the Selling Securityholders in this prospectus, we are referring to the parties under the same agreements, as applicable and, as applicable, their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

The Selling Securityholders may sell some, all or none of the Shares and/or Warrant Shares, as applicable. We do not know how long the Selling Securityholders will hold the Shares or Warrant Shares before selling them, and we currently have no agreements, arrangements or understandings with the Selling Securityholders regarding the sale or other disposition of any of the Shares or Warrant Shares. The Shares and/or Warrant Shares covered hereby may be offered from time to time by the Selling Securityholders.

The following table sets forth the name of each Selling Securityholder, the number of Shares and/or Warrant Shares owned by the Selling Securityholders as of October 14, 2019, the number of Shares and Warrant Shares that may be offered under this prospectus, and the number of shares of our Common Stock to be beneficially owned by the Selling Securityholders assuming all of the Shares and, after being exercised, the Warrant Shares covered hereby are sold. Solely for purposes of the following table, we have assumed that the Warrant Shares to be issued pursuant to the Warrants are owned by the Selling Securityholders even though the Warrants have not been exercised.

All information contained in the table below and the footnotes thereto is based upon information provided to us by the Selling Securityholders. The information in the table below and the footnotes thereto regarding shares of Common Stock to be beneficially owned after the offering assumes the sale of all Shares and Warrant Shares being offered by the Selling Securityholders under this prospectus. We believe that each of the Selling Securityholders named in this table has sole voting and investment power with respect to the shares of Common Stock indicated as owned.

The following table sets forth:

|

|

●

|

the name of each of the Selling Securityholders;

|

|

|

●

|

the number of shares of our Common Stock owned by each such Selling Securityholder prior to this offering on October 14, 2019;

|

|

|

●

|

the number of shares of our Common Stock being offered pursuant to this prospectus; and

|

|

|

●

|

the number of shares of our Common Stock beneficially owned upon completion of this offering.

|

Assuming all Shares and Warrant Shares are sold, all Selling Securityholders will still own more than 1% of our Common Stock after the offering, except Empery Tax Efficient, LP and Ladenburg, as shown in the below table.

|

Name of Selling Securityholder

|

|

Shares of Common Stock Owned Prior to Offering(1)

|

|

Shares of Common Stock Being Offered

|

|

Shares of Common Stock Owned After Offering(2)

|

|

Percent Owned After the Offering

|

|

Xiao Rui Liu

|

|

1,942,856(3)

|

|

800,000(4)

|

|

1,142,856

|

|

4.1%

|

|

Hai Dong Pang

|

|

2,057,142(5)

|

|

1,600,000(6)

|

|

457,142

|

|

1.6%

|

|

Ping Huang

|

|

4,142,856(7)

|

|

3,000,000(8)

|

|

1,142,856

|

|

4.1%

|

|

Armistice Capital Master Fund Ltd.

|

|

4,200,000(9)

|

|

2,100,000(10)

|

|

2,100,000

|

|

7.5%

|

|

Empery Asset Master, LTD

|

|

1,247,648(11)

|

|

623,824(12)

|

|

623,824

|

|

2.2%

|

|

Empery Tax Efficient, LP

|

|

362,510(13)

|

|

181,255(14)

|

|

181,255

|

|

*

|

|

Empery Tax Efficient II, LP

|

|

2,586,974(15)

|

|

1,293,487(16)

|

|

1,293,487

|

|

4.6%

|

|

Ladenburg Thalmann & Co. Inc.

|

|

167,942

|

|

167,942(17)

|

|

0

|

|

*

|

*Less than 1%

|

(1)

|

Includes shares of Common Stock issuable upon exercise of the Warrants. For purposes hereof, we assume the issuance of all such Warrant Shares pursuant to a cash exercise.

|

|

(2)

|

The numbers in the below column assume that all Shares and Warrant Shares, pursuant to this prospectus, are sold.

|

|

(3)

|

Consists of: (1) securities purchased in the Foreign Offering including 400,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 400,000 shares of Common Stock owned by the Selling Securityholder after the automatic conversion of the Preferred Stock on October 9, 2019 and (2) securities purchased in a private placement that occurred in June 2019 (the “June Private Placement”) including 571,428 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 571,428 shares of Common Stock owned by the Selling Securityholder, with such shares and shares underlying the warrants issued in the June Private Placement subsequently registered with the SEC on a Form S-3 (File No. 333-233623).

|

|

(4)

|

Consists of 400,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 400,000 shares of Common Stock owned by the Selling Securityholder after the automatic conversion of the Preferred Stock on October 9, 2019.

|

|

(5)

|

Consists of: (1) securities purchased in the Foreign Offering including 800,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 800,000 shares of Common Stock owned by the Selling Securityholder after the automatic conversion of the Preferred Stock on October 9, 2019 and (2) securities purchased in the June Private Placement including 228,571 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 228,571 shares of Common Stock owned by the Selling Securityholder, with such shares and shares underlying the warrants issued in the June Private Placement subsequently registered with the SEC on a Form S-3 (File No. 333-233623).

|

|

(6)

|

Consists of 800,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 800,000 shares of Common Stock owned by the Selling Securityholder after the automatic conversion of the Preferred Stock on October 9, 2019.

|

|

(7)

|

Consists of: (1) securities purchased in the Foreign Offering including 1,500,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 1,500,000 shares of Common Stock owned by the Selling Securityholder after the automatic conversion of the Preferred Stock on October 9, 2019 and (2) securities purchased in the June Private Placement including 571,428 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 571,428 shares of Common Stock owned by the Selling Securityholder, with such shares and shares underlying the warrants issued in the June Private Placement subsequently registered with the SEC on a Form S-3 (File No. 333-233623).

|

|

(8)

|

Consists of 1,500,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 1,500,000 shares of Common Stock owned by the Selling Securityholder after the automatic conversion of the Preferred Stock on October 9, 2019.

|

|

(9)

|

Consists of 2,100,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 2,100,000 shares of Common Stock, both purchased in the Domestic Offering.

|

|

(10)

|

Reflects the 2,100,000 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder, subject to the offering described in this prospectus.

|

|

(11)

|

Consists of 623,824 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 623,824 shares of Common Stock both purchased in the Domestic Offering.

|

|

(12)

|

Reflects the 623,824 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder, subject to the offering described in this prospectus.

|

|

(13)

|

Consists of 181,255 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 181,255 shares of Common Stock, both purchased in the Domestic Offering.

|

|

(14)

|

Reflects the 181,255 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder, subject to the offering described in this prospectus.

|

|

(15)

|

Consists of 1,293,487 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder and 1,293,487 shares of Common Stock, both purchased in the Domestic Offering.

|

|

(16)

|

Reflects the 1,293,487 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder, subject to the offering described in this prospectus.

|

|

(17)

|

Consists of 167,942 shares of Common Stock issuable upon the exercise of warrants held by the Selling Securityholder.

|

Relationships with the Selling Securityholders

Prior to the Foreign Offering, on June 17, 2019, the Company entered into a Securities Purchase Agreement for the sale of an aggregate of 1,371,427 shares of our Common Stock and warrants exercisable for 1,371,427 shares of Common Stock to the Foreign Selling Securityholders, for an aggregate purchase price of $2,400,000 (the “June 2019 Private Placement”).

Except as relates to the Domestic Offering described herein, within the past three years, neither the Domestic Selling Securityholders nor Ladenburg have had any position, office or other material relationship with the Company.

PLAN OF DISTRIBUTION

The Company is registering the shares of its Common Stock offered pursuant to the registration statement and related prospectus on behalf of the Selling Securityholders. The Selling Securityholders, which term as used herein includes pledgees, donees, transferees or other successors-in-interest selling shares received from the Selling Securityholders as a gift, pledge, partnership distribution or other transfer after the date of the prospectus, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in shares of Common Stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. The Selling Securityholders will pay any brokerage commissions and similar selling expenses attributable to the sale of the shares. The Company will pay other expenses relating to the preparation, updating and filing of the registration statement. The Company will not receive any of the proceeds from the sale of the Shares or Warrant Shares by the Selling Securityholders. In the case, however, of the Warrants, upon a cash exercise of the Warrants by the Selling Securityholders, the Company will receive, for each share of Common Stock exercised, the exercise price of $1.15 for the Foreign Warrants and Domestic Warrants and $1.25 for the Ladenburg Warrants. If the Warrants are exercised in a cashless exercise, the Company will not receive any proceeds from the exercise of the Warrants.

These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. To the extent any of the Selling Securityholders gift, pledge or otherwise transfer the Shares or Warrant Shares offered hereby, such transferees may offer and sell the Shares and Warrant Shares from time to time under the prospectus, provided that the prospectus has been amended under Rule 424(b)(3) or other applicable provision of the Securities Act, to include the name of such transferee in the list of Selling Securityholders under the prospectus.

The Selling Securityholders may use any one or more of the following methods when disposing of Shares or Warrant Shares or interests therein, some of which may or may not involve broker-dealers acting as agent or principal:

|

|

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

●

|

block trades in which the broker-dealer will attempt to sell the Shares or Warrant Shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

●

|

privately negotiated transactions;

|

|

|

●

|

settlement of short sales, to the extent permitted by law;

|

|

|

●

|

through the writing or settlement of options or other hedging transactions, whether through an option exchange or otherwise;

|

|

|

●

|

in transactions through broker-dealers that agree with the Selling Securityholders to sell a specified number of such Shares or Warrant Shares at a stipulated price per share;

|

|

|

●

|

a combination of any such methods of sale; or

|

|

|

●

|

any other method permitted pursuant to applicable law.

|

The Selling Securityholders may also sell securities under Rule 144, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Securityholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Securityholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with the Supplementary Material to FINRA Rule 2121.

In connection with the sale of the securities or interests therein, the Selling Securityholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Securityholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Securityholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Securityholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Securityholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the Selling Securityholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because Selling Securityholders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act, including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than under this prospectus. The Selling Securityholders have advised us that there is no underwriter or coordinating broker acting in connection with the proposed sale of the resale securities by the Selling Securityholders.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Securityholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance with the current public information requirements under Rule 144 or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Securityholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities of the Common Stock by the Selling Securityholders or any other person. We will make copies of this prospectus available to the Selling Securityholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

Certain legal matters with respect to the validity of the issuance of the securities offered hereby will be passed upon by our counsel, Squire Patton Boggs (US) LLP, Washington, DC.

EXPERTS

The consolidated financial statements of NovaBay appearing in its Annual Report on Form 10-K for the year ended December 31, 2018, as amended, have been audited by OUM & Co. LLP, an independent registered public accounting firm, as set forth in their report thereon, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement on Form S-1 that we have filed with the SEC under the Securities Act and therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration statement that are excluded from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other document.

We are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet site that contains reports, proxy and information statement, and other information regarding issuers that file electronically with the SEC, which are available at the SEC's website at http://www.sec.gov.

We also maintain a website at http://www.novabay.com/investors/sec-filings, through which you can access our SEC filings. The information set forth on our website is not part of this prospectus.

Incorporation by Reference

The SEC allows us to “incorporate by reference” the information we file with the SEC. This permits us to disclose important information to you by referring to these filed documents. Any information referred to in this way is considered part of this prospectus. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits, for further information about us and the securities we may offer pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete and each statement is qualified in all respects by that reference. We incorporate by reference the following documents that have been filed with the SEC (other than information furnished under Item 2.02 or Item 7.01 of Form 8-K and all exhibits related to such items):

|

|

●

|

our Annual Report on Form 10-K for the year ended December 31, 2018, as filed with the SEC on March 29, 2019 and amended on April 12, 2019;

|

|

|

●

|

our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2019 and June 30, 2019, as filed with the SEC on May 15, 2019 and August 7, 2019, respectively;

|

|

|

●

|

our Current Reports on Form 8-K, as filed with the SEC on March 1, 2019, March 11, 2019, March 28, 2019, April 1, 2019, April 15, 2019, May 3, 2019, May 21, 2019, June 3, 2019, June 17, 2019, June 19, 2019, June 26, 2019, July 1, 2019, July 25, 2019, August 9, 2019, August 13, 2019, September 16, 2019 and October 10, 2019; and

|

|

|

●

|

the description of our Common Stock in our registration statement on Form 8-A, as filed with the SEC on August 29, 2007 and updated by our Current Report on Form 8-K filed with the SEC on June 29, 2010.

|

Any information in any of the foregoing documents will automatically be deemed to be modified or superseded to the extent that information in this prospectus modifies or replaces such information. We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering of the securities made by this prospectus, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

We will provide, upon written or oral request, without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, a copy of any or all of the information incorporated herein by reference (exclusive of exhibits to such documents unless such exhibits are specifically incorporated by reference herein). You may request in writing or orally a copy of these filings, at no cost, by writing or telephoning us at the following address:

NovaBay Pharmaceuticals, Inc.

2000 Powell Street, Suite 1550

Emeryville, CA 94608

(510) 899-8800

Attn: Corporate Secretary

2,700,000 Shares of Common Stock

and

7,066,508 Shares of Common Stock Issuable upon Exercise of Warrants

PROSPECTUS

We have not authorized any dealer, salesperson or other person to give any information or to make any representations not contained in this prospectus. You must not rely on any unauthorized information. This prospectus is not an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is current as of the date of this prospectus. You should not assume that this prospectus is accurate as of any other date.

October 25, 2019

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 13. Other Expenses of Issuance and Distribution.

The expenses (other than underwriting discounts and expenses) payable by us in connection with this offering are as follows:

|

|

|

|

|

|

|

Amount

|

|

SEC registration fee

|

|

$717

|

|

|

|

Accounting fees and expenses

|

|

$5,000

|

|

|

|

Legal fees and expenses

|

|

$10,000

|

|

|

|

Transfer agent fees and expenses

|

|

$2,000

|

|

|

|

Total expenses

|

|

$17,717

|

|

|

|

|

|

* To be filed by amendment.

|

|

|

ITEM 14. Indemnification of Directors and Officers.

The Company’s amended and restated certificate of incorporation provides that the liability of the directors for monetary damages shall be eliminated to the fullest extent under applicable law. If the Delaware General Corporation Law is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Company shall be eliminated to the fullest extent permitted by the Delaware General Corporation Law, as so amended. Under the Delaware General Corporation Law, no director will be personally liable to the Company or the Company’s stockholders for monetary damages for breach of fiduciary duty as a director, except for liability:

|

|

●

|

for any breach of the duty of loyalty to the Company or the Company’s stockholders;

|

|

|

●

|

for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

|

|

|

●

|

for unlawful payment of dividends or unlawful stock repurchases or redemptions under Section 174 of the Delaware General Corporation Law; and

|

|

|

●

|

for any transaction from which the director derived an improper personal benefit.

|

|

|

|

The Company’s amended and restated bylaws provide that:

|

|

|

|

|

|

|

●

|

the Company is required to indemnify the Company’s directors and executive officers to the fullest extent not prohibited by Delaware law, subject to limited exceptions;

|

|

|

●

|

the Company may indemnify the Company’s other employees and agents as set forth in the Delaware General Corporation Law;

|

|

|

●

|

the Company is required to advance expenses to the Company’s directors and executive officers as incurred in connection with legal proceedings against them for which they may be indemnified, against an undertaking by the indemnified party to repay such advances if it is ultimately determined that the indemnified party is not entitled to indemnification; and

|

|

|

●

|

the rights conferred in the amended and restated bylaws are not exclusive.

|

The Company has entered into indemnification agreements with each of the Company’s directors and executive officers that require the Company to indemnify these persons all direct and indirect costs of any type or nature whatsoever, including attorney’s fees, witness fees, and other out-of-pocket costs of whatever nature, incurred by the director or officer in any action or proceeding, whether actual, pending or threatened, subject to certain limitations, to which any of these people may be made a party by reason of the fact that he or she is or was a director or an executive officer of the Company or is or was serving or at any time serves at the request of the Company as a director, officer, employee or other agent of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise.

The Company has purchased insurance on behalf of any person who is or was a director or officer of the Company against any loss arising from any claim asserted against him or her and incurred by him or her in any such capacity, subject to certain exclusions.

ITEM 15. Recent Sales of Unregistered Securities.

During the last three completed fiscal years and to date in the current fiscal year, we sold the following unregistered securities:

|

Capital Raise

|

|

# of Shares, Units or Warrants

|

|

Date

|

|

Sale of an aggregate 1,518,567 shares of Common Stock to Pioneer Pharma (Singapore) Pte. Ltd. and Mark M. Sieczkarek at $1.91 per share and to Jian Ping Fu at $1.81 per share for an aggregate purchase price of $2,830,804

|

|

1,518,567

|

|

February 16, 2016

|

|

|

|

|

|

|

|

Sale of an aggregate of 6,173,299 shares of Common Stock at $1.91 per share and warrants exercisable for 3,086,651 shares at an exercise price of $1.91 per share for an aggregate purchase price of $11,791,000

|

|

9,259,950

|

|

April 4, 2016

|

|

|

|

|

|

|

|

Sale of an aggregate of 1,700,000 shares of Common Stock at $3.52 per share for an aggregate purchase price of $5,984,000

|

|

1,700,000

|

|

February 8, 2018

|

|

|

|

|

|

|

|

Issuance of a secured convertible promissory note with an original principal amount of $2,215,000 which may be converted to shares of Common Stock at a conversion price of $1.65 per share for an aggregate purchase price of $2,000,000

|

|

—

|

|

March 26, 2019

|

|

|

|

|

|

|

|

Sale of an aggregate of 1,371,427 shares of Common Stock at $1.75 per share and warrants exercisable for 1,371,427 shares at an exercise price of $0.87 per share (subsequently registered on a resale registration statement on a Form S-3 (File No. 333-233623)) for an aggregate purchase price of $2,400,000

|

|

2,742,854

|

|

June 26, 2019

|

|

|

|

|

|

|

|

Sale of warrants exercisable for 4,198,566 shares at an exercise price of $1.15 per share that were sold with 4,198,566 shares of Common Stock in a registered direct offering for an aggregate purchase price of $4,198,566

|

|

4,198,566

|

|

August 13, 2019

|

|

|

|

|

|

|

|

Sale of an aggregate of 2,700,000 shares of Common Stock at $1.00 per share and warrants exercisable for 2,700,000 shares at an exercise price of $1.15 per share for an aggregate purchase price of $2,700,000

|

|

5,400,000

|

|

August 13, 2019

|