As filed with the Securities and Exchange Commission on December 20, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Viking Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

2834

|

46-1073877

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

Viking Therapeutics, Inc.

12340 El Camino Real, Suite 250

San Diego, CA 92130

(858) 704-4660

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Brian Lian, Ph.D.

President and Chief Executive Officer

Viking Therapeutics, Inc.

12340 El Camino Real, Suite 250

San Diego, CA 92130

(858) 704-4660

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Jeffrey T. Hartlin, Esq.

Paul Hastings LLP

1117 S. California Avenue

Palo Alto, CA 94304

(650) 320-1804

|

Approximate date of commencement of proposed sale to the public

: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

☐

|

Accelerated filer

☐

|

Non-accelerated filer

☐

(Do not check if a smaller reporting company)

|

Smaller reporting company

☒

|

Emerging growth company

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☒

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered

(1)

|

|

|

Proposed Maximum Offering Price Per

Share

(2)

|

|

|

Proposed Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration Fee

|

|

Shares of common stock, $0.00001 par value per share, issuable upon exercise of warrants

|

|

2,552,337

(3)

|

|

|

$3.75

|

|

|

$9,571,263.75

|

|

|

$1,191.62

|

|

(1)

|

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this Registration Statement also covers any additional shares of common stock which may become issuable to prevent dilution from stock splits, stock dividends and similar events.

|

|

(2)

|

Pursuant to Rule 457(c) of the Securities Act of 1933, as amended, calculated on the basis of the average of the high and low prices per share of the registrant’s common stock as reported by the Nasdaq Capital Market on December 14, 2017.

|

|

(3)

|

All 2,552,337 shares of Common Stock issuable upon exercise of the Warrants are to be offered by the selling stockholders named herein, which Warrants were issued to such selling stockholders on June 19, 2017 pursuant to that certain Securities Purchase Agreement, dated June 14, 2017, by and among the Registrant and the purchasers identified on the signature pages thereto.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is no

t complete and may be changed. The selling stockholder

s

may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the selli

ng stockholder

s

are

not soliciting offers to buy these securities, in any state where the offer or sale of these securities is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 20, 2017

PROSPECTUS

2,552,337 Shares

Common Stock

This prospectus relates to the resale by the investors listed in the section of this prospectus entitled “Selling Stockholders” (the “Selling Stockholders”), of up to 2,552,337 shares (the “Shares”) of our common stock, par value $0.00001 per share (the “Common Stock”). The 2,552,337 shares of Common Stock are issuable upon exercise of outstanding warrants to purchase shares of Common Stock (the “Warrants”), issued by us to the Selling Stockholders on June 19, 2017 pursuant to that certain Securities Purchase Agreement, dated June 14, 2017, by and among the Registrant and the purchasers signatory thereto. The Warrants are subject to a blocker provision (the “Warrant Blocker”), which restricts the exercise of a Warrant if, as a result of such exercise, the holder, together with its affiliates and any other person whose beneficial ownership of Common Stock would be aggregated with the holder’s for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended, would beneficially own in excess of 4.99% of our then issued and outstanding shares of Common Stock (including the shares of Common Stock issuable upon such exercise), as such percentage ownership is determined in accordance with the terms of the Warrants. The Warrants are currently exercisable, have a term of five years from the date of issuance and have an exercise price of $1.30 per share of Common Stock.

Our registration of the Shares covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the Shares. The Selling Stockholders may sell the Shares covered by this prospectus in a number of different ways and at varying prices. For additional information on the possible methods of sale that may be used by the Selling Stockholders, you should refer to the section of this prospectus entitled “Plan of Distribution” beginning on page 12 of this prospectus. We will not receive any of the proceeds from the Shares sold by the Selling Stockholders, other than any proceeds from any cash exercise of Warrants.

No underwriter or other person has been engaged to facilitate the sale of the Shares in this offering. The Selling Stockholders may, individually but not severally, be deemed to be an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), of the Shares that they are offering pursuant to this prospectus. We will bear all costs, expenses and fees in connection with the registration of the Shares. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their respective sales of the Shares.

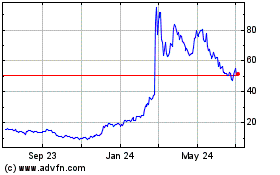

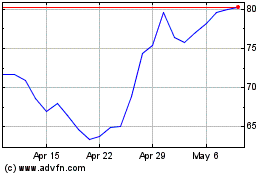

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “VKTX.” On December 19, 2017, the last reported sale price per share of our Common Stock was $4.29.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings

.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is .

TABLE OF CONTENTS

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions under the section of this prospectus entitled “Where You Can Find More Information”. You should carefully read this prospectus as well as additional information described under the section of this prospectus entitled “Incorporation of Certain Information by Reference,” before deciding to invest in our common shares.

Unless the context otherwise requires, the terms “Viking,” “we,” “us” and “our” in this prospectus refer to Viking Therapeutics, Inc., and “this offering” refers to the offering contemplated in this prospectus.

Neither we nor the selling stockholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under the circumstances and in the jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the selling stockholders are not, making an offer of these securities in any jurisdiction where such offer is not permitted.

i

DISCLOSURE REGARDING F

ORWARD-LOOKING

STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this prospectus and the documents incorporated by reference in this prospectus include, but are not limited to, statements about:

|

|

•

|

risks and uncertainties associated with our research and development activities, including our clinical trials and preclinical studies;

|

|

|

•

|

the timing or likelihood of regulatory filings and approvals or of alternative regulatory pathways for our drug candidates;

|

|

|

•

|

the potential market opportunities for commercializing our drug candidates;

|

|

|

•

|

our expectations regarding the potential market size and the size of the patient populations for our drug candidates, if approved for commercial use, and our ability to serve such markets;

|

|

|

•

|

estimates of our expenses, future revenue, capital requirements and our needs for additional financing;

|

|

|

•

|

our ability to develop, acquire and advance our product candidates into, and successfully complete, clinical trials and preclinical studies and obtain regulatory approvals;

|

|

|

•

|

the implementation of our business model and strategic plans for our business and drug candidates;

|

|

|

•

|

the initiation, cost, timing, progress and results of future preclinical studies and clinical trials, and our research and development programs;

|

|

|

•

|

the terms of future licensing arrangements, and whether we can enter into such arrangements at all;

|

|

|

•

|

timing and receipt or payments of licensing and milestone revenues, if any;

|

|

|

•

|

the scope of protection we are able to establish and maintain for intellectual property rights covering our drug candidates and our ability to operate our business without infringing the intellectual property rights of others;

|

|

|

•

|

regulatory developments in the United States and foreign countries;

|

|

|

•

|

the performance of our third party suppliers and manufacturers;

|

|

|

•

|

our ability to maintain and establish collaborations or obtain additional funding;

|

|

|

•

|

the success of competing therapies that are currently or may become available;

|

|

|

•

|

our expectations regarding the time during which we will be an emerging growth company under the JOBS Act;

|

|

|

•

|

our ability to continue as a going concern;

|

|

|

•

|

our financial performance; and

|

|

|

•

|

developments and projections relating to our competitors and our industry.

|

We caution you that the forward-looking statements highlighted above do not encompass all of the forward-looking statements made in this prospectus or in the documents incorporated by reference in this prospectus.

1

We have based the forward-looking statements contained in this prospect

us and in the documents incorporated by reference in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The

outcomes of the events described in these forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and experience to differ from those projected, including, but not limited to, the risk factors descr

ibed herein and the risk factors set forth in Part I - Item 1A, “Risk Factors”, in our Annual Report on Form 10-K for the year ended December 31, 201

6

, as filed with the SEC on March

21

, 201

7

, in our Quarterly Report on Form 10-Q for the quarter ended

June

30

, 201

7

, as filed with the SEC on

August 9

,

2017,

in our Quarterly Report on Form 10-Q for the quarter ended

September 30

, 201

7

, as filed with the SEC on

November 8

,

2017

,

and elsewhere in the documents incorporated by reference into this prospectus. Moreover, we operate in a very competitive and challenging environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks

and uncertainties that could have an impact on the forward-looking statements contained in this prospectus and in the documents incorporated by reference in this prospectus. We cannot assure you that the results, events and circumstances reflected in the

forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in

the forward-looking statements.

The forward-looking statements contained in this prospectus and in the documents incorporated by reference in this prospectus relate only to events as of the date on which the statements are made. We do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, other strategic transactions or investments we may make

.

2

PROSPECTU

S

SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information you should consider before investing in our Common Stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information included elsewhere in this prospectus. Before you decide whether to purchase shares of our Common Stock, you should read this entire prospectus carefully, including the risks of investing in our securities discussed under the section of this prospectus entitled “Risk Factors” and similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

The Company

We are a clinical-stage biopharmaceutical company focused on the development of novel, first-in-class or best-in-class therapies for metabolic and endocrine disorders. We have exclusive worldwide rights to a portfolio of five drug candidates in clinical trials or preclinical studies, which are based on small molecules licensed from Ligand Pharmaceuticals Incorporated, or Ligand.

Our lead clinical program is VK5211, an orally available drug candidate, currently in a Phase 2 clinical trial for acute rehabilitation following non-elective hip fracture surgery. VK5211 is a non-steroidal selective androgen receptor modulator, or SARM. A SARM is designed to selectively interact with a subset of receptors that have a normal physiologic role of interacting with naturally-occurring hormones called androgens. Broad activation of androgen receptors with drugs, such as exogenous testosterone, can stimulate muscle growth and improve bone mineral density, but often results in unwanted side effects such as prostate growth, hair growth and acne. VK5211 is expected to selectively produce the therapeutic benefits of testosterone in muscle and bone tissue, potentially accelerating rehabilitation and improving patient outcomes. VK5211 is also expected to have improved safety, tolerability and patient acceptance relative to testosterone. We believe that VK5211 may also have potential benefits to patients suffering from muscle loss in other settings, such as joint replacements or muscle wasting disorders. We reported positive top-line results from this Phase 2 trial in November 2017. See “—Recent Developments—VK5211 Phase 2 Clinical Trial” below.

Our second clinical program is VK2809, an orally available, tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta, or TRß, that is in a Phase 2 clinical trial for the treatment of patients with hypercholesterolemia and fatty liver disease. Selective activation of the TRß receptor in liver tissue is believed to favorably affect cholesterol and lipoprotein levels via multiple mechanisms, including increasing the expression of low-density lipoprotein receptors and increasing mitochondrial fatty acid oxidation. We are currently conducting a Phase 2 clinical trial of VK2809 in patients with hypercholesterolemia and fatty liver disease and expect to report initial results from this Phase 2 trial in the first half of 2018. In October 2017, we announced positive final results from an eight-week study of VK2809 in an in vivo model of non-alcoholic steatohepatitis (NASH). See “—Recent Developments—VK2809 In Vivo Study of NASH” below.

In February 2017, we announced that we are commencing efforts to utilize VK2809 to potentially help patients who suffer from Glycogen Storage Disease type Ia, or GSD Ia. GSD Ia is a rare, orphan genetic disease caused by a deficiency of glucose-6-phosphatase (G6PC), an enzyme responsible for the liver’s production of free glucose from glycogen and gluconeogenesis. Approximately 2,000 patients in the U.S. suffer from GSD Ia. We have conducted a proof-of-concept study utilizing VK2809 in an in vivo model of GSD Ia. Data demonstrated that treatment with VK2809 led to statistically significant reductions in key metabolic markers of GSD Ia. VK2809’s potential to rapidly reduce hepatic triglyceride levels, as demonstrated in this initial evaluation in a GSD Ia model, provides support for the continued investigation of the compound in this indication. We expect to file an Investigational New Drug Application, or IND, and then initiate a Phase 1 human proof-of-concept clinical trial to evaluate VK2809 in patients with GSD Ia in the first quarter of 2018 and to announce initial results from the trial in the second half of 2018.

3

We are also developing VK0214 for X-linked adrenoleukodystrophy, or X-ALD, a rare X-linked, inherited neurological disorder char

acterized by a breakdown in the protective barriers surrounding brain and nerve cells. The disease, for which there is no approved treatment, is caused by mutations in a peroxisomal transporter of very long chain fatty acids, or VLCFA, known as ABCD1. As a

result, transporter function is impaired and patients are unable to efficiently metabolize VLCFA. The TRß receptor is known to regulate expression of an alternative VLCFA transporter, known as ABCD2. Various preclinical models have demonstrated that incre

ased expression of ABCD2 can lead to normalization of VLCFA metabolism.

Preliminary data suggest that VK0214 stimulates ABCD2 expression in an

in vitro

model and reduces VLCFA levels in an

in vivo

model of X-ALD. Pending completion of certain toxicology s

tudies, we expect to file an IND

and then initiate a proof-of-concept clinical trial in the second half of 2018.

We were incorporated under the laws of the State of Delaware on September 24, 2012. Since our incorporation, we have devoted most of our efforts towards conducting certain clinical trials and preclinical studies related to our VK5211, VK2809 and VK0214 programs, as well as efforts towards raising capital and building infrastructure. We obtained worldwide rights to our VK5211, VK2809 and VK0214 programs and certain other assets pursuant to an exclusive license agreement with Ligand. The terms of this license agreement are detailed in the Master License Agreement, which we entered into on May 21, 2014 with Ligand, as amended, or the Master License Agreement. A summary of the Master License Agreement can be found in the section entitled “Business —Agreements with Ligand —Master License Agreement” in Part I, Item 1 of our Annual Report on Form 10-K filed with the SEC on March 21, 2017.

For a complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by reference in this prospectus, including our Annual Report on Form 10-K for the year ended December 31, 2016, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2017. For instructions on how to find copies of these documents, see the section of this prospectus entitled “Where You Can Find More Information”

.

Recent Developments

VK2809 In Vivo Study of NASH

In October 2017, we announced positive final results from an eight-week study of VK2809 in an in vivo model of NASH. Treatment with VK2809 resulted in: (1) statistically significant reductions in several key measures of steatosis, including liver triglyceride content and total liver lipid content, (2) fibrotic activity, including total liver fibrosis, type I collagen and hydroxyproline, relative to vehicle controls, and (3) statistically significant changes in the expression of key genes associated with NASH development and progression, relative to vehicle control, suggesting improved lipid and cholesterol metabolism, improved lipid metabolism and insulin sensitivity and reduced fibrotic activity.

VK5211 Phase 2 Clinical Trial

On November 28, 2017, we announced positive top-line results from our 12-week, Phase 2 clinical trial of VK5211 in patients who recently suffered a hip fracture. Top-line data showed that the trial achieved its primary endpoint, demonstrating statistically significant, dose dependent increases in lean body mass, less head, following treatment with VK5211 as compared to placebo. The study also achieved certain secondary endpoints, demonstrating statistically significant increases in appendicular lean body mass and total lean body mass for all doses of VK5211, compared to placebo. VK5211 demonstrated encouraging safety and tolerability in this study, with no drug-related serious adverse events (SAEs) reported.

The Phase 2 clinical trial was a randomized, double-blind, placebo-controlled, parallel group, international study designed to evaluate the efficacy, safety and tolerability of VK5211 in patients recovering from hip fracture surgery. A total of 108 patients were randomized to receive once-daily VK5211 doses of 0.5 mg, 1.0 mg, 2.0 mg, or placebo for 12 weeks. Top-line results include:

4

|

|

•

|

All doses of VK5211

demonstrated statistically significant increases in total lean body mass, less head, the study’s primary endpoint. Placebo-adjusted increases in lean body mass were 4.8% at 0.5 mg (p < 0.005), 7.2% at 1.0 mg (p < 0.001), and 9.1% at 2.0 mg (p < 0.001).

These corresponded to placebo-adjusted increases of 1.6 kg at 0.5 mg (p < 0.005), 2.5 kg at 1.0 mg (p < 0.001), and 3.1 kg at 2.0 mg (p < 0.001).

|

|

|

•

|

The proportion of patients experiencing at least a 5% increase in total lean body mass, less head, were 19% with placebo, 61% at 0.5 mg, 65% at 1.0 mg, and 75% at 2.0 mg (p < 0.01 for each). The proportion of patients demonstrating at least a 2.0 kg gain in total lean body mass, less head, were 14% with placebo, 57% at 0.5 mg, 65% at 1.0 mg, and 81% at 2.0 mg (p < 0.01 for each).

|

|

|

•

|

All doses of VK5211 produced statistically significant increases in appendicular lean body mass, a secondary efficacy endpoint. Placebo-adjusted increases in appendicular lean body mass were 6.1% at 0.5 mg (p < 0.01), 9.0% at 1.0 mg (p < 0.001), and 10.2% at 2.0 mg (p < 0.001). These corresponded to placebo-adjusted increases of 0.8 kg at 0.5 mg (p < 0.05), 1.3 kg at 1.0 mg (p < 0.001), and 1.4 kg at 2.0 mg (p < 0.001).

|

|

|

•

|

All doses of VK5211 produced statistically significant increases in total lean body mass, including head, a secondary efficacy endpoint. Increases in total lean body mass were 6.3% (p < 0.005), 8.2% (p < 0.001), and 9.9% (p < 0.001) from baseline, corresponding to placebo-adjusted increases of 4.7% at 0.5 mg (p < 0.005), 6.8% at 1.0 mg (p < 0.001), and 8.3% at 2.0 mg (p < 0.001). These corresponded to placebo-adjusted increases of 1.7 kg at 0.5 mg (p < 0.005), 2.6 kg at 1.0 mg (p < 0.001), and 3.1 kg at 2.0 mg (p < 0.001).

|

|

|

•

|

Patients receiving VK5211 demonstrated numerical improvements in certain exploratory assessments of functional performance, including the 6-minute walk test and short physical performance battery, compared with placebo. These endpoints were not powered for significance. Further evaluation of exploratory functional endpoints is underway.

|

|

|

•

|

There were no significant differences in the rates of adverse events reported among patients receiving VK5211 compared with placebo. There were no dose-related differences in reported adverse events among various VK5211 treatment groups. No drug-related SAEs were observed in patients receiving VK521.

|

We expect to receive follow-up data for the Phase 2 clinical trial in the first half of 2018.

Public Offering of Common Stock

On December 11, 2017, we closed an

underwritten public offering of shares of our common stock pursuant to which we sold an aggregate of 5,900,000 shares of our common stock at a public offering price of $2.50 per share, including 769,565 shares sold pursuant to the underwriters’ full exercise of their option to purchase additional shares to cover over-allotments. The gross proceeds to us from this offering are expected to be approximately $14.8 million, before deducting underwriting discounts and commissions and other estimated offering expenses.

Corporate Information

We were incorporated under the laws of the State of Delaware on September 24, 2012

.

Our principal executive offices are located at 12340 El Camino Real, Suite 250, San Diego, CA 92130, and our telephone number is (858) 704-4660. Our website address is

www.vikingtherapeutics.com.

We have included our website address in this prospectus solely as an inactive textual reference

.

We do not incorporate the information on, or accessible through, our website into this prospectus, and you should not consider any information on, or accessible through, our website as part of this prospectus.

Emerging Growth Company Status

We qualify as an “emerging growth company,” as that term is defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For as long as we qualify as an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that do not

5

qualify as emerging growth

companies, including, without limitation, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended, reduced disclosure obligations relating to executive compensation and exempti

ons from the requirements of holding advisory “say-on-pay,” “say-when-on-pay” and “golden parachute” executive compensation votes

.

Under the JOBS Act, we will remain an emerging growth company until the earliest of:

|

|

•

|

the last day of the fiscal year during which we have total annual gross revenues of $1.07 billion or more;

|

|

|

•

|

the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, or December 31, 2020;

|

|

|

•

|

the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; and

|

|

|

•

|

the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, or the Exchange Act (i.e., the first day of the fiscal year after we have (1) more than $700.0 million in outstanding common equity held by our non-affiliates, measured each year on the last day of our second fiscal quarter, and (2) been public for at least 12 months).

|

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this prospectus and may elect to take advantage of other reduced reporting requirements in future filings with the SEC. As a result, the information that we provide to

our

stockholders may be different than the information you receive from other public reporting companies

.

6

RISK FA

CTORS

Investing in shares of our Common Stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described under “Risk Factors” in our most recent Annual Report on Form 10-K, and the updates in our Quarterly Reports on Form 10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus before deciding whether to purchase any of the Common Stock being offered. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of shares of our Common Stock could decline due to any of these risks, and you may lose all or part of your investment.

7

USE

OF

PR

OCEEDS

We will receive no proceeds from the sale of the Shares by the Selling Stockholders. We may, however, receive cash proceeds equal to the total exercise price of the Warrants to the extent that the Warrants are exercised for cash. The exercise price of the Warrants is $1.30 per share of Common Stock. The exercise price and the number of shares of Common Stock issuable upon exercise of the Warrants may be adjusted in certain circumstances, including stock splits, dividends or distributions, or other similar transactions. However, the Warrants contain a “cashless exercise” feature that allow the holders to exercise the Warrants without making a cash payment to us in the event that there is no registration statement registering the Shares. There can be no assurance that any of these Warrants will be exercised by the Selling Stockholders at all or that the Warrants will be exercised for cash rather than pursuant to the “cashless exercise” feature. To the extent we receive proceeds from the cash exercise of the Warrants, we intend to use such proceeds to provide capital support or for general corporate purposes, which may include, without limitation, supporting asset growth and engaging in acquisitions or other business combinations. We do not have any specific plans for acquisitions or other business combinations at this time. Our management will retain broad discretion in the allocation of the net proceeds from the exercise of the Warrants.

The Selling Stockholders will pay any underwriting discounts and commissions and any similar expenses they incur in disposing of the Shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the Shares covered by this prospectus. These may include, without limitation, all registration and filing fees, printing fees and fees and expenses of our counsel and accountants.

8

SELLIN

G STOCKHOLDER

S

Unless the context otherwise requires, as used in this prospectus, “Selling Stockholders” includes the selling stockholders listed below and donees, pledgees, transferees or other successors-in-interest selling shares received after the date of this prospectus from a selling stockholder as a gift, pledge or other non-sale related transfer.

We have prepared this prospectus to allow the Selling Stockholders or their successors, assignees or other permitted transferees to sell or otherwise dispose of, from time to time, up to

2,552,337

shares of our Common Stock.

The 2,552,337 shares of

Common

Stock to be offered hereby are issuable to the Selling Stockholders in connection with the exercise of the Warrants

.

Pursuant to the terms of the Securities Purchase Agreement, we issued the Warrants to the Selling Stockholders. The Warrants have an exercise price of $1.30 per share of Common Stock, subject to adjustment as provided in the Warrants, are currently exercisable and have a term of five years from the date of issuance. The exercisability of the Warrants is subject to the Warrant Blocker, as described in the footnotes below.

All of the

2,552,337

shares of

Common

Stock to be offered hereby

will be issued in reliance on the exemption from securities registration in Section 4(a)(2) under the Securities Act and Rule 506 promulgated thereunder.

The shares of Common Stock to be offered by the Selling Stockholders are “restricted” securities under applicable federal and state securities laws and are being registered under the Securities Act to give the Selling Stockholders the opportunity to sell these shares publicly. The registration of these shares does not require that any of the shares be offered or sold by the Selling Stockholders. Subject to these resale restrictions, the Selling Stockholders may from time to time offer and sell all or a portion of their shares indicated below in privately negotiated transactions or on the NASDAQ Capital Market or any other market on which our Common Stock may subsequently be listed.

The registered shares may be sold directly or through brokers or dealers, or in a distribution by one or more underwriters on a firm commitment or best effort basis. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any particular offering will be set forth in a prospectus supplement. See the section of this prospectus entitled “Plan of Distribution”. The Selling Stockholders and any agents or broker-dealers that participate with the Selling Stockholders in the distribution of registered shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commissions received by them and any profit on the resale of the registered shares may be deemed to be underwriting commissions or discounts under the Securities Act.

No estimate can be given as to the amount or percentage of Common Stock that will be held by the Selling Stockholders after any sales made pursuant to this prospectus because the Selling Stockholders are not required to sell any of the Shares being registered under this prospectus. The following table assumes that the Selling Stockholders will sell all of the Shares listed in this prospectus.

Unless otherwise indicated in the footnotes below, no Selling Stockholder has had any material relationship with us or any of our affiliates within the past three years other than as a security holder.

We have prepared this table based on written representations and information furnished to us by or on behalf of the Selling Stockholders. Since the date on which the Selling Stockholders provided this information, the Selling Stockholders may have sold, transferred or otherwise disposed of all or a portion of the shares of Common Stock in a transaction exempt from the registration requirements of the Securities Act. Unless otherwise indicated in the footnotes below, we believe that: (1) none of the Selling Stockholders are broker-dealers or affiliates of broker-dealers, (2) no Selling Stockholder has direct or indirect agreements or understandings with any person to distribute their Shares, and (3) the Selling Stockholders have sole voting and investment power with respect to all Shares beneficially owned, subject to applicable community property laws. To the extent any Selling Stockholder identified below is, or is affiliated with, a broker-dealer, it could be deemed, individually but not severally, to be an “underwriter” within the meaning of the Securities Act. Information about the Selling Stockholders may change over time. Any changed information will be set forth in supplements to this prospectus, if required.

9

The following table sets forth information with respect to the beneficial ownership of our Common Stock held, as of

December

1

9

, 2017

, by the Selling Stockholders and the number of Shares being registered hereby and information

with

respect to shares to be beneficially owned by the Selling Stockholders after completion of the offering of the shares for resale. The percentages in the following table reflect the shares beneficially owned by the Selling Stockholders as a percentage of

the total number of shares of Common Stock outstanding as of

December

1

9

,

2017

. As of such date,

35,

060,283

shares of Common Stock were outstanding.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially

Owned

Prior to the Offering of Shares for Resale

(1)

|

|

|

Maximum Number of Shares of Common Stock to be Offered for Resale Pursuant to this Prospectus

|

|

Shares

Beneficially

Owned

After the

Offering of Shares for Resale

(1)(2)

|

|

Name

|

Number

|

|

Percentage

|

|

|

Number

|

|

Number

|

|

|

Percentage

|

|

PoC Capital, LLC

|

|

26,087

(3)

|

|

|

|

*

|

|

|

|

26,087

|

|

|

|

—

|

|

|

|

—

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

|

743,319

(4)

|

|

|

|

2.09%

|

|

|

|

565,000

|

|

|

|

178,319

|

|

|

|

*

|

|

Lincoln Park Capital Fund, LLC

|

|

1,823,233

(5)

|

|

|

|

4.98%

|

|

|

|

1,012,500

|

|

|

|

810,733

|

|

|

|

2.13%

|

|

Empery Asset Management, LP

|

|

926,250

(6)

|

|

|

|

2.57%

|

|

|

|

326,250

|

|

|

|

600,000

|

|

|

|

1.57%

|

|

G. Nicholas Farwell

|

|

2,490,008

(

7

)

|

|

|

|

7.10%

|

|

|

|

472,500

(8)

|

|

|

|

2,490,008

|

|

|

|

6.40%

|

|

Donald E. Garlikov

|

|

1,611,000

(

9

)

|

|

|

|

4.51%

|

|

|

|

150,000

|

|

|

|

1,461,000

|

|

|

|

3.83%

|

|

TOTAL

|

|

—

|

|

|

|

—

|

|

|

|

2,552,337

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Less than 1%.

|

|

(1)

|

Beneficial ownership is determined in accordance with Rule 13d-3 under the Exchange Act. In computing the number of

shares beneficially owned by a person and the percentage ownership of that person, shares of Common Stock subject to

warrants, options and other convertible securities held by that person that are currently exercisable or exercisable within 60 days (of December 19

, 2017

) are deemed outstanding. Shares subject to warrants, options and other convertible securities, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

|

|

(2)

|

Assumes that the Selling Stockholders dispose of all of the shares of Common Stock covered by this prospectus and do not acquire beneficial ownership of any additional shares. The registration of these shares does not necessarily mean that the Selling Stockholders will sell all or any portion of the shares covered by this prospectus. Also assumes that all of the Warrants are exercised in full.

|

|

(3)

|

The number of shares consists solely of

26,087

shares of Common Stock issuable upon exercise of the Warrant held by the Selling Stockholder.

Voting and dispositive power with respect to the 26,087 shares issuable to the Selling Stockholder upon exercise of the Warrant is held by Daron Evans, who is the Managing Director of the Selling Stockholder

.

The business address of the Selling Stockholder

is 2995 Woodside Rd., Suite 400-121, Woodside, CA 94062, Attn: Daron Evans

.

|

|

(4)

|

The number of shares consists of (1) 565,000

shares of Common Stock issuable upon exercise of the Warrant held by the Selling Stockholder and (2) 178,319 shares of Common Stock held directly by the Selling Stockholder. Sabby Management, LLC is the investment manager of Sabby Volatility Warrant Master Fund, Ltd. and shares voting and investment power with respect to these shares in this capacity. As manager of Sabby Management, LLC, Hal Mintz also shares voting and investment power on behalf of the Selling Stockholder. Therefore, v

oting and dispositive power with respect to the

565,000

shares issuable to the Selling Stockholder upon exercise of the Warrant and the 178,319 shares of Common Stock is shared by Sabby Management, LLC and Hal Mintz

. Each of Sabby Management, LLC and Hal Mintz disclaims beneficial ownership over the securities listed except to the extent of their pecuniary therein.

The business address of the Selling Stockholder

is c/o Sabby Management, LLC,

10 Mountainview Road, Suite 205, Upper Saddle River, NJ 07458

.

|

10

|

|

|

|

(5)

|

The number of shares consists of: (1) 1,012,500

shares of Common Stock issuable upon exercise of the Warrant held by the Selling Stockholder, except to the extent such exercise is restricted by the Warrant Blocker, (2)

292,333 shares of common stock held directly by the Selling Stockholder, and (3) 518,400

shares of Common Stock upon exercise of an additional warrant to purchase shares of Common Stock held by the Selling Stockholder, except to the extent such exercise is restricted by the Warrant Blocker

.

Josh Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park Capital, LLC, are deemed to be beneficial owners of all of the shares of common stock beneficially owned by Lincoln Park Capital Fund, LLC. Messrs. Cope and Scheinfeld have shared voting and investment power over the shares. The business address of the Selling Stockholder is 440 North Wells, Suite 410, Chicago, IL 60654

.

|

|

(6)

|

The number of shares consists of (1) 153,900 shares of Common Stock issuable upon exercise of the Warrant held by Empery Asset Master, LTD (“EAM”), (2)

256,292

shares of Common Stock issuable upon exercise of an additional warrant to purchase shares of Common Stock held by EAM, (3)

74,042 shares of Common Stock issuable upon exercise of the Warrant held by Empery Tax Efficient, LP (“ETE”), (4)

203,145 shares of Common Stock issuable upon exercise of an additional warrant to purchase shares of Common Stock held by ETE, (5) 98,308 shares of Common Stock issuable upon exercise of the Warrant held by Empery Tax Efficient II, LP (“ETE II”), and (6) 140,563 shares of Common Stock issuable upon exercise of an additional warrant to purchase shares of Common Stock held by ETE II. Empery Asset Management LP is the authorized agent of each of EAM, ETE and ETE II and has discretionary authority to vote and dispose of the shares beneficially held by each of EAM, ETE and ETE II and may be deemed to be the beneficial owner of such shares.

Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power over the shares beneficially held by e

ach of EAM, ETE and ETE II

. Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares

.

The business address of the Selling Stockholder

is One

Rockefeller Plaza, Suite 1205, New York, NY 10020

.

|

|

(7)

|

The number of shares consists of:

(1)

950,000 shares of Common Stock held by a family trust of which the Selling Stockholder is one of the trustees and over which the Selling Stockholder shares voting and dispositive power,

(2)

500,000 shares of Common Stock held directly by the Selling Stockholder, (3) 1,040,000 shares of Common Stock held in the Selling Stockholder’s IRA, (4) 123,750 shares of Common Stock issuable upon exercise of the Warrant held by a family trust of which the Selling Stockholder is one of the trustees and over which the Selling Stockholder shares voting and dispositive power, (5) 75,000 shares of Common Stock issuable upon exercise of the Warrant held directly by the Selling Stockholder, (6) 273,750 shares of Common Stock issuable upon exercise of the Warrant held in the Selling Stockholder’s IRA, (7) 540,000 shares of Common Stock issuable upon exercise of an additional warrant to purchase shares of Common Stock held by a family trust of which the Selling Stockholder is one of the trustees and over which the Selling Stockholder shares voting and dispositive power, (8) 185,000 shares of Common Stock issuable upon exercise of an additional warrant to purchase shares of Common Stock held directly by the Selling Stockholder, and (9) 573,750 shares of Common Stock issuable upon exercise of an additional warrant to purchase shares of Common Stock held in the Selling Stockholder’s IRA, except in the cases of items (4) through (9) to the extent any such exercise is restricted by the Warrant Blocker

.

The business address of the Selling Stockholder

is

1240 Arbor Road, Menlo Park, CA 94025

.

|

|

(8)

|

Assumes that (1) 123,750 shares of Common Stock are issued upon exercise of the Warrant held by a family trust of which the Selling Stockholder is one of the trustees and over which the Selling Stockholder shares voting and

dispositive power, (2) 75,000 shares of Common Stock are issued upon exercise of the Warrant held directly by the Selling Stockholder, and (3) 273,750 shares of Common Stock are issued upon exercise of the Warrant held in the Selling Stockholder’s IRA, even though the exercise of such Warrants is currently restricted by the Warrant Blocker.

|

|

(9)

|

The number of shares consists of: (1) 150,000

shares of Common Stock issuable upon exercise of the Warrant held by the Selling Stockholder, (2)

975,000 shares of common stock directly by the Selling Stockholder, and (3) 486,000

shares of Common Stock upon exercise of an additional warrant to purchase shares of Common Stock held by the Selling Stockholder. The business address of the Selling Stockholder is 41 South High Street, Suite 3400, Columbus, OH 43215.

|

11

PLAN OF DIST

RIBUTION

We are registering the shares of Common Stock issuable upon exercise of the Warrants previously issued to the

Selling Stockholders

to permit the resale of these shares of Common Stock by the holders of the Warrants from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the

Selling Stockholders

of the shares of Common Stock. We will bear all fees and expenses incident to our obligation to register the shares of Common Stock.

The

Selling Stockholders

may sell all or a portion of the shares of Common Stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of Common Stock are sold through underwriters or broker-dealers, the

Selling Stockholders

will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of Common Stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. The

Selling Stockholders

will act independently of us in making decisions with respect to the timing, manner and size of each sale. These sales may be effected in transactions, which may involve cross or block transactions:

|

|

•

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

•

|

in the over-the-counter market;

|

|

|

•

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

•

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

•

|

in ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

in block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

through purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

in an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

in privately negotiated transactions;

|

|

|

•

|

through the distribution of the Common Stock by any Selling Stockholder to its partners, members or stockholders;

|

|

|

•

|

through one or more underwritten offerings on a firm commitment or best efforts basis;

|

|

|

•

|

in sales pursuant to Rule 144;

|

|

|

•

|

whereby broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

in a combination of any such methods of sale; and

|

|

|

•

|

in any other method permitted pursuant to applicable law.

|

If the

Selling Stockholders

effect such transactions by selling shares of Common Stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the

Selling Stockholders

or commissions from purchasers of the shares of Common Stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of the shares of Common Stock or otherwise, the

Selling Stockholders

may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of the shares of Common Stock in the course of hedging in positions they assume. The

Selling Stockholders

may also sell shares of Common Stock short and deliver shares of Common Stock covered

by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The

Selling Stockholders

may also loan or pledge shares of Common Stock to broker-dealers that in turn may sell such shares.

The

Selling Stockholders

may pledge or grant a security interest in some or all of the shares of Common Stock or the Warrants owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if

12

necessary, the list of

Selling Stockholders

to include the pledgee, transferee or other successors in interest as

Selling Stockholders

under this prospectus. The

Selling Stockholders

also may transfer and donate the shares of Common Stock in other

circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The

Selling Stockholders, individually and not severally,

and any broker-dealer participating in the distribution of the shares of Common Stock may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of the shares of Common Stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of Common Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the

Selling Stockholders

and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers. The

Selling Stockholders

may indemnify any broker-dealer that participates in transactions involving the sale of the shares of Common Stock against certain liabilities, including liabilities arising under the Securities Act.

Under the securities laws of some states, the shares of Common Stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of Common Stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any

Selling Stockholder

will sell any or all of the shares of Common Stock registered pursuant to the registration statement of which this prospectus forms a part.

The

Selling Stockholders

and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of Common Stock by the

Selling Stockholders

and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of Common Stock to engage in market-making activities with respect to the shares of Common Stock. All of the foregoing may affect the marketability of the shares of Common Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common Stock.

We will pay all expenses of the registration of the shares of Common Stock pursuant to the Warrants, estimated to be $25,000 in total, including, without limitation, SEC filing fees and expenses of compliance with state securities or “Blue Sky” laws;

provided

,

however

, that a

Selling Stockholder

will pay all underwriting discounts and selling commissions, if any.

Once sold under the registration statement, of which this prospectus forms a part, the shares of Common Stock will be freely tradable in the hands of persons other than our affiliates.

13

DESCRIPTIO

N OF CAPITAL STOCK

General

The following description summarizes the most important terms of our capital stock. Because it is only a summary of the provisions of our amended and restated certificate of incorporation and amended and restated bylaws, it does not contain all of the information that may be important to you. For a complete

description

of the matters set forth in this “Description of Capital Stock,” you should refer to our amended and restated certificate of incorporation,

amended

and restated bylaws, and the form of the Warrants, each of which are included as exhibits to the registration statement of which this prospectus is a part, and to the applicable provisions of Delaware law. Our authorized capital stock consists of 300,000,000 shares of Common Stock, $0.00001 par value per share, and 10,000,000 shares of undesignated preferred stock, $0.00001 par value per share.

As of December 19

, 2017

, there were 35,060,283 shares of our

Common Stock outstanding, held by approximately 11

stockholders of record, not including beneficial holders whose shares are held in names other than their own. Our board of directors is authorized, without stockholder approval except as required by the rules and listings standards of The Nasdaq Stock Market LLC, to issue additional shares of our capital stock.

Common

Stock

Dividend Rights

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of our Common Stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines to issue dividends and then only at the times and in the amounts that our board of directors may determine.

Voting Rights

Holders of our Common Stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders. Our amended and restated certificate of incorporation does not provide for cumulative voting for the election of directors, and it establishes a classified board of directors that is divided into three classes with staggered three-year terms. Only the directors in one class will be subject to election at each annual meeting of our stockholders, with the directors in the other classes continuing for the remainder of their respective three-year terms.

No Preemptive or Similar Rights

Our Common Stock is not entitled to preemptive rights, and is not subject to conversion, redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

If we become subject to a liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable ratably among the holders of our Common Stock and any participating preferred stock outstanding at that time, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights of and the payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Fully Paid and Non-Assessable

All of the outstanding shares of our Common Stock are, and the shares of our Common Stock to be issued pursuant to this prospectus or which may be issued upon conversion of or exchange for preferred stock or debt securities that provide for conversion or exchange, or upon exercise of warrants or units to be issued pursuant to this prospectus, will be, fully paid and non-assessable.

Preferred Stock

Our board of directors is authorized, subject to limitations prescribed by Delaware law, to issue up to 10,000,000 shares of our preferred stock in one or more series, to establish from time to time the number of shares to be included in each series, and to fix the designation, powers, preferences, and rights of the shares of each series and any of its qualifications, limitations or restrictions, in each case without further vote or action by our stockholders. Our board of

14

directors can also increase or decrease the number of shares of any series of preferred stock, but not below the number of shares of that series then outstanding, without any further vote or action by ou

r stockholders. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our Common Stock. The issuance of preferred stock, while pr

oviding flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of our company and might adversely affect the market price of our

Common Stock and the voting and other rights of the holders of our Common Stock.

Equity Awards

As of November 30

, 2017

, options to purchase 1,585,864

shares of our Common Stock with a weighted-average exercise price of $2.67

per share were outstanding, restricted stock awards representing an aggregate of

62,001

shares of our Common Stock were unvested and outstanding, and restricted stock units representing

56,250

shares of our Common Stock were outstanding.

Outstanding Warrants

As of

December 19

, 2017

, in addition to the Warrants we are registering hereunder, warrants to purchase an aggregate of 9,566,150

shares of our Common Stock with a weighted-average exercise price of $1.58

per share were outstanding. Our warrants to purchase an aggregate of

8,519,900 shares of our

Common Stock issued in April 2016 are listed on the Nasdaq Capital Market under the symbol “VKTXW”.

Ligand Convertible Note

As of

September 30, 2017

, the aggregate outstanding principal amount under that certain Secured Convertible Promissory Note issued by us to Ligand on May 21, 2014 or the Note, plus all accrued and previously unpaid interest thereon, was approximately $

1,926,490

. We may repay any portion of the outstanding principal amount of the loans under the Note, plus accrued and previously unpaid interest thereon, by delivering a notice to Ligand, or the Additional Repayment Notice, specifying the amount that we wish to repay, or the Additional Payment Amount. Ligand will have five days to elect to receive the Additional Payment Amount in cash, our equity securities or a combination of cash and our equity securities. If Ligand does not make an election within such five-day period, the form of the Additional Payment Amount will be at our sole election and discretion, subject to the number of equity securities being reduced to the extent that the issuance of such equity securities would increase Ligand’s beneficial ownership of our Common Stock to greater than 49.9%. To the extent that any portion of an Additional Payment Amount will be paid in the form of our equity securities, we will issue to Ligand, with respect to the portion of the Additional Payment Amount that will be paid in our equity securities, such number of shares of our Common Stock equal to the greater of (a) such number of shares of Common Stock equal to the quotient obtained by dividing the Additional Payment Amount by the volume weighted-average closing price of our Common Stock for the 30 days prior to the date we deliver the Additional Repayment Notice, and (b) such number of shares of Common Stock equal to the quotient obtained by dividing the Additional Payment Amount by $8.00 (subject to adjustment for stock dividends, splits, combinations or similar transactions). Each $1.00 of any Additional Payment Amount will reduce the amount of accrued and unpaid interest and then unpaid principal amount under the Note by $0.50.

Registration Rights

On May 21, 2014, we entered into a Registration Rights Agreement with Ligand, as amended, or the Ligand Registration Rights Agreement, pursuant to which we agreed, among other things, that we would file with the SEC, by no later than January 23, 2017, a Registration Statement on Form S-1 under the Securities Act that covers the resale of (1) the securities issued by us to Ligand pursuant to the Master License Agreement we previously entered into with Ligand and the securities issuable by us to Ligand pursuant to the Note, or, collectively, the Viking Securities, (2) the shares of our Common Stock issued or issuable upon conversion of the Viking Securities, if applicable, and (3) the shares of our Common Stock issued as a dividend or other distribution with respect to, in exchange for or in replacement of the Viking Securities.

We issued to Laidlaw & Company (UK) Ltd., the representative of the underwriters for our initial public offering as additional compensation a warrant, or the Representative’s Warrant, to purchase an aggregate of 82,500 shares of our Common Stock. Pursuant to the terms of the Representative’s Warrant, the holders of 51% of the shares issuable upon exercise of the Representative’s Warrant, or the Representative’s Warrant Shares, have the right to demand, on one

15

occasion, the registration by us of the Representative’s Warrant Share

s. Additionally, we have agreed under the terms of the Representative’s Warrant to provide the holder of the Representative’s Warrant Shares with certain piggyback registration rights.

On February 8, 2017, we issued to PoC Capital, LLC, or PoC Capital an aggregate of 1,286,173 shares of Common Stock, or the PoC Shares pursuant to a stock purchase agreement. Under the terms of such stock purchase agreement, we agreed to file with the SEC, by no later than February 23, 2017, a Registration Statement under the Securities Act that covers the resale of all of the PoC Shares.

We filed a registration statement registering the Viking Securities, the Representative’s Warrant Shares and the PoC Shares for resale on February 14, 2017, and the registration statement was declared effective on March 27, 2017.

On September 28, 2017, we entered into a Registration Rights Agreement with Lincoln Park Capital Fund, LLC, or Lincoln Park, pursuant to which we agreed to file with the SEC one or more registration statements as necessary to register for sale under the Securities Act shares of Common Stock that we issued or may issue to Lincoln Park pursuant to the Purchase Agreement we entered into with Lincoln Park on September 28, 2017. On October 17, 2017, we filed a registration statement registering 6,873,975 of such shares of Common Stock for resale, and such registration statement was declared effective on October 26, 2017.

Anti-Takeover Provisions

Certain provisions of Delaware law, along with certain provisions of our amended and restated certificate of incorporation and our amended and restated bylaws, may have the effect of delaying, deferring or discouraging another person from acquiring control of our company. These provisions are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed, in part, to encourage persons seeking to acquire control of our company to first negotiate with our board of directors. However, these provisions could have the effect of delaying, discouraging or preventing attempts to acquire us, which could deprive our stockholders of opportunities to sell their shares of Common Stock at prices higher than prevailing market prices.

Delaware Law

We are subject to the provisions of Section 203 of the General Corporation Law of the State of Delaware, or the DGCL, regulating corporate takeovers. In general, those provisions prohibit a public Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the date that the stockholder became an interested stockholder, unless:

|

|

•

|

the transaction is approved by the board of directors before the date the interested stockholder attained that status;

|

|

|

•

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

|

|

•

|

on or after the date of the transaction, the transaction is approved by the board of directors and authorized at a meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

|

|

•

|

In general, Section 203 of the DGCL defines a business combination to include the following:

|

|

|

•

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

16

|

|

•

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 of the DGCL defines an interested stockholder as any entity or person beneficially owning, or who within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by any such entity or person.

A Delaware corporation may opt out of this provision by express provision in its original certificate of incorporation or by amendment to its certificate of incorporation or bylaws approved by its stockholders. However, we have not opted out of, and do not currently intend to opt out of, this provision. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire our company.

Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

Our amended and restated certificate of incorporation and our amended and restated bylaws include a number of provisions that could deter hostile takeovers or delay or prevent changes relating to the control of our board of directors or management team, including the following:

|

|

•

|

Board of Directors Vacancies

. Our amended and restated certificate of incorporation and amended and restated bylaws authorize only our board of directors to fill vacant directorships, including newly created seats. In addition, the number of directors constituting our board of directors can be set only by a resolution adopted by a majority vote of our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of directors and then gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change the composition of our board of directors and promotes continuity of management.

|

|

|

•

|

Classified Board

. Our amended and restated certificate of incorporation and amended and restated bylaws provide that our board of directors is classified into three classes of directors. A third party may be discouraged from making a tender offer or otherwise attempting to obtain control of our company as it is more difficult and time consuming for stockholders to replace a majority of the directors on a classified board of directors.

|

|

|

•

|

Stockholder Action; Special Meeting of Stockholders