Tencent Third-Quarter Net Profit Rises Nearly 70%, Beating Estimates -- 2nd Update

November 15 2017 - 10:21AM

Dow Jones News

By Alyssa Abkowitz in Beijing and Chester Yung in Hong Kong

Chinese internet giant Tencent Holdings Ltd. continued its

winning streak, reporting earnings that rose nearly 70% from a year

earlier, driven by growth in mobile-gaming and advertising sales,

particularly on the company's video-streaming platform.

Shares of the Shenzhen, China-based company have more than

doubled since Jan. 1, raising its market capitalization to nearly

$466 billion. Tencent also made headlines last week when it bought

a 12% stake in U.S. social media company Snap Inc., becoming one of

its largest shareholders.

On a conference call with investors Wednesday, Tencent President

Martin Lau said the company saw an opportunity to acquire Snap

shares at "a pretty attractive price" and said Tencent may look to

do "something more strategic with them" in the future.

Profits handily beat Wall Street's expectations, reaching 18

billion yuan ($2.71 billion) from 10.6 billion yuan a year earlier.

Revenues climbed 61% to 65.2 billion yuan from 40.3 billion yuan.

The company reported after the close of trading in Hong Kong

Wednesday, where shares closed down 1.3%.

Heavy spending on video content is starting to pay off for

Tencent, which at the end of September was the No. 1

video-streaming service in paid subscriptions, according to data

firm App Annie. Tencent now has more than 43 million paying

subscribers, up from 20 million in November 2016.

The company also said revenues from video advertising grew 70%

from the year-earlier period, which helped contribute to overall

online advertising revenue increasing 48% from the year-ago

period.

"While the video sector as a whole is still making losses, we

will continue to invest in the long run," Mr. Lau said, adding that

video is an important component of the firm's cross-media

strategy.

Video-streaming is a hotly contested area for Tencent and its

other tech rivals, Alibaba Group Holding Ltd. and Baidu Inc.

Tencent and Baidu, particularly, have been going back and forth to

woo paid subscribers with a mix of exclusive and licensed content.

Mr. Lau said Tencent had made headway in expanding its young female

user base in drama, the most popular genre, and in scheduling

programming to optimize viewership.

The bulk of Tencent's revenues continued to come from games.

Smartphone gaming revenues rose 84% from a year earlier, anchored

by smash hit battle game "Honor of Kings."

The company's messaging, mobile-payment and social-media

platform, WeChat, which is the most popular app in China, reached

980 million users at the end up September, up 16% from a year

earlier.

Its other businesses, including mobile payments and cloud

services, recorded revenue growth of 143% from the year-ago period.

The company said payment volume from mobile payments in

brick-and-mortar stores rose 280%.

Mr. Lau said overseas growth of WeChat Pay will be serving

Chinese tourists, and that globally, the company is pursuing a

"partnership strategy" with local players instead of competing with

them.

On the heels of Tencent's successful spinoff of its online

publishing business, China Literature Ltd., Tencent executives

noted that as investee companies reach maturity, the company will

look to make them go public but that homegrown businesses make more

sense to "stay together so they can reinforce each other."

Write to Alyssa Abkowitz at alyssa.abkowitz@wsj.com and Chester

Yung at chester.yung@wsj.com

(END) Dow Jones Newswires

November 15, 2017 10:06 ET (15:06 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

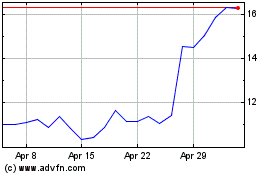

Snap (NYSE:SNAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Snap (NYSE:SNAP)

Historical Stock Chart

From Apr 2023 to Apr 2024