Vote Paves Way for Dell to Trade Publicly Again

December 11 2018 - 1:26PM

Dow Jones News

By Cara Lombardo and Micah Maidenberg

Dell Technologies Inc. is set to return to public markets later

this month, after the PC maker and data-storage company recut a

deal that garnered sufficient shareholder support.

Shareholders of a stock that tracks Dell's interest in software

maker VMware Inc. voted Tuesday to approve a deal that will

simplify Dell's complex ownership structure and return it to the

public markets. The vote followed months of shareholder resistance

that prompted Dell to increase its offer and restructure its

deal.

Under the terms of the roughly $24 billion deal, Dell will buy

out shareholders in the tracking stock, known by its ticker, DVMT.

When the deal closes, which is expected Dec. 28, Dell shares will

begin trading on the New York Stock Exchange under the ticker

DELL.

Dell said Tuesday that more than 61% of all the unaffiliated

shareholders in the tracking stock voted in favor of the

transaction. Of the unaffiliated shareholders who cast votes, 89%

supported the deal.

The shareholder opposition was led by activist investor Carl

Icahn, who argued Dell was overvaluing its own shares and, as a

result, not paying tracking-stock shareholders enough for theirs.

Mr. Icahn, who also lobbied against the deal that took Dell private

in 2013, launched a proxy fight against the transaction and sued

Dell, accusing it of withholding information.

Other shareholders unhappy with the deal's original terms

included Elliott Management Corp., BlackRock Inc., and Dodge &

Cox, among others.

The Wall Street Journal reported that Dell met with several top

shareholders last month to negotiate a new offer that would have

adequate shareholder support. It came out days later with a

sweetened offer publicly endorsed by several top shareholders who

owned a combined 17% stake in DVMT.

Dell's final offer had an implied value of about $24 billion,

including $14 billion in cash and the remainder in shares of the

future publicly traded Dell. In a unique twist, the exact

consideration was tied to how DVMT shares trade. Dell also agreed

to allow shareholders of the newly public Dell to elect an

independent board member.

Mr. Icahn withdrew his proxy fight and lawsuit after Dell

increased the deal terms.

The initial offer had an implied value of about $22 billion. As

shareholder dissatisfaction simmered, Dell considered a traditional

initial public offering instead and interviewed several banks for

underwriting roles, The Wall Street Journal reported.

Dell set up the DVMT tracking stock in 2015 to help it finance

its takeover of the data-storage company EMC Corp., then the owner

of most of VMware. Tracking stocks let companies expose business to

public markets, potentially increasing their value and

visibility.

Dell was taken private in a $24.4 billion leveraged buyout. That

deal was led by Michael Dell, the company's founder, and investment

firm Silver Lake. Dell's return to public markets also would allow

Silver Lake to cash out of its investment.

Write to Cara Lombardo at cara.lombardo@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

December 11, 2018 13:11 ET (18:11 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

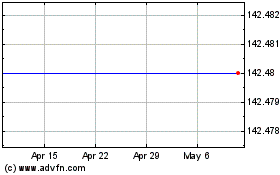

Vmware (NYSE:VMW)

Historical Stock Chart

From Aug 2024 to Sep 2024

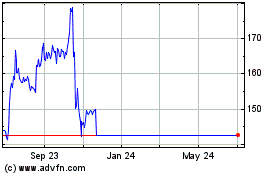

Vmware (NYSE:VMW)

Historical Stock Chart

From Sep 2023 to Sep 2024