Fannie, Freddie to Consider Alternatives to FICO Scores--3rd Update

August 13 2019 - 4:10PM

Dow Jones News

By Andrew Ackerman

WASHINGTON -- One firm's dominance over the credit scores used

to vet many U.S. mortgages is getting a shake-up.

Fannie Mae and Freddie Mac, two mortgage-finance firms that back

nearly half of U.S. mortgages, will have to consider credit-score

alternatives to Fair Isaac Corp.'s FICO score when determining a

mortgage applicant's creditworthiness, under a new rule issued on

Tuesday by the mortgage-finance giants' federal overseer.

The move by the Federal Housing Finance Agency is seen as a win

for VantageScore, a credit-score system by VantageScore Solutions

LLC, which is owned by the three large credit-reporting firms:

Equifax Inc., TransUnion and Experian PLC.

"One of my priorities is to ensure that the American people have

a safe and sound path to sustainable homeownership, which requires

tools to accurately measure risk," FHFA Director Mark Calabria said

in a written statement. The new rule "is an important step toward

achieving that goal, " he added.

Regulatory rollback legislation signed into law last year

required the FHFA to set new standards for Fannie Mae and Freddie

Mac to approve credit-score models.

Many nonbank lenders -- who approve mortgages to individuals and

initiate the bulk of mortgage dollars issued in the U.S. -- have

asked for the ability to use a credit score provided by

VantageScore. These lenders say the alternative score would open

the mortgage market to a greater number of people and lead to more

mortgage approvals, helping to boost home sales and the

economy.

Some lenders view FICO scores as an impediment, saying they tend

to be more conservative than alternatives.

Tuesday's final rule is a boon to VantageScore because it

eliminates language from a December proposal that would have

prohibited any credit score models developed by a company related

to a credit-reporting firm. The FHFA eliminated that restriction

amid pushback from the credit-reporting industry and congressional

lawmakers.

"Competition is critical for markets to operate efficiently and

we are confident this decision will benefit consumers, lenders and

the economy at-large," said Barrett Burns, president and chief

executive of VantageScore Solutions, in a written statement.

Credit scores help determine who gets a mortgage and on what

terms. They played a role in the last housing boom and bust as

lenders lowered credit-score requirements, extending hundreds of

billions of dollars of mortgages to subprime borrowers -- creating

a crushing number of defaults.

After the financial crisis, lenders tightened requirements for

potential home buyers. As part of this, they required higher credit

scores that reduced the number of people who qualified for a

mortgage.

That led some lenders to seek new kinds of scores that could be

used to expand the lending pool.

Since Fannie and Freddie back roughly half of U.S. mortgages, by

buying mortgages originated by others, their requirements have huge

sway over the mortgage market.

VantageScore has long said its score could help approve more

mortgage applicants, in part because it can assign a score to

consumers who haven't used credit in more than six months. FICO

said that VantageScore's approach, which seeks to give credit

scores to people with stale or thin credit files, would lead to

less predictive scores and riskier loans.

The measure goes into effect 60 days after its publication in

the Federal Register.

AnnaMaria Andriotis contributed to this article.

Write to Andrew Ackerman at andrew.ackerman@wsj.com

(END) Dow Jones Newswires

August 13, 2019 15:55 ET (19:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

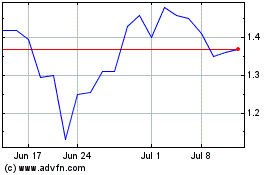

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

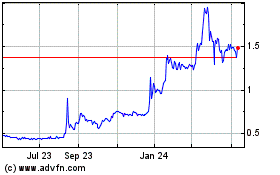

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024