FedEx Sets Buyouts As Unit Struggles -- WSJ

December 19 2018 - 3:02AM

Dow Jones News

By Paul Ziobro and Patrick Thomas

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 19, 2018).

Earlier this year, FedEx Corp. was giving out raises and bonuses

to its hourly workers. Now it's looking to eliminate thousands of

U.S. jobs.

The parcel carrier said Tuesday it was starting a voluntary

buyout program for some U.S. workers after troubles in its express

delivery business and a European acquisition have hurt profits. The

company declined to say how many jobs it is targeting, but said it

plans to make a similar offer to international workers.

FedEx employs more than 450,000 people globally. The company

says the vast majority of its buyout offers will be made to workers

at the FedEx Express unit, which has 227,000 employees, and at

FedEx Services, which provides back-office functions and employs

another 30,000 people.

The Memphis-based company also cut its profit targets for the

current fiscal year, which ends in May. The changes come after

FedEx abruptly replaced the head of its Express unit David

Cunningham, who is retiring at the end of the month.

Shares of FedEx plunged 6% to $173.80 in after-hours trading. As

of Tuesday's closing price, the stock had fallen about 26% so far

this year, compared with a 19% decline for United Parcel Service

Inc., shares of which fell about 4% in late trading.

In the wake of last year's U.S. tax overhaul that dropped the

corporate rate, FedEx was one of the first companies to commit to

new spending and wage increases. In January, the company said it

would spend $200 million on raises, mostly for hourly workers, and

put $1.5 billion into pension plans.

FedEx executives say major challenges have emerged overseas,

with weakness across Europe stemming from ongoing Brexit talks to

protests in France. Tariffs and trade disputes are also raising

concerns in Asia, and causing some customers to reevaluate their

supply chains. "The peak for global economic growth now appears to

be behind us," FedEx Chief Marketing Officer Raj Subramaniam said

on a conference call.

FedEx also said Tuesday that it was offering four weeks of pay

for every year of service, up to a maximum of two years of pay, as

well as funding to healthcare accounts.

The carrier said the buyout program should result in a $450

million to $575 million pre-tax charge in the quarter ending May

31. Costs will depend on how many employees exit. The company said

savings from this program are expected to be $225 million to $275

million in fiscal 2020.

FedEx is also taking other measures to absorb the slowdown,

including reducing international capacity at FedEx Express,

limiting hiring and curbing discretionary spending.

The company has struggled since acquiring European rival TNT

Express for $4.8 billion in 2016. The business was paralyzed by a

cyberattack in 2017 and has also struggled with integration and

lower-than-expected package volumes.

FedEx said the TNT deal won't improve profits by at least $1.2

billion next fiscal year as it had projected.

The buyouts and cost cuts come as FedEx is in the midst of its

peak shipping period, the busiest stretch of the year between

Thanksgiving and Christmas. FedEx Chairman and CEO Fred Smith said

that despite slowdowns overseas, the U.S. economy remains

strong.

Mr. Smith said the company's performance during peak has been

good so far this season. In FedEx's ground unit, 96% of packages

are moving through automated facilities and, recently, 67% of

packages were being delivered one day faster than promised.

For the quarter ended Nov. 30, FedEx reported a profit of $935

million, compared with $866 million a year ago. Revenue was $17.8

billion. For the full year, FedEx lowered its per-share earnings

forecast for the current fiscal year to $12.65 to $13.40 a share

from $15.50 to $16.60.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

December 19, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

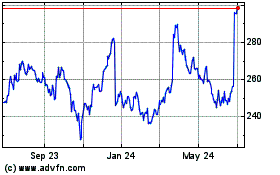

FedEx (NYSE:FDX)

Historical Stock Chart

From Aug 2024 to Sep 2024

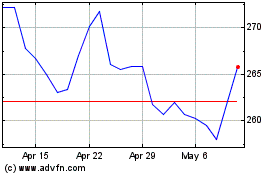

FedEx (NYSE:FDX)

Historical Stock Chart

From Sep 2023 to Sep 2024