Weaker Shipments Hurt Results at Union Pacific

October 17 2019 - 8:58AM

Dow Jones News

By Micah Maidenberg

Union Pacific Corp. said weaker demand from a range of customers

pinched the railroad's revenue in the third quarter.

Overall volumes, as measured by revenue-generating carloads,

fell 8% in the quarter compared with the year earlier, Union

Pacific said Thursday. Volumes at Union Pacific were also lower in

the first and second quarters.

Higher shipments from industrial customers in the latest period

were more than offset by weaker shipments for agricultural goods,

energy products and higher-value items, the company said.

Union Pacific, based in Omaha, Neb., reported a quarterly profit

of $1.56 billion, or $2.22 a share, compared with $1.59 billion, or

$2.15 a share, the year earlier. Analysts predicted $2.31 a share

in adjusted profit, according to FactSet.

Revenue fell 7% from the year earlier to $5.52 billion, less

than the $5.67 billion forecast by Wall Street analysts.

Railroads operating in the U.S. are wrestling with a series of

challenges, including trade tensions that have damped Chinese

purchases of agricultural products, lower demand from utilities for

thermal coal and a slowing manufacturing sector.

U.S. railroads hauled about 21.3 million carloads and intermodal

units during the first 41 weeks of the year, down 4% compared with

the comparable period in 2018, according to the Association of

American Railroads.

(END) Dow Jones Newswires

October 17, 2019 08:43 ET (12:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

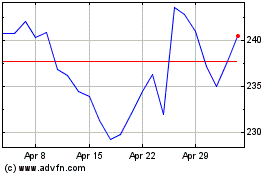

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Mar 2024 to Apr 2024

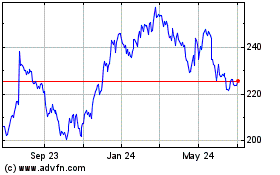

Union Pacific (NYSE:UNP)

Historical Stock Chart

From Apr 2023 to Apr 2024