Net Sales Increased 2.8% to $2.3B; Comparable

Store Sales Increased 2.8%

Operating Income Increased 14.2% to $167.5M;

Adjusted Operating Income Increased 5.0% to $205.3M

Diluted EPS Increased 35.9% to $1.59; Adjusted

EPS Increased 24.7% to $1.97

Announces New $600 Million Share Repurchase

Authorization

Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive

aftermarket parts provider in North America, that serves both

professional installer and do-it-yourself customers, today

announced its financial results for the second-quarter ended

July 14, 2018.

Second Quarter Performance Summary ($ in

millions, except per share data)

Twelve Weeks Ended

Twenty-Eight Weeks Ended Favorable/(Unfavorable)

July 14, 2018 July 15, 2017 July 14,

2018 July 15, 2017 Net sales $ 2,326.7 $

2,263.7 $ 5,200.5 $ 5,154.6 change in Net sales 2.8 % 0.9 %

Comparable store sales % 2.8 % 0.0 % 0.8 % (1.5 %)

Gross profit $ 1,011.6 $ 993.1 $ 2,283.8 $ 2,263.8 Gross

profit margin (% net sales) 43.5 % 43.9 % 43.9 % 43.9 % change in

Gross profit margin (39 ) bps — bps

Adjusted gross

profit (a) $ 1,016.9 $ 993.1 $ 2,289.2 $ 2,263.8 Adjusted gross

profit margin (% net sales) 43.7 % 43.9 % 44.0 % 43.9 % change in

Adjusted gross profit margin (16 ) bps 10 bps

SG&A $ 844.0 $ 846.4 $ 1,918.1 $ 1,937.3 SG&A (% net

sales) 36.3 % 37.4 % 36.9 % 37.6 % change in SG&A (% net sales)

111 bps 70 bps

Adjusted SG&A (a) $ 811.6 $ 797.6

$ 1,859.8 $ 1,863.3 Adjusted SG&A (% net sales) 34.9 % 35.2 %

35.8 % 36.1 % change in Adjusted SG&A (% net sales) 35 bps 39

bps

Operating income $ 167.5 $ 146.7 $ 365.8 $ 326.5

Operating income margin (% net sales) 7.2 % 6.5 % 7.0 % 6.3 %

change in Operating income margin 72 bps 70 bps

Adjusted

operating income (a) $ 205.3 $ 195.5 $ 429.4 $ 400.4 Adjusted

operating income margin (% net sales) 8.8 % 8.6 % 8.3 % 7.8 %

change in Adjusted operating income margin 19 bps 49 bps

Diluted EPS $ 1.59 $ 1.17 $ 3.43 $ 2.63

Adjusted EPS

(a) $ 1.97 $ 1.58 $ 4.07 $ 3.18

Average diluted

shares (in thousands) 74,244 74,093 74,222 74,093

(a)

For a better understanding of the

Company's adjusted results, refer to the reconciliation of non-GAAP

adjustments in the accompanying financial tables in this press

release.

Second Quarter 2018 Highlights

“Our relentless focus on strengthening our Customer Value

Proposition while embracing an owner’s mindset on cost and cash

resulted in improved sales and profit performance in the second

quarter. I am encouraged by the progress our team made during the

first half of 2018 and confident in our ability to drive growth

throughout the balance of 2018,” said Tom Greco, President and

Chief Executive Officer.

Total Net sales for the second quarter of 2018 were $2.3

billion, a 2.8% increase versus the second quarter of the prior

year. Comparable store sales for the second quarter of 2018

increased 2.8%.

Adjusted gross margin was 43.7% of Net sales in the second

quarter of 2018, a 16 basis point decrease from the second quarter

of 2017. The decline was primarily driven by an increase in supply

chain costs, including higher transportation and fuel expenses. The

Company's GAAP Gross profit margin decreased to 43.5% from 43.9% in

the second quarter of the prior year.

Adjusted SG&A was 34.9% of Net sales in the second quarter

of 2018, a 35 basis point improvement as compared to the second

quarter of 2017. This was primarily driven by savings in labor and

insurance costs, partially offset by higher bonus. The Company's

GAAP SG&A of 36.3% of Net sales decreased compared to 37.4% in

the same quarter of the prior year.

The Company's Adjusted operating income was $205.3 million in

the second quarter of 2018, an increase of 5.0% versus the second

quarter of the prior year. Adjusted operating income margin

improved versus the same quarter of the prior year by 19 basis

points to 8.8% of Net sales for the second quarter of 2018. On a

GAAP basis, the Company's Operating income was $167.5 million, 7.2%

of Net sales, an increase of 72 basis points from the second

quarter of 2017.

The Company's effective tax rate in the second quarter of 2018

was 25.2%, compared to 36.0% in the second quarter of the prior

year. The Company's Adjusted EPS was $1.97 for the second quarter

of 2018, an increase of 24.7% compared to the second quarter of the

prior year. On a GAAP basis, the Company's Diluted EPS increased

35.9% to $1.59.

Operating cash flow was $444.0 million through the second

quarter of 2018 versus $267.3 million in the same period of the

prior year, an increase of 66.1%. Free cash flow through the second

quarter of 2018 was $382.2 million, an increase of 163.6% compared

to the same period of the prior year.

2018 Full Year Guidance

Mr. Greco commented “Following a stronger start to the year and

our expectation that the improving demand environment continues, we

are updating our full year 2018 guidance. Our increased revenue

outlook is reflective of the improving industry trends, coupled

with our top-line growth, better operational execution and our

robust SKU assortment. Our team remains dedicated to cost control

to enable further margin improvement.”

The Company provided the following update to its full year 2018

outlook:

Full Year 2018 ($ in millions)

Low

High Total Net Sales $ 9,300 $ 9,500 Comparable Store

Sales (1) 0.0% 1.5% Adjusted Operating Income Margin (2) 7.5% 7.8%

Income Tax Rate 24% 26% Integration & Transformation Expenses

(2) $ 140 $ 180 Capital Expenditures $ 180 $ 220 Free Cash Flow

Minimum $ 500

(1)

Comparable store sales estimate excludes

sales to independently owned Carquest locations.

(2)

For a better understanding of the

Company's adjusted results, refer to the reconciliation of non-GAAP

adjustments in the accompanying financial tables in this press

release. Because of the forward-looking nature of the 2018 non-GAAP

financial measures, specific quantifications of the amounts that

would be required to reconcile these non-GAAP financial measures to

their most directly comparable GAAP financial measures are not

available at this time.

Share Repurchase Authorization

“I am pleased with our ability to manage working capital and

build cash balances that provide enhanced value for our

shareholders. In line with our financial priorities, we are

delighted to announce our target to return $100 - $200 million to

our shareholders through the new share repurchase program during

the second half of 2018. This reinforces our confidence in the

strength of our balance sheet and the level of liquidity achieved

through the disciplined execution of our strategic plan.” said Mr.

Greco.

On August 8, 2018, the Company's Board of Directors authorized a

$600 million share repurchase program. This new authorization

replaces the Company's $500 million share repurchase program

authorized in May 2012, which had $415 million remaining.

Dividend

On August 8, 2018, the Company's Board of Directors

declared a regular quarterly cash dividend of $0.06 per share to be

paid on October 5, 2018 to all common shareholders of record

as of September 21, 2018.

Investor Conference Call

The Company will detail its results for the second quarter of

2018 via a webcast scheduled to begin at 8 a.m. Eastern Time on

Tuesday, August 14, 2018. The webcast will be accessible via

the Investor Relations page of the Company's website

(www.AdvanceAutoParts.com).

For individuals unable to access the webcast, the event will be

available by dialing (844) 877-5989 and referencing conference

identification number 1687557. A replay of the conference call will

be available on the Company's website for one year.

About Advance Auto Parts

Advance Auto Parts, Inc. is a leading automotive aftermarket

parts provider that serves both professional installer and

do-it-yourself customers. As of July 14, 2018, Advance

operated 5,026 stores and 133 Worldpac branches in the United

States, Canada, Puerto Rico and the U.S. Virgin Islands. The

Company also serves 1,219 independently owned Carquest branded

stores across these locations in addition to Mexico and the

Bahamas, Turks and Caicos, British Virgin Islands and Pacific

Islands. Additional information about the Company, including

employment opportunities, customer services, and online shopping

for parts, accessories and other offerings can be found at

www.AdvanceAutoParts.com.

Forward-Looking Statements

Certain statements contained in this release are forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements address future events or

developments, and typically use words such as “believe,”

“anticipate,” “expect,” “intend,” “plan,” “forecast,” “guidance,”

“outlook” or “estimate.” These forward-looking statements include,

but are not limited to, key assumptions for future financial

performance including net sales, store growth, comparable store

sales, gross profit rate, SG&A, adjusted operating income,

income tax rate, integration and transformation costs, adjusted

operating income rate targets, capital expenditures, inventory

levels and free cash flow; statements regarding expected growth and

future performance of Advance Auto Parts, Inc. (the “Company”);

statements regarding enhancements to shareholder value, strategic

plans or initiatives, growth or profitability, productivity targets

and all other statements that are not statements of historical

facts. These statements are based upon assessments and assumptions

of management in light of historical results and trends, current

conditions and potential future developments that often involve

judgment, estimates, assumptions and projections. Forward-looking

statements reflect current views about our plans, strategies and

prospects, which are based on information currently available as of

the date of this report. Except as required by law, we undertake no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of such statements. Please

refer to the “Risk Factors” section of the annual report on Form

10-K for the year ended December 30, 2017, and other filings

made by the Company with the Securities and Exchange Commission for

additional risk factors that could materially affect the Company’s

actual results. Forward-looking statements are subject to risks and

uncertainties, many of which are outside our control, which could

cause actual results to differ materially from these statements.

Therefore, you should not place undue reliance on those statements.

We intend for any forward-looking statements to be covered by, and

we claim the protection under, the safe harbor provisions for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (in thousands)

(unaudited)

July 14, 2018 December 30,

2017

Assets

Current assets: Cash and cash equivalents $ 902,249 $

546,937 Receivables, net 664,149 606,357 Inventories 4,159,756

4,168,492 Other current assets 151,662 105,106 Total current

assets 5,877,816 5,426,892

Property and equipment,

net 1,338,931 1,394,138

Goodwill 991,934 994,293

Intangible assets, net 571,953 597,674

Other assets,

net 54,922 69,304 $ 8,835,556 $ 8,482,301

Liabilities and

Stockholders' Equity

Current liabilities: Accounts payable $ 2,909,990 $

2,894,582 Accrued expenses 635,896 533,548 Other current

liabilities 52,331 51,967 Total current liabilities

3,598,217 3,480,097

Long-term debt 1,045,077

1,044,327

Deferred income taxes 314,091 303,620

Other

long-term liabilities 220,222 239,061

Total stockholders'

equity 3,657,949 3,415,196 $ 8,835,556 $

8,482,301

NOTE: These preliminary condensed consolidated balance sheets

have been prepared on a basis consistent with our previously

prepared balance sheets filed with the Securities and Exchange

Commission, but do not include the footnotes required by generally

accepted accounting principles, or GAAP, for complete financial

statements.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations (in

thousands, except per share data) (unaudited)

Twelve Weeks Ended Twenty-Eight Weeks Ended

July 14, 2018 July 15, 2017 July 14,

2018 July 15, 2017 Net sales $ 2,326,652 $

2,263,727 $ 5,200,500 $ 5,154,565 Cost of sales 1,315,093

1,270,639 2,916,658 2,890,793 Gross profit

1,011,559 993,088 2,283,842 2,263,772 Selling, general and

administrative expenses 844,018 846,377 1,918,061

1,937,281 Operating income 167,541 146,711

365,781 326,491 Other, net: Interest expense

(12,855 ) (13,921 ) (30,537 ) (32,351 )

Other income, net

2,785 3,169 3,243 7,982 Total other,

net (10,070 ) (10,752 ) (27,294 ) (24,369 ) Income before provision

for income taxes 157,471 135,959 338,487 302,122 Provision for

income taxes 39,635 48,910 83,925 107,113

Net income $ 117,836 $ 87,049 $ 254,562

$ 195,009 Basic earnings per share $ 1.59 $ 1.18 $

3.44 $ 2.64 Average shares outstanding 74,054 73,848 74,011 73,810

Diluted earnings per share $ 1.59 $ 1.17 $ 3.43 $ 2.63

Average diluted shares outstanding 74,244 74,093 74,222 74,093

NOTE: These preliminary condensed consolidated statements of

operations have been prepared on a basis consistent with our

previously prepared statements of operations filed with the

Securities and Exchange Commission, but do not include the

footnotes required by GAAP for complete financial statements.

Advance Auto Parts, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (in

thousands) (unaudited)

Twenty-Eight Weeks Ended

July 14, 2018 July 15, 2017 Cash

flows from operating activities:

Net income

$ 254,562 $ 195,009 Depreciation and amortization 128,244 135,200

Share-based compensation 12,413 19,938 Provision (benefit) for

deferred income taxes 11,195 (16,006 ) Other non-cash adjustments

to net income 5,937 6,212 Net change in: Receivables, net (59,995 )

(37,012 ) Inventories 2,140 41,923 Accounts payable 19,083 (153,750

) Accrued expenses 112,214 91,333 Other assets and liabilities, net

(41,825 ) (15,498 ) Net cash provided by operating activities

443,968 267,349

Cash flows from investing

activities: Purchases of property and equipment (61,815 )

(122,364 ) Proceeds from sales of property and equipment 578 1,311

Other, net — 20 Net cash used in investing activities

(61,237 ) (121,033 )

Cash flows from financing activities:

Decrease in bank overdrafts (8,362 ) (4,202 ) Net payments on

credit facilities — — Dividends paid (13,398 ) (13,363 ) Proceeds

from the issuance of common stock 1,697 2,281 Tax withholdings

related to the exercise of stock appreciation rights (304 ) (6,230

) Repurchase of common stock (5,657 ) (3,303 ) Other, net 784

(2,027 ) Net cash used in financing activities (25,240 )

(26,844 ) Effect of exchange rate changes on cash (2,179 ) 2,580

Net increase in cash and cash equivalents

355,312 122,052

Cash and cash equivalents, beginning of

period 546,937 135,178

Cash and cash

equivalents, end of period $ 902,249 $ 257,230

NOTE: These preliminary condensed consolidated statements of

cash flows have been prepared on a consistent basis with previously

prepared statements of cash flows filed with the Securities and

Exchange Commission, but do not include the footnotes required by

GAAP for complete financial statements.

Reconciliation of Non-GAAP Financial

Measures

The Company's financial results include certain financial

measures not derived in accordance with accounting principles

generally accepted in the United States of America

(“GAAP”). Non-GAAP financial measures should not be used as a

substitute for GAAP financial measures, or considered in isolation,

for the purpose of analyzing our operating performance, financial

position or cash flows. We have presented these non-GAAP financial

measures as we believe that the presentation of our financial

results that exclude (1) non-operational expenses associated with

the integration of General Parts International, Inc. ("GPI") and

store closure and consolidation costs; (2) non-cash charges related

to the acquired GPI intangibles; and (3) transformation expenses

under our strategic business plan, is useful and indicative of our

base operations because the expenses vary from period to period in

terms of size, nature and significance and/or relate to the

integration of GPI and store closure and consolidation activity in

excess of historical levels. These measures assist in comparing our

current operating results with past periods and with the

operational performance of other companies in our industry. The

disclosure of these measures allows investors to evaluate our

performance using the same measures management uses in developing

internal budgets and forecasts and in evaluating management’s

compensation. Included below is a description of the expenses we

have determined are not normal, recurring cash operating expenses

necessary to operate our business and the rationale for why

providing these measures is useful to investors as a supplement to

the GAAP measures.

GPI Integration Expenses - We

acquired GPI for $2.08 billion in 2014 and are in the midst of a

multi-year plan to integrate the operations of GPI with AAP. This

includes the integration of product brands and assortments, supply

chain and information technology. The integration is being

completed in phases and the nature and timing of expenses will vary

from quarter to quarter over several years. The integration of

product brands and assortments was primarily completed in 2015. Our

our focus then shifted to integrating the supply chain and

information technology systems. Due to the size of the acquisition,

we consider these expenses to be outside of our base business.

Therefore, we believe providing additional information in the form

of non-GAAP measures that exclude these costs is beneficial to the

users of our financial statements in evaluating the operating

performance of our base business and our sustainability once the

integration is completed.

Store Closure and Consolidation

Expenses - Store closure and consolidation expenses consist

of expenses associated with our plans to convert and consolidate

the Carquest stores acquired from GPI. The conversion and

consolidation of the Carquest stores is a multi-year process that

began in 2014. As of July 14, 2018, 352 Carquest stores

acquired from GPI had been consolidated into existing Advance Auto

Parts (“AAP”) stores and 423 stores had been converted to the AAP

format. While periodic store closures are common, these closures

represent a major program outside of our typical market evaluation

process. We believe it is useful to provide additional non-GAAP

measures that exclude these costs to provide investors greater

comparability of our base business and core operating performance.

We also continue to have store closures that occur as part of our

normal market evaluation process and have not excluded the expenses

associated with these store closures in computing our non-GAAP

measures.

Transformation Expenses - We expect

to recognize a significant amount of transformation expenses over

the next several years as we transition from integration of our

Advance Auto Parts and Carquest US ("AAP/CQUS") businesses to a

plan that involves a more holistic and integrated transformation of

the entire Company, including Worldpac and Autopart International

("AI"). These expenses will include, but not be limited to,

restructuring costs, third-party professional services and other

significant costs to integrate and streamline our operating

structure across the enterprise. We are focused on several areas

throughout Advance, such as supply chain and information

technology.

Reconciliation of

Adjusted Net Income and Adjusted EPS:

Twelve Weeks Ended Twenty-Eight Weeks

Ended (in thousands, except per share data)

July 14,

2018 July 15, 2017 July 14, 2018

July 15, 2017 Net income (GAAP) $ 117,836 $ 87,049 $ 254,562

$ 195,009 Cost of sales adjustments:

Transformation expenses

5,327 — 5,327 — SG&A adjustments: GPI integration and store

consolidation costs 716 6,919 2,938 19,783 GPI amortization of

acquired intangible assets 8,750 9,124 20,466 21,403 Transformation

expenses 22,974 32,753 34,853 32,753 Other income adjustment (a) —

(502 ) — (8,878 ) Provision for income taxes on adjustments (b)

(9,442 ) (18,351 ) (15,896 ) (24,723 ) Adjusted net income

(Non-GAAP) $ 146,161 $ 116,992 $ 302,250 $

235,347 Diluted earnings per share (GAAP) $ 1.59 $

1.17 $ 3.43 $ 2.63 Adjustments, net of tax 0.38 0.41

0.64 0.55 Adjusted EPS (Non-GAAP) $ 1.97 $

1.58 $ 4.07 $ 3.18

Note: Table amounts may not foot due to

rounding.

(a)

The adjustment to Other income for the

twelve and twenty-eight weeks ended July 15, 2017 relates to income

recognized from an indemnification agreement associated with the

acquisition of General Parts.

(b)

The income tax impact of non-GAAP

adjustments is calculated using the estimated tax rate in effect

for the respective non-GAAP adjustments.

Reconciliation of

Adjusted Gross Profit

Twelve Weeks Ended Twenty-Eight

Weeks Ended (in thousands)

July 14, 2018 July

15, 2017 July 14, 2018 July 15, 2017 Gross

Profit (GAAP) $ 1,011,559 $ 993,088 $ 2,283,842 $ 2,263,772 Gross

Profit adjustments 5,327 — 5,327 — Adjusted

Gross Profit (Non-GAAP) $ 1,016,886 $ 993,088 $

2,289,169 $ 2,263,772

Reconciliation of

Adjusted Selling, General and Administrative

Expenses:

Twelve Weeks Ended Twenty-Eight Weeks

Ended (in thousands)

July 14, 2018 July 15,

2017 July 14, 2018 July 15, 2017 SG&A

(GAAP) $ 844,018 $ 846,377 $ 1,918,061 $ 1,937,281 SG&A

adjustments (32,440 ) (48,795 ) (58,257 ) (73,939 ) Adjusted

SG&A (Non-GAAP) $ 811,578 $ 797,582 $ 1,859,804

$ 1,863,342

Reconciliation of

Adjusted Operating Income:

Twelve Weeks Ended Twenty-Eight

Weeks Ended (in thousands)

July 14, 2018 July

15, 2017 July 14, 2018 July 15, 2017

Operating income (GAAP) $ 167,541 $ 146,711 $ 365,781 $ 326,491

Cost of sales and SG&A Adjustments 37,767 48,795

63,584 73,939 Adjusted operating income (Non-GAAP) $ 205,308

$ 195,506 $ 429,365 $ 400,430

NOTE: Adjusted Operating Income is a non-GAAP measure.

Management believes Adjusted Operating Income is an important

measure in assessing the overall performance of the business and

utilizes this metric in its ongoing reporting. On that basis,

Management believes it is useful to provide Adjusted Operating

Income to investors and prospective investors to evaluate the

Company’s operating performance across periods adjusting for these

items (refer to the reconciliation of non-GAAP adjustments above).

Adjusted Operating Income might not be calculated in the same

manner as, and thus might not be comparable to, similarly titled

measures reported by other companies. Adjusted Operating Income

should not be used by investors or third parties as the sole basis

for formulating investment decisions, as it excludes a number of

important cash and non-cash recurring items.

Reconciliation of

Free Cash Flow:

Twenty-Eight Weeks Ended (In thousands)

July 14, 2018 July 15, 2017 Cash flows from

operating activities $ 443,968 $ 267,349 Purchases of property and

equipment (61,815 ) (122,364 ) Free cash flow $ 382,153 $

144,985

NOTE: Management uses free cash flow as a measure of our

liquidity and believes it is a useful indicator to investors or

potential investors of our ability to implement our growth

strategies and service our debt. Free cash flow is a non-GAAP

measure and should be considered in addition to, but not as a

substitute for, information contained in our condensed consolidated

statement of cash flows.

Adjusted Debt to

Adjusted EBITDAR:

Four Quarters Ended (In thousands, except

adjusted debt to adjusted EBITDAR ratio)

July 14, 2018

December 30, 2017 Total debt $ 1,045,258 $ 1,044,677

Add: Capitalized lease obligations (six times rent expense)

3,230,118 3,189,756 Adjusted debt 4,275,376 4,234,433

Operating income 609,502 570,212 Add: Adjustments (a) 67,214 76,632

Depreciation and amortization 242,304 249,260 Adjusted

EBITDA 919,020 896,104 Rent expense (less favorable lease

amortization of $202 and $1,864) 538,353 531,626 Share-based

compensation 27,742 35,267 Adjusted EBITDAR $ 1,485,115

$ 1,462,997

Adjusted Debt to Adjusted EBITDAR

2.9 2.9

(a)

The adjustments to the four quarters ended

July 14, 2018 and December 30, 2017 include General Parts

integration, store consolidation costs and transformation

expenses.

NOTE: Management believes its Adjusted Debt to Adjusted EBITDAR

ratio (“leverage ratio”) is a key financial metric for debt

securities, as reviewed by rating agencies, and believes its debt

levels are best analyzed using this measure. The Company’s goal is

to maintain a 2.5 times leverage ratio and investment grade rating.

The Company's credit rating directly impacts the interest rates on

borrowings under its existing credit facility and could impact the

Company's ability to obtain additional funding. If the Company was

unable to maintain its investment grade rating this could

negatively impact future performance and limit growth

opportunities. Similar measures are utilized in the calculation of

the financial covenants and ratios contained in the Company's

financing arrangements. The leverage ratio calculated by the

Company is a non-GAAP measure and should not be considered a

substitute for debt to net earnings, net earnings or debt as

determined in accordance with GAAP. The Company adjusts the

calculation to remove rent expense and capitalize the Company’s

existing operating leases to provide a more meaningful comparison

with the Company’s peers and to account for differences in debt

structures and leasing arrangements. The use of a multiple of rent

expense to calculate the adjustment for capitalized operating lease

obligations is a commonly used method of estimating the debt the

Company would record for its leases that are classified as

operating if they had met the criteria for a capital lease or the

Company had purchased the property. The Company’s calculation of

its leverage ratio might not be calculated in the same manner as,

and thus might not be comparable to, similarly titled measures by

other companies.

Store Information:

During the twenty-eight weeks ended July 14, 2018, 11

stores and branches were opened and 35 were closed or consolidated,

resulting in a total of 5,159 stores and branches as of

July 14, 2018, compared to a total of 5,183 stores and

branches as of December 30, 2017.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180814005123/en/

Advance Auto Parts, Inc.Investor Relations

Contact:Elisabeth Eisleben,

919-227-5466invrelations@advanceautoparts.comorMedia

Contact:Kevin Nash, 866-463-4512kevin.nash@advance-auto.com

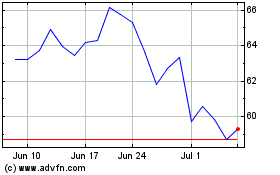

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Aug 2024 to Sep 2024

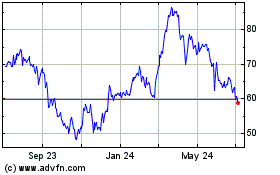

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Sep 2023 to Sep 2024