Eli Lilly Increases 2018 Guidance -- Earnings Review

January 31 2018 - 7:46AM

Dow Jones News

By Allison Prang

Eli Lilly and Co. reported its fourth-quarter results Wednesday

before the market opened. Here's what you need to know.

LOSS: The company reported a loss of $1.66 billion, or $1.58 a

share, compared with a profit of $771.8 million, or 73 cents a

share, in the same period a year earlier. The company recorded

about $1 billion in charges related to cost-cutting efforts such as

the launch of its voluntary early retirement program. On an

adjusted basis, the Indianapolis-based firm earned $1.21 billion,

or $1.14 a share, up 19% from $1.01 billion, or 95 cents a share.

Analysts polled by Thomson Reuters were predicting adjusted

earnings of $1.07 a share.

TAX REFORM: Eli Lilly said it had a $1.94 billion expense as a

result of the tax code changes. The company said Wednesday it "may

utilize more than $9 billion in cash" from operations across the

world because of changes in rules regarding profits held

overseas.

REVENUE: Revenue climbed 6.9% to $6.16 billion. The increase was

helped by revenue outside the U.S., which rose more than domestic

revenue. Eli Lilly gets more of its revenue domestically.

SPECIFIC DRUGS: Revenue from Strattera, a drug that helps young

people with ADHD, fell 60% in the fourth quarter, while revenue

from Forteo, a drug for osteoporosis, rose 21%. Revenue from

Humalog, Eli Lilly's largest product by revenue, fell 4.6% to

$782.2 million. Of the company's newer products, revenue from

Lartruvo, which treats soft-tissue sarcoma, rose 396%. Revenue from

Basaglar, a drug for diabetes, rose 289%. Of Eli Lilly's newer

products, Trulicity, which helps control blood-sugar levels,

brought in the most money at $649 million, up 93% from the same

quarter a year before.

GUIDANCE: The company boosted some of its guidance because of

the recent tax law and expects adjusted earnings per share in 2018

to be between $4.81 and $4.91, up between 12% and 15% from 2017.

Revenue is still expected to be between $23 billion and $23.5

billion, Eli Lilly said.

Shares, which have gained 12% over the past year, rose 0.6% in

premarket trading to $86.60.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

January 31, 2018 07:31 ET (12:31 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

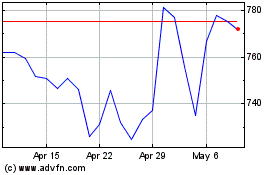

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2023 to Apr 2024