By Lingling Wei and Yoko Kubota

BEIJING -- When a group of American executives and other global

corporate chieftains met with Chinese Vice President Wang Qishan in

late March, they received a stern message about the simmering

U.S.-China trade conflict: If tensions escalate, buckle up.

"The message was pretty clear," said a person who attended. "A

lot of companies would become victims in a U.S.-China trade

war."

That is what American multinationals are now bracing for, after

the Trump administration said it would move ahead with 25% tariffs

on $50 billion in Chinese goods. Beijing said in response to the

U.S. move Friday that it would retaliate in "equal scale and equal

strength."

While a battle between the world's two largest economies would

inflict pain on businesses and consumers in both countries, in the

crosshairs, in particular, are multinationals with a footprint in

the mainland.

A sophisticated global supply chain means many foreign companies

nowadays assemble their products in China with parts bought

elsewhere, and then sell to the U.S. and other markets. That leaves

them vulnerable to any new U.S. sanctions as well as pressure and

other retaliation from Beijing.

Foreign-invested companies, including firms from Hong Kong and

Taiwan, produce 43% of China's exports, according to an analysis by

the Conference Board, a New York think tank. The manufacturers

among them notably make up 77% of China's exports of information

and communications technology -- a sector highlighted by the Trump

administration for new tariffs.

At the March gathering, people who attended said, Mr. Wang told

the business leaders -- which included senior executives from

International Business Machines Corp., chip maker Qualcomm Inc. and

private-equity firm Blackstone Group -- that they should try harder

to lobby the Trump administration against launching a trade

offensive.

The U.S. said on Friday the trade levies are designed to hit

products linked to Chinese strategic plans to dominate new

high-technology industries, and released a list that covers 1,102

categories of goods. Though China didn't immediately announce its

targets, a previously issued list proposed penalizing U.S. farm

exports, smaller commercial passenger planes and other goods.

While multinationals assess the potential impact from the

escalation of trade tensions, makers of consumer electronics have

been canvassing suppliers and, in the case of at least two

personal-computer makers, inquiring about shifting some of

production in China to the U.S.

Foxconn Technology Group of Taiwan, the world's largest contract

manufacturer of electronics and known for assembling Apple Inc.'s

smartphones in China, conducted a review of its supply chain, said

a person familiar with the matter. The review, which assessed the

proficiency of Chinese suppliers, could be used to assess the

impact of potential tariffs, the person said.

It isn't clear if Foxconn is taking any action following the

review; the company didn't respond to a request for comment late

Friday.

The new U.S. tariffs exempt commonly purchased consumer goods,

according to the U.S. Trade Representative. Semiconductors -- the

guts of smartphones and many connected devices -- were put on the

target list, drawing protest from the Semiconductor Industry

Association. The Washington-based trade group said that most

semiconductors exported from China are designed and made in the

U.S.

Boeing Co. is likely to feel the pain from both sides, though it

stands to get hurt more by potential Chinese retaliation. Boeing,

the largest U.S. exporter, delivered 202 aircraft to China last

year -- more than a quarter of its total global sales. Past rounds

of political tensions with the U.S. have seen China switch its

purchases to rival Airbus SE , and Chinese state media have warned

to expect the same this time.

Boeing also buys some parts for its 737 and 787 jetliners from

Chinese suppliers, mainly the state-run Aviation Industry Corp. of

China. The latest U.S. tariffs include some China-made aerospace

products, potentially jacking up the costs of those components for

Boeing. But they constitute a small part of Boeing planes' total

value, according to aviation analysts.

Also hanging in the balance is Qualcomm's planned $44 billion

purchase of Dutch company NXP Semiconductors NV , a deal widely

seen as critical for the U.S. chip maker. Late last month, amid

signs of progress in trade talks by Washington and Beijing, Chinese

authorities indicated their intention to wrap up the review and

clear the transaction.

Momentum, however, stalled following the White House decision to

move ahead with tariffs and congressional pushback against Mr.

Trump's decision to save China's ZTE Corp . from crippling

punishment for violating U.S. sanctions.

"The anticipated escalation of trade tensions will complicate

China's ability to approve the Qualcomm-NXP transaction from a

face-saving perspective," said Stephen Myrow, a former Treasury

official in the George W. Bush administration who is now managing

partner of Beacon Policy Advisors LLC., a U.S. research firm.

The U.S. is stepping up its trade offensive over what the Trump

administration alleges is Beijing's pressure on U.S. firms to

transfer technology to Chinese companies. In doing so, the U.S. is

effectively ending a truce called late last month by U.S. Treasury

Secretary Steven Mnuchin and China's chief trade negotiator Liu He,

following the second of three rounds of talks.

"Three rounds of negotiations with Beijing have failed to delay

or prevent this outcome," said Tai Hui, chief market strategist at

J.P. Morgan Asset Management. "The threshold to come to a consensus

or a compromise seems high."

Some Chinese officials said they are feeling frustrated by the

Trump administration's shifting positions, which they say have hurt

the credibility of the U.S. government. The U.S. is "provoking the

trade war, " Chinese Foreign Ministry spokesman Lu Kang said Friday

night.

Washington's latest hard-line approach, Chinese officials said,

isn't going to wring concessions from China.

In particular, Beijing isn't going to give up its plan to

upgrade its manufacturing capabilities as laid out in the Made in

China 2025 initiative -- specifically targeted by the new U.S.

tariffs to prevent "unfair transfers of American technology and

intellectual property," the Trump administration said.

"It's wrong for the U.S. to think its pressure tactics are

working," said a Beijing official.

Already, some U.S. companies are facing increased regulatory

scrutiny in China, according to Jacob Parker, vice president of

China operations at the U.S.-China Business Council. For instance,

he said, it takes longer for their products, be they automobiles,

pork or other farm products, to clear Chinese customs; in other

instances, Chinese regulators are putting advertisement slogans by

U.S. firms under review.

"Maintaining a low profile in the China market and ensuring that

you're completely compliant are more important now than in the

past," Mr. Parker said.

--Trefor Moss in Shanghai contributed to this article.

Write to Lingling Wei at lingling.wei@wsj.com and Yoko Kubota at

yoko.kubota@wsj.com

(END) Dow Jones Newswires

June 15, 2018 13:30 ET (17:30 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

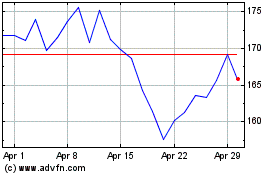

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Aug 2024 to Sep 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Sep 2023 to Sep 2024